Before providing a quote, insurers consider a variety of factors to determine the cost of a policy. They request specific details about the individual or business and the property to be insured. For instance, for auto insurance, insurers consider factors such as driving history, age, gender, location, the number of miles driven, and the vehicle type. Similarly, for homeowners insurance, insurers ask about the home's location, plumbing system, roof type, and other details. Insurers use this information to assess the risk and determine the premium. It's important to obtain quotes from multiple insurers and compare the coverage offered to find the best option.

What You'll Learn

Driving history, age, gender, location, and vehicle

Driving History

Insurance companies review a person's driving record when setting insurance premiums. Safe drivers with clean records and no history of at-fault accidents, DUI, or moving violations are considered less likely to get into accidents and are therefore rewarded with lower premiums. Conversely, those with a history of dangerous driving habits, such as speeding or reckless driving, will likely pay more for car insurance.

Age

Age is a significant factor in determining insurance rates. Younger and less experienced drivers, especially teenagers, are statistically more likely to drive dangerously and be involved in fatal accidents. As a result, teens and young adults typically pay the highest insurance rates. Premiums usually decrease once a driver turns 25 and continue to drop as they get older, with drivers over 55 generally paying lower rates. However, at around age 75, premiums tend to rise again.

Gender

In states that allow insurance companies to consider gender when setting premiums, women often pay less for car insurance than men. This is because women are statistically less likely to be involved in car accidents and, when they are, the accidents tend to be less severe.

Location

Location plays a crucial role in determining insurance rates due to varying risks of accidents, theft, and vandalism. Urban drivers typically pay higher insurance prices than those in small towns or rural areas. The cost of car repairs and medical care also varies by location, impacting insurance rates. Additionally, certain locations are more prone to weather-related risks, such as wildfires or windstorms, which can damage vehicles.

Vehicle

The type of vehicle driven is another critical factor in insurance rates. More expensive cars tend to be costlier to repair and replace, making them more expensive to insure. The likelihood of a vehicle being stolen, its safety record and features, the size of its engine, and the potential damage it can inflict in a collision are all considered. Vehicles with excellent safety and anti-theft features often qualify for premium discounts.

In summary, insurance companies consider a multitude of factors when determining insurance quotes, and driving history, age, gender, location, and vehicle are key components in their assessment.

**The Uninsured ER Visit: When Billing Insurance Isn't an Option**

You may want to see also

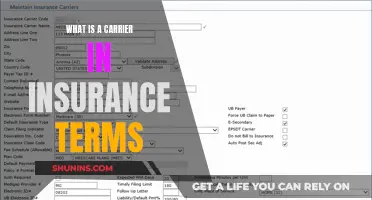

Personal information and property details

When it comes to personal information and property details, insurance companies will ask for a range of details to determine the quote they will offer. The exact information required will vary depending on the type of insurance being sought, but there are some commonalities. For instance, for car insurance, the insurer will need to know the make, model, and vehicle identification number for each car to be insured, as well as the names of the drivers covered by the policy. They will also need to know about the driving history of the drivers, including any past tickets or accidents.

For home insurance, the insurer will ask for personal information such as names, dates of birth, and Social Security numbers. They will also need to know about the property itself, including its address, the type of plumbing system, the roof material, and so on. The insurer will also want to know about any renovations or repairs that have been carried out, as well as details about the current condition of the property, such as the age of the water heater, the state of the plumbing, and whether there is a fireplace. This information helps determine the home's current condition and the potential cost of repairs or rebuilding in the event of damage.

In addition, for renters, the insurance company will ask for the address of the rental home and the number of rooms. They will also inquire about the value of the renter's belongings, as this will influence the personal property coverage limit.

The level of detail required by insurers can be extensive, and it is important to provide accurate and consistent information to ensure you receive the correct quote.

Exploring Short-Term Insurance Options: Understanding the Array of Products Available

You may want to see also

Health history and current health

When requesting a quote for insurance, an insurer will typically ask for basic information. However, if you are purchasing life insurance, you may need to provide more extensive information. Insurers will ask for your health history and current health details to determine your insurance quote.

Health History

Insurers will ask about your health history, including any chronic conditions you may have. They will also inquire about any major surgeries or accidents you have experienced in the past five to ten years. Additionally, they may request authorization to review your medical records. This information helps them understand the risks associated with providing coverage for you.

Current Health

Before finalizing your insurance quote, insurers may require you to undergo a comprehensive medical examination. This could include blood, urine, and cardiovascular tests to assess your current health status. The results of these tests play a crucial role in determining the final insurance quote offered to you.

Impact on Insurance Goals

The agent will inquire about the purpose of the life insurance policy, such as paying off a mortgage, replacing lost income, or funding a child's education in the event of your death. Your health history and current health will influence the type and amount of coverage that is suitable for your specific situation and goals.

Income and Assets

Insurers will also consider your financial situation, including your income and assets, when determining your insurance quote. This information, along with your insurance goals, will help establish the ideal amount of coverage and the length of the policy's term.

Remember, it is essential to provide consistent information to each insurer when requesting quotes to make accurate comparisons and choose the most suitable option for your needs.

Birthing Costs: Unraveling the Insurance Billing Process for New Mothers

You may want to see also

Insurance history and credit score

An insurance score, also known as a credit-based insurance score or an insurance credit score, is a rating computed and used by insurance companies to determine the probability of an individual filing an insurance claim while under coverage. The score is based on the individual's credit rating and will affect the premiums they pay for their coverage.

Insurance scores are calculated using several factors, many of which overlap with those used to determine an individual's credit score. These factors include previous credit performance, outstanding debt, credit history length, and pursuit of new credit. A higher insurance score indicates that an individual is less likely to file a claim, and they will therefore benefit from lower insurance premiums.

Insurers also consider an individual's insurance history when determining their insurance premium. Lapses in insurance coverage are seen as an indication of higher risk, and will result in higher premiums.

It's important to note that not all states allow the use of insurance scores as a factor for determining insurance rates. For example, California, Hawaii, Massachusetts, and Michigan prohibit the use of credit history in auto insurance ratings, while Maryland prohibits its use in homeowners insurance ratings.

Converting Term Insurance: Timing the Switch for Maximum Benefits

You may want to see also

Coverage selections

For instance, if you're seeking a car insurance quote, you may be offered optional coverages such as collision insurance and comprehensive insurance, which protect the policyholder by covering repair or replacement costs in the event of a crash or other damage. Uninsured and underinsured motorist coverage is another optional coverage that will protect you in case of an accident with a driver who has insufficient insurance.

Similarly, when obtaining a home insurance quote, you may be asked about renovations and repairs, as well as the current condition and amenities of your home. This information helps determine the home's value and the potential cost of repairs or rebuilding in the event of damage.

The coverage selections you make will vary depending on the type of insurance you're seeking and your specific needs. It's important to carefully consider your options and choose the coverages that best align with your lifestyle, the value of your belongings, and the value of your home, if applicable.

Additionally, it's worth noting that not all insurance providers offer the same coverages, so the options presented to you during the quoting process may differ between companies. This is why it's beneficial to gather quotes from multiple insurers and compare the coverages offered, in addition to the quoted prices.

Understanding the Ins and Outs of PDP Plans: Unraveling the Insurance Acronym

You may want to see also

Frequently asked questions

Insurers take into account several factors when determining insurance premiums. These factors include age, gender, marital status, driving record, credit score, health history, and the type of insurance coverage being sought.

Insurers typically ask for basic personal information such as name, address, date of birth, Social Security number, and driver's license number. They may also inquire about driving history, vehicle information, health history, and income.

Obtaining an insurance quote has become a convenient and quick process. Many insurers offer online systems or mobile apps that allow individuals to input their information and receive a quote instantly. Alternatively, individuals can contact an insurance company directly and speak with an agent or use the services of an independent broker who can help compare quotes from multiple insurers.