Level term life insurance is a type of insurance policy that lasts a set term, usually between 10 and 30 years, and comes with a level death benefit and level premiums that remain the same for the duration of the policy. It is the simplest and most affordable life insurance option for most people. The main difference between level term and other types of term insurance is that its premiums and death benefit stay the same for the duration of the policy. Level term life insurance is also known as level premium term life insurance.

| Characteristics | Values |

|---|---|

| Payout | Remains the same for the duration of the policy |

| Premium payments | Remain the same for the duration of the policy |

| Term | Usually between 10 and 30 years |

| Renewal | Possible for another term |

| Conversion | Can be converted to a permanent policy |

| Riders | Add-ons available, e.g. waiver of premium rider, return of premium rider |

What You'll Learn

- Level term life insurance is a type of permanent or term life insurance

- The premium remains the same over the policy's life

- Level-premium insurance is more cost-effective in the long run

- Level term life insurance is predictable and affordable

- Level term life insurance is a level death benefit for the entire time the policy is in effect

Level term life insurance is a type of permanent or term life insurance

Level term life insurance is often used to refer to a policy with a premium that doesn't change over its life. This is actually a level premium term life insurance policy, but it's often referred to simply as "level term life insurance". The two options usually go hand in hand: a level life insurance death benefit with level premium payments. Most of the "normal" term policies available today are some flavour of level term life.

Level term life insurance is a good option for people who want financial protection at a reasonable price. It is the simplest and most affordable life insurance option for most people. It is also predictable, allowing the policyholder to know how much money they will be leaving to their beneficiaries. It also helps with budgeting, as the amount paid for coverage stays the same year after year.

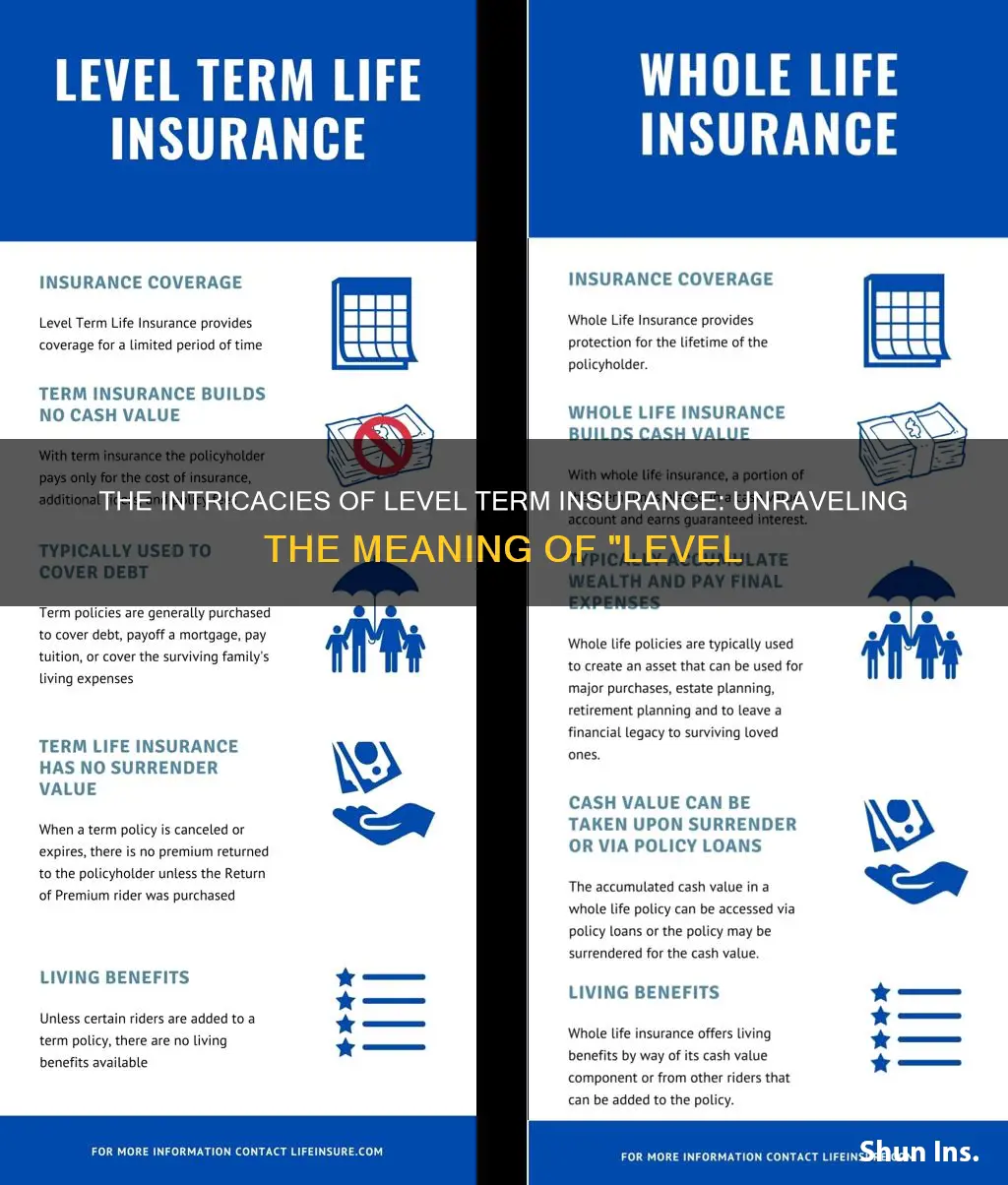

Level term life insurance is typically more expensive than decreasing term life insurance, where the death benefit decreases over time. However, compared to permanent life insurance, term policies tend to cost policyholders much less. That is because term policies are not guaranteed to pay out, while permanent policies are, provided all premiums are paid.

The premium remains the same over the policy's life

Level term life insurance is a policy that has a level death benefit for the entire time the policy is in effect. This means that the payout remains the same for the duration of the policy, allowing the policyholder to make long-term plans. The premium also remains the same over the policy's life. This means that the policyholder will know exactly how much their payments are and can budget accordingly.

Level term life insurance is usually offered for a set term, typically between 10 and 30 years. The policyholder makes premium payments that never change, and if they die while the coverage is in place, a tax-free cash benefit is paid out to their beneficiaries. The payout amount is guaranteed as long as the policy is active.

Level term life insurance is one of the most popular types of life insurance due to its predictability and affordability. The premium is locked in for the duration of the policy, so if the policyholder's health improves, they may end up paying more than necessary. However, if the policyholder's health deteriorates, they will still be paying the same premium.

Level term life insurance is a good option for those who want coverage for a set period and want stable premiums over that term. It is also a good choice for those who are concerned about the affordability of life insurance and do not want their death benefit to change.

Compared to permanent life insurance, level term life insurance is typically more affordable. This is because term policies are not guaranteed to pay out, while permanent policies are. Level term life insurance is also generally more expensive than decreasing term life insurance, where the death benefit decreases over time.

The Intricacies of Insurance Twisting: Unraveling the Practice and Its Impact

You may want to see also

Level-premium insurance is more cost-effective in the long run

Level-premium insurance is a type of permanent or term life insurance where the premium remains the same over the policy's duration. This means that the policyholder pays the same amount each year, regardless of changes in their age, health, or other factors that might otherwise affect their premium.

While level-premium insurance policies tend to be more expensive upfront compared to annually-renewing life insurance policies, they offer long-term cost savings. Here are several reasons why level-premium insurance is more cost-effective in the long run:

Predictable Premium Payments

Level-premium insurance offers stable and predictable premium payments that remain the same throughout the policy's term. This makes it easier for policyholders to budget for their insurance expenses, as they can be confident that their premiums will not increase unexpectedly. The predictability of premium payments provides peace of mind and helps policyholders manage their finances effectively.

Long-Term Cost Savings

Level-premium insurance policies can provide significant cost savings over time compared to other types of insurance premiums, which may increase as the policyholder ages or due to other factors. By locking in the premium rate at the beginning of the policy, level-premium insurance offers a more affordable option in the long run.

Protection Against Inflation

Inflation can erode the purchasing power of money over time, impacting the affordability of insurance premiums in the future. Level-premium insurance protects against inflation by locking in premium rates at the time of policy purchase, ensuring that policyholders do not face increased costs due to rising inflation rates.

Encouragement of Early Purchase

Level-premium insurance encourages individuals to purchase policies earlier in life when premiums are typically more affordable. Younger individuals generally have lower premium rates due to their longer life expectancy. Purchasing a policy at a younger age can result in lower premium rates, providing an incentive for individuals to secure financial protection for their beneficiaries sooner.

Increased Coverage Over Time

For permanent insurance policies, such as whole life insurance, the amount of coverage provided increases over time, even as the premiums remain the same. This means that policyholders can access higher death benefit coverage as the policy matures, providing additional financial security for their beneficiaries.

Limited Premium Increases

Level-premium insurance policies are less vulnerable to premium increases compared to other types of insurance. While certain factors, such as age and health, can impact the cost of level-premium insurance, the premiums are generally locked in and remain stable throughout the policy term. This stability provides cost predictability and helps policyholders avoid unexpected premium increases.

Understanding Extended Term Insurance: Unlocking the Benefits of Long-Term Coverage

You may want to see also

Level term life insurance is predictable and affordable

Level Term Life Insurance: Predictable and Affordable

Level term life insurance is a type of insurance policy that offers a fixed premium and death benefit for the duration of the policy's term. This means that the policyholder will pay the same premium and receive the same death benefit regardless of when they die within the term of the policy. The term of a level term life insurance policy can vary, but is typically between 10 and 30 years. This type of insurance is considered to be predictable and affordable, making it a popular choice for individuals and families.

Level term life insurance provides flexibility to prospective policyholders by offering a range of term options. The policy term selected will influence the premiums paid, with shorter terms typically costing less than longer ones. The coverage amount, or death benefit, can also be customized to meet the needs of the policyholder and their beneficiaries. This amount is typically chosen based on factors such as funeral costs, living expenses, and debt management. Level term life insurance policies also offer the potential for conversion to permanent life insurance, providing long-term coverage.

Advantages of Level Term Life Insurance

One of the main advantages of level term life insurance is its predictability. Policyholders know exactly what their premiums and coverage will be for the duration of the policy, making it easy to budget and plan for the future. The simplicity of these policies also makes them attractive, as there are no complex features or varying rates to navigate. Additionally, level term life insurance is generally the most affordable type of life insurance, making it a cost-effective option for individuals and families.

Disadvantages of Level Term Life Insurance

One of the drawbacks of level term life insurance is the limited coverage period. Unlike permanent life insurance, level term policies only provide coverage for a specified term, after which the policy expires. This can leave individuals without coverage in their later years, or facing higher premiums to renew or convert their policy. Additionally, level term life insurance does not accumulate cash value, so it cannot be used as a retirement income or borrowed against.

Level term life insurance is a popular choice for individuals and families due to its predictability and affordability. The fixed premiums and death benefits make it easy to budget and plan, while the potential for conversion to permanent life insurance provides flexibility. However, the limited coverage period and lack of cash value accumulation are disadvantages to consider. Overall, level term life insurance can be a good option for those seeking straightforward and cost-effective life insurance coverage.

The Dynamic Nature of Term Insurance: Unraveling the Ever-Increasing Coverage Component

You may want to see also

Level term life insurance is a level death benefit for the entire time the policy is in effect

Level term life insurance is a type of insurance policy that lasts a set term, usually between 10 and 30 years. It is a popular choice for those seeking life insurance for the first time, as it offers predictability and affordability. The key feature of level term life insurance is that it provides a level death benefit, meaning the payout remains the same for the entire duration of the policy. This allows policyholders to make long-term financial plans, knowing exactly how much their loved ones will receive in the event of their death.

The death benefit of level term life insurance is often coupled with level premium payments, which remain unchanged throughout the policy term. This combination of a level death benefit and level premiums distinguishes level term life insurance from other types of term life insurance, such as decreasing term life insurance, where the death benefit decreases over time.

Level term life insurance offers several advantages. Firstly, it provides predictability, as policyholders know exactly how much their beneficiaries will receive and can make financial plans accordingly. Secondly, it facilitates budgeting, as the level premiums allow for easy financial planning and management. Lastly, it can be more cost-effective in the long run, especially for those who are young and healthy when they purchase the policy. By locking in a lower rate based on their current health, policyholders can benefit from affordable coverage for the entire term.

However, there is also a potential drawback to level term life insurance. The premiums are linked to the policyholder's health at the time of purchase. If a policyholder improves their health during the term, they may find themselves paying a higher rate than necessary. In such cases, they may need to reapply for a new policy or request a rate reconsideration from their insurer.

Understanding Direct Term Insurance: Unraveling the Basics of This Pure Protection Plan

You may want to see also

Frequently asked questions

Level term insurance is a type of term life insurance where the premium and death benefit remain the same for the length of the policy.

Level term insurance generally comes with several policy term options, typically ranging from 10 to 30 years. Policyholders can also add life insurance riders, such as a waiver of premium rider, which allows them to pause premium payments if they become critically injured or ill.

Level term insurance may be a good option if you only need coverage for a specific period, such as until your mortgage is paid off or your children become financially independent. It can also be a good choice if you want stable premiums and a fixed death benefit.

A level term policy offers stable premiums and a fixed death benefit, making it easy to budget. It can also be cheaper in the long run if you lock in a low rate based on your current health. However, a potential drawback is that you may be stuck with a higher premium if your health deteriorates, and you could end up paying for more coverage than you need if your financial circumstances change.

Level term insurance is generally one of the most affordable types of life insurance policies. The cost depends on factors such as age, health, gender, and lifestyle. The younger and healthier you are, the lower your rates are likely to be.