Form 8962 is used to calculate the amount of premium tax credit (PTC) you’re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace. It is used to reconcile the difference between the amount of advanced premium tax credit (APTC) you received and the amount of PTC you’re eligible to receive, which is based on your income for the year. This calculation determines whether or not you owe money to the IRS.

You need to complete Form 8962 if you wish to claim a PTC on your tax return, or you received APTC during the year. Form 8962 is used along with Form 1095-A, which your health insurance marketplace should send you.

| Characteristics | Values |

|---|---|

| Purpose of Form 8962 | To calculate the amount of premium tax credit (PTC) you’re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace |

| Who Can File Form 8962 | Only those who have health insurance through the Affordable Care Act Health Insurance Marketplace |

| What is Form 8962 Used For | To reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit you’re eligible to receive |

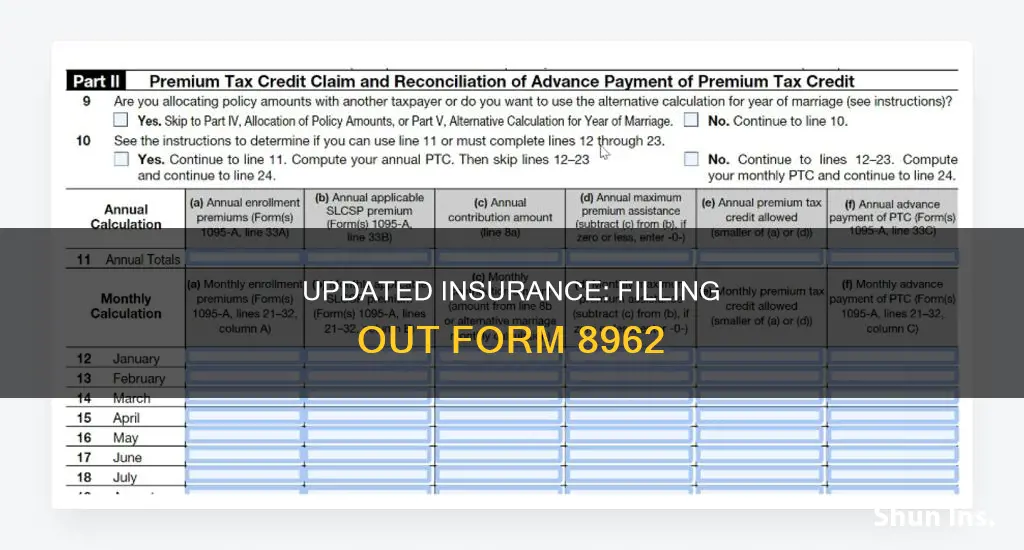

| How to Fill Out Form 8962 | Form 8962 is divided into five parts. Part I is where you record annual and monthly contribution amounts using your family size, modified adjusted gross income, and household income. Part II is where you reconcile your advanced premium tax credit received with monthly premium amounts. Part III is used to calculate any excess advanced premium tax credit payments, based on the information you provided in Part II. Part IV allows you to allocate policy amounts, while Part V is used for alternative calculation of your year of marriage |

What You'll Learn

Calculating your Premium Tax Credit (PTC) amount

Form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace. You need to complete Form 8962 if you wish to claim a premium tax credit on your tax return, or you received advance payments of premium tax credits during the year.

Form 8962 is divided into five parts. Before you dive into Part I, write your name and Social Security number at the top of the form.

Part I is where you record annual and monthly contribution amounts using your family size, modified adjusted gross income, and household income. You’ll enter the number of exemptions and the modified adjusted gross income (MAGI) from your 1040 or 1040NR. You’ll also enter your household income as a percentage of the federal poverty line. Consult the table in the IRS Instructions for Form 8962 to fill out the form. By the end of Part I, you’ll have your annual and monthly contribution amounts (lines 8a and 8b).

Part II is where you reconcile your advanced premium tax credit received with monthly premium amounts. This is where you’ll figure out your PTC and compare it against any advance payments (APTC). If you had marketplace coverage for the whole year you’ll use Line 11 to enter your annual totals. Otherwise, use one or more of the lines for the 12 months of the year to enter your monthly contributions. At the end of Part II, you’ll have three very important numbers to enter. On line 24 you’ll write the total PTC. On line 25 you’ll write the advance payment of the PTC amount. And on line 26 you’ll write the net PTC.

Part III is used to calculate any excess advanced premium tax credit payments, based on the information you provided in Part II. If your APTC is greater than your PTC, you’ll need to enter this information in Part III. On line 27, subtract line 24 from line 25 if line 25 is greater. Follow the form instructions to enter the repayment limitation on line 28. Enter your excess advance premium tax credit repayment on line 29. Write the smaller of either line 27 or line 28 on line 29, and on your Form 1040 or 1040NR. That’s the amount you owe in repayment for getting more than your fair share in advance payment of the PTC.

Part IV allows you to allocate policy amounts, while Part V is used for alternative calculation of your year of marriage.

Updating Dentrix Insurance Records: Address Change Procedure

You may want to see also

Reconciling your PTC with any advance payments of the Advance Premium Tax Credit (APTC)

Form 8962 is used to calculate the amount of premium tax credit (PTC) you’re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace. The PTC is a refundable tax credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace.

Who Can File Form 8962?

You only need to complete Form 8962 if you purchased health insurance through the Affordable Care Act’s Health Insurance Marketplace. If you’re covered by a health insurance plan at work or you purchased health insurance directly from an insurance company outside of the exchange, you don’t need this form to complete your tax filing.

Form 8962 is used to reconcile the difference between the amount of advanced premium tax credit (APTC) you received and the amount of PTC you’re eligible to receive, which is based on your income for the year. This calculation matters because it determines whether or not you owe money to the IRS.

How to Fill Out Form 8962

Form 8962 is divided into five parts. Before you dive into Part I, write your name and Social Security number at the top of the form. Part I is where you enter your annual and monthly contribution amounts. You’ll enter the number of exemptions and the modified adjusted gross income (MAGI) from your 1040 or 1040NR.

You’ll also enter your household income as a percentage of the federal poverty line. Consult the table in the IRS Instructions for Form 8962 to fill out the form. By the end of Part I, you’ll have your annual and monthly contribution amounts (lines 8a and 8b).

Part II is where you reconcile your advanced premium tax credit received with monthly premium amounts. Part III is used to calculate any excess advanced premium tax credit payments, based on the information you provided in Part II.

Part IV allows you to allocate policy amounts, while Part V is used for alternative calculation of your year of marriage.

Using Form 8962, you are reconciling the tax credit you are entitled to with any advance credit payments (or subsidies) for the tax year.

The Unsung Heroes of Healthcare: Unraveling the Crucial Role of Insurance Billing Specialists

You may want to see also

Determining if you need to repay excess APTC

If you received advance payments of the premium tax credit (APTC) for health insurance that you purchased last year on HealthCare.gov or a state-run health insurance Marketplace, and your income ended up increasing during that year, you might have to pay back some of your premium tax credit for health insurance. This is known as excess APTC.

To determine if you need to repay excess APTC, you must complete Form 8962, which will walk you through the calculations to determine whether you received any excess premium tax credit and how much you are required to repay.

The Pros and Cons of Direct Billing for Body Shop Repairs

You may want to see also

Claiming net premium tax credits

If you are eligible for the Premium Tax Credit (PTC), you can use it to reduce the premiums you pay during the year for your health insurance, or you can receive the full credit when you file your tax return. The PTC is a refundable tax credit that can help lower your insurance premium costs when you enroll in a health plan through the Health Insurance Marketplace.

You can receive this credit before you file your return by estimating your expected income for the year when applying for coverage in the Marketplace. This counts as the advance premium tax credit (APTC). You can also claim the premium tax credit after the fact on your tax return with your actual income.

The amount of credit you receive depends on your estimated income and your household information, which you'll report on any application you file with the Marketplace. If your estimated income falls between 100% and 400% of the federal poverty level for a household of your size, you can claim the premium tax credit. You may use some or all of this credit in advance to lower your monthly premium costs, leaving money in your pocket.

If you use more of the PTC than your final taxable income allows, you may need to repay the difference when you file your taxes, but if you use less than you qualify for, you may receive the difference as a refundable credit on your return.

The first part of Form 8962 determines your annual and monthly contribution amount based on your family income and tax family size. Your tax family generally includes you and your spouse if filing a joint return and your dependents. You must include all of your family's or household's income. After filling in this information and determining your applicable federal poverty level, you can figure out the amount of credit you can claim. You have two choices for how to claim it:

- A credit to reduce your monthly payments on your health insurance premiums

- A credit to reduce your taxes on your return

If you choose the monthly payments, the government pays your insurer over the course of the year, which lowers your monthly premium costs.

If you can claim the premium tax credit and your insurer received advanced payments from the government, the second part of Form 8962 compares how much credit you used and your final available credit. There are three possible scenarios:

- If you elected to receive the refundable premium tax credit on your tax return, you can claim it against your tax liability

- If you have more available credit than the payments made to your insurer on your behalf, you can claim the remaining balance on your return to reduce your taxes

- If you underestimated your income and the government paid out more than your actual credit value, you'll need to repay the difference when you file your taxes

Navigating Insurance Changes at Rex Hospital: A Step-by-Step Guide

You may want to see also

Allocating policy amounts

- You are married but filing a separate return from your spouse

- You got divorced during the tax year and shared a policy with your ex-spouse for a certain time prior to the separation

- One of the individuals on your tax return enrolled someone not on the tax return in a qualified health plan

- One of the individuals on your tax return was enrolled in a qualified health plan by someone who is not part of your tax family

If you are allocating policy amounts, you need to fill out Part IV of Form 8962. You will need to allocate the enrollment premiums, SLCSP premiums, and/or the APTC on a Form 1095-A between this tax return and another tax return if:

- The policy covered at least one individual on this tax return and at least one individual on another tax return

- The Form 1095-A lists someone who is not on this tax return or does not list someone who is on this tax return

- Someone on this tax return is listed on another tax return's Form 1095-A

If you are allocating policy amounts, you will need to determine your allocation percentage. This can be agreed upon between the two taxpayers, but if you cannot agree, the allocation percentage is equal to the number of individuals enrolled by one taxpayer who are included in the tax return of the other taxpayer for the tax year, divided by the total number of individuals enrolled in the same policy as the individual(s).

Chiropractic Care and Insurance Billing: Understanding the Process

You may want to see also

Frequently asked questions

Form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace.

Only those who have health insurance through the Affordable Care Act Health Insurance Marketplace (also known as the exchange) are eligible to use Form 8962.

You must file Form 8962 with your 1040 or 1040NR if you want to take the PTC, if APTC was paid during the year for you or someone in your tax household, or if APTC was paid for someone (including you) for whom you told the marketplace you would claim a personal exemption.

To complete Form 8962, you will need Form 1095-A, which your health insurance marketplace should send you, as well as your Form 1040 showing your modified adjusted gross income.

Form 8962 is divided into five parts. Part I is where you record annual and monthly contribution amounts using your family size, modified adjusted gross income, and household income. Part II is where you reconcile your advanced premium tax credit received with monthly premium amounts. Part III is used to calculate any excess advanced premium tax credit payments, and Part IV allows you to allocate policy amounts. Part V is used for alternative calculation of your year of marriage.