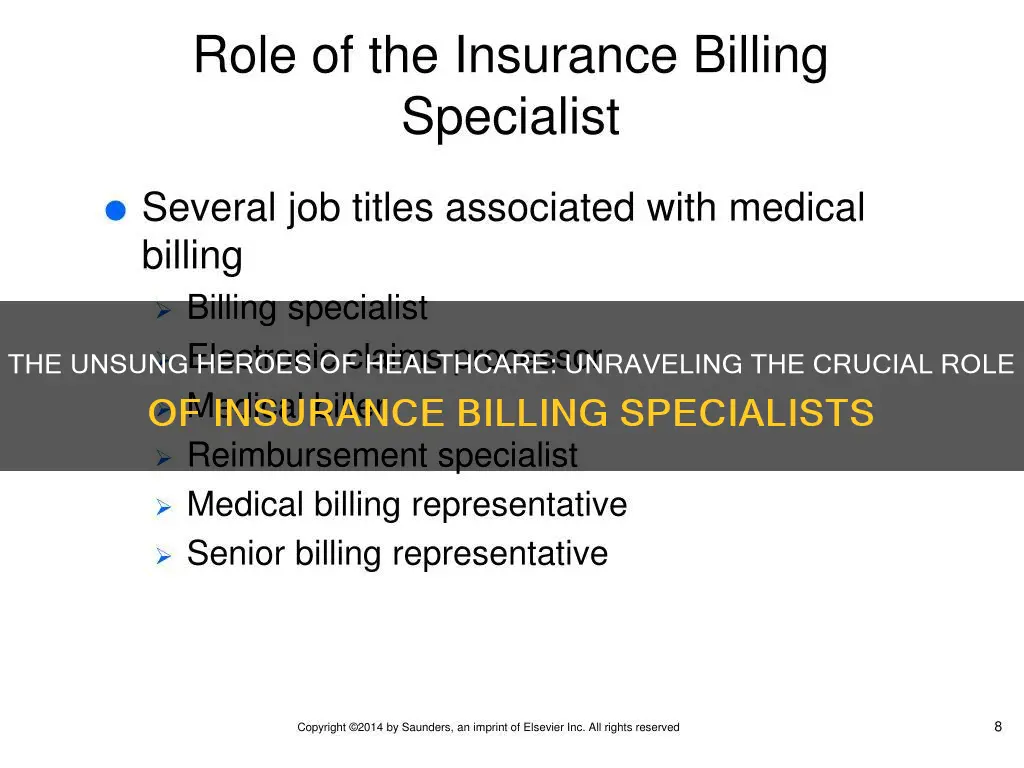

An insurance billing specialist, also known as a medical billing specialist or coding specialist, is an administrator who manages billing processes for an insurance company or a healthcare facility. They act as a liaison between the medical office and insurance companies, ensuring healthcare providers are reimbursed for their services.

A billing specialist's duties include managing medical billing for patients, updating patient information, generating invoices, and processing payments. They also submit reimbursement requests to insurance companies, work with self-paying patients to develop payment arrangements, and follow up on insurance claims.

| Characteristics | Values |

|---|---|

| Job Title | Insurance Billing Specialist, Medical Billing Specialist, Coding Specialist |

| Role | Administrator |

| Who They Work For | Health Care Facilities, Insurance Companies |

| Tasks | Collecting and entering patient data, submitting insurance claims, following up on rejected or unpaid claims, assisting with collecting payments, providing information to collection agencies, posting payments |

| Qualifications | High School Diploma, Associate's Degree, Bachelor's Degree, Technical Certificates |

| Skills | HIPAA Compliance, Medical Coding, Attention to Detail, Computer Literacy, Customer Service, Communication, Interpersonal Skills, Technical Skills, Analysis Skills, Organisation Skills |

What You'll Learn

Managing billing processes

A billing specialist is an administrator who manages billing processes, usually for an insurance company or a medical facility. They are responsible for managing medical billing for patients, updating patient information, generating invoices, and processing payments.

Billing specialists are often responsible for coordinating payment schedules for self-pay customers. They work with self-paying patients to develop payment arrangements and ensure proper records handling by entering data accurately and promptly. They also post payments when received and document payment records and issues.

Billing specialists submit reimbursement requests to state, private, and employer insurance. They follow up on insurance claims, including denials, payments, and requests for more information. They initiate private pay collections after insurance cancellation, denial, or other issues.

Billing specialists also assist patients and their families with financial matters. They help patients apply for healthcare credit programs and other financial solutions. They consult with patients' families as needed and may refer them to collection agencies for past-due accounts.

In addition to managing billing processes, billing specialists play a crucial role in facilitating communication between insurance companies and patients. They act as a liaison between the medical office and insurance providers, ensuring that healthcare providers are reimbursed for their services.

Understanding Sprint's Insurance Charges: A Guide to Unexpected Fees

You may want to see also

Reviewing patient documents

As an insurance billing specialist, reviewing patient documents is a critical aspect of the role. This involves meticulously examining patient records, including medical history, diagnosis, treatment plans, and procedure notes. Here are some detailed paragraphs outlining the process and importance of reviewing patient documents:

Understanding Medical Coding

The first step in reviewing patient documents is understanding medical coding. Medical coding is a standardised system of alphanumeric codes used to represent specific medical procedures, diagnoses, and treatments. Insurance billing specialists must be proficient in using these codes to translate patient records into a language that insurance companies can understand. Common coding systems include Current Procedural Terminology (CPT), International Classification of Diseases (ICD), and Healthcare Common Procedure Coding System (HCPCS). CPT codes are used for identifying specific procedures and examinations, while ICD codes are used for medical diagnoses. HCPCS codes cover items and services not included in the other two coding systems, such as medical devices or non-physician services.

Accurate Coding and Data Entry

When reviewing patient documents, insurance billing specialists must accurately assign the appropriate codes to each procedure, diagnosis, and treatment. This process requires a strong attention to detail to avoid errors. Specialists must then enter these codes into the billing software, ensuring that each code is placed correctly according to specific guidelines. This step is crucial as it directly impacts insurance reimbursement and patient billing. A single mistake in coding or data entry can lead to rejected claims or incorrect billing.

Verifying Patient Information

Compliance and Regulations

When reviewing patient documents, insurance billing specialists must ensure compliance with relevant regulations, such as the Health Insurance Portability and Accountability Act (HIPAA). This includes maintaining the confidentiality of patient information and adhering to guidelines for handling and storing patient records. Additionally, specialists need to stay updated on coding guidelines and industry changes to ensure compliance with billing and reimbursement policies.

Interacting with Medical Professionals

In conclusion, reviewing patient documents is a critical aspect of an insurance billing specialist's role. It involves accurately assigning codes, verifying patient information, ensuring compliance, and interacting with medical professionals. This process directly impacts insurance reimbursement and patient billing, making it a vital step in the overall billing and claims management process.

Salary Slip Significance: Why Term Insurance Requires Proof of Income

You may want to see also

Following up on insurance claims

The follow-up process should begin as early as 7-10 days after the initial claim has been submitted. If there is no response after the first follow-up, the billing specialist should continue to follow up at regular intervals, ideally every 6 weeks or 30-45 days. This will create a sufficient time window to make the necessary inquiries and resubmissions within the time limits.

There are several reasons why a claim may be denied or cannot be paid, including wrong information, missing authorisations, and incorrect coding. It is important to identify the reason for the denial and make any necessary corrections before resubmitting the claim. If the denial was incorrect, the billing specialist should attempt to appeal the decision, either by phone, by refiling the claim, or by submitting an appeal letter. This should be done within 7 days of receiving the denial to maximise the chance of success.

If the claim is taking a long time to process, the billing specialist should contact the insurance company to inquire about the status of the claim and to expedite the process. It is helpful to have a good rapport with at least one insurance representative from each carrier, as they may be able to provide more detailed information about the claim.

In some cases, the patient may need to get involved in the follow-up process. The billing specialist can request the patient to contact the insurance company on their behalf, especially if the patient has been paying premiums for their insurance.

To ensure a smooth follow-up process, the billing specialist should be organised and proactive. They should also have a good understanding of the insurance policies and procedures, as well as strong communication and interpersonal skills to effectively interact with patients, insurance companies, and medical professionals.

E-Health Short-Term Insurance: Exploring the Digital Revolution in Healthcare Coverage

You may want to see also

Consulting with patients' families

- Explanation of Billing Procedures: Insurance billing specialists help families understand the often complex world of medical billing. They explain the billing process, including the use of medical codes, invoices, and payment schedules. This ensures that families have a clear idea of the costs and payment methods.

- Financial Planning: Billing specialists work closely with families to develop financial plans that meet their needs. This may involve creating payment arrangements, assisting with healthcare credit applications, or providing information about available payment plans. They ensure that families can access the necessary financial resources to cover medical expenses.

- Claims and Appeals: In cases where insurance claims are rejected or denied, billing specialists provide valuable support to patients' families. They guide them through the appeals process, helping them navigate the complex insurance landscape. This includes submitting appeals on behalf of the families and following up with insurance companies.

- Record-Keeping: Insurance billing specialists ensure that patient records are accurately maintained and updated. This is crucial for families to have a clear understanding of their loved one's medical history and any ongoing treatments.

- Communication Facilitation: Billing specialists act as a bridge between the medical facility and patients' families. They facilitate effective communication, ensuring that families receive timely updates and notifications. This includes scheduling appointments, sending reminders, and providing information about treatments and procedures.

- Problem-Solving: When issues arise with billing, payments, or insurance coverage, billing specialists are there to help families resolve these problems. They offer solutions, provide alternatives, and ensure that the families' concerns are addressed in a timely and efficient manner.

- Educating Families: Insurance billing specialists educate patients' families about their rights and options. They provide information about insurance policies, coverage limits, and any applicable laws or regulations. This empowers families to make informed decisions about their loved one's healthcare.

- Emotional Support: Dealing with medical issues can be stressful for families. Billing specialists offer a supportive presence, providing reassurance and guidance throughout the process. They understand the emotional aspects of healthcare and can provide referrals to additional support services if needed.

By consulting with patients' families, insurance billing specialists play a vital role in easing the financial and administrative burden associated with medical care. Their expertise helps families navigate the complex world of insurance and billing, ensuring that patients receive the care they need while families have peace of mind.

Unraveling the Intricacies of Insurance: Exploring Trade Dress Infringement

You may want to see also

Assisting with healthcare credit applications

Billing specialists also assist patients with billing inquiries and problems. They are responsible for managing billing processes, including generating invoices, processing payments, and coordinating payment schedules for self-pay customers. They must also resolve billing issues and ensure accurate and timely billing for clients.

Billing specialists are also responsible for submitting reimbursement requests to insurance companies and following up on insurance claims, including denials, payments, and requests for more information. They work closely with insurance companies, patients, and healthcare providers to facilitate the billing and payment process.

In addition to assisting with healthcare credit applications, billing specialists play an important role in the financial aspects of healthcare, ensuring that patients receive the care they need while managing the costs associated with their treatment.

Haven Insurance: Understanding the Fine Print

You may want to see also

Frequently asked questions

An insurance billing specialist is an administrator who manages billing processes, usually for an insurance company or a healthcare facility. They are also known as medical billing specialists or coding specialists.

Insurance billing specialists process insurance claims on behalf of healthcare facilities. They review patient documents and translate treatments and procedures into codes that insurance companies can understand. They also collect and enter patient data, submit insurance claims, follow up on rejected or unpaid claims, assist healthcare facilities with collecting payments, and provide information to collection agencies.

A high school diploma is the minimum requirement to become an insurance billing specialist. However, most people in this profession have at least an associate's degree, and some employers may prefer a bachelor's degree. Relevant degrees include accounting, healthcare administration, or health information management.

Insurance billing specialists need a mix of technical and interpersonal skills. They must be familiar with medical coding, have strong attention to detail, be computer literate, and possess good customer service skills.

The salary of an insurance billing specialist can vary depending on experience, industry, organisation size, and location. In the US, the average salary is around $33,000 to $40,000 per year, but it can range from $26,000 to $47,000.