Short-term health insurance is a convenient option for those who want to avoid being uninsured for a temporary period. It is designed for people who experience a temporary gap in their major medical insurance, such as those in between jobs or waiting for Medicare coverage to begin. Short-term health insurance is typically more affordable than long-term plans, but it offers less coverage. It usually covers emergency hospital visits, certain prescription medications, and some doctor's appointments not related to pre-existing conditions. However, it generally does not cover pre-existing conditions, maternity care, mental health, and preventive care. Short-term health insurance is a good option for those who are healthy and do not require regular health services or prescription medications.

| Characteristics | Values |

|---|---|

| Coverage Duration | Typically available for 30 days to 365 days. |

| Coverage | Emergency hospital visits, doctor's appointments, prescription medications, surgeries, X-rays, and laboratory services. |

| Cost | More affordable than major medical plans. |

| Application | Requires a health questionnaire. |

| Renewal | Can be renewed two times, for a total coverage of up to three years. |

| Availability | Not available in all states. |

| Ideal For | Individuals with temporary coverage needs or those seeking lower-cost options for a limited time. |

What You'll Learn

- Short-term health insurance is a convenient option to bridge the gap during transitional periods

- It is more affordable than ACA major medical plans, but offers less coverage

- It is not a long-term solution and does not cover pre-existing conditions

- Short-term health insurance is not available in all states

- It is ideal for those who are healthy and do not require regular health services

Short-term health insurance is a convenient option to bridge the gap during transitional periods

Short-term health insurance is a convenient option for those who need coverage for a temporary, specific period. It bridges the gap during transitional periods, such as switching jobs, and provides peace of mind until new benefits or long-term coverage kicks in.

Short-term health insurance is ideal for those who:

- Missed the Affordable Care Act (ACA) open enrollment period

- Are waiting for coverage from a new employer to begin

- Need quick proof of insurance for a special activity or trip

- Are waiting to enrol in Medicare

- Are between jobs and don't want to pay high COBRA health insurance premiums

- Are waiting to become eligible for Medicare

- Need coverage until the Open Enrollment Period begins

- Are not yet eligible for a major medical plan through their employer

Short-term health insurance is typically available for limited durations of 365 days or fewer, with the option to renew or purchase another short-term policy for coverage up to a cumulative 36 months. It is designed to fill gaps in coverage and is a good option for those who are healthy and do not generally require regular medical services or have prescription needs.

Short-term health insurance is also a more affordable option for those who cannot afford major medical plans. It provides basic coverage for unexpected illnesses or injuries, including doctor visits, emergency room visits, surgeries, and laboratory services. However, it does not cover pre-existing conditions and may not cover maternity care, mental health services, and prescription drugs.

Short-term health insurance is a flexible solution for those in transitional periods, offering lower premiums and quick coverage. However, it is important to note that it provides limited benefits and may not be suitable for those with pre-existing conditions or comprehensive coverage needs.

Weighing the Benefits: Exploring the Switch from Term to Permanent Life Insurance

You may want to see also

It is more affordable than ACA major medical plans, but offers less coverage

Short-term health insurance is a convenient and flexible option for those who need temporary coverage. It bridges the gap for people who are in between permanent insurance plans, such as students who are no longer covered by their parents' insurance, recent graduates, retirees, or those who are switching jobs. Short-term insurance is also ideal for those who missed the ACA open enrollment period, cannot afford traditional insurance, or require immediate coverage.

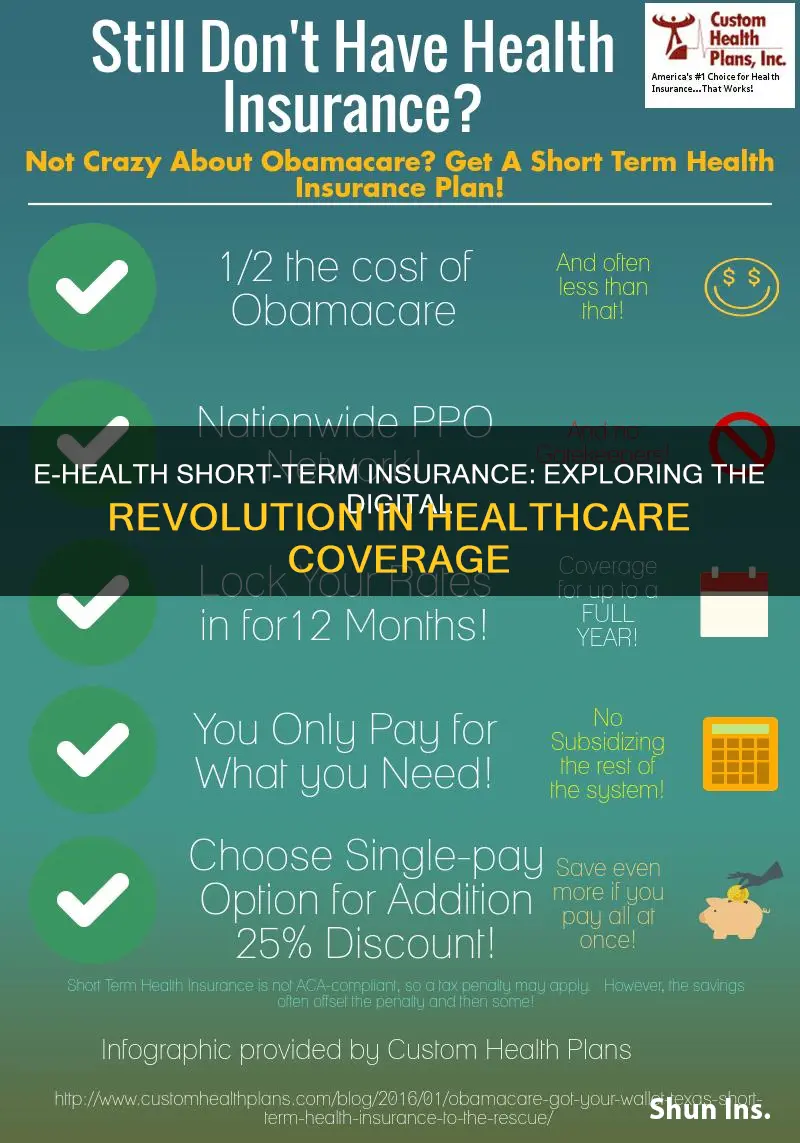

Short-term health insurance is more affordable than ACA major medical plans, with monthly premiums as low as $55 compared to at least $225 for major medical coverage. However, this lower cost comes with significantly less coverage. Short-term plans are not ACA-compliant and do not cover the ten essential health benefits that ACA plans cover. These include mental health services, prescription drugs, maternity and newborn care, preventive care, and substance abuse treatment. Short-term plans also do not cover pre-existing conditions and may deny coverage or offer limited benefits for such conditions.

Short-term health insurance is designed to provide basic coverage for unexpected illnesses or injuries. It typically covers emergency room visits, surgeries, hospital stays, and related x-rays and laboratory services. However, it does not cover routine medical needs and often excludes preventative, vision, dental, and mental health care benefits.

While short-term health insurance offers a cost-effective solution for temporary coverage, it is important to consider the limitations in coverage compared to ACA major medical plans. Short-term plans may not be suitable for individuals with pre-existing conditions or those seeking comprehensive and long-term coverage for ongoing healthcare needs.

Insurance Classification Conundrum: Understanding the Nuanced World of Amateur Pilot Insurance

You may want to see also

It is not a long-term solution and does not cover pre-existing conditions

Short-term health insurance is not intended to be a long-term solution to your healthcare needs. It is designed to bridge the gap between permanent policies, providing temporary coverage for a specific period, usually less than 365 days. Short-term health insurance is a good option for those who are healthy and do not require regular health services or prescriptions. It is ideal for those who need immediate coverage in case of an emergency.

Short-term health insurance plans do not cover pre-existing conditions. They are exempt from the Affordable Care Act (ACA) requirement to cover pre-existing conditions. Short-term insurers may deny you coverage or charge you more if you have a pre-existing condition. Any medical condition that was treated under a previous plan will be considered a pre-existing condition if you renew or purchase a new short-term plan.

Short-term health insurance is not a substitute for long-term, comprehensive health insurance. It is important to carefully review the limitations of your short-term plan and understand that it will not provide the same level of coverage as a long-term plan. Short-term plans are intended for individuals experiencing a temporary gap in their major medical insurance, such as those who are between jobs or waiting for employer benefits to start.

Get in Touch: A Guide to Contacting Momentum Short-Term Insurance

You may want to see also

Short-term health insurance is not available in all states

Short-term health insurance is a type of health plan that provides temporary medical coverage when you are between health plans, outside enrollment periods, and need some coverage in case of an emergency. It is designed for people who experience a temporary coverage gap in major medical insurance offered by an employer, or purchased on the state or federal exchange, or provided by Medicare.

However, the sale of short-term health insurance is regulated by state laws, and these vary across the US. Some states prohibit or place significant restrictions on the sale of short-term policies. These states include California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maine, Maryland, Massachusetts, New Jersey, New Mexico, New York, Rhode Island, Vermont, and Washington.

In some states, short-term health insurance is available for purchase but comes with strict regulations. For example, in Washington, short-term health insurance is limited to three months in any 12-month period. In other states, such as New Hampshire and Minnesota, no insurers offer short-term health plans.

Therefore, it is important to check the regulations and availability of short-term health insurance in your specific state before considering this type of coverage.

Understanding Extended Term Nonforfeiture: An Important Decision for Policyholders

You may want to see also

It is ideal for those who are healthy and do not require regular health services

Short-term health insurance is ideal for those who are healthy and do not require regular health services. It is designed for people who need temporary coverage, such as during transitional periods in their lives. For example, if you are switching jobs, short-term coverage can provide peace of mind until your new benefits kick in. Additionally, if you are a recent graduate who is no longer covered by your parents' insurance, or an early retiree waiting to qualify for Medicare, short-term health insurance can bridge the gap.

Short-term health insurance is also a good option for those who are healthy and do not generally require health services or have regular prescription needs. It can provide a health plan in case of emergency or immediate coverage. Most short-term plans will cover emergency hospital visits, certain prescription medications, and some doctor's appointments not related to pre-existing conditions.

Short-term health insurance is typically much more affordable than major medical plans. It offers lower premiums and greater flexibility than ACA-compliant comprehensive health insurance. However, this lower cost comes with much less coverage. Short-term plans do not cover pre-existing conditions and may not cover other essential benefits such as substance abuse treatment, mental health issues, and maternity care.

Short-term health insurance is also not intended as a long-term solution to your healthcare needs. It is meant to fill a gap in coverage and provide temporary protection from unexpected medical expenses. The coverage duration is usually limited to a specific period, typically less than 365 days, and may not be renewed beyond the initial coverage period.

Navigating the Path of 'Do-It-Yourself' Term Insurance: A Guide to Going Solo

You may want to see also

Frequently asked questions

Short-term health insurance is a type of health coverage available for a limited duration, typically 365 days or fewer. It is designed to bridge the gap during transitional periods when an individual might not have permanent health insurance coverage.

Short-term health insurance is suitable for individuals who are in transition. This could include those who have missed the open enrollment period for the year, lost their job, are waiting for their Medicare coverage to begin, or are waiting for employer benefits to start. Short-term health insurance is also a good option for those who are healthy and do not generally require health services.

Short-term health insurance typically covers emergency hospital visits, certain prescription medications, and some doctor's appointments not related to pre-existing conditions. The exact coverage depends on the specific plan and insurance company.

Short-term health insurance plans are typically much more affordable than major medical plans. They are available for as little as \$55 per month, compared to at least \$225 per month for major medical coverage. However, the cost can vary depending on factors such as zip code, age, gender, and the number of people covered.