Cigna Healthcare offers a range of health insurance plans to help individuals and families manage their medical expenses. After receiving healthcare services, Cigna members will receive a medical bill from their provider and an Explanation of Benefits (EOB) from Cigna. The EOB is not a bill but outlines how the claim was paid, including how much each service costs, what the insurance plan covers, and the remaining amount the member must pay. Cigna members can access their plan details, including reimbursement rates and requirements, through their personal webpages. Cigna also provides resources to help members understand and manage their medical bills, such as organising bills and statements, comparing bills with insurance statements, and identifying billing errors.

What You'll Learn

Understanding your Cigna bill

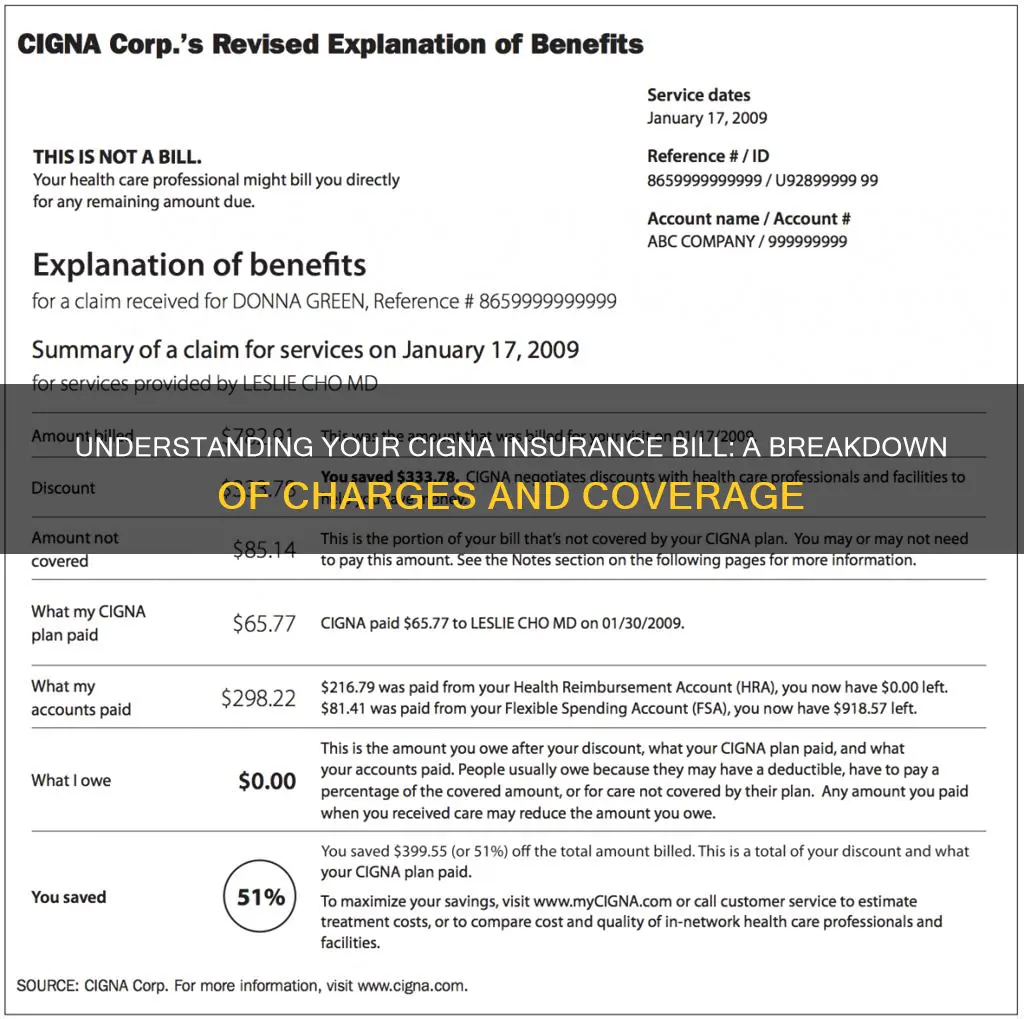

A Cigna bill is not a traditional bill, but an Explanation of Benefits (EOB). This document is designed to help you understand how much each service costs, what your plan will cover, and how much you will have to pay when you receive a bill from your healthcare provider or hospital.

The EOB is sent to you after a healthcare visit or procedure. It is not a bill, but it will show you how your claim was paid. It is important to keep your EOBs for tax purposes and for your records.

When you receive a bill from a healthcare provider, it is likely that you will pay less than the amount billed if you are insured. You will receive an EOB from Cigna, which will show how much of the bill you need to pay. It is a good idea to compare your medical bill and EOB before paying to ensure you have been charged the correct amount.

You can also pair your medical bill with your insurance statement. This will help you keep track of your payments and understand your bill. Your insurance statement will include the following:

- Date, type of service, and provider

- Allowable amount

- Amount insurance pays

- Amount you pay

- Payment date

- Amount you've paid toward your deductible

You can access all the information regarding your plan and benefits by logging in to your personal Cigna webpages. You can also contact Cigna by email, post, or phone.

The Intricacies of Self-Insurance: Exploring the Viable Alternative to Traditional Insurance

You may want to see also

How to pay Cigna bills

When it comes to paying Cigna bills, there are a few things to keep in mind. Firstly, it's important to understand the difference between a claim and a bill. A claim is a request for payment sent by you or your healthcare provider to Cigna after you receive care. Once Cigna receives a claim, they will check it against your plan to ensure the services are covered. If approved, Cigna will pay the healthcare provider directly or reimburse you, depending on who submitted the claim. Any remaining charges not covered by your plan will be billed to you directly by the provider. This bill from your provider is separate from the claim and is what you need to pay.

To manage your Cigna bills effectively, here are some steps you can take:

- Organize your medical bills: Keep paper bills and statements, or create electronic folders on your computer to stay organized.

- Keep a calendar: Note down each medical appointment, including the provider and the care received. Also, record the dates you paid for prescription medication.

- Organize bills by date of service: If you have multiple family members on the plan, maintain separate files for each individual.

- Pair medical bills with insurance statements: Insurance statements often cover multiple medical bills, so keep these papers together. If possible, make a copy of the statement and match it with each bill it mentions.

- Create a spreadsheet: Label columns with relevant headings such as date, type of service, provider, allowable amount, amount insurance pays, amount you pay, payment date, and amount paid towards your deductible. Update this spreadsheet each time you receive a bill, insurance statement, or make a payment.

- Compare your medical bill and insurance statement: Ensure the date, provider, and type of care are correct on both. Understand the amount you need to pay as per your insurer. If you have questions or spot errors, contact your provider's billing office or your insurer.

- Solve payment problems promptly: Not paying a medical bill can negatively impact your credit rating. If you miss a due date, contact the billing office immediately and try to pay over the phone. If you can't pay the full amount, ask about arranging a payment plan with regular instalments.

Additionally, Cigna offers various methods to pay your bills:

- Online: You can pay your Cigna Medicare plan premium online through the myCigna website or the Cigna mobile app. You will need your Cigna Healthcare ID card, customer ID number, and payment information (credit/debit card or bank account details).

- Automatic payments: Set up automatic payments through your bank account, debit card, credit card, or Social Security check. You can sign up for this online, by phone, or by mailing a completed form.

- By phone: Contact Cigna's customer service to make a payment over the phone.

- By mail: Send a check or money order, along with the bottom portion of your invoice, to the designated Cigna mailing address.

Insurance Classification Conundrum: Understanding the Nuanced World of Amateur Pilot Insurance

You may want to see also

Cigna billing errors

Cigna is a health insurance company that offers a range of plans to individuals, families, and employers. While the company strives to provide efficient and hassle-free services, billing errors can occur. Here are some common issues related to Cigna billing errors:

Delayed or Denied Claims Reimbursement

Some customers have reported delays in receiving reimbursements for their claims. In certain cases, Cigna may deny coverage for specific procedures or services, leading to out-of-pocket expenses for the insured. These delays or denials can cause financial strain and frustration for customers.

Incorrect Charges or Billing Mistakes

There have been instances where Cigna policyholders have received bills for services that should have been covered by their plans. This can occur due to errors in interpreting plan benefits or miscalculating the amount payable by the customer.

Out-of-Network Coverage Disputes

Cigna customers have occasionally faced challenges with out-of-network coverage. In some cases, Cigna has denied claims for out-of-network services, even when prior authorization was obtained. This has resulted in unexpected financial burdens for customers seeking care outside of Cigna's network.

Issues with In-Network Providers

In certain situations, Cigna policyholders have encountered issues with in-network providers. Some customers have reported that Cigna refused to cover services provided by in-network doctors or facilities, requiring them to pay out of pocket.

Delays in Processing Claims

There have been reports of Cigna taking an extended amount of time to process claims, particularly when the company is responsible for reimbursing the insured. This delay can cause frustration and financial difficulties for customers awaiting payment.

Mental Health Coverage Disputes

Some Cigna customers have experienced issues with mental health coverage. In certain cases, Cigna has denied coverage for out-of-network mental health services or applied confusing and inconsistent policies for determining deductible amounts.

Lack of Timely Communication

Cigna customers have occasionally faced challenges in communicating with the company. Some have reported long wait times, difficulty reaching the appropriate representatives, and a lack of timely responses to inquiries and appeals.

To address these billing errors and issues, Cigna customers are advised to carefully review their billing paperwork, compare medical bills with insurance statements, and promptly report any discrepancies. Filing appeals and seeking assistance from customer service or executive correspondence teams are also recommended steps to resolve billing errors and ensure accurate billing practices.

The Evolution of Term Insurance: A Historical Perspective

You may want to see also

Cigna payment plans

Cigna offers a wide range of insurance plans and products that focus on all aspects of your well-being, both physical and emotional. The company provides health insurance, dental plans, and Medicare, as well as supplemental insurance policies that offer additional coverage and cash benefits.

Payment Plans

Cigna offers several options for paying your insurance premiums:

- Online payments: You can pay your monthly plan premium at any time using Cigna's secure payment website, which is available 24 hours a day, 7 days a week. You will need your Cigna HealthcareSM ID card, your 8- or 11-digit customer ID number, and your credit or debit card number and expiration date, or your checking or savings bank account number and routing number.

- Automatic payments: You can set up automatic payments so that your premium is withdrawn from your bank account or debit card, or charged to your credit card each month. You can sign up or make changes online, by phone, or by mail.

- Social Security or Railroad Retirement Board (RRB) Benefits Check Withdrawal: You can opt to have your monthly plan premiums withdrawn from your Social Security check or your RRB benefits check.

- Check or money order: You can pay your plan premium by mailing a check or money order directly to Cigna. You may pay monthly, quarterly, or yearly, but the payment must be received by the last day of the month it is due.

Understanding Your Bills

After receiving health care services, you will get a medical bill from your provider and an Explanation of Benefits (EOB) from Cigna. The EOB is not a bill but a statement that shows how your claim was paid. It explains how much each service costs, what your plan will cover, and how much you will need to pay the health care provider or hospital.

It is important to compare your medical bill and EOB before paying to ensure that you have been charged the correct amount. You can also call your provider's billing office or Cigna if you have any questions about your bill or EOB.

Additionally, Cigna offers resources to help you manage your medical bills, such as steps to keep your medical bills organized and a list of headings to include when creating a spreadsheet to track your medical expenses.

Supplemental Insurance: Understanding Its Role and Relationship with Short-Term Coverage

You may want to see also

Cigna billing contact information

Cigna offers 24/7 customer service for its members. You can contact Cigna by email, post, or phone. The company usually responds to queries within two days, but if your request is urgent, it asks that you call them. You can find the phone number on your personal webpages or on your ID card. When sending an email, include your personal reference number in the subject line for a quicker response time.

- Eligibility/Billing Phone: 1 (603) 268-7830

- Fax: 1 (603) 268-7973

- Mailing Address: Cigna Healthcare Employer Services PO Box 2010 Concord, NH 03302

- Cigna Healthcare Supplemental Benefits Mailing Address: 11501 Alterra Parkway Suite 500 Austin, TX 78758

- Cigna Healthcare Supplemental Benefits TTY/TDD Service Mailing Address: 11095 Viking Drive Suite 350 Eden Prairie, MN 55344

- Cigna Home Delivery Pharmacy Mailing Address: Cigna Healthcare PO Box 10190 Horsham, PA 19044

- Cigna Healthcare Vision Claims Mailing Address: Cigna Healthcare Vision Claims Department c/o First American Administrators, Inc. PO Box 8504 Mason, OH 45040-7111

- Cigna Healthcare Medicare Advantage Plans Mailing Address: Cigna Healthcare Attn: Medicare P.O. Box 29030 Phoenix, AZ 85038-9971

- Cigna Healthcare Medicare Prescription Drug Plans Mailing Address: Cigna Healthcare Medicare Prescription Drug Plans P.O. Box 269005 Weston, FL 33326-9927

- Cigna Healthcare Customer Service Mailing Address: Cigna Healthcare Attn: Customer Service P.O. Box 20002 Nashville, TN 37202

- Cigna Healthcare Claims Mailing Address: Cigna Healthcare Claims PO Box 5200 Scranton, PA 18505

- Cigna Healthcare PO Box Mailing Address: Cigna Healthcare PO Box 747102 Pittsburgh, PA 15274-7102

- Cigna Healthcare PO Box Mailing Address: Cigna Healthcare PO Box 742642 Atlanta, GA 30374-2642

- Cigna Healthcare PO Box Mailing Address: Cigna Healthcare PO Box 847990 Dallas, TX 75284-7990

- Cigna Healthcare Direct Billing Mailing Address: Cigna Healthcare PO Box 650843 Dallas, TX 75265-0843

- Cigna Healthcare Corporate Headquarters Address: 1601 Chestnut Street, Two Liberty Place Philadelphia, PA 19192

You can also contact Cigna through the myCigna member portal, the Health Care Provider portal, or the Client Resource Portal.

Understanding the Fundamentals: Is Insurance Term or Permanent?

You may want to see also

Frequently asked questions

A claim is a request to be paid, similar to a bill. If you recently went to the doctor and received care, you or your doctor will submit or “file” a claim. In most cases, if you received in-network care, your provider will file a claim for you.

When Cigna receives a claim, it checks it against your plan to make sure the services are covered. Once approved, Cigna pays the health care provider or reimburses you, depending on who submitted the claim. Any remaining charges that weren’t covered by your plan are billed directly to you by your provider.

An EOB is a claim statement that Cigna sends to you after a health care visit or procedure to show you how your claim was paid. It is not a bill but a document to help you understand how much each service costs, what your plan will cover, and how much you will have to pay when you receive a bill from your health care provider or hospital.

To submit a medical, dental, or mental health claim, download and print the appropriate claim form. Follow the instructions included on the form to complete it, then mail your completed claim to the address shown on the form.

In some cases, you need to have a procedure or service pre-approved by Cigna before you receive care, otherwise the claim may be denied. This is known as prior authorization. If your claim is denied, Cigna will notify you in writing about your appeal rights.