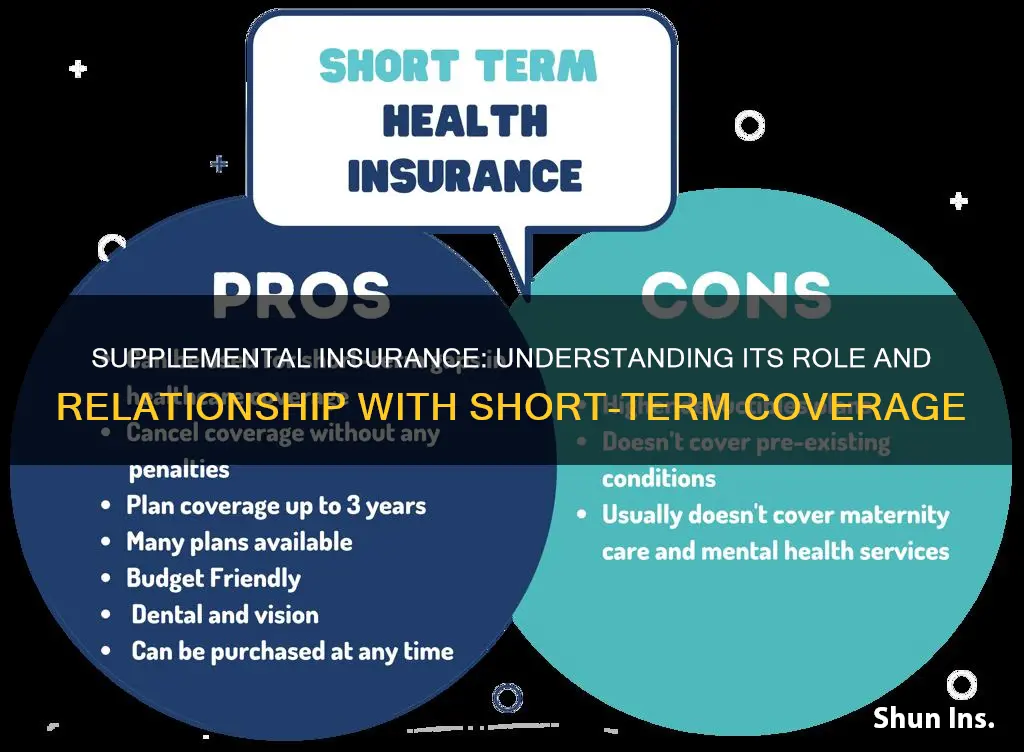

Supplemental insurance and short-term insurance are two different policies with different objectives. Supplemental insurance is designed to supplement your regular major medical insurance policy. It includes coverage for accidents, dental, vision, cancer, fixed indemnity, and critical illness. On the other hand, short-term health insurance is a temporary plan that bridges the gap between standard health insurance plans. It usually has restricted benefits and doesn't cover pre-existing conditions, prescription drugs, or maternal care. While short-term insurance is more affordable, it often leads to higher out-of-pocket costs.

| Characteristics | Values |

|---|---|

| Purpose | Fill gaps in primary health insurance |

| Coverage | Extended coverage for specific medical issues |

| Cost | Lower premiums than other health insurance policies |

| Coverage Period | Up to 90 days |

| Application | Simple application process |

| Pre-existing Conditions | Does not cover pre-existing conditions |

| Preventative Care | Does not cover preventative medical care |

What You'll Learn

- Supplemental insurance is not a substitute for comprehensive health insurance

- Short-term health insurance is cheaper than standard insurance

- Short-term health insurance has limited benefits

- Short-term health insurance is not available in every state

- Short-term health insurance is not a good long-term solution

Supplemental insurance is not a substitute for comprehensive health insurance

Supplemental insurance is not comprehensive coverage. It is limited benefit coverage that supplements your regular major medical insurance policy. It is not meant to replace it. Supplemental insurance policies are not required to adhere to standards established by the Affordable Care Act (ACA). They can deny coverage based on health status, refuse to cover pre-existing conditions, and cap benefits at predetermined levels.

Comprehensive health insurance, on the other hand, provides broad coverage of a wide range of healthcare services, including physician visits, hospitalization, and emergency room visits. It covers both preventive care and treatment for injuries or illnesses. It is designed to be your primary source of health insurance coverage, while supplemental insurance is meant to enhance that coverage.

In conclusion, supplemental insurance is not a substitute for comprehensive health insurance. It is an additional layer of coverage that can help with specific expenses or provide additional benefits. Comprehensive health insurance is your primary source of coverage, providing a broad range of benefits to meet your healthcare needs.

The Truth About Term Insurance: Unraveling the Mystery of Surrender and Refund Values

You may want to see also

Short-term health insurance is cheaper than standard insurance

Short-term health insurance is a temporary alternative to standard health insurance. It is often used as a bridge between full-benefit health insurance plans or when an individual is unable to obtain affordable coverage. Short-term health insurance is cheaper than standard insurance because it offers limited coverage and has lower premiums. However, it is important to note that short-term health insurance has its limitations and should not be considered a long-term solution.

Lower premiums

Short-term health insurance offers lower premiums than standard health insurance policies. This is because short-term plans have lower coverage and higher out-of-pocket costs. The lower premiums make short-term health insurance attractive to those who are between jobs or unable to afford a more comprehensive plan.

Limited coverage

Short-term health insurance plans do not offer the same comprehensive coverage as standard health insurance. They are not regulated by the Affordable Care Act (ACA) and are therefore not required to cover essential health benefits such as prescription drugs, mental healthcare, maternity care, and pre-existing conditions. Short-term plans also have restricted benefits, which can lead to high out-of-pocket costs when individuals need certain types of medical care.

Not a long-term solution

Short-term health insurance is not meant to be a long-term solution as it has significant limitations and exclusions. These plans are designed to fill temporary gaps in coverage and are not a substitute for comprehensive health insurance. In addition, short-term health insurance may not be available in all states and may have restrictions on the length of coverage.

In conclusion, short-term health insurance is cheaper than standard insurance due to its limited coverage and lower premiums. However, individuals considering short-term health insurance should carefully weigh the pros and cons as it may not provide adequate coverage for their needs.

The Intricacies of Self-Insurance: Exploring the Viable Alternative to Traditional Insurance

You may want to see also

Short-term health insurance has limited benefits

Short-term health insurance is a temporary solution for those who are between insurance coverages, outside of enrollment periods, or need coverage in case of an emergency. It is not meant to be a long-term solution and has limited benefits compared to standard health insurance policies. Here are some key points to illustrate the limited benefits of short-term health insurance:

- Higher out-of-pocket costs: While short-term health insurance plans have lower premiums, they often result in higher out-of-pocket costs when certain types of medical care are needed. The deductibles, copayments, and coinsurance for short-term plans can be significantly higher than those of traditional plans.

- Limited coverage: Short-term health insurance plans typically do not cover pre-existing conditions, routine medical needs, maternity care, mental health care, preventive care, or prescription drugs. They are designed to cover unexpected medical events not linked to pre-existing conditions.

- Limited duration: Short-term health insurance plans are meant to fill short gaps in coverage and are not meant to be long-term solutions. The plans usually have a duration of less than a year, and even with renewals, the total coverage period is limited.

- Lack of comprehensive benefits: Short-term health insurance plans do not offer the same comprehensive benefits as traditional plans. They often exclude coverage for essential health benefits such as maternity care, mental health services, substance abuse treatment, and prescription drugs.

- No guarantee of renewability: Short-term health insurance plans are not guaranteed to be renewable. Even if a plan is renewed, any medical conditions treated under the previous plan may be considered pre-existing conditions, and coverage may be denied.

- Limited availability: Short-term health insurance plans are not available in all states. Some states prohibit the sale of such plans, while others have regulations that restrict their duration and availability.

- Medical underwriting: Short-term health insurance plans often involve medical underwriting, where applicants with health conditions may be turned down or charged higher premiums. This is in contrast to ACA-compliant plans, which prohibit medical underwriting and pre-existing condition exclusions.

- Limited provider networks: Short-term health insurance plans may not have broad provider networks, and out-of-network care may not be covered. This can limit the choice of doctors and hospitals available to the policyholder.

- High deductibles: Short-term health insurance plans often have significantly higher deductibles than traditional plans, which means higher out-of-pocket expenses before insurance coverage kicks in.

- Exclusions and limitations: Short-term health insurance plans typically have a list of exclusions and limitations that vary depending on the specific plan. It is important to carefully read the "exclusions and limitations" information before purchasing a plan to understand what is covered and what is not.

Maximizing Long-Term Health Insurance Savings: Strategies for the Savvy Consumer

You may want to see also

Short-term health insurance is not available in every state

The availability of short-term health insurance varies from state to state. Some states have banned the sale of short-term plans, while others have imposed regulations that make it unattractive for insurers to offer them. For example, New Jersey requires all health plans to provide full-year coverage and comprehensive benefits that exceed the requirements of the Affordable Care Act (ACA).

In some states, insurers have stopped offering short-term plans due to changes in state regulations. For instance, in Washington, the sale of short-term health plans was discontinued in mid-2022, and as of 2023, no insurers offer short-term plans in the state.

The Biden administration has proposed further restrictions on short-term health insurance. The proposed rule would limit the initial term of short-term policies to no more than three months and the total duration, including renewals, to no more than four months. These changes aim to ensure that short-term coverage is used to fill temporary gaps between comprehensive policies rather than serving as a long-term solution.

It is important to note that the availability of short-term health insurance can change over time due to evolving state regulations and insurer business practices. Therefore, it is advisable to check the current availability and regulations for your specific state.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

Short-term health insurance is not a good long-term solution

Firstly, short-term health insurance is not intended to be a permanent solution. It is designed to fill temporary gaps in health insurance coverage, such as when individuals are between jobs or waiting for their employer-sponsored health insurance to begin.

Secondly, short-term health insurance typically has restricted benefits when compared to standard health insurance plans. This can result in high out-of-pocket costs when individuals need certain types of medical care, especially for pre-existing conditions. Short-term health insurance often does not cover pre-existing conditions, routine medical needs, maternity care, or prescription drugs.

Thirdly, short-term health insurance plans are not regulated by the Affordable Care Act (ACA) and are therefore not required to cover essential health benefits such as maternity care, mental health services, substance use disorder treatment, and prescription drugs. This means that individuals with short-term health insurance may have to pay out-of-pocket for these services, leading to unexpected costs.

Fourthly, short-term health insurance plans often have higher deductibles and out-of-pocket costs than traditional health insurance plans. While the monthly premiums for short-term health insurance may be lower, individuals may end up paying more overall if they need extensive medical care.

Finally, short-term health insurance plans are not available in all states, and the availability and regulations of these plans vary from state to state.

In conclusion, while short-term health insurance can be a good temporary solution for individuals who need immediate coverage, it is not a good long-term solution due to its limited benefits, higher out-of-pocket costs, lack of coverage for pre-existing conditions, and lack of regulation by the ACA. Individuals should carefully consider their needs and explore all their options before enrolling in a short-term health insurance plan.

Capitalization Conundrum: Navigating the World of Insurance Terminology

You may want to see also

Frequently asked questions

Supplemental insurance is a limited-benefit policy that provides additional cash benefits in the event of a medical condition or circumstance covered by the policy. It is designed to supplement your regular major medical insurance policy.

Short-term insurance is a temporary plan that provides coverage when you don't have a standard policy. It is typically cheaper than a regular plan but has restricted benefits, leading to high out-of-pocket costs.

Supplemental insurance is meant to be used alongside your primary insurance, to help cover additional costs associated with a medical condition or circumstance. Short-term insurance, on the other hand, is meant to provide temporary coverage during gaps between other health plans. It is not meant to be a long-term solution and does not cover pre-existing conditions.