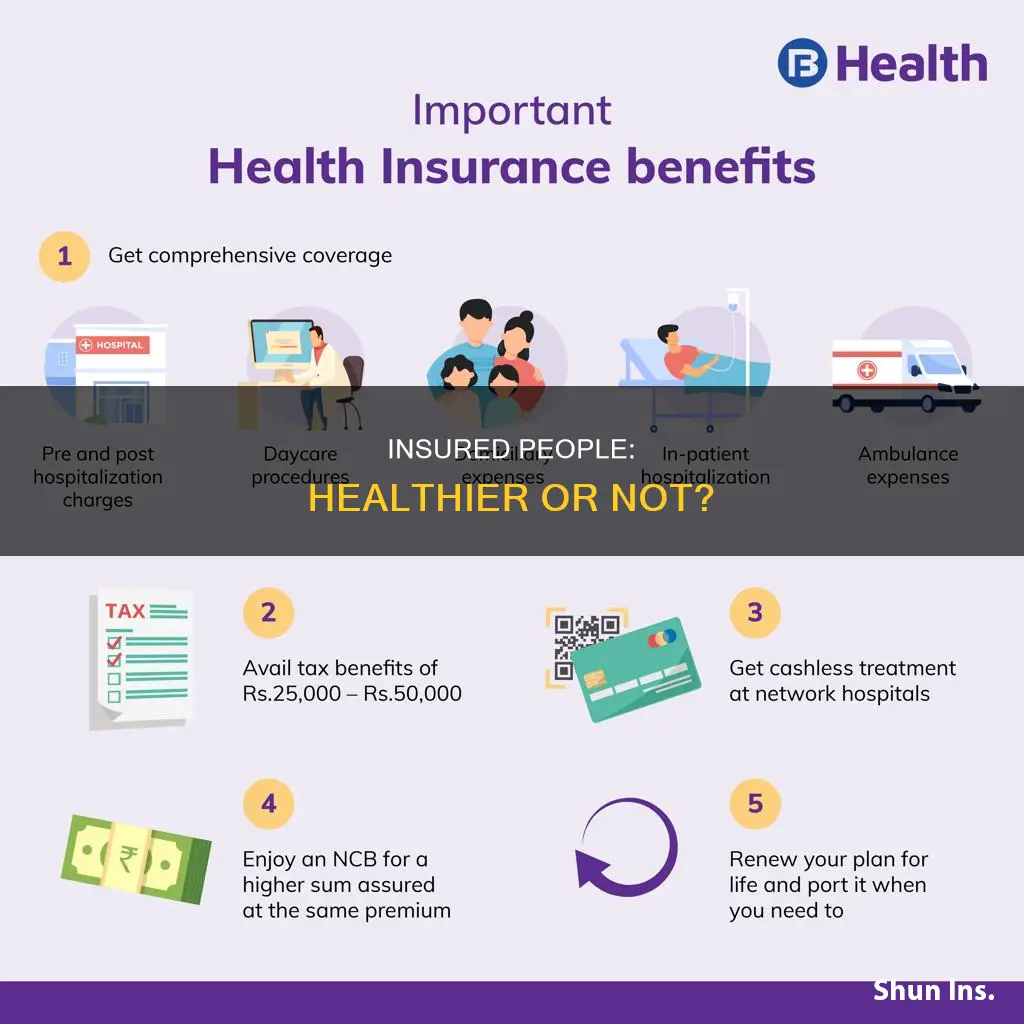

It is a well-known fact that people with health insurance are healthier than those without it. However, this is a surprisingly hard question to answer. People with health insurance look different from those without it in many ways. For example, people with Medicaid often have much worse health outcomes and higher mortality rates. But that doesn't mean that having health insurance makes you less healthy. Being low-income is hard on your health, and being disabled is inherently hard on your health, independent of health insurance.

In 2008, the state of Oregon decided to expand its Medicaid program through a lottery, and this provided a unique opportunity to study the effects of health insurance. The Oregon Health Insurance Experiment found that people with insurance were more likely to go to the doctor, use more prescription medications, and report better access to care and higher-quality care. They were also less likely to delay or forgo care due to costs. However, insurance did not seem to improve physical health outcomes such as blood pressure, cholesterol, diabetes, or obesity.

Overall, while health insurance improves access to healthcare and financial protection, its impact on physical health is more nuanced and complex.

What You'll Learn

- People with insurance are more likely to receive preventive care and services for major health conditions and chronic diseases

- People with insurance are more likely to have a regular source of care

- People with insurance are more likely to receive timely care

- People with insurance are less likely to delay or forgo care due to costs

- People with insurance are less likely to face unaffordable medical bills

People with insurance are more likely to receive preventive care and services for major health conditions and chronic diseases

People with health insurance are more likely to receive preventive care and services for major health conditions and chronic diseases. This is because health insurance facilitates a continuing care relationship or a regular source of care, which increases the likelihood of receiving appropriate care.

People with insurance are more likely to receive preventive care and screening services. According to the US Preventive Services Task Force (USPSTF), uninsured adults are less likely to receive recommended preventive and screening services and are less likely to receive them at the recommended frequencies. For example, uninsured adults are less likely to receive mammograms, Pap tests, and colorectal cancer screenings. This is because insurance benefits are less likely to include preventive and screening services. However, over time, coverage of preventive and screening services has been increasing.

In addition, people with insurance are more likely to receive services for major health conditions and chronic diseases. Uninsured adults with hypertension or high cholesterol have diminished access to care and are less likely to be screened, take prescription medication, and experience worse health outcomes. Uninsured people with diabetes are also less likely to receive recommended services and may experience uncontrolled blood sugar levels, increasing the risk of hospitalisation. Uninsured people with chronic diseases, in general, are less likely to receive appropriate care to manage their health conditions and have worse clinical outcomes than those with health insurance.

Furthermore, uninsured cancer patients generally have poorer outcomes and are more likely to die prematurely than those with insurance, largely due to delayed diagnosis. Uninsured women are more likely to receive a late-stage diagnosis for breast cancer and have a greater risk of dying than women with private coverage. Uninsured patients with colorectal cancer, prostate cancer, and melanoma also have a greater risk of dying than those with private insurance.

Prescribed Medication Privacy: Understanding Insurance Bills

You may want to see also

People with insurance are more likely to have a regular source of care

People with health insurance are more likely to have a regular source of care. This is because health insurance improves access to health care services and diminishes the adverse effects of being uninsured. People with insurance are more likely to receive preventive care and services for major health conditions and chronic diseases. They are also more likely to receive timely and appropriate care, including screening services, prescription drugs, and specialty mental health services.

The positive effects of health insurance on having a regular source of care are particularly evident for people with chronic conditions, such as diabetes, hypertension, HIV, and mental illness. Health insurance enhances their opportunities to acquire a regular source of care and facilitates ongoing care with a primary health care provider. This is crucial for effective chronic disease management, as it enables continuous monitoring, early diagnosis, and timely treatment.

Furthermore, health insurance reduces financial barriers to obtaining health care services. Uninsured individuals often face unaffordable medical bills and medical debt when they seek care. In contrast, insured individuals are more likely to afford health care costs and have better financial security.

Health insurance also plays a role in reducing racial and ethnic disparities in health care access and utilization. It has been shown to lessen disparities in the receipt of preventive care and services for cardiovascular disease among racial and ethnic minority groups.

Overall, health insurance improves access to health care, reduces financial barriers, and leads to better health outcomes. It enables individuals to have a regular source of care, which is essential for maintaining and improving their health.

The Intricacies of Loss Pick: Unraveling the Insurance Industry's Unique Language

You may want to see also

People with insurance are more likely to receive timely care

People with health insurance are more likely to receive timely care than those without. This is because health insurance facilitates entry into the healthcare system and is strongly associated with receiving timely and continuous care.

The availability of health insurance is a key factor in determining whether individuals can access healthcare services. Those with insurance are more likely to have a usual source of care and are thus able to develop an ongoing relationship with their healthcare provider. This is particularly important for those with chronic conditions, as it enables better management of their health and improved medication adherence. Moreover, insurance coverage increases the likelihood of receiving preventive services and recommended screenings.

Research has shown that individuals without health insurance are less likely to receive preventive care and services for major health conditions and chronic diseases. They are more likely to delay or forgo care due to costs, leading to preventable conditions or chronic diseases going undetected. Uninsured individuals also face unaffordable medical bills and often struggle to afford health care costs, which can quickly result in medical debt.

Furthermore, insurance coverage has a significant impact on health outcomes. Uninsured adults have poorer overall health and are more likely to experience declines in their health status over time. They are also at greater risk of premature death and have higher in-hospital mortality rates compared to those with insurance.

During the COVID-19 pandemic, the number of uninsured individuals in the United States decreased, largely due to coverage expansions and protections put in place. These included continuous enrollment in Medicaid and enhanced subsidies in the Marketplace, which made private coverage more affordable. As a result, the uninsured rate reached a record low of 9.6% in 2022.

Unraveling the Complexities of Insurance Billing for DOs and MDs

You may want to see also

People with insurance are less likely to delay or forgo care due to costs

People without health insurance are less likely to receive preventive care and services for major health conditions and chronic diseases. They are more likely to delay or forgo care due to costs.

In 2022, nearly half (47.4%) of nonelderly uninsured adults reported not seeing a doctor or health care professional in the past 12 months compared to 16.6% with private insurance and 14% with public coverage. A significant reason for not accessing care among uninsured individuals is that many (43.1%) do not have a regular place to go when they are sick or need medical advice. However, cost also plays a role. Over one in five (22%) nonelderly adults without coverage said that they went without needed care in the past year because of cost compared to 4.7% of adults with private coverage and 7.4% of adults with public coverage.

Uninsured children were more likely than those with private insurance to go without needed care due to cost in 2022 (8.6% versus less than 1%). Furthermore, nearly one-quarter (24.5%) of uninsured children had not seen a doctor in the past year compared to 4.3% and 5.7% for children with public and private coverage, respectively.

Uninsured people are less likely to receive the treatments their health care providers recommend for them because of the cost of care. In 2022, uninsured nonelderly adults were over twice as likely as adults with private coverage to say that they delayed filling or did not get a needed prescription drug due to cost (12.3% vs. 5.4%).

People without health coverage are less likely to have regular outpatient care. They are more likely to be hospitalized for avoidable health problems and to experience declines in their overall health. When they are hospitalized, uninsured people receive fewer diagnostic and therapeutic services and also have higher mortality rates than those with insurance.

Research demonstrates that gaining health insurance improves access to health care considerably and diminishes the adverse effects of having been uninsured. A review of research on the effects of the ACA Medicaid expansion finds that expansion led to positive effects on access to care, utilization of services, the affordability of care, and financial security among the low-income population.

Understanding Loss Assessment: Unraveling the Intricacies of Shared Property Insurance Coverage

You may want to see also

People with insurance are less likely to face unaffordable medical bills

People with health insurance are less likely to face unaffordable medical bills. Those without insurance are more likely to delay or forgo care due to costs. Studies show that uninsured people are less likely than those with insurance to receive preventive care and services for major health conditions and chronic diseases. Uninsured people often face unaffordable medical bills when they do seek care, and these costs can quickly translate into medical debt.

Uninsured non-elderly adults are nearly twice as likely as those with insurance to say they have difficulty affording health care costs. In 2022, 64% of uninsured non-elderly adults said that they were uninsured because the cost of coverage was too high. Uninsured people are more likely to delay filling or not get a needed prescription drug due to cost. They are also more likely to experience negative consequences due to health care debt, such as using up savings, having difficulty paying other living expenses, or borrowing money.

Health insurance is associated with more appropriate use of health care services and better health outcomes for adults. It facilitates ongoing care with a regular health care provider and reduces financial barriers to obtaining those services.

Who Qualifies as Insurable Dependents?

You may want to see also

Frequently asked questions

Health insurance impacts health by improving access to healthcare services and reducing financial barriers to obtaining those services. People with health insurance are more likely to receive preventive care and services for major health conditions and chronic diseases. They are also less likely to delay or forgo care due to costs.

Not having health insurance can lead to lower access to care, higher out-of-pocket costs, and worse health outcomes. People without insurance are more likely to delay or forgo care, leading to preventable conditions or chronic diseases going undetected. They also often face unaffordable medical bills and medical debt.

There are various factors that can contribute to a person being uninsured, including income, employment status, age, racial and ethnic identity, and public policies regarding insurance coverage. People with lower incomes, those who are unemployed or work in jobs that don't offer insurance, and certain racial and ethnic minorities are more likely to be uninsured. Additionally, public policies and insurance industry practices can impact the availability and affordability of insurance.