Term life insurance does not have a cash surrender or refund value. This means that if you cancel your term life insurance policy, you will not get any money back. Term life insurance is designed to provide basic insurance coverage at a low cost, and it does not have any additional features or benefits that can be utilised while the policyholder is alive. On the other hand, permanent life insurance policies often include a cash value component, which allows policyholders to access the money while they are still alive. This cash value is built up over time through premium payments and can be used for loans, to pay premiums, or for withdrawals.

| Characteristics | Values |

|---|---|

| Does term insurance have a surrender value? | No, term insurance does not have a surrender value. |

| Does term insurance have a refund value? | No, term insurance does not offer a refund if you cancel or outlive the policy. |

| Can you cancel a term insurance policy? | Yes, you can cancel a term insurance policy at any time without penalty. |

| What is the cash surrender value? | The cash surrender value is the amount of money a life insurance policyholder receives for canceling their policy before it matures or they pass away. |

What You'll Learn

- Term insurance policies don't have cash values but are cost-effective

- Surrendering a term life insurance policy means removing the monthly premium from the budget

- Surrendering a whole life insurance policy means cancelling the policy

- Surrendering a life insurance policy means agreeing to take the cash surrender value assigned by the insurance company and forgoing the death benefit

- Surrender charges can last about 10 to 15 years after buying the policy

Term insurance policies don't have cash values but are cost-effective

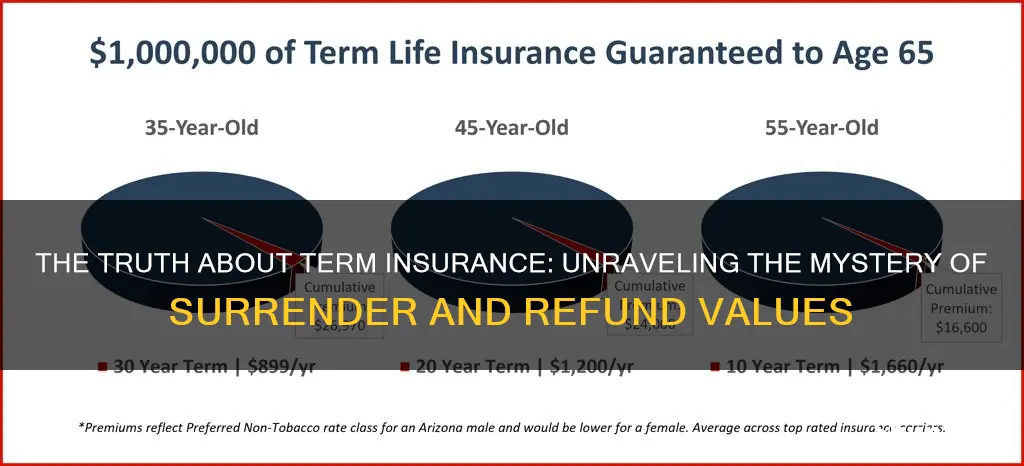

Term life insurance policies do not have cash values, but they are a cost-effective way to ensure your loved ones are protected. Term life insurance is a type of life insurance policy that provides coverage for a specific period, or "term". It is straightforward, without the bells and whistles of other insurance types. It is also easy to understand, as you pay premiums for a set term and a set amount is paid out if you pass away during that term.

Term life insurance is often more affordable than whole life insurance. It is a cost-effective way to ensure your loved ones are protected. You can choose a term that aligns with your needs, such as until your children are grown or your mortgage is paid off.

Term life insurance is also flexible. You can choose a term length that suits your needs, ranging from 10 to 40 years. The longer the term, the higher the premium might be as the insurance company is taking on a longer risk.

Term life insurance is a pivotal element in securing your loved one's financial future. It offers a practical and affordable way to ensure your family can navigate life even after you're gone. When deciding on term life insurance, consider the term length and coverage amount meticulously and consult an insurance agent to align the policy with your financial landscape.

Term life insurance is designed for the singular purpose of providing a death benefit payout when you die. There aren't any additional features that you can utilize when you're alive, like a cash-value account. This makes term life insurance simple and significantly cheaper. However, it also means you won't have the added benefits that come with a cash-value account, such as being able to borrow from the account.

Cigna's Individual Term Insurance Plans: Exploring Personalized Coverage Options

You may want to see also

Surrendering a term life insurance policy means removing the monthly premium from the budget

Term life insurance is a simple and cost-effective form of insurance that provides basic coverage at a low cost. Unlike permanent life insurance, term life insurance does not have a cash value component, meaning there is no savings-like account that the policyholder can withdraw from while they are alive. Instead, term life insurance offers a singular benefit in the form of a death benefit, which the beneficiaries will receive if the policyholder dies while the policy is in effect.

Term life insurance policies can be cancelled at any time without penalty. However, since term life insurance does not have a cash value component, there is no money to be reimbursed upon cancellation. Surrendering a term life insurance policy essentially means removing the monthly premium from your budget.

While term life insurance policies do not offer cash value, some policies allow policyholders to recover their premiums. Additionally, term life insurance policies can be converted into regular life policies before the maturity date, allowing policyholders to continue enjoying life protection without purchasing a new policy.

Term life insurance is a popular choice for individuals seeking affordable coverage, particularly those who are young and healthy. It is important to carefully consider your financial goals and needs before surrendering a term life insurance policy, as doing so may impact your long-term finances.

Exploring Short-Term Insurance Options with Horizon

You may want to see also

Surrendering a whole life insurance policy means cancelling the policy

Term life insurance does not have a cash value, but it is more affordable than permanent life insurance. Term life insurance is a basic low-cost insurance that provides coverage for a set number of years. It is very cheap for young buyers but becomes prohibitively expensive for older customers. Term life insurance does not have a cash value component, and there is no refund if you cancel or outlive a term life policy.

Permanent life insurance, on the other hand, includes a savings component and offers lifelong coverage. Whole life insurance, a type of permanent life insurance, combines life insurance with an investment component. It is characterized by level premiums and a savings component. The savings component of whole life insurance policies builds cash value over time, which can be withdrawn while the policyholder is still alive. This cash value is also known as the cash surrender value.

Before surrendering a whole life insurance policy, it is recommended to consult a financial advisor or tax professional to understand the financial implications. There may be alternative options, such as withdrawing or borrowing from the cash value, that can help you access cash while maintaining the policy.

Understanding Extended Term Insurance: Unlocking the Benefits of Long-Term Coverage

You may want to see also

Surrendering a life insurance policy means agreeing to take the cash surrender value assigned by the insurance company and forgoing the death benefit

Term life insurance does not have a cash surrender value. However, permanent life insurance policies, such as whole life and universal life, do have a cash surrender value. This is the amount of money that a policyholder receives when they cancel their policy before it matures or they pass away.

The cash surrender value is the amount of money that a life insurance company pays out to a policyholder if they decide to cancel the plan. A policyholder builds cash value with premium payments, and this grows over time. Life insurance companies could deduct fees for a policy surrender, which could be as high as 10% to 35% of the policy cash value. These fees tend to decrease over time and usually end after 10 to 15 years.

If you surrender your policy, you will no longer have to pay premiums and will receive all your cash surrender value. However, you will lose your life insurance protection, and your heirs will not receive a death benefit when you pass away.

Understanding Direct Term Insurance: Unraveling the Basics of This Pure Protection Plan

You may want to see also

Surrender charges can last about 10 to 15 years after buying the policy

Term life insurance does not have a cash value, and therefore, does not have a surrender or refund value. However, some policies allow you to recover your premiums.

Permanent life insurance policies, on the other hand, often have a cash value component. This means that if you cancel your policy before it matures or you pass away, the insurance company will pay out a cash surrender value. This value is the amount of money that a policyholder has built up over time through premium payments.

When you surrender a permanent life insurance policy, you may incur a surrender charge or fee. This is a penalty for cancelling your policy early and can be as high as 10-35% of your policy's cash value. Surrender charges are designed to cover the costs of keeping the policy on the insurance provider's books and to discourage investors from withdrawing funds early.

Surrender charges can last for a significant period after buying the policy, typically ranging from 5 to 15 years. During this time, the surrender charge decreases annually until it reaches 0%. For example, if the surrender charge is 10% in the first year, it may decline to 1% by the ninth year, and there will be no surrender fee from the tenth year onwards.

It is important to carefully review the terms of your policy to understand the potential fees and charges associated with surrendering your policy. In some cases, there may be ways to avoid or minimise surrender charges, such as waiting until the end of the surrender period or taking advantage of certain waivers or provisions.

Understanding Short-Term Insurance: Temporary Coverage, Long-Term Peace of Mind

You may want to see also

Frequently asked questions

Term insurance does not have a cash surrender value. Surrendering a term policy means removing the monthly premium from your budget, but you won't get any money back.

Cash value is the sum of money you paid for the policy. Surrender value is the money you get back from the life insurance company after fees.

Cash surrender value is the amount of money a life insurance policyholder receives for cancelling their policy before it matures or they pass away. This is the savings component of permanent life insurance policies.

The cash surrender value of a life insurance policy is equal to the total accumulated cash value, minus prior withdrawals, outstanding loans, and surrender charges.