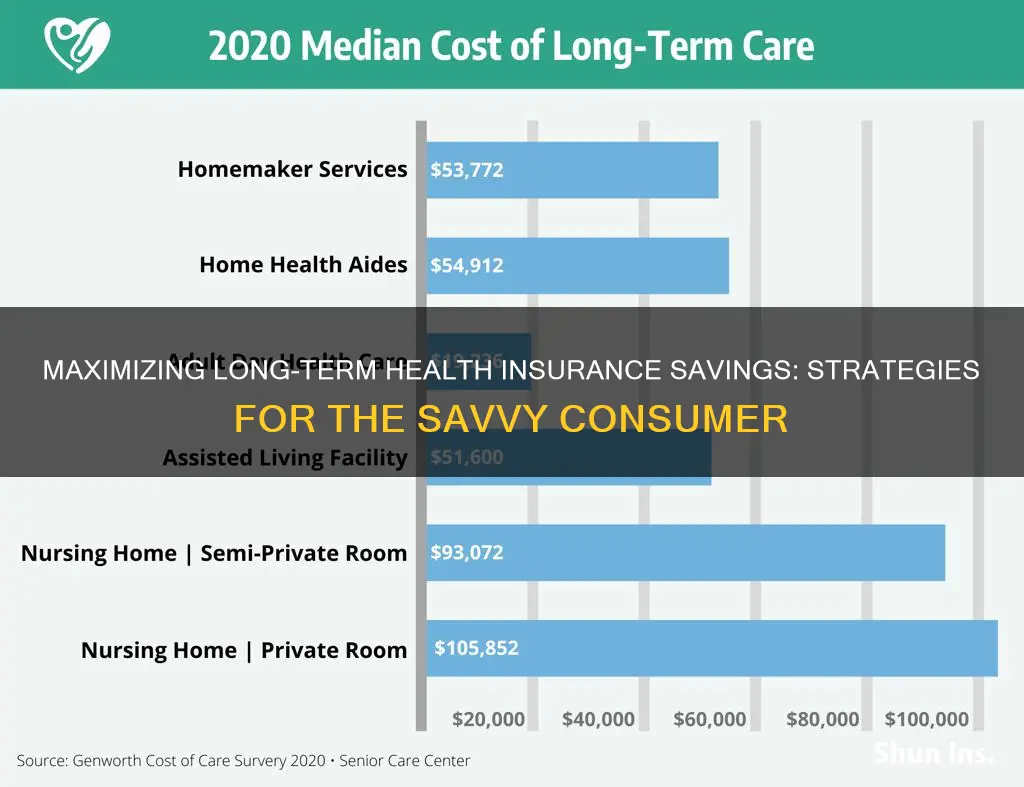

Long-term care insurance is designed to cover the costs of health services that regular health insurance does not. This includes assistance with routine daily activities like bathing, dressing, or getting in and out of bed. The cost of long-term care can be financially, physically, and emotionally taxing, so it is important to plan ahead. There are several ways to save on long-term health insurance. Firstly, it is recommended to buy a policy when you are younger and healthier, as the older you are and the more health problems you have, the more you will pay. You can also save by choosing a policy with a longer waiting period before benefits start being paid out, and by choosing a defined benefit period rather than an unlimited one. Additionally, some employers offer group long-term care insurance policies, which can be cheaper than buying individual coverage. Finally, it is worth comparing policies from different insurers, as rates vary widely.

What You'll Learn

Choose a financially stable insurance company with a strong track record

When choosing a long-term health insurance provider, it is important to select a company with a strong track record and solid financial health. This is because you want to make sure that the company will still be around for the long term and will be able to pay your benefits when you need them.

There are several agencies that rate insurance companies based on their financial stability. These include A.M. Best, Standard & Poor's, Moody's, Fitch, and Demotech. A.M. Best is the most prevalent insurance-specific agency and is the one most commonly used by major insurers. Standard & Poor's and Moody's are widely used across many types of businesses worldwide and are not specific to the insurance industry.

When reviewing the financial ratings of insurance companies, it is important to consider the following criteria:

- The amount of cash on hand

- Debt ratio (debt divided by financial assets)

- Diversity of revenue streams

- Risk management protocols

- Quality of insurance policies written (e.g., not all policies are for high-risk people)

It is also worth noting that insurance companies are subject to financial ratings that assess their ability to withstand financial strain, such as a natural disaster. Therefore, when choosing a long-term health insurance provider, it is advisable to opt for a company with strong financial ratings from reputable agencies. This will ensure that the company has the financial stability to honour its commitments and pay out claims when needed.

The Intricacies of Insurance Twisting: Unraveling the Practice and Its Impact

You may want to see also

Keep premiums at 7% of your income or less

Keeping your long-term care insurance premium at 7% of your income or less is a good rule of thumb, according to the National Association of Insurance Commissioners. This is especially important if you are already facing financial strain and struggling to cover essential expenses such as food, medicine, and utilities.

- Assess your income: Calculate 7% of your monthly income to determine the maximum amount you should be paying for long-term care insurance. For example, if your monthly income is $4000, your long-term care insurance premium should not exceed $280 per month.

- Choose a reputable company: Ensure the insurance company you select is financially stable and has a strong track record. Check independent rating agencies for the financial strength ratings of the companies you are considering.

- Compare prices: Shop around and compare prices and benefits offered by different insurance companies. This can help you find the best value for your money.

- Consider a group policy: Find out if your employer offers long-term care benefits through a group policy. Employers may subsidize the cost, reducing the amount you need to pay.

- Combine policies: Check if you can add long-term care benefits to an existing life insurance or annuity policy. These "combination" arrangements can provide savings as the insurance company gains operational savings that can be passed on to you.

- Choose a longer waiting period: Opting for a longer waiting period before your policy starts paying benefits can reduce your premium. For example, choosing a 90-day waiting period instead of 30 days can lower your premium by 30%. However, keep in mind that you will need to cover the costs during the waiting period.

- Spousal policy: If you are married, consider purchasing a joint policy for you and your spouse. This type of policy pays when either spouse needs care and can cover both individuals up to the benefit limits.

- Adjust coverage: If you are still looking to reduce your premium further, consider a policy that covers most, but not all, of the average nursing home costs in your area. Ensure that you also purchase an inflation-protection provision to account for rising costs over time.

Term Insurance: Understanding the Wait for Coverage

You may want to see also

Check for long-term care benefits through your employer

Long-term care insurance is a crucial aspect of financial planning, especially for those approaching retirement. The cost of long-term care can be a significant financial burden, and insurance can help mitigate this expense. One way to save on long-term care insurance is to check for long-term care benefits offered by your employer. Here are some key points to consider:

Availability and Eligibility

Firstly, it is important to determine if your employer offers long-term care insurance as a benefit. Many employers are increasingly recognising the importance of this benefit to retain experienced and valuable employees. Contact your company's benefits or pensions office to inquire about the availability of long-term care insurance. Even if your current employer does not offer this benefit, it is worth exploring this option when considering future employment opportunities.

Group Rates and Voluntary Plans

If your employer offers long-term care insurance, it is typically provided as a group plan. Group plans often come with lower premiums compared to individual policies. Employers may negotiate favourable group rates, making the coverage more affordable for employees. In some cases, employers may even subsidise a portion of the cost, further reducing the financial burden on employees. Additionally, voluntary plans are also an option, where employees pay the entire premium but still benefit from the group rate.

Comparison with Individual Policies

When considering employer-provided long-term care insurance, it is essential to compare the coverage and costs with individual policies. Evaluate the features, benefits, and premiums offered by both options. Individual policies may provide more flexibility and independence, but group policies can offer significant cost savings. Weigh the trade-offs between premium costs and the extent of coverage to make an informed decision.

Portability of Coverage

Another important consideration is the portability of your long-term care insurance coverage. Inquire about whether the policy can be transferred if you leave your current employer. Some long-term care policies are portable, meaning you can continue the coverage even after changing jobs. This ensures that you maintain your insurance protection even during career transitions.

Health Considerations

Your current health status and medical history are crucial factors when purchasing long-term care insurance. Employer-provided group policies may have less stringent health requirements than individual policies, making it easier to qualify for coverage. If you have pre-existing health conditions or are concerned about future insurability, an employer-provided group plan could be a more viable option.

Spousal and Family Coverage

Examine the extent of coverage offered by your employer's long-term care insurance plan. Some group policies extend coverage not only to employees but also to their spouses, parents, and in-laws. Additionally, look into shared care options, where couples can pool their benefits together. This can provide a more cost-effective way to ensure both partners have adequate coverage.

In summary, checking for long-term care benefits through your employer can be a strategic way to save on insurance costs. Employer-provided group plans often come with lower premiums and may offer more comprehensive coverage for you and your family. However, it is important to carefully review the specifics of the plan and compare it with individual policy options to make an informed decision that best suits your needs and financial situation.

Understanding Term Insurance: A Guide to This Essential Coverage

You may want to see also

Consider a joint policy if you're married

If you and your spouse are considering buying long-term care policies, it may be more cost-effective to buy a joint policy for both of you. A joint policy will pay out when either spouse needs care and can cover both, if necessary, up to its benefit limits.

Joint policies are also known as shared care or survivorship policies. They are typically used by married couples to ensure that their heirs, such as adult children, receive a death benefit and use the proceeds to pay estate taxes.

A joint policy can also be useful if one spouse is in poor health and unable to secure their own policy. Additionally, some employers offer group long-term care insurance policies that extend coverage to spouses. These group policies are usually cheaper than individual policies.

However, it is important to note that joint policies may not always be the best option. For example, if one spouse has a large amount of out-of-pocket medical expenses, filing taxes separately might help surpass the IRS's threshold to deduct these costs.

Therefore, it is essential to carefully consider your specific circumstances and compare different policies before making a decision.

Haven Insurance: Understanding the Fine Print

You may want to see also

Compare costs and benefits from several companies

Comparing costs and benefits from several companies is a great way to save on long-term health insurance. Here are some tips to help you get started:

- Check with multiple companies and agents: Compare both benefits and costs from several companies and agents. By doing so, you may find significant differences in prices for similar coverage. For instance, the American Association for Long-Term Care Insurance (AALTCI) found that rates for identical coverage could vary by more than double among insurers.

- Look for a "sweet spot" policy: Each insurance company sets its own rates based on the type of clients it wants to attract. For example, a company offering the lowest cost for a 55-year-old married couple may not be the cheapest option for a 55-year-old single individual or a 64-year-old married couple. Finding your "sweet spot" can help you get the most protection for the lowest cost.

- Look for discounts: Ask about available discounts, such as those for good health, couples, and the addition of a "deductible" or elimination period. For instance, individuals with few or no current health conditions may qualify for a 10% good health discount. Similarly, married couples or unmarried adults living together may be eligible for discounts of up to 40%.

- Compare policy features: When comparing costs, also consider the features of the policies. For example, some policies may offer a shared care option for couples, allowing them to share a pool of benefits. Additionally, look for policies that offer inflation protection to ensure your benefits keep pace with rising costs over time.

- Get quotes: Request quotes from several companies for the same coverage to accurately compare prices. Even if you're offered a group discount through your employer, you may find better rates elsewhere.

Choosing the Right Term Insurance Horizon: Navigating the Optimal Tenure for Peace of Mind

You may want to see also

Frequently asked questions

There are a few ways to save on long-term health insurance. Firstly, consider the financial stability of the insurance company and choose a company that has been around for a while. Secondly, keep the premium for your long-term care insurance policy at 7% of your income or less. Thirdly, check if long-term care benefits are available through a group policy from your employer, as employers may subsidize the cost. Finally, consider buying a policy with the longest waiting period you can afford, as this can cut the premium significantly.

When choosing a long-term health insurance policy, it is important to consider your age, health, marital status, and the insurance company's rates. The older you are and the more health problems you have, the higher your rates will be. Additionally, women generally pay more than men due to their longer life expectancy. Marital status also plays a role, as premiums are typically lower for married individuals than for single individuals. It is also crucial to compare quotes from different insurance companies, as rates can vary significantly.

There are four main ways to pay for long-term care: government assistance, traditional long-term care insurance, hybrid insurance, and personal savings. Government assistance programs such as Medicaid and the Veterans Health Administration offer long-term care coverage for eligible individuals with low incomes. Traditional long-term care insurance policies allow you to choose the amount of coverage, duration, and waiting period before receiving benefits. Hybrid insurance combines life insurance or annuity benefits with long-term care coverage. Personal savings can also be used to pay for long-term care, but it is important to consider the impact on your retirement plan and whether you have enough time to save.

The best time to buy long-term care insurance is typically in your mid-50s to 60s. At this age, you are more likely to be in good health, which can result in lower rates. Additionally, your health may start to decline from your mid-50s, increasing the likelihood of needing long-term care. Buying early can help you get the most benefits for the cheapest costs.