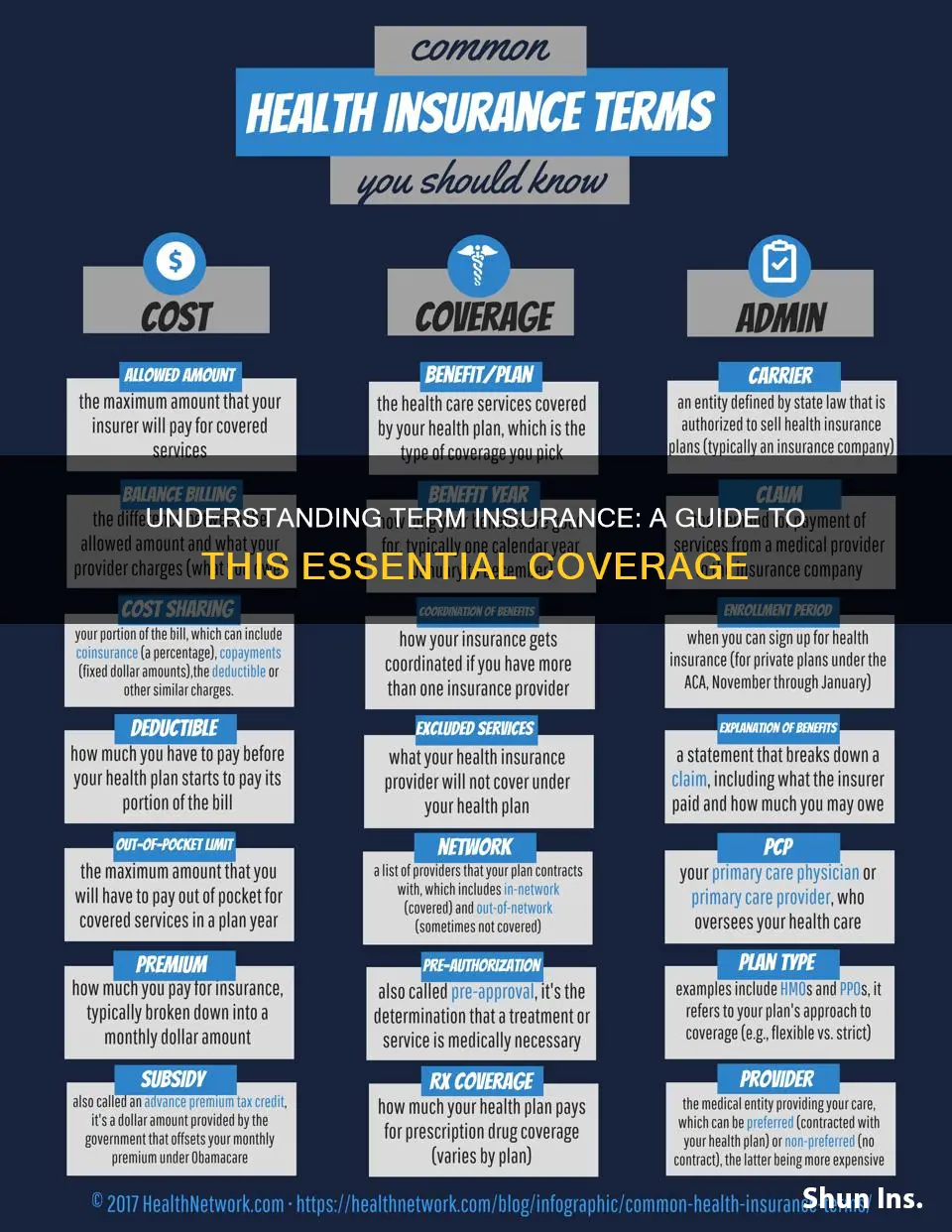

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, typically ranging from one to 40 years. It is called term life insurance because it lasts for a set amount of time, after which the policy expires. Term life insurance is generally considered the simplest and most affordable type of life insurance, as it is designed to provide financial protection for loved ones in the event of the policyholder's death during the specified term. The death benefit provided by term life insurance can be used to cover expenses such as mortgage payments, education costs, or everyday expenses. While term life insurance does not accumulate cash value, it offers level premiums that remain the same throughout the duration of the policy, making it a budget-friendly option. Additionally, many term policies offer the option to convert to a permanent life insurance policy, providing flexibility to the policyholder.

| Characteristics | Values |

|---|---|

| Type of insurance | Life insurance |

| Type of life insurance | Term insurance |

| Coverage | Coverage for a certain period of time, or a specified "term" of years |

| Payout | A death benefit will be paid if the insured dies during the time period specified and the policy is active |

| Cost | Initially much less expensive compared to permanent life insurance |

| Cash value | No cash value |

| Premium | Level premiums for the duration of the policy |

| Renewal | Policies can be renewed at a higher rate |

| Convertibility | Many policies can be converted from term to permanent insurance |

What You'll Learn

- Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, typically ranging from one to 40 years

- It is often chosen to safeguard beneficiaries against financial obligations like mortgages or college tuition

- Term life insurance is usually the most affordable option when compared to permanent life insurance

- The policy has no cash value and cannot be used as a wealth-building strategy

- Term life insurance policies may be classified as either level or decreasing term

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, typically ranging from one to 40 years

Here's how term life insurance works:

Choosing a Policy

When selecting a term life insurance policy, individuals can choose the length of the term, typically ranging from one to 40 years, and the coverage amount, which can vary from tens of thousands to millions of dollars. The insurance company will then determine the premium based on factors such as the policyholder's age, health, and life expectancy. In some cases, a medical exam or health questionnaire may be required.

Coverage and Benefits

During the specified term, if the insured person passes away, the beneficiaries named in the policy will receive a death benefit. This benefit is usually tax-free and can be used to cover expenses such as funeral costs, mortgage payments, or everyday living expenses. However, if the insured person survives the term, the policy expires without any payout, and the premiums paid are typically non-refundable.

Renewable and Convertible Policies

Term life insurance policies may offer the option to renew or convert the policy. If the policy is renewable, the policyholder can extend the coverage for another term, although the premiums may increase based on the person's age at the time of renewal. Some term policies can also be converted into permanent life insurance policies, such as whole or universal life insurance, providing lifelong coverage. However, converting a term policy to a permanent policy will also result in higher premiums.

Types of Term Life Insurance

There are several types of term life insurance policies available:

- Level Term: Offers fixed premiums and death benefits throughout the duration of the policy.

- Increasing Term: Allows the policyholder to scale up the value of the death benefit over time, resulting in slightly higher premiums.

- Decreasing Term: Reduces the premium payments over time, which may result in a smaller death benefit.

- Annual Renewable: Provides coverage on a yearly basis and must be renewed by the end of the policy term. The premiums usually increase with each renewal.

- Convertible Term: Allows the policyholder to convert the term policy into a permanent life insurance policy without requiring additional medical exams or considering health conditions.

Advantages of Term Life Insurance

Term life insurance is often considered the most affordable option for life insurance, especially when compared to permanent life insurance policies. It provides flexibility in terms of coverage length and the ability to renew or convert policies. Additionally, term life insurance offers simplicity, with straightforward benefits and an easy application process.

In summary, term life insurance is a cost-effective way to ensure financial protection for loved ones during a specified period. It offers flexibility, simplicity, and affordable coverage, making it a popular choice for individuals seeking life insurance to meet their temporary financial obligations.

Unraveling the Mystery: Exploring the Cash Value Potential of Term Insurance

You may want to see also

It is often chosen to safeguard beneficiaries against financial obligations like mortgages or college tuition

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, typically ranging from one to 30 years. It is often chosen to safeguard beneficiaries against financial obligations like mortgages or college tuition. This type of insurance is usually more affordable than other types of life insurance and can provide financial protection for loved ones in the event of the policyholder's death.

Term life insurance is particularly useful for covering specific financial obligations, such as a mortgage or a child's college education. In the event of the policyholder's death during the specified term, the insurance company will pay out a death benefit to the beneficiaries, helping them to cover these financial commitments. This can provide much-needed financial security and peace of mind for the beneficiaries, ensuring they can maintain their standard of living and meet important milestones even in the absence of the insured person.

The length of the term and the coverage amount are two crucial decisions when purchasing term life insurance. The term should ideally cover the duration of the financial obligations, such as the number of years left on a mortgage or until children finish college. The coverage amount, on the other hand, should be sufficient to pay off these obligations and provide ongoing financial support.

Additionally, term life insurance offers flexibility, as it can be renewed or converted into a permanent life insurance policy, depending on the policyholder's needs and preferences. This adaptability makes it a popular choice for those seeking financial protection for their loved ones without committing to a permanent policy.

In summary, term life insurance is a valuable tool for safeguarding beneficiaries against financial obligations. By providing coverage for a specified term, it helps ease the financial burden on loved ones and ensures they can meet important milestones, even in the unfortunate event of the policyholder's death.

The Intricacies of Level Term Insurance: Unraveling the Meaning of "Level

You may want to see also

Term life insurance is usually the most affordable option when compared to permanent life insurance

Term life insurance is a popular option for people who want to ensure their loved ones are financially protected in the event of their death. It is a straightforward type of insurance that offers a death benefit for a specified period, known as the term. This can range from one to 30 years, or until a certain age, providing coverage during an individual's working years or until their children become financially independent.

One of the main advantages of term life insurance is its affordability. Compared to permanent life insurance, term life insurance is typically much cheaper. This is because term life insurance only covers a set period, whereas permanent life insurance provides coverage for an entire lifetime. Additionally, term life insurance does not have a cash value component, which means it does not accrue savings over time. As a result, the premiums for term life insurance tend to be significantly lower than those for permanent life insurance.

Permanent life insurance, on the other hand, offers lifelong protection as long as the premiums are paid. It also includes a savings or investment component called cash value, which grows tax-deferred and can be accessed by the policyholder during their lifetime. However, this additional benefit comes at a cost, making permanent life insurance considerably more expensive than term life insurance.

While term life insurance is more affordable, it's important to consider the trade-offs. Unlike permanent life insurance, term life insurance does not provide lifelong coverage, and there is no opportunity to build cash value. If an individual outlives the term, the policy expires, and the premiums paid are not refunded. On the other hand, permanent life insurance offers the security of lifetime coverage and the potential for cash value accumulation, making it a more comprehensive but costly option.

In conclusion, term life insurance is usually the most affordable option when compared to permanent life insurance. It provides coverage for a specified term at a lower cost, making it a popular choice for individuals seeking financial protection for their loved ones without breaking the bank. However, those considering term life insurance should carefully weigh the benefits and limitations to ensure it aligns with their long-term financial goals and needs.

Understanding Direct Term Insurance: Unraveling the Basics of This Pure Protection Plan

You may want to see also

The policy has no cash value and cannot be used as a wealth-building strategy

Sure! Here is some information on the topic of "What is term insurance?", focusing on the statement, "The policy has no cash value and cannot be used as a wealth-building strategy":

When it comes to term insurance, it's important to understand that this type of policy is purely protection-oriented and provides no cash value or investment component. Term insurance is a simple and cost-effective way to ensure financial protection for your loved ones in the event of your untimely death during a specified period.

The key characteristic of term insurance is that it offers a high level of coverage for a relatively low premium. You pay a fixed premium amount for a predetermined period, known as the "term," which can range from one year to 30 years or even longer, depending on the insurer. If the insured person passes away during the term, the death benefit is paid out to the beneficiaries. However, if the insured survives the term, the policy simply terminates, and there is no payout or monetary return.

The absence of cash value in term insurance means that, unlike permanent life insurance policies, it does not accumulate a cash reserve over time. There is no savings or investment component attached to the policy. As a result, term insurance should not be viewed as a wealth-building tool or a means to grow your money. Instead, its primary purpose is to provide financial security and peace of mind during the policy term.

While term insurance cannot directly contribute to your long-term financial goals or wealth accumulation, it plays a crucial role in ensuring your family's financial stability and protecting them from financial burdens in your absence. It can help cover expenses such as mortgage payments, education costs, or everyday living expenses, providing your dependents with the financial support they need during a difficult time. Therefore, term insurance is particularly valuable for individuals with young families, dependents, or significant financial obligations, offering a safety net at a relatively low cost.

In summary, while term insurance may not offer cash value or wealth-building opportunities, it serves as a vital tool for protecting your loved ones financially. By understanding the nature of term insurance and its limitations, individuals can make informed decisions about their financial planning, ensuring they have the necessary protection in place while also exploring other avenues for building their wealth over the long term.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

Term life insurance policies may be classified as either level or decreasing term

Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, or a specified "term" of years. If the insured dies during the specified time period, and the policy is active, then a death benefit will be paid. Term life insurance policies can be further classified as either level term or decreasing term.

Level term life insurance policies are the more common form of term life insurance. They are designed to pay out a fixed sum to the insured's beneficiaries if the insured dies within the term of the policy. The payout remains the same throughout the term unless the policyholder chooses to change their policy. Level term life insurance is often used to cover interest-only mortgages, other debts, or to protect loved ones by helping to cover everyday living expenses.

Decreasing term life insurance policies are similar to level term policies, but with one significant difference: the amount of insurance coverage reduces over time, roughly in line with the way a repayment mortgage decreases. This type of policy is typically purchased to help clear a specific debt, such as a repayment mortgage. As the debt decreases over time, so does the amount of insurance coverage. Decreasing term life insurance is generally cheaper than level term insurance because the amount of coverage decreases over time, reducing the insurer's risk.

Understanding Extended Term Insurance: Unlocking the Benefits of Long-Term Coverage

You may want to see also

Frequently asked questions

Term insurance is a type of life insurance policy that provides coverage for a certain period of time, or a specified "term" of years. It is much less expensive compared to permanent life insurance and has no cash value.

When you buy term insurance, you choose a policy in set increments, typically anywhere from one to 30 years, and the cost remains the same for the entire term. If the insured person dies during the active policy period, the beneficiaries will receive the death benefit.

Term insurance is the simplest and most affordable type of life insurance. It helps ease financial burdens on loved ones and can be converted to a permanent policy that lasts a lifetime.