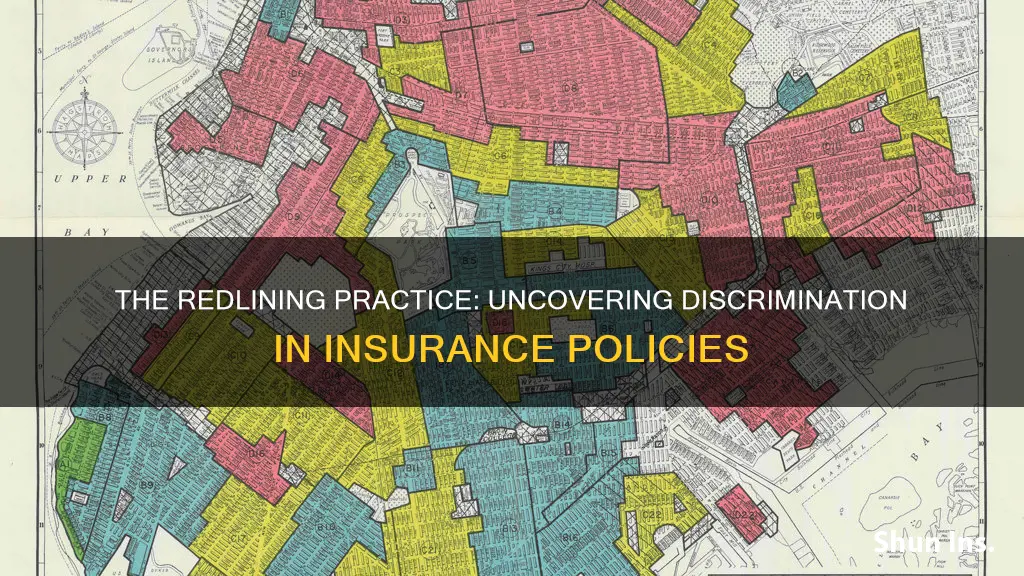

Redlining is the illegal practice of refusing to provide insurance policies or financial services to people from certain geographical areas, particularly inner-city neighbourhoods. The term originates from the practice of marking these areas with a red line on a map. Redlining is discriminatory, as it is based on the race or ethnicity of the residents in these areas. The practice has been illegal since the mid-1970s, but it still exists today, and companies that engage in redlining can face punitive consequences.

| Characteristics | Values |

|---|---|

| Definition | The practice of refusing to approve insurance policies or financial services to people who live in or are from a certain geographical area. |

| Origin | The term "redlining" was coined by sociologist John McKnight in the 1960s. |

| History | The practice originated in the U.S. government's homeownership programs in the 1920s and 1930s, where maps were used to colour-code neighbourhoods based on loan worthiness, with red indicating areas deemed unworthy of inclusion in the programs. |

| Impact | Redlining resulted in lower homeownership and wealth in minority communities, with homes in redlined neighbourhoods being worth significantly less than those in non-redlined areas. |

| Legality | Redlining is considered illegal in most states and companies engaged in the practice can face punitive consequences. |

| Examples | Insurance companies refusing to provide policies to individuals living in certain neighbourhoods based on race, colour, or national origin of the residents. |

What You'll Learn

Redlining is a discriminatory practice

Redlining is based on the assumed characteristics of the people in the redlined area, such as their perceived inability to pay premiums or their perceived fiscal irresponsibility. It is not the same as withholding insurance based on geological features, such as refusing homeowners' insurance in areas prone to natural disasters. Redlining specifically targets communities based on the racial demographics of the neighborhood.

The history of redlining in the United States is deeply rooted in racial discrimination. The practice originated in the 1920s and 1930s with the government's homeownership programs, which provided government-insured mortgages to support the economy during the Great Depression. Maps were created to indicate loan worthiness, with predominantly Black neighborhoods marked in red and deemed unworthy of inclusion in the programs. This resulted in the denial of government-insured loans to Black residents.

The Civil Rights Movement led to the passing of the Fair Housing Act in 1968, which prohibited discrimination in the sale, rental, and financing of housing based on race, religion, national origin, or sex. Despite these anti-redlining laws, racial discrimination in insurance and lending practices persists.

Redlining has had destructive effects beyond the economic sphere. Studies have shown that redlining has impacted health and longevity in affected communities, resulting in a higher prevalence of chronic diseases and reduced life expectancy.

The Intricacies of Dwelling Insurance: Unraveling the Concept of 'Dwelling' in Property Coverage

You may want to see also

It involves the systematic denial of services

Redlining is a discriminatory practice that involves the systematic denial of services such as insurance, mortgages, loans, and other financial services to residents of certain areas based on their race or ethnicity. This practice disregards individuals' qualifications and creditworthiness and instead focuses solely on the residency of those individuals in minority neighbourhoods, which are often deemed "hazardous" or "dangerous".

The term "redlining" originates from the U.S. government's homeownership programs established in the 1920s and 1930s. During the New Deal era, the government created colour-coded maps to determine which neighbourhoods were considered safer or riskier bets for home loans. The areas marked in red—usually neighbourhoods with majority Black populations—were deemed the riskiest, and the residents within them were consistently denied home loans and other services.

Insurance companies that engage in redlining do so because of the higher premium default rates in certain locations. By discriminating based on geographical location, they can avoid providing insurance to individuals living in communities with significant numbers of visible or racial minorities. This practice is considered illegal in most states, and companies found guilty of redlining can face punitive consequences.

Redlining involves the systematic denial of services by drawing literal or metaphorical red lines around certain neighbourhoods. These redlined areas are then excluded from access to essential services, such as insurance, loans, and even the construction of grocery stores or healthcare services. The impact of redlining extends beyond the financial realm, contributing to lower homeownership rates, reduced wealth, and negative health outcomes in affected communities.

Despite laws such as the Fair Housing Act of 1968 and the Community Reinvestment Act of 1977, which aim to prevent redlining, critics argue that discrimination in financial services continues. Additionally, new forms of redlining, such as reverse redlining and corporate redlining, have emerged, further exacerbating the issue.

The Intricacies of CPI in Insurance: Unraveling the Complexities of Coverage and Protection

You may want to see also

Redlining gets its name from maps used by financial institutions

Redlining is a discriminatory practice that involves the systematic denial of financial services, such as insurance, mortgages, and loans, to residents of certain areas based on their race, ethnicity, or geographical location. The term "redlining" comes from the practice of financial institutions using red lines on maps to indicate the areas where they would deny services. These redlined areas were typically low-income communities or communities with significant racial minority populations.

The practice of redlining originated in the 1920s and 1930s with the U.S. government's homeownership programs during the New Deal era. The government set out maps of different areas and properties that would be eligible for government-insured mortgages, with each map colour-coded to indicate loan worthiness. Neighbourhoods deemed unworthy of inclusion in these homeownership programs were marked in red, and these areas were predominantly inhabited by Black residents. As a result, Black residents were systematically denied government-insured loans.

The term "redlining" was coined by sociologist John McKnight in the 1960s to describe this discriminatory practice. Redlining was not limited to government-insured loans but also extended to private banks and insurance companies that adopted similar practices. These institutions would refuse to provide services to individuals based solely on the fact that they lived in certain neighbourhoods, regardless of their individual qualifications or creditworthiness.

Redlining has had destructive consequences, not only economically but also on the health and longevity of residents in affected communities. It has contributed to lower homeownership rates, wealth disparities, and reduced life expectancy in redlined neighbourhoods. Despite being illegal today, redlining continues to exist in various forms, and critics argue that discrimination in financial services persists.

Understanding Term Insurance: A Guide to This Essential Coverage

You may want to see also

It is considered illegal in most states

Redlining is a discriminatory practice that involves the systematic denial of insurance policies and financial services to individuals based on the geographical location of their residence. It is considered illegal in most states, with companies engaging in redlining facing punitive consequences. The practice gets its name from the historical use of red lines on maps to demarcate areas where residents would be denied services. These redlined areas often corresponded to low-income communities or those with significant racial minority populations.

The illegality of redlining in most states stems from its discriminatory nature, which disproportionately affects minority and low-income communities. By withholding insurance products and financial services, redlining contributes to lower rates of homeownership and wealth accumulation in these communities. Recognising the detrimental impact of redlining, anti-redlining laws were established during the Civil Rights Movement to address these injustices.

Discrimination based on geographical location has been illegal since the mid-1970s. However, redlining specifically refers to the denial of services based on the assumed characteristics of individuals within the redlined area, such as their perceived inability to pay premiums or fiscal irresponsibility. It is important to distinguish redlining from the legal practice of withholding insurance products based on geological factors, such as refusing to provide homeowner's insurance in areas prone to natural disasters.

While redlining in its original form may have been curtailed by anti-discrimination laws, critics argue that discrimination in insurance and financial services continues today. For example, a phenomenon known as reverse redlining has emerged, where minority neighbourhoods are targeted for higher prices or unfair lending terms, perpetuating a cycle of financial disadvantage.

To combat redlining and promote equitable access to insurance and financial services, states have implemented laws against "unfair discrimination" in insurance and lending practices. These laws require insurers and lenders to justify their practices using actuarial data and prohibit explicit discrimination based on race, ethnicity, national origin, or income. However, critics argue that these laws are often interpreted narrowly, allowing insurers and lenders to circumvent anti-discrimination measures.

The Perils and Pitfalls of Insurance: Understanding the Risks Covered by Your Policy

You may want to see also

Redlining is associated with mortgage lending practices

Redlining is a discriminatory practice that involves the systematic denial of services such as insurance, loans, mortgages, and other financial services to residents of certain areas based on their race or ethnicity. It disregards individuals' qualifications and creditworthiness, instead taking into account the residency of those individuals in minority neighbourhoods.

Redlining is most often associated with mortgage lending practices. It refers to a real estate practice in which public and private housing industry officials and professionals designated certain neighbourhoods as high-risk, largely due to racial demographics, and denied loans or backing for loans on properties in those neighbourhoods.

Redlining practices were prevalent from the 1930s to the 1960s. During this time, federal programs such as the Home Owners' Loan Corporation (HOLC) and the Federal Housing Administration (FHA) were established to encourage widespread homeownership and suburban development by making home loans and mortgages affordable. However, neighbourhoods that were mixed-race or predominantly African American did not benefit from these programs as their credit was considered high-risk. As a result, redlining effectively restricted minority homeownership and investment to "risky" neighbourhoods.

While redlining is now illegal, its legacy persists and continues to impact home values, homeownership, and individuals' net worth. Discrimination and inequities in housing practices and home financing still exist today.

The Intricacies of COIs: Navigating Insurance Terminology

You may want to see also

Frequently asked questions

Redlining is the practice of refusing to provide insurance policies or financial services to people from a certain geographical area. The term comes from the practice of marking these areas with red lines on a map.

Insurance companies that redline do so because of the higher premium default rates in certain locations. However, this practice is illegal in most states and companies that engage in redlining can face consequences.

An example of redlining is the denial of auto insurance to Thurgood Marshall when he lived in Harlem in 1940. He was told that Harlem was a "congested area".