Collateral Protection Insurance (CPI) is a type of insurance that covers physical damage to property that is held as collateral for credit agreements, loans, and leases. It is purchased by lenders to protect their interests when borrowers lack full-coverage insurance. CPI is also known as force-placed insurance, lender's placed insurance, lien protection insurance, or auto loan protection insurance. While it is typically more expensive than standard insurance, it can be cancelled if the borrower purchases their own full-coverage insurance policy.

What You'll Learn

Collateral Protection Insurance (CPI) is a type of car insurance

When a borrower takes out an auto loan, they are usually required to maintain physical damage insurance to cover the loan collateral. This is because, until the car is entirely paid off, it technically belongs to the lender. Should the vehicle be damaged or stolen, the lender would be left with an asset that has lost significant value.

If a borrower fails to provide proof of insurance, or if the insurance they have is deemed inadequate, the lender may opt to purchase CPI to fulfil the borrower's insurance requirement. The cost of this insurance is then added to the borrower's monthly car payment.

CPI typically covers physical damage to the vehicle, including collision and comprehensive coverage. It may also include medical expenses and liability coverage. Collision coverage protects a vehicle against damage caused by striking a fixed object, while comprehensive coverage protects against vandalism, theft, animals, and weather-related damage.

It is important to note that CPI is generally more expensive than standard car insurance and does not always offer full coverage. It is also not a replacement for personal auto insurance, as it primarily serves the lender's financial interests rather than the borrower's.

To avoid CPI, borrowers should ensure they have adequate insurance before driving away from the dealership and maintain continuous coverage without any lapses. If CPI has already been added to a borrower's loan, it can be removed by purchasing a full-coverage auto insurance policy that meets the lender's requirements and providing proof of this coverage to the lender.

The Arbitration Alternative: Exploring Insurance Dispute Resolution

You may want to see also

CPI is purchased by the lender to protect their interests

Collateral Protection Insurance (CPI) is a type of insurance purchased by lenders to protect their interests when borrowers lack full coverage or the required amount of insurance. It is also known as force-placed insurance or lender's placed insurance. CPI insures property held as collateral for credit agreements, loans, and leases against physical damage and unrecovered theft.

CPI is typically purchased when borrowers fail to secure their own insurance or when their existing insurance does not meet the lender's requirements. By purchasing CPI, lenders ensure that the collateral for the loan, such as a vehicle, is protected against potential accidents or damages. This helps mitigate the risk of financial loss for the lender in case the borrower defaults on the loan.

It's important to note that CPI is usually more expensive than standard insurance policies, and borrowers are responsible for the additional costs, which are added to their monthly loan payments. CPI also offers limited flexibility and may not provide the most cost-effective or tailored coverage for the borrower, as it is designed primarily to protect the lender's interests.

While CPI provides coverage for physical damage to the collateral, it usually does not offer liability coverage for injuries or property damage caused by the borrower. Additionally, CPI may not meet the minimum insurance requirements of the state, which could result in penalties for the borrower. Therefore, it is essential for borrowers to maintain open communication with their lenders and ensure they have adequate insurance coverage to avoid unnecessary costs and complications associated with CPI.

Medigap and Supplemental Insurance: Understanding the Difference

You may want to see also

CPI covers physical damage to the vehicle

Collateral Protection Insurance (CPI) is a type of insurance that covers physical damage to a vehicle. It is purchased by a lender when a borrower fails to secure their own full-coverage car insurance policy or when their existing policy does not meet the lender's requirements. CPI ensures that the vehicle, which serves as collateral for the loan, is protected against potential accidents or damage.

CPI is often more expensive than standard car insurance, and borrowers may find more competitive rates by exploring the open market. Additionally, CPI might not always offer full coverage, and borrowers should carefully review the specifics of the package chosen by the lender.

While CPI provides coverage for physical damage to the vehicle, it does not cover bodily injury, no-fault claims, or liability insurance. It is crucial to understand the limitations of CPI and ensure that borrowers obtain the necessary additional coverage to comply with state requirements.

In summary, CPI serves as a safeguard for lenders by covering physical damage to the vehicle. Borrowers should be aware of the scope and limitations of CPI and take the necessary steps to obtain additional coverage as needed to ensure comprehensive protection.

Understanding Term Insurance: A Guide to This Essential Coverage

You may want to see also

CPI is also known as force-placed insurance

Collateral Protection Insurance (CPI) is also known as force-placed insurance. CPI is a type of insurance that lenders purchase to protect their collateral for credit agreements, loans, and leases. When a borrower fails to obtain insurance or lets their insurance lapse, the lender has the right to get insurance to cover the collateral. This insurance is called force-placed insurance.

Force-placed insurance is designed to protect the lender's financial interests in the collateral. It is typically more expensive than standard insurance and may offer less coverage. The cost of force-placed insurance is added to the borrower's loan payments.

CPI is often used in the context of auto loans and leases. In these cases, CPI covers the value of the car and is similar to comprehensive and collision coverage. However, CPI usually does not provide liability coverage for the driver.

CPI can also be used in the context of real estate transactions. In these cases, force-placed insurance covers the lender's financial stake in the property loan. This type of insurance is typically more expensive than similar policies obtained by the homeowner.

CPI is important for lenders to manage their risk of loss. By purchasing CPI, lenders transfer the risk of loss to an insurance company. CPI only affects uninsured borrowers or lender-owned collaterals, such as auto repossession and home foreclosure.

In summary, CPI, or force-placed insurance, is a type of insurance that lenders purchase to protect their financial interests in collateral when borrowers fail to obtain sufficient insurance coverage. It is more expensive and may offer less coverage than standard insurance policies.

Unraveling the Intricacies of Insurance Reserves: A Guide to Understanding This Crucial Concept

You may want to see also

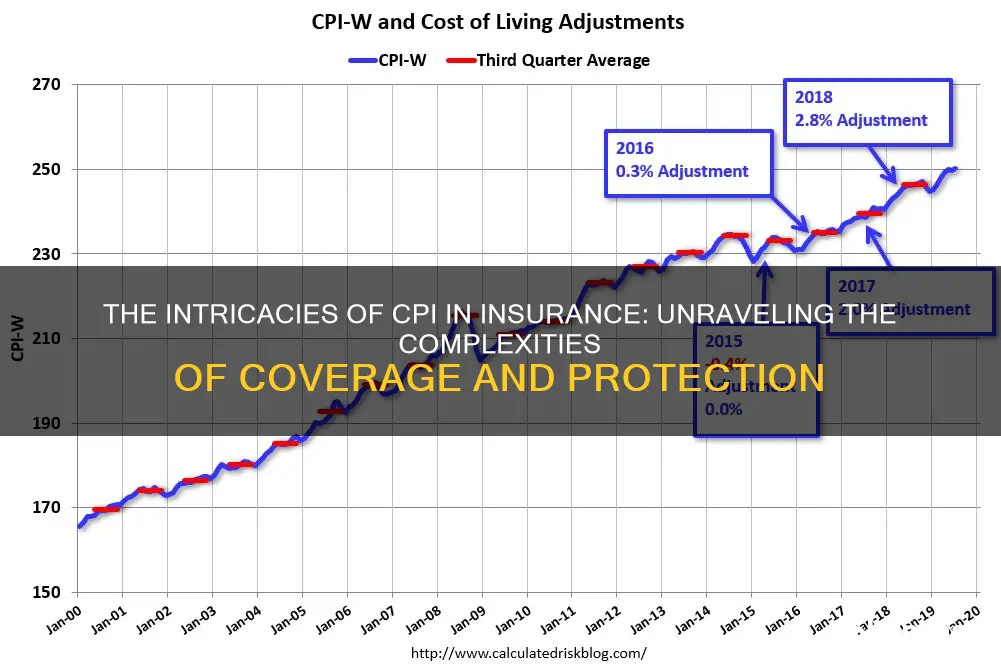

CPI is more expensive than standard car insurance

Collateral Protection Insurance (CPI) is a type of insurance that covers the cost of physical damage to property that is held as collateral for credit agreements, loans, and leases. In the context of car insurance, CPI is a type of insurance purchased by a lender to protect their collateral (the car) in the event that the borrower does not have the required amount of insurance coverage.

CPI is typically more expensive than standard car insurance for several reasons:

- Lack of Customization: CPI is a one-size-fits-all policy that does not take into account individual risk factors such as personal information, credit score, or driving history. This lack of customization results in higher premiums compared to personalized auto insurance policies.

- Protection of Lender's Interests: CPI is designed primarily to protect the interests of the lender, not the borrower. The coverage provided by CPI may not be the most cost-effective or tailored to the borrower's needs, as it is chosen by the lender.

- Administrative Costs: The costs associated with monitoring uninsured borrowers and implementing CPI are passed on to the borrower, contributing to higher premiums.

- Limited Competition: CPI is not subject to market competition as it is not chosen by the borrower. This lack of competition leads to higher rates compared to standard insurance policies.

- Backdated Coverage: In some cases, CPI policies may be backdated to cover periods when the borrower did not have insurance. This means that the borrower may have to pay for coverage retroactively, increasing the overall cost.

While CPI can be more expensive, it serves an important purpose in protecting lenders and providing some level of protection for borrowers who may not have adequate insurance coverage. However, borrowers are typically responsible for the cost of CPI, which is added to their monthly car payments.

The Fine Print: Understanding Riders in Term Insurance Policies

You may want to see also

Frequently asked questions

CPI stands for Collateral Protection Insurance.

CPI is a type of insurance that covers physical damage to property used as collateral for credit agreements, loans, and leases.

CPI protects the interests of the creditor or lender. In the case of car insurance, it can also protect the borrower.

The borrower pays for CPI, although it is chosen by the lender. The cost of CPI is added to the borrower's monthly payments.

CPI can be removed by purchasing a full-coverage auto insurance policy that meets the lender's requirements. Once proof of insurance is sent to the lender, they will cancel the CPI policy.