The Affordable Care Act (ACA) has led to a significant increase in the number of people with health insurance coverage in the United States. According to the Department of Health and Human Services (HHS), 31 million Americans now have health coverage through the ACA, with reductions in uninsured rates across all states. This includes 11.3 million people enrolled in ACA Marketplace plans and 14.8 million newly-eligible individuals enrolled in Medicaid through the ACA's expansion. The ACA has also resulted in increased coverage for young adults, with 2.3 million benefiting from the provision allowing them to remain insured as dependents on their parents' plans until the age of 26. Overall, the ACA has played a crucial role in providing coverage to millions of Americans, improving access to care, financial security, and health outcomes.

| Characteristics | Values |

|---|---|

| Number of people who lost insurance | 5.9 million |

| Time period | Between 2013 and 2016 |

| Reason | Due to the ACA |

What You'll Learn

- The number of nonelderly uninsured individuals decreased by 1.9 million from 2021 to 2022

- The uninsured rate decreased from 10.2% in 2021 to 9.6% in 2022

- The number of people with employer-sponsored insurance increased from 57% in 2021 to 57.5% in 2022

- The share of people with non-group coverage increased from 7.3% in 2021 to 7.5% in 2022

- The share of nonelderly people with Medicaid coverage increased by 1.7% from 2019 to 2022

The number of nonelderly uninsured individuals decreased by 1.9 million from 2021 to 2022

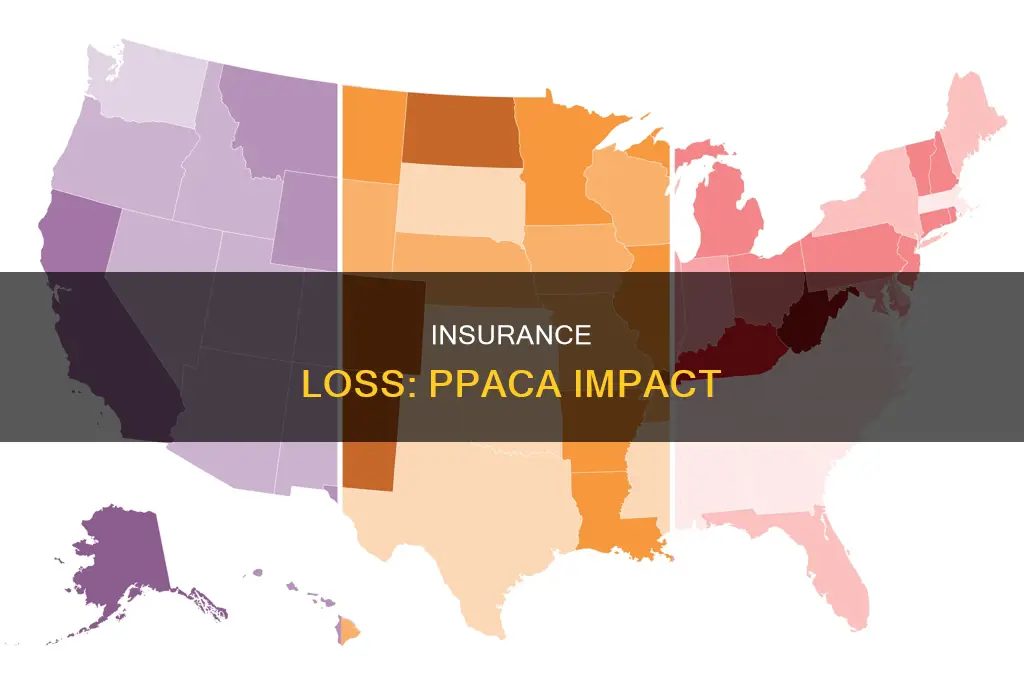

The Patient Protection and Affordable Care Act (PPACA), also known as Obamacare, has been instrumental in reducing the number of uninsured individuals in the United States. The Act has been particularly beneficial for nonelderly adults, who are more likely to be uninsured than children due to more limited availability of public coverage.

In 2022, the number of nonelderly uninsured individuals continued a downward trend, dropping by nearly 1.9 million from 27.5 million in 2021 to 25.6 million. This decrease in the number of uninsured individuals is a continuation of a pattern established since the implementation of the PPACA. Between 2010 and 2016, the number of nonelderly uninsured adults decreased by 41%, falling from 48.2 million to 28.2 million. All 50 states and the District of Columbia experienced reductions in their uninsured rates, with states that expanded Medicaid seeing the most significant reductions.

The decrease in the number of nonelderly uninsured individuals from 2021 to 2022 can be attributed to several factors. Firstly, the continuous enrollment provision in Medicaid and enhanced subsidies in the Marketplace helped to protect low-income individuals from coverage losses. Secondly, the improved affordability of private coverage made it more accessible to a wider range of people. Additionally, the enhanced ACA Marketplace subsidies, first enacted in the American Rescue Plan Act (ARPA) and later renewed for three years in the Inflation Reduction Act of 2022 (IRA), played a significant role in increasing coverage.

The reduction in the number of nonelderly uninsured individuals has had a positive impact on access to healthcare and financial security. Uninsured individuals often face unaffordable medical bills, which can quickly lead to medical debt, especially for those with low or moderate incomes. With more people gaining insurance coverage, there is improved access to preventive care and services for major health conditions and chronic diseases. This leads to better overall health outcomes and financial stability for those who were previously uninsured.

Life Insurance: Estate Asset?

You may want to see also

The uninsured rate decreased from 10.2% in 2021 to 9.6% in 2022

The number of uninsured people in the US has been steadily declining since the implementation of the Affordable Care Act (ACA). The uninsured rate decreased from 10.2% in 2021 to 9.6% in 2022, a record low. This decrease is a continuation of a downward trend that began during the coronavirus pandemic. The number of nonelderly uninsured individuals dropped by 1.9 million from 2021 to 2022, and by 3.3 million from 2019 to 2022.

The ACA's coverage expansions, including Medicaid expansion and subsidized Marketplace coverage, served as a safety net for people who lost their jobs or experienced other economic disruptions during the pandemic. The continuous enrollment provision in Medicaid and enhanced subsidies in the Marketplace further protected low-income individuals from coverage losses and made private coverage more affordable.

The decline in the uninsured rate from 2019 to 2022 was driven by an increase in employer-sponsored, Medicaid, and non-group coverage among nonelderly adults. The share of nonelderly people with Medicaid coverage increased by 1.7 percentage points from 2019 to 2022, while the share with non-group coverage increased by 0.5 percentage points. During the same period, employer coverage declined by 0.6 percentage points.

The uninsured rate among children was 5.1% in 2022, less than half the rate among nonelderly adults (11.3%). This is largely due to the broader availability of Medicaid and CHIP coverage for children compared to adults. However, racial and ethnic disparities in coverage persist, with Hispanic and White individuals comprising the largest shares of the nonelderly uninsured population.

The ACA has played a crucial role in providing coverage to millions of Americans, with over 31 million people enrolled in health coverage through the Act as of February 2021. About half of this increase reflects gains in private coverage due to ACA policies such as subsidies for individual market coverage and reforms to the individual insurance market. The rest is attributed to increased Medicaid coverage due to the ACA's Medicaid expansion to low-income adults and policies making it easier to enrol.

The decline in the uninsured rate and the increase in coverage among nonelderly adults during the pandemic were driven by coverage protections put in place during that time. Provisions in the Families First Coronavirus Response Act (FFCRA) required states to keep individuals enrolled in Medicaid until the month after the end of the COVID-19 public health emergency. Additionally, enhanced ACA Marketplace subsidies first enacted in the American Rescue Plan Act (ARPA) were renewed for another three years in the Inflation Reduction Act of 2022 (IRA).

The overall number of Americans without health insurance dropped by 5.6 million from 2019 to 2022. Among working-age Americans (ages 18-64), 12.2% did not have health insurance in 2022, a decrease from 14.7% in 2019. The percentage of Americans under 65 with exchange-based private health insurance increased by 16% during this period.

Understanding Proof of Loss: A Crucial Component of the Insurance Claims Process

You may want to see also

The number of people with employer-sponsored insurance increased from 57% in 2021 to 57.5% in 2022

The Patient Protection and Affordable Care Act (PPACA), also known as Obamacare, has been instrumental in providing health coverage to millions of Americans. The law's coverage expansions and safety nets have led to a decrease in the number of uninsured individuals, with more people gaining coverage through health insurance marketplaces and Medicaid expansion.

As of 2022, the number of people with employer-sponsored insurance increased from 57% in 2021 to 57.5% in 2022. This increase is significant, especially considering the challenges posed by the COVID-19 pandemic. The pandemic caused disruptions in employment and economic hardships, which could have resulted in a loss of insurance for many. However, the coverage expansions and protections put in place by the Affordable Care Act, such as continuous enrollment for Medicaid enrollees and enhanced marketplace subsidies, helped prevent significant coverage losses.

The increase in employer-sponsored insurance can be attributed to several factors, including economic recovery, a strong job market, and the continued impact of the Affordable Care Act. The law's provisions, such as subsidies for individual market coverage, reforms to the individual insurance market, and allowing young adults to stay on their parents' plans, have made it easier for people to access and maintain health insurance.

It is worth noting that while employer-sponsored insurance increased, other forms of coverage also played a role in reducing the number of uninsured individuals. For example, the share of people with non-group coverage increased from 7.3% in 2021 to 7.5% in 2022. Additionally, Medicaid expansion under the Affordable Care Act has been crucial in providing coverage to low-income adults, contributing to the overall decrease in uninsured rates.

The impact of the Affordable Care Act on insurance coverage extends beyond the increase in employer-sponsored insurance. The law has helped reduce uninsured rates across different demographic groups, including low-income families, racial and ethnic minorities, and both young and older adults. This has resulted in improved access to healthcare, better financial security, and enhanced quality of care for millions of Americans.

Updating Dentrix Insurance Records: Address Change Procedure

You may want to see also

The share of people with non-group coverage increased from 7.3% in 2021 to 7.5% in 2022

The Patient Protection and Affordable Care Act (PPACA), also known as Obamacare, has been instrumental in providing health coverage to millions of Americans. As of February 2021, 11.3 million people were enrolled in the ACA Marketplace plans, and as of December 2020, 14.8 million newly eligible people had enrolled in Medicaid through the ACA's expansion. The law's coverage expansions have led to a decrease in the number of uninsured individuals across the country, with all 50 states and the District of Columbia experiencing reductions in their uninsured rates.

The increase in non-group coverage can be attributed to several factors, including the improved affordability and accessibility of private insurance plans due to PPACA policies. The Act's subsidies for individual market coverage, reforms to the insurance market, and the mandate requiring most people to have coverage have all contributed to this shift. Additionally, the expansion of Medicaid to cover more low-income adults has played a role in increasing overall health coverage and reducing the number of uninsured individuals.

The impact of the PPACA is evident in the decrease in uninsured rates across various demographics. From 2019 to 2022, the uninsured rate for American Indian and Alaska Native people decreased by 2.4 percentage points, while the uninsured rate for Hispanic people decreased by 2.0 percentage points. Adults in low-income families experienced the most significant decline in the uninsured rate, dropping from 18.1% in 2019 to 15.7% in 2022. These reductions in uninsured rates are a direct result of the coverage expansions and protections put in place by the PPACA.

The PPACA has played a crucial role in improving access to healthcare for millions of Americans, especially during the COVID-19 pandemic. The continuous enrollment provision in Medicaid and enhanced subsidies in the Marketplace helped protect individuals and families, particularly those with low incomes, from coverage losses. As a result, the number of nonelderly uninsured individuals continued a downward trend, dropping by nearly 1.9 million from 27.5 million in 2021 to 25.6 million in 2022. The uninsured rate also decreased from 10.2% in 2021 to a record low of 9.6% in 2022.

Uninsured: Millions Exposed

You may want to see also

The share of nonelderly people with Medicaid coverage increased by 1.7% from 2019 to 2022

The Affordable Care Act (ACA) has been instrumental in ensuring that more Americans have health coverage. The Act's coverage expansions, including Medicaid expansion and subsidized Marketplace coverage, have served as a safety net for people facing economic and coverage disruptions, especially during the coronavirus pandemic.

From 2019 to 2022, the share of nonelderly people with Medicaid coverage increased by 1.7%. This increase is significant as it represents a larger proportion of the nonelderly population gaining access to essential health services. The rise in Medicaid coverage is primarily due to the ACA's expansion of eligibility to include low-income adults. Additionally, ACA policies have made it easier for eligible individuals to enrol in Medicaid.

The impact of the ACA is evident in the reduction of uninsured rates across all 50 states and the District of Columbia. States that expanded Medicaid experienced the most significant reduction in their uninsured rates. For instance, California, Kentucky, New York, Oregon, Rhode Island, Washington, and West Virginia reduced their uninsured rates by half from 2013 to 2019 through Marketplace coverage and Medicaid expansion.

The success of the ACA is further highlighted by the latest data from February 2024, showing that 76,289,951 individuals were enrolled in Medicaid across 51 states and the District of Columbia. This number demonstrates a continued commitment to providing health coverage to those who need it.

The ACA has not only increased access to health coverage but has also improved the quality of coverage. The Act requires all plans to offer "essential health benefits," prohibits annual and lifetime limits on coverage, and protects individuals from having their coverage rescinded if they become ill. These provisions ensure that those with health coverage can access the care they need without fear of losing their insurance or facing excessive costs.

In conclusion, the ACA has played a pivotal role in increasing health coverage for nonelderly individuals, as evidenced by the 1.7% increase in Medicaid coverage from 2019 to 2022. This expansion of coverage translates into improved access to care, enhanced financial security, and better health outcomes for those who were previously uninsured.

Unraveling the Complexities of Retroactive Insurance Billing

You may want to see also

Frequently asked questions

It is unclear how many people lost insurance under the PPACA, but it is estimated that between 2.9 and 8.7 million people who are currently enrolled in the individual market were previously uninsured. Additionally, as many as 5.9 million may have lost employer-sponsored insurance (ESI) because of the PPACA.

According to the Department of Health and Human Services (HHS), 20 million people gained insurance under the PPACA, with 17.7 million people newly insured since October 2013 and 2.3 million being young adults who benefited from the provision allowing them to stay on their parents' insurance.

The PPACA has led to a significant increase in the number of people with health insurance, with more than 20 million people gaining coverage. The law has also resulted in reductions in uninsured rates across all 50 states and the District of Columbia, with states that expanded Medicaid experiencing the largest decreases.