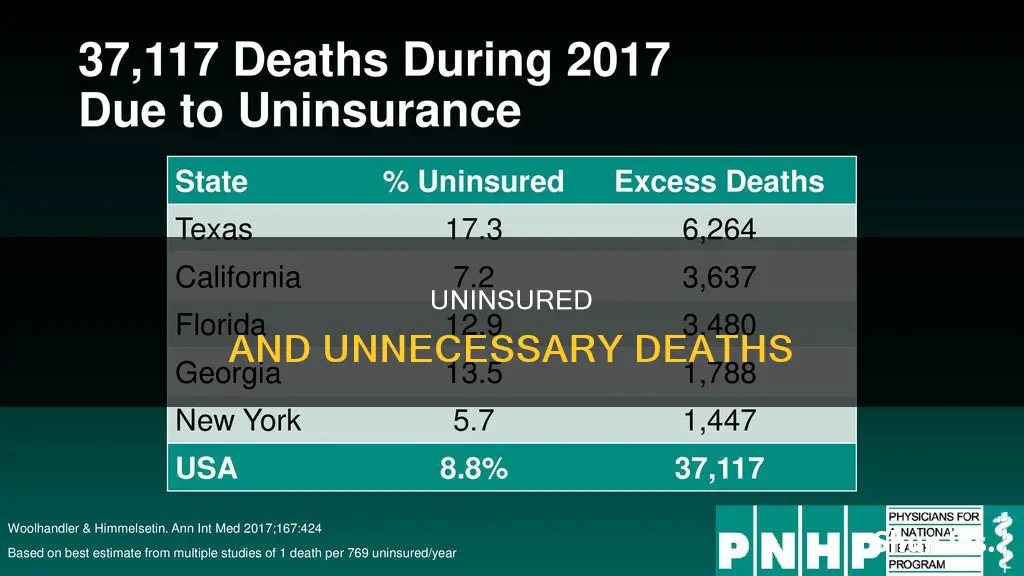

A lack of health insurance is a matter of life and death for many Americans. A 2009 study by researchers at Harvard Medical School found that 45,000 people die every year as a direct result of not having health insurance coverage. This figure is more than double the previous estimate of 18,000 made by the Institute of Medicine in 2002. The increase is partly due to the rising number of uninsured people and the erosion of the medical safety net for the disadvantaged. The uninsured are more likely to delay or avoid seeking medical care, leading to preventable illnesses and premature deaths. This issue highlights the urgent need for reforms to expand healthcare access and reduce costs, ensuring that no one dies because they cannot afford essential medical care.

| Characteristics | Values |

|---|---|

| Number of people who die due to lack of insurance | 26,000-45,000 per year |

| Comparison with previous estimates | More than double the previous estimate made by the Institute of Medicine in 2002 |

| Risk of death for uninsured vs insured | 40% higher risk of death than their privately insured counterparts |

| Leading cause of death | Third leading single cause of death among Americans aged 55 to 64, after heart disease and cancer |

What You'll Learn

- The number of people dying due to lack of insurance is increasing

- People without insurance are less likely to seek preventative care

- People without insurance are more likely to delay or forgo medical care

- People without insurance are more likely to have medical debt

- People without insurance are more likely to be uninsured due to high costs

The number of people dying due to lack of insurance is increasing

It is a sad reality that the lack of insurance is causing people to die. In the United States, the number of people dying due to a lack of health insurance is particularly alarming. A study by Families USA, a non-profit organisation that advocates health care for all Americans, found that more than 26,000 Americans died each year between 2000 and 2006 because they lacked health insurance. This is more than twice as many as were murdered. The situation is worsening, with the number of uninsured Americans reaching 47 million in 2006 and continuing to rise.

The consequences of not having insurance are dire. Uninsured people are faced with medical debt, often go without necessary care, and die prematurely. They are less likely to have a regular source of care outside of emergency departments and are forced to delay or forgo medical treatment. When they do receive medical care, they pay more for it as they cannot negotiate discounts on hospital and doctors' charges like insurance companies can.

The impact of lacking insurance is especially pronounced for those with chronic illnesses. They are less likely to have a usual source of medical care, decreasing their chances of receiving preventative and primary care. Furthermore, the discontinuity of insurance is harmful; those with intermittent insurance coverage are more likely to die than those with consistent coverage.

Research has found a strong association between uninsurance and death. A study published in the American Journal of Public Health in 2009 concluded that uninsured, working-age Americans had a 40% higher risk of death than their privately insured counterparts. This figure has increased from a 25% excess death rate found in a similar study in 1993. The study estimated that approximately 44,789 excess deaths occur annually due to a lack of health insurance, exceeding the number of deaths caused by many common diseases such as kidney disease.

The reasons behind the substantial increase in deaths linked to a lack of insurance include a rise in the number of uninsured individuals and a deterioration in the medical safety net for disadvantaged populations. Additionally, the improved quality of care for those who can afford it has widened the gap in the risk of death between the insured and the uninsured.

The issue of people dying due to a lack of insurance is a pressing concern that needs to be addressed. Providing health insurance coverage to all can help mitigate this issue and save lives.

OSF Billing Confusion: Understanding Unexpected Charges and Insurance Billing

You may want to see also

People without insurance are less likely to seek preventative care

The lack of preventative care can lead to more severe health issues in the long run. For example, people without insurance are more likely to be diagnosed with late-stage cancer, which has poorer outcomes and a higher risk of premature death. Uninsured people with hypertension or high cholesterol are also less likely to be screened, monitored, and treated, which can lead to complications and deterioration in their condition.

The lack of insurance can also lead to a decline in overall health. For instance, uninsured adults are more likely to report a decline in general health, physical functioning, and mental health. They are also more likely to experience major health declines, new functional limitations, and adverse cardiovascular outcomes.

Overall, the lack of insurance is associated with higher mortality rates. Uninsured people have a higher risk of dying prematurely than those with insurance. This is particularly true for those with acute or chronic conditions, such as cancer, cardiovascular disease, diabetes, and mental illness.

The consequences of lacking insurance are significant and underscore the importance of universal health coverage to improve health outcomes and reduce health disparities.

Dwelling Insurance: What's Covered?

You may want to see also

People without insurance are more likely to delay or forgo medical care

People without health insurance are less likely to receive preventive and screening services and are less likely to receive them at the recommended frequencies. They are also less likely to receive timely care and more likely to postpone health care or forgo it altogether because of concerns over costs. The consequences can be severe, particularly when preventable conditions or chronic diseases go undetected.

People without health insurance are less likely to receive recommended preventive and screening services and are less likely to receive them at the recommended frequencies. For example, uninsured adults are less likely to receive mammography, Pap smears, and colorectal cancer screening. They are also less likely to have a regular source of care, which increases the likelihood of receiving appropriate care.

The uninsured are more likely to go without needed care than the insured. They are more likely to visit the emergency department and be admitted to the hospital for "ambulatory care sensitive conditions", suggesting that preventable illnesses are a consequence of uninsurance. The uninsured are also more likely to delay or forgo medical care they need. When they do get medical care, they pay more for it, because they cannot negotiate discounts on hospital and doctors' charges, as insurance companies do.

Examples

- Uninsured women are more likely to receive a late-stage diagnosis for invasive cervical cancer than are privately insured women.

- Uninsured patients with colorectal cancer have a greater risk of dying than do patients with private indemnity insurance, even after adjusting for differences in the stage at which the cancer is diagnosed and the treatment modality.

- Uninsured adults with hypertension or high cholesterol have diminished access to care, are less likely to be screened, are less likely to take prescription medication if diagnosed, and experience worse health outcomes.

Understanding BICE Calculations and Their Impact on Term Insurance Policies

You may want to see also

People without insurance are more likely to have medical debt

There are several reasons why people with health insurance can still find themselves in medical debt. Firstly, high deductibles and other forms of cost-sharing can lead to individuals receiving medical bills that they are unable to pay, even with insurance. For example, people with health insurance may still have to pay high out-of-pocket costs for emergency room visits, COVID-19 treatment, or mental health treatment. Additionally, people with insurance may choose to charge medical bills to credit cards, which often have high interest rates that can quickly increase the amount of debt owed.

Another reason for medical debt among insured individuals is the opaque pricing of medical procedures. It can be difficult to obtain cost estimates before agreeing to potentially expensive procedures, and unexpected bills can lead to financial strain. Furthermore, insurance may not cover all aspects of treatment, such as out-of-network care or experimental treatments. Transportation costs, childcare costs, and income loss due to illness can also contribute to medical debt, even for those with insurance.

The risk of medical debt is particularly high for those without insurance. In the US, over 20 million people (nearly 1 in 12 adults) owe medical debt, and this number is even higher among those who are uninsured. Lack of insurance is a significant cause of medical debt, as uninsured individuals are less likely to have a regular source of care and often delay or forgo necessary medical treatment due to cost. This can lead to a cycle of worsening health and increasing debt.

Nature's Fury: Understanding Tornadoes and Their Impact on Home Insurance Policies

You may want to see also

People without insurance are more likely to be uninsured due to high costs

Full-time, full-year employment is generally required to obtain and maintain health insurance. However, even those who are employed may not have access to insurance through their workplace, as smaller firms are less likely to offer health benefits to their employees. Lower-income workers are especially vulnerable, as they are less likely to be offered health benefits and often cannot afford the premiums for employment-based coverage.

The availability of health insurance in the workplace is a crucial factor in determining whether individuals and their families are insured. Wage earners in larger firms are more likely to have access to health insurance, while those in smaller firms (fewer than 25 employees) have a higher uninsured rate. Additionally, certain occupations and employment sectors are associated with higher uninsured rates. For example, almost half of all wage earners working in private households are uninsured, while less than 10% of those in professional jobs lack insurance.

The costs of insurance also affect individuals' ability to maintain coverage over time. Continuous enrollment provisions and enhanced subsidies implemented during the COVID-19 pandemic helped protect individuals with low incomes from coverage losses. However, as these protections are phased out, the number of uninsured individuals is expected to rise.

The consequences of being uninsured can be dire. Uninsured individuals have lower access to care and are more likely to delay or forgo necessary medical treatment due to costs. They often face unaffordable medical bills and medical debt, which can lead to significant financial strain and negative consequences such as difficulty paying living expenses.

The lack of insurance also has broader societal implications. Uninsured individuals are less likely to receive preventive care and services for major health conditions and chronic diseases, which can result in avoidable hospitalizations and higher mortality rates. The high costs of insurance contribute to health disparities and place a substantial burden on individuals, families, communities, and the nation as a whole.

Unraveling the Rental Insurance Billing Process: A Comprehensive Guide

You may want to see also

Frequently asked questions

Estimates vary, but according to a 2009 study by researchers at Harvard Medical School, around 45,000 people die each year in the US due to lack of insurance. A 2008 study by the Urban Institute puts the number at 27,000.

Uninsured people are less likely to have a regular source of care outside of emergency departments and often delay or forgo medical care. They are also less likely to obtain recommended screening and care for chronic conditions and are more likely to suffer undiagnosed chronic conditions.

Organisations like Families USA and Public Citizen advocate for health care for all Americans through a single-payer program administered by the federal government.