Term life insurance is a type of life insurance policy that has a specified end date, such as 20 years from the start date. The concept of life insurance, however, is much older. The origins of the idea can be traced back to ancient Rome, where Caius Marius, a Roman military leader, created a burial club among his troops. In the event of a club member's unexpected death, other members would pay for the funeral expenses. Many similar clubs originated in this era, and the concept was embraced by the government and military. The concept disappeared for a long time after the fall of the Roman Empire around 450 A.D. The earliest known life insurance policy was made in Royal Exchange, London, on 18 June 1583, when Richard Martin insured William Gybbons, paying thirteen merchants 30 pounds for 400 if the insured died within one year. The first company to offer life insurance in modern times was the Amicable Society for a Perpetual Assurance Office, founded in London in 1706.

What You'll Learn

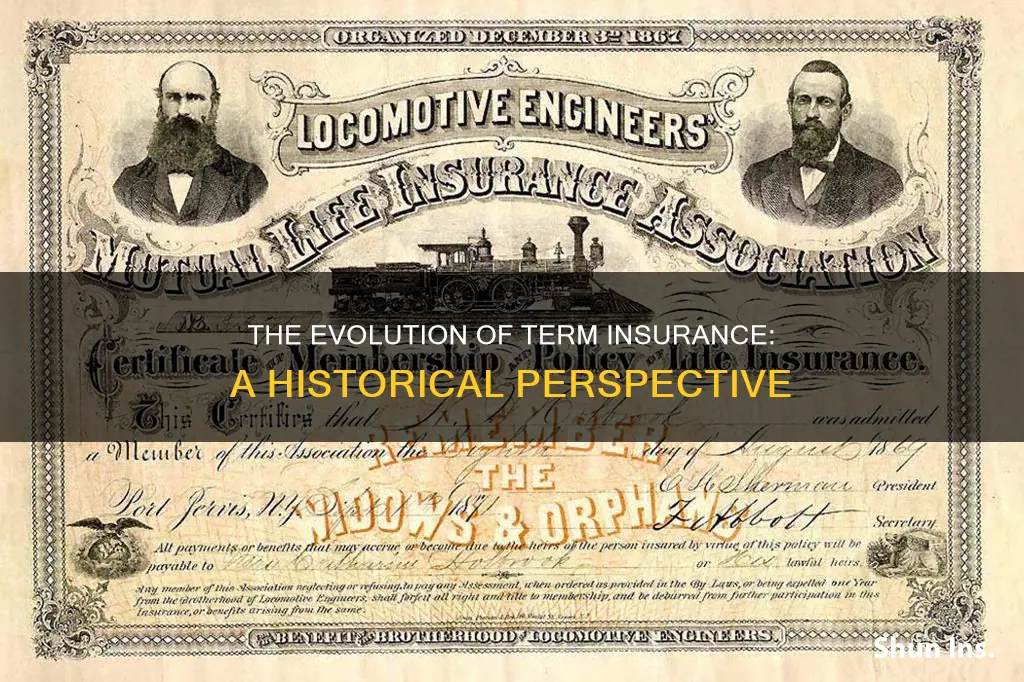

The first term insurance policies

The history of insurance dates back to ancient civilisations, with the first forms of insurance recorded by Babylonian and Chinese traders. The Code of Hammurabi, written around 1750 BCE, is considered by some to be the first example of insurance and transferring risk. The code describes a form of bottomry, whereby a ship's cargo could be pledged in exchange for a loan. The loan was contingent on a successful voyage, and the debtor did not have to repay the loan if the ship was lost at sea.

In the ancient world, merchants would divide their items among various ships to limit the loss of goods when crossing treacherous waters. The Achaemenian monarchs were the first to insure their people, and insurance records were submitted to notary offices. The ancient Greeks and Romans formed the first types of life and health insurance with their benevolent societies, which provided care for the families of deceased citizens.

The first known life insurance policy was made in the Royal Exchange, London, in 1583. A Richard Martin insured a William Gybbons, with 13 merchants paying 30 pounds for 400 if the insured died within a year. The first company to offer life insurance in modern times was the Amicable Society for a Perpetual Assurance Office, founded in London in 1706. Each member made an annual payment per share, and at the end of the year, a portion of the "amicable contribution" was divided among the wives and children of deceased members.

Unraveling the Intricacies of Insurance: Exploring Trade Dress Infringement

You may want to see also

How term insurance works

Term insurance is a type of life insurance that provides coverage for a specific period of time, known as the 'term'. This type of insurance offers a death benefit to the beneficiary or nominee in the event of the policyholder's death during the policy term.

- Signing the Contract: Term insurance is an agreement between the insurer and the policyholder, where the policyholder agrees to pay the premiums in instalments for a specified period, and the insurer agrees to financially secure the policyholder's loved ones.

- Proposal Form: Before purchasing a plan, the applicant needs to fill out a proposal form, providing basic information such as name, date of birth, gender, annual income, educational qualifications, lifestyle habits, and family medical history.

- Assessing Needs: It is crucial to assess the needs of both the policyholder and their family to determine the appropriate level of coverage and ensure that the policy aligns with their financial goals.

- Adequate Life Cover: Calculating the right amount of life cover is essential to ensure that the policy provides sufficient financial protection. A general rule of thumb is to have a life cover that is 15 to 20 times the policyholder's annual income.

- Policy Term: The policy term determines the duration of coverage. It should be chosen based on the policyholder's financial dependencies and can range from 5 to 40 years, or even whole life coverage in some cases.

- Premium Payment Options: Term plans typically offer flexible premium payment options, allowing policyholders to choose the most suitable payment term and mode, such as monthly, annual, semi-annual, or quarterly payments.

- Benefit Payout Options: The benefit payout can be structured as a lump sum, regular income, or a combination of both, depending on the policyholder's preferences and needs.

- Riders: Riders are additional benefits that can be added to the base plan to enhance the coverage. Common types of riders include critical illness, terminal illness, accidental death, and disability coverage.

- Life Stage Benefits: Some term insurance plans offer life stage benefits, allowing policyholders to increase their life cover amount to accommodate life events such as marriage or having children.

- Application and Medical Evaluation: After assessing their needs and choosing the appropriate coverage, the applicant submits the application form along with relevant information, including personal details, family medical history, and existing health conditions. The insurer may require a medical evaluation to determine the final premium rate.

- Premium Payments: Once the application is approved, the policyholder makes regular premium payments to maintain their coverage.

- Assigning the Nominee: The policyholder selects the beneficiary who will receive the benefit amount in the event of their untimely death during the policy term. This can be a family member, friend, sibling, or even an external party such as a charity.

- Claim Process: In the unfortunate event of the policyholder's death during the policy term, the insurer pays the sum assured as the death benefit to the nominated beneficiary. If the policyholder outlives the policy term, there is typically no maturity benefit, unless a return of premium plan is chosen.

Understanding the Nature of Prepaid Insurance: A Short-Term Asset Strategy

You may want to see also

Benefits of term insurance

Term insurance is a type of life insurance that provides coverage for a specific number of years, or a 'term'. It is a pure death benefit that provides a lump-sum payment to beneficiaries if the insured person dies during the policy term. Term insurance is often chosen over permanent insurance because it is much more affordable, and offers the greatest death benefit for the lowest premium outlay. Here are some of the benefits of term insurance:

Simplicity

Term insurance plans are much easier to understand than other insurance plans, such as endowment policies, which combine risk cover with savings. Term life insurance is simple: you pay the premium and get covered for the term chosen.

Competitive pricing

Term life policies can be easily compared on the basis of price, as they are structurally similar and simple to understand. This has led to a very competitive market in which term life policies are rapidly becoming a commodity. Buyers suffer fewer information problems with term insurance, making the term market more price-competitive than for cash value policies.

Flexibility

Opting out of a term life policy is much easier than getting out of cash value policies. With term policies, if you stop paying the premium, the risk cover ceases and the policy ends. However, many term life policies are renewable and convertible. Renewable policies ensure you can take out another term policy without a medical exam at the end of the first term policy. Convertible policies allow you to convert your term life policy into an endowment policy for the same sum, with an associated increase in premium, if this makes sense during the term of the policy.

Tax benefit

Although the premium for term insurance is much lower than for endowment insurance, it is still eligible for tax benefits.

Lowest premiums

The premium for term insurance is much lower than that for comparative cash value policies. For example, currently, a 30-year-old person can buy a level term insurance policy of 20 years for an annual premium of around Rs 3000. For an endowment policy without profits, with exactly the same death benefit, the premium will be a little above Rs 30,000 annually.

Large death benefit

Term insurance allows a person to acquire the greatest death benefit for the lowest premium outlay when the policy is first issued.

Protection for family

Term insurance is a good option for people in their family-formation years, especially if they're on a tight budget, because it allows them to buy high levels of coverage when the need for protection is often greatest.

The Flexibility of Term Insurance: Understanding Portability Options

You may want to see also

Term insurance riders

- Accidental Death Rider: This rider provides an additional payout on top of the base sum assured if the policyholder dies due to an accident.

- Hospicare Benefit Rider: Under this rider, the insured person receives a fixed amount for every day they spend in the hospital, whether in the general ward or the ICU.

- Critical Illness Rider: The rider sum assured is paid to the policyholder as a lump sum upon the diagnosis of any critical illnesses specified under the term life insurance plan.

- Accidental Total And Permanent Disability Rider (ATPD): The rider sum assured is paid to the policyholder in case of total and permanent disability due to an accident during the policy period.

- Accelerated Death Benefit Rider: The entire/part of the sum assured is paid to the policyholder in advance if they are diagnosed with a terminal illness.

- Waiver of Premium Rider: This rider waives future term life insurance premiums if the policyholder is unable to pay them due to critical illness or permanent total disability leading to job loss.

- Term Life Insurance Rider: This rider can be added to a permanent life insurance policy to temporarily increase the death benefit for a set period.

- Long-term Care Rider: This rider lets the insured person access their policy's death benefit while they are still alive if they need qualifying long-term care.

- Child and Spouse Riders: These riders are designed to pay out a small death benefit if the insured child or spouse passes away during the rider's term. The payout can typically cover medical bills and funeral expenses.

Understanding Short-Term Insurance: Temporary Coverage, Long-Term Peace of Mind

You may want to see also

Term insurance plans in India

Term insurance is a type of life insurance that provides coverage for a specific number of years, also known as the 'term'. If the policyholder dies during the term, the policy will pay a death benefit to the beneficiary. Term insurance is one of the most popular types of insurance schemes in the market. A term insurance plan provides protection in the form of financial assistance to your family. It pays a certain sum to take care of your family’s financial needs in case of your untimely demise.

- ICICI Pru iProtect Smart

- HDFC Life Click 2 Protect Super

- Max Life Smart Secure Plus

- TATA AIA SRS Vitality Protect

- Bajaj Allianz eTouch Lumpsum

- PNB MetLife Mera Term Plan Plus

- Canara HSBC Young Term Plan

- Bandhan Life iTerm Comfort

- SBI Life eSheild Next

- Aditya Birla Sun Life Insurance DigiShield Plan

- LIC New Tech Term Plan

When choosing a term insurance plan, it is important to consider the claim settlement ratio, solvency ratio, customer reviews, flexible payout options, and benefits offered. It is also beneficial to purchase term plans online, as it often saves time and may result in a discount.

The Many Faces of Insurance Brokers: Exploring Alternative Terms for Intermediaries

You may want to see also

Frequently asked questions

Term insurance is a type of life insurance that has been around for centuries, with the first known life insurance policy issued in Royal Exchange, London, in 1583.

Insurance is based on the idea of spreading risk among a large group of people or entities, so that the financial burden of an adverse event can be shared and mitigated.

Term insurance has evolved to become more accessible and affordable, with policies now available online and premiums calculated based on sophisticated mortality tables and individual factors such as age, health, and lifestyle.