Calculating auto insurance after an accident can be a stressful process. Car insurance rates typically increase after an accident, especially if it was your fault. The increase in insurance premiums can vary depending on factors such as your age, location, driving record, and the insurance company you are with. It's important to note that the accident will usually affect your insurance rates for at least three to five years. To lower your insurance rates after an accident, you can consider taking advantage of discounts, improving your credit score, or comparing quotes from different insurance companies.

| Characteristics | Values |

|---|---|

| Average increase in car insurance rates after an at-fault accident | $840 |

| Average annual rate for drivers with a single accident on their record | $2,940 |

| Average annual rate for a driver with a clean driving record | $2,068 |

| Average increase in car insurance rates after an accident that resulted in injuries | 47% |

| Average increase in car insurance rates after an accident that resulted in property damage | 45% |

| Average increase in car insurance rates after an accident (Forbes Advisor analysis) | 45% |

| Average increase in car insurance rates after an accident (NerdWallet analysis) | 47% |

| Average increase in car insurance rates after an accident (ValuePenguin analysis) | 49% |

| Average increase in car insurance rates after an accident (MarketWatch analysis) | 45% |

| Average increase in car insurance rates after an accident for drivers with previous speeding tickets or accidents | 54% |

| Average increase in car insurance rates after a second at-fault accident | 56% |

| Average increase in car insurance rates after an accident in Massachusetts | 101% |

| Average increase in car insurance rates after an accident in Maine | $1,491 per year or $125 per month |

| Average increase in car insurance rates after an accident in Michigan | $6,032 per year or $503 per month |

What You'll Learn

- How to calculate auto insurance after an accident that wasn't your fault?

- How to calculate auto insurance after a minor accident?

- How to calculate auto insurance after a major accident?

- How to calculate auto insurance after an accident with injuries?

- How to calculate auto insurance after an accident with property damage?

How to calculate auto insurance after an accident that wasn't your fault

If you've been in a car accident that wasn't your fault, you may still see an increase in your insurance premium. This is because insurance companies may now perceive you as a high-risk driver. Any involvement in an accident, regardless of fault, can indicate a higher chance of being in future incidents.

However, if you live in a no-fault state like New York, your insurance company will pay your medical bills and lost wages, but you will still need to prove the other party was responsible for other damages.

If you've been in an accident that wasn't your fault, your insurance company will likely ask for proof. This can include:

- A police report about the accident

- A statement from the other driver's insurance company accepting fault

- A written statement from the other driver, under penalty of perjury, attesting to fault

- A legal document showing that you were reimbursed for accident damage

Additionally, accident claims paid by comprehensive insurance generally don't result in a rate increase. These include collisions with animals and damage caused by falling or flying objects.

It's important to note that your insurance premium may still be impacted even if you weren't at fault. If your insurance company covers your claim, your rates could increase depending on your state and insurance company. The best way to find out how an accident will impact your rates is to ask your insurance representative.

If you're concerned about your car insurance rates increasing after an accident, there are a few things you can do:

- Enrol in an accident forgiveness program: Many insurance companies offer accident forgiveness programs that can help waive the surcharge. However, most programs only allow you to waive the first at-fault accident, and there may be limitations for new drivers.

- Improve your credit: If your state allows it, improving your credit score may help lower your insurance rate over time.

- Increase your deductible: Raising your deductible can lower your premium, but keep in mind that this will also increase your out-of-pocket expenses if you need to file a claim.

- Look for discounts: Many insurance companies offer a variety of discounts, such as good student discounts, multi-policy discounts, and usage-based telematics programs.

- Shop around: Compare quotes from different insurance companies, as they may have different policies on adjusting rates after an accident.

Canceling Auto Insurance: Early Termination

You may want to see also

How to calculate auto insurance after a minor accident

Calculating the cost of auto insurance after a minor accident can be a stressful process. Here's a step-by-step guide to help you through it:

Step 1: Understand the Factors Affecting Your Insurance Calculation

Several factors influence the calculation of auto insurance rates, and these factors vary among insurance companies. Some common factors include:

- Driving history: Insurance companies consider your driving record, including any accidents, traffic violations, or claims. A minor accident on your record will likely impact your rates.

- Location: The state and city where you live can affect your insurance rates. Different states have different regulations and average rates.

- Vehicle type: The make, model, and safety features of your vehicle are considered when calculating insurance rates.

- Age and gender: In certain states and for specific age groups, age and gender can influence insurance rates.

- Credit score: In many states, insurance companies take your credit score into account when determining rates.

Step 2: Contact Your Insurance Company

Contact your insurance representative to understand how your specific policy will be impacted by the minor accident. Ask about any changes to your premiums, deductibles, or coverage limits. Find out if you have accident forgiveness or other benefits that can mitigate the impact of the accident on your rates.

Step 3: Compare Rates with Other Insurance Companies

Even if you weren't at fault for the accident, insurance companies may perceive you as a higher risk and increase your rates. To ensure you're getting the best deal, it's a good idea to compare rates from multiple insurance providers. Obtain quotes from several companies, considering factors like coverage limits, deductibles, and any available discounts.

Step 4: Explore Ways to Lower Your Insurance Rates

There are several strategies you can employ to reduce your auto insurance rates after a minor accident:

- Take advantage of discounts: Insurance companies offer various discounts, such as multi-policy discounts, safe driver discounts, or loyalty programs. Ask your insurance company about what discounts you may be eligible for.

- Increase your deductible: By agreeing to pay a higher deductible, you can often lower your insurance premium. However, keep in mind that this means you'll have higher out-of-pocket expenses if you need to file a claim in the future.

- Improve your credit score: If your state allows credit scores to be considered for insurance rates, focus on improving your credit. This can be a long-term strategy to lower your insurance costs.

- Adjust your coverage: Review your policy and consider removing any coverage that you no longer need. Ensure you still meet the minimum required coverage for your state and any lease or loan requirements.

Step 5: Understand How Long the Accident Will Impact Your Rates

Typically, a minor accident will affect your insurance rates for around three to five years. After this period, your rates may return to normal, provided you maintain a clean driving record. The impact of the accident on your rates will gradually decrease over time.

Leasing a Vehicle: Is Insurance Included?

You may want to see also

How to calculate auto insurance after a major accident

Calculating the cost of auto insurance after a major accident can be a stressful process. Here's a step-by-step guide to help you understand and calculate your insurance costs:

Step 1: Understand the Factors Affecting Your Insurance Rates

Several factors can influence the cost of your auto insurance after an accident. These include:

- Location: The state you live in plays a significant role in determining insurance rates. Different states have different regulations and average rates, with California having the largest rate increase and Alaska the smallest.

- Insurance Company: Different insurance companies have different policies and rates for drivers with accidents on their records. It's essential to compare rates from multiple companies.

- Driving History: Your overall driving history, including previous accidents, violations, and claims, will be considered when calculating your new rates.

- Age and Gender: In certain states, your age and gender can also impact your insurance rates, with younger drivers often considered riskier to insure.

- Type of Vehicle: The make, model, and safety features of your vehicle can affect your insurance rates. Insuring a more expensive or less safe car may result in higher rates.

Step 2: Determine Fault and Claim Type

Whether or not you were at fault in the accident will have a significant impact on your insurance rates. If you were at fault:

- Your insurance rates will likely increase, as you are now considered a higher-risk driver.

- The severity of the accident, including property damage, injuries, and any influence of drugs or alcohol, will also be considered.

If you were not at fault:

- Your rates may still increase, especially if you've made multiple claims in a short period.

- However, in some states, like Oklahoma and California, insurers are not allowed to increase rates if the accident was not your fault.

Step 3: Review Your Insurance Policy and Coverage

Understanding your insurance policy and coverage limits is crucial. Here's what you should consider:

- Liability Insurance: This covers property damage or injuries caused to others in an accident. If you are at fault, this portion of your policy will likely be affected, resulting in a surcharge (rate increase) when you renew your policy.

- Collision and Comprehensive Coverage: These cover damages to your own vehicle. If you have collision or comprehensive coverage, filing a claim will likely result in a rate increase, regardless of fault.

- Deductible: Raising your deductible can lower your insurance rates, but it will also increase your out-of-pocket expenses if you need to file a claim in the future.

Step 4: Calculate the Cost of Insurance After the Accident

To calculate the cost of insurance after a major accident, you can follow these steps:

- Determine Your Base Rate: Start by calculating your base insurance rate, which is the rate you would pay without any accidents or violations on your record. This will depend on various factors, including your age, location, vehicle, and insurance company.

- Identify the Surcharge: The surcharge is the additional amount you will be charged due to the accident. This can vary based on the insurance company, the severity of the accident, and your driving history. You can contact your insurance company or agent to get an estimate of the surcharge.

- Apply the Surcharge: Add the surcharge to your base rate to calculate the new insurance rate after the accident. This will give you an idea of how much your insurance costs will increase.

Step 5: Explore Ways to Lower Your Insurance Rates

There are several strategies you can use to mitigate the increase in insurance rates after a major accident:

- Shop Around: Compare rates from multiple insurance companies, as they have different policies and rates for drivers with accidents.

- Look for Discounts: Insurance companies offer various discounts, such as multi-policy discounts, safe driver discounts, and loyalty programs.

- Consider Accident Forgiveness: Some insurance companies offer accident forgiveness programs, where they waive the surcharge for the first accident. This may be included in your policy or available as an add-on.

- Improve Your Driving Record: If you have a single accident on your record, focus on maintaining a clean driving record going forward. This can help reduce the impact of the accident on your insurance rates over time.

Auto Insurance and Boat Rentals: Understanding the Coverage Gap

You may want to see also

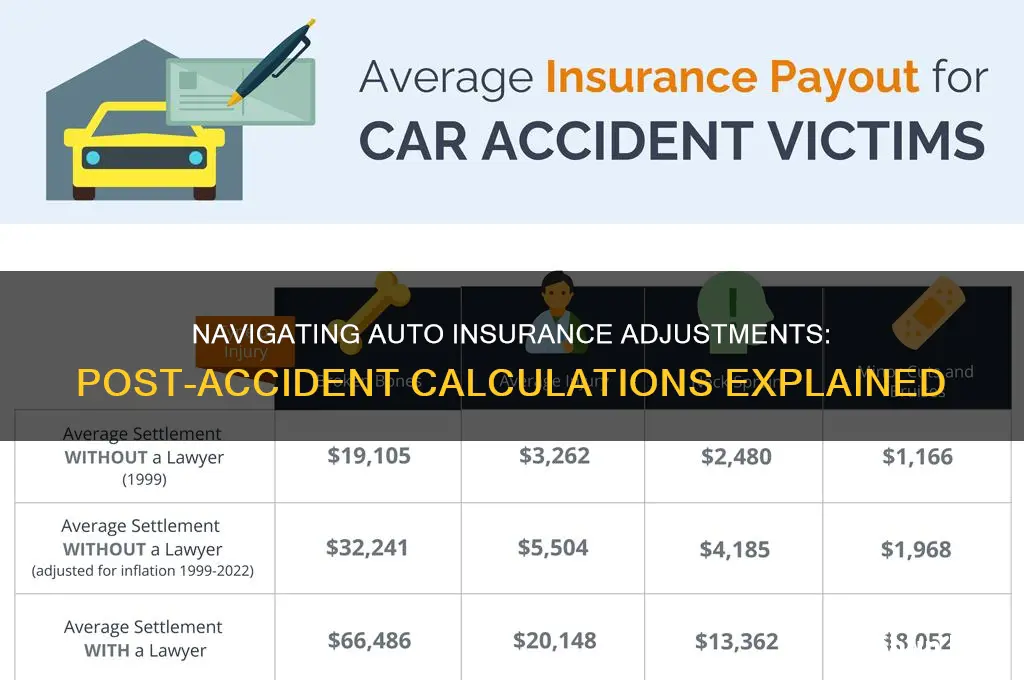

How to calculate auto insurance after an accident with injuries

It's important to understand how auto insurance works in the aftermath of an accident, especially when injuries are involved. Here's a guide on calculating auto insurance after an accident with injuries:

Understanding Auto Insurance Calculations

Auto insurance rates are calculated based on risk assessment. The more likely you are to file a claim, the higher your insurance premiums will be. Factors such as your driving record, age, location, type of vehicle, and claims history all play a role in determining your risk profile. Additionally, the cost of insurance increases after an accident, especially if it resulted in injuries.

Steps to Calculate Auto Insurance After an Accident with Injuries:

- Review Your Policy: Understand the terms and conditions of your auto insurance policy. Pay close attention to the coverage limits, deductibles, and exclusions. This will help you identify what is covered and what is not.

- Determine Fault: In most cases, the driver who is at fault for the accident will see an increase in their insurance rates. If you are deemed at fault, your insurance company will likely view you as a higher risk, resulting in higher premiums.

- Assess the Severity: The severity of the accident and the resulting injuries will impact your insurance rates. Accidents causing serious injuries will lead to substantial increases in insurance costs. The more extensive the injuries and damage, the higher the claims and subsequent rate adjustments.

- Review State-Specific Regulations: Insurance rate increases after an accident vary by state. Some states have no-fault insurance laws, which means your rates may increase regardless of who is at fault. Understand your state's regulations to anticipate potential changes.

- Consider Policy Renewal: Insurance companies typically adjust rates at the time of policy renewal. Your current policy premium may remain unchanged until the next renewal period. This gives you time to shop around for better rates before your policy comes up for renewal.

- Contact Your Insurance Company: Speak to your insurance representative to understand how your specific policy and circumstances will impact your rates. They can provide you with an accurate assessment of the expected increase in insurance costs after the accident with injuries.

- Explore Options for High-Risk Drivers: If you are considered a high-risk driver due to multiple accidents or other factors, you may need to explore alternative insurance options. These could include insurers specializing in high-risk drivers, government-provided insurance plans, or non-standard policies.

- Utilize Accident Forgiveness: If your policy includes accident forgiveness, your rates may not increase after your first accident. However, this benefit usually comes with certain conditions, such as having a clean driving record for a specific period before the accident.

- Consider Policy Adjustments: To mitigate the impact of higher rates, you can make adjustments to your policy. This may include raising your deductible, reducing your coverage, or taking advantage of various discounts offered by your insurance company.

- Shop Around for Better Rates: Different insurance companies have varying policies on adjusting rates after an accident. By comparing quotes from multiple providers, you may find more favourable rates, especially if you have a good driving record.

Remember, the exact calculation of auto insurance after an accident with injuries will depend on various factors, including your specific policy, state regulations, and individual circumstances. It's always a good idea to consult with your insurance provider to understand the precise impact on your premiums.

U.S.AA: Auto Insurance Worth It?

You may want to see also

How to calculate auto insurance after an accident with property damage

If you've been in a car accident, you may be wondering how it will affect your insurance rates. The short answer is that it depends on several factors, including whether you were at fault, the severity of the accident, your insurance provider, your driving record, and your location. Here's a more detailed look at how to calculate auto insurance after an accident with property damage:

How Insurance Companies Calculate Rates After an Accident

Insurance companies calculate premiums based on risk. If you have an at-fault accident on your record, insurers may view you as a higher risk and increase your rates. The increase in your premium will depend on several factors, including the company's policies and the specific circumstances of the accident. Some companies may not raise rates after a minor accident, while others may increase rates by a significant amount.

Understanding Property Damage Liability Coverage

Property damage liability coverage is a type of auto insurance that covers the cost of repairing or replacing other vehicles involved in an accident, as well as other related property damage. This type of coverage is required in most states and is separate from collision coverage, which covers damage to your own vehicle. It's important to understand that property damage liability coverage will not pay for damage to your own property or vehicle.

Factors Affecting Insurance Rates After an Accident

- Fault: If you are found to be at fault for the accident, your insurance rates will likely increase. In some cases, your insurer may even deny your policy renewal, especially if the accident caused serious injury or extensive property damage.

- Severity: The severity of the accident will also impact your rates. Minor accidents, such as a fender bender in a parking lot, will typically have a smaller impact on your rates compared to major accidents.

- Insurance Provider: Different insurance companies have different policies for calculating rates after an accident. It's a good idea to compare rates from multiple companies to find the best option for you.

- Driving Record: If you have multiple accidents or traffic violations on your record, insurers will consider you a higher risk and may increase your rates accordingly.

- Location: Insurance rates after an accident can vary from state to state. Some states have laws that restrict how much insurance companies can raise rates after an accident, while others allow for more significant increases.

Steps to Take After an Accident

If you're involved in an accident, there are several important steps you should take:

- Notify your insurance company and file a claim as soon as possible.

- Get a repair estimate from a reputable auto shop. You can choose your own shop, or your insurance company may recommend one.

- Remember that you have the right to choose where to get your vehicle repaired. You are not required to use the insurance company's recommended shop or accept the lowest repair estimate.

- Be cautious of low-ball estimates from insurance companies or their preferred repair shops. It's important to get multiple independent estimates to ensure the repairs are done properly and thoroughly.

- Keep in mind that your insurance company will only pay up to your policy limits. If the cost of repairs exceeds your coverage, you may be responsible for the remaining amount.

- Consider purchasing additional liability coverage to protect your assets in case of a costly accident.

Delta Community Credit Union: Auto Insurance Options and Member Benefits

You may want to see also

Frequently asked questions

If you have accident forgiveness on your policy and this is your first accident, your rate likely won’t go up. Accident forgiveness is an optional coverage type offered by many insurers that prevents your car insurance premium from increasing after your first accident.

Your rates may still increase after a not-at-fault accident if you file a claim against your own insurance company. It may not rise as much as it would have if you were at fault, but it is common practice for insurers to increase rates, especially if you’ve made more than one not-at-fault claim within a set period of time.

An accident will usually affect your insurance rates for three to five years, depending on your state and insurer. It may stay on your driving record for longer, but most insurance companies only look back three to five years for eligibility and rate purposes.