Full coverage auto insurance in Arizona is a combination of liability, collision, and comprehensive insurance. While liability insurance is mandatory in Arizona, collision and comprehensive insurance are optional but important coverage types if you can't afford to repair or replace your car after an accident. The state's minimum requirements for liability insurance are $25,000 in bodily injury coverage per person, $50,000 per accident, and $15,000 in property damage coverage.

| Characteristics | Values |

|---|---|

| Full Coverage Car Insurance | More than the state's minimum liability coverage |

| Liability-Only Car Insurance | $25,000 in bodily injury coverage per person |

| $50,000 per accident | |

| $15,000 in property damage coverage | |

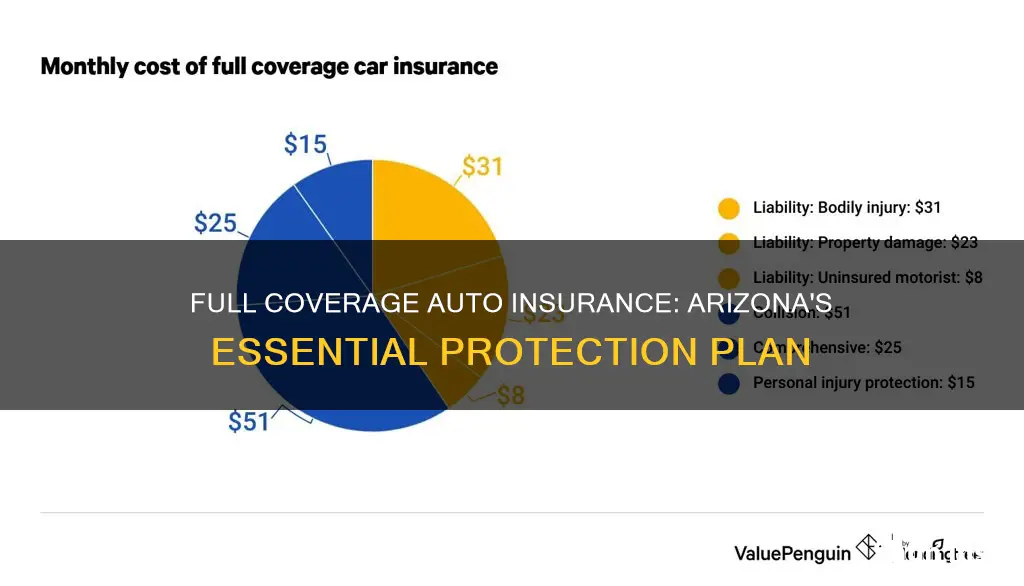

| Average Cost of Full Coverage Insurance in Arizona | $2,111 per year |

| Average Cost of State Minimum Policy | $720 per year |

| Collision Insurance | Covers repair or replacement costs if you are in an accident, drive into an object, or flip your car |

| Comprehensive Insurance | Covers repair or replacement costs if your car is damaged by falling objects, natural disasters, floods, fires, theft, vandalism, or animals |

| Uninsured/Underinsured Motorist Insurance | Replaces the liability coverage an at-fault driver should've had and pays for your costs up to your policy limits |

What You'll Learn

Liability insurance

In Arizona, all drivers are required to carry liability insurance at a minimum. This is to ensure that you can pay for any damage you cause in an accident. The minimum requirements for liability insurance in Arizona are:

- $25,000 for one person sustaining bodily injury or death in an accident

- $50,000 for two or more persons sustaining bodily injury or death in an accident

- $15,000 for damage to others' property

It is important to note that the minimum liability insurance may not be sufficient to cover all costs in the event of a major accident. To ensure you have adequate protection, you may consider purchasing higher liability limits or additional coverages.

In addition to liability insurance, Arizona also requires uninsured and underinsured motorist coverage. This coverage will protect you if you are in an accident with a driver who does not have sufficient insurance. The minimum limits for this coverage are the same as the liability coverage limits.

Auto Insurance: Can I Get Covered Now?

You may want to see also

Collision coverage

In Arizona, full coverage auto insurance is a combination of liability, collision, and comprehensive insurance. While collision coverage is not mandatory, it is an important component of full coverage.

When deciding whether to opt for collision coverage, consider the value of your vehicle. If it is brand new or worth a significant amount, collision coverage can help with expensive repairs or replacement costs. Additionally, if you are leasing or financing your vehicle, your lender may require collision coverage to protect their investment.

However, if you own your vehicle outright and feel you could cover the costs of repairs or replacement out of pocket, you may choose to forgo collision coverage. For example, if you have an older car with low value, the cost of collision coverage may outweigh the potential benefits.

In summary, collision coverage is a valuable component of full coverage auto insurance in Arizona, providing financial protection in the event of a collision. While it is not legally required, it can offer peace of mind and help you get back on the road quickly after an accident.

Auto Insurance in Virginia: Understanding Minimum Coverage Requirements

You may want to see also

Comprehensive coverage

In Arizona, comprehensive coverage is one of the components of full coverage auto insurance. Comprehensive coverage pays for damage to your car in non-collision scenarios. This includes damage from natural disasters, such as hail, floods, and windstorms, as well as damage from falling objects, fire, theft, vandalism, and collisions with animals. Comprehensive coverage also includes theft of all or part of the vehicle and glass breakage.

The recommended amount of comprehensive coverage may depend on the age and value of your vehicle, as well as your ability to cover the costs of repairs or replacement in the event of significant damage or theft. If you live in an area with a high risk of incidents covered by comprehensive insurance, such as animal collisions, car theft, vandalism, or severe weather, it is advisable to have this type of coverage.

In Arizona, comprehensive coverage can also include a safety glass non-deductible option, which means that repairing or replacing safety glass, such as the windshield and windows, does not require you to pay a deductible.

U-Tow, We-Cover: Understanding USAA's Towing Insurance Benefits

You may want to see also

Uninsured/underinsured motorist coverage

Arizona law requires drivers to have proof of financial responsibility when operating a vehicle. This is typically demonstrated by purchasing an auto insurance policy. Uninsured motorist coverage and underinsured motorist coverage are legally required in Arizona. These coverages protect you and your passengers in the event of bodily injury caused by a driver with insufficient or no insurance.

Uninsured motorist coverage (UM) protects you financially if you or your passengers are injured in an accident caused by a driver with no insurance. In Arizona, it is estimated that 13% of drivers are uninsured, which is over one in ten drivers. Uninsured motorist coverage ensures that you are not left with thousands of dollars in medical bills due to another driver's negligence. For example, if an uninsured driver causes an accident that results in you requiring medical procedures, their insurance would typically cover your medical bills. However, if they do not have insurance, your uninsured motorist coverage would protect you from these costs. This coverage also applies in hit-and-run scenarios, where the responsible driver cannot be identified.

Underinsured motorist coverage (UIM) provides financial protection if the at-fault driver has insufficient insurance to cover the costs of your injuries. For instance, if the driver only has the minimum required liability coverage in Arizona, which is $15,000 for bodily injury, and your injuries amount to $30,000 in costs, underinsured motorist coverage can help cover the remaining expenses. This coverage ensures that you receive adequate compensation for your injuries and are not burdened with medical debt due to another driver's negligence.

The minimum coverage limits required by law in Arizona for both uninsured and underinsured motorist bodily injury coverage are $25,000 per person and $50,000 per accident. While these are the minimum requirements, it is recommended to consider higher coverage limits for added protection.

Allstate: Smart Home and Auto Bundling

You may want to see also

Medical payments coverage

Even if you have major medical insurance, you may still want to have some medical payments coverage to take care of deductibles and co-payments that are not covered by your health insurance plan. MedPay is different from regular health insurance as it covers various costs related to your medical care following a car accident that your regular health insurance may not. For example, it can cover any number of immediate expenses, such as deductibles and co-pays, and it can also cover certain procedures or health support that may not be covered under your health insurance plan.

MedPay is important for Arizona drivers and is available for purchase from virtually all companies. However, many agents do not recommend it because it is usually not a profitable policy for the business. MedPay coverage of $5,000, which is usually sufficient for many, can often be purchased for no more than $10 every six months or so.

While MedPay is not mandatory for Arizona drivers, it can still be a good investment considering its low cost. It is also worth noting that MedPay applies to named drivers even if they were passengers, pedestrians, or cyclists when the car accident occurred.

Understanding 'NB' in Auto Insurance: What Does It Mean?

You may want to see also

Frequently asked questions

Arizona's financial responsibility law requires drivers to carry insurance with minimum amounts of $25,000 per person/$50,000 per accident for bodily injury liability, and $15,000 per accident for property damage liability.

Full coverage auto insurance in Arizona includes liability, collision, and comprehensive coverage. These coverages are more extensive than the state's minimum requirements, offering better protection against a variety of incidents.

Full coverage auto insurance costs an average of $224 per month or $2,111 per year in Arizona.

Additional coverage options include emergency roadside service, rental reimbursement, and towing services.