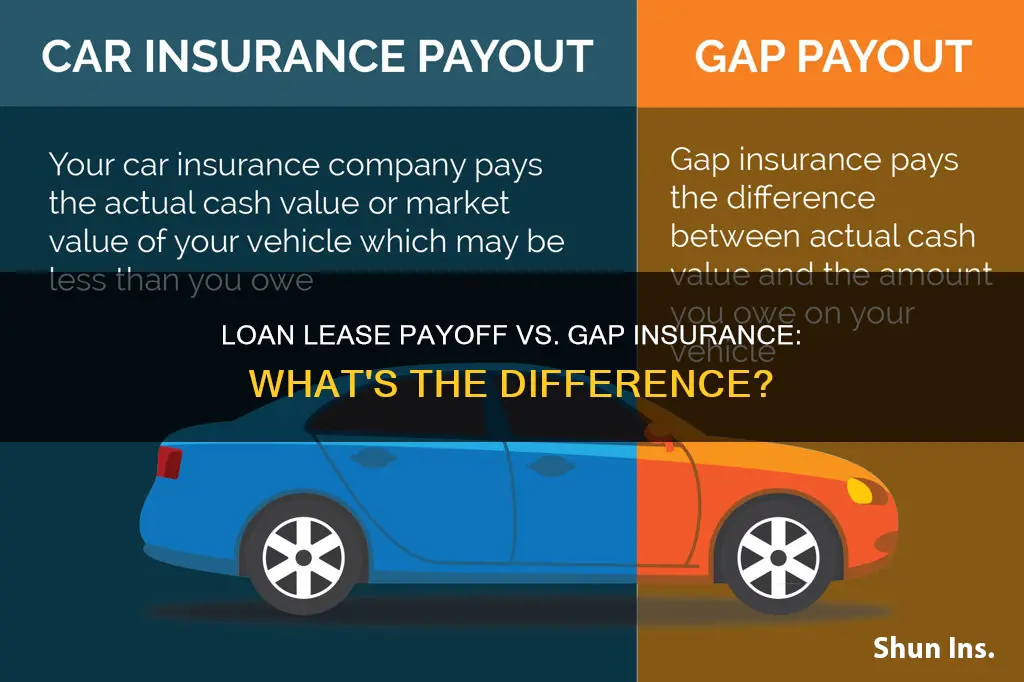

When buying a new car, it's important to consider the financial implications if it's written off or stolen. Gap insurance and loan/lease payoff coverage are two options that can help protect you financially in these situations. While both options can help pay off a car loan or lease, they have some key differences. Gap insurance covers the difference between the amount your insurer pays out for your car and the amount you owe to a lender or dealership. It typically covers your deductible and pays the difference between the car's actual cash value (ACV) and the loan balance. Loan/lease payoff coverage, on the other hand, usually only pays up to 25% of your car's ACV and doesn't cover your deductible. This type of coverage can be useful if you're making payments on a leased vehicle or if you owe more than the car's value. It's important to carefully consider your options and choose the coverage that best suits your needs.

| Characteristics | Values |

|---|---|

| Time frame to purchase the coverage | Gap insurance must be purchased within a short time frame (usually within 30 days of purchase). Loan/lease payoff coverage can be purchased at any time. |

| Coverage | Gap insurance covers the entire difference between what you owe on a vehicle and its ACV. Loan/lease payoff generally covers 25% of the ACV. |

| Deductible | Gap insurance often covers the deductible. With loan/lease coverage, the deductible usually applies. |

| Availability | Gap insurance is more common and offered by most auto lenders. Loan/lease payoff is offered by fewer companies, including Progressive. |

| Cost | Both types of coverage are fairly inexpensive. |

What You'll Learn

- Gap insurance covers the difference between the value of your auto loan and the value of your car

- Loan/lease payoff coverage is limited to a percentage of the car's ACV

- Gap insurance is optional and not legally required

- Loan/lease payoff coverage can be purchased at any time

- Gap insurance is more common than loan/lease payoff coverage

Gap insurance covers the difference between the value of your auto loan and the value of your car

Gap insurance is an optional, additional form of auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the value of your auto loan and the value of your car. This is important because most car insurance policies reimburse you based on the actual cash value (ACV) of your car, rather than the amount you owe on your loan. This means you could be left with a bill for the difference.

For example, if you owe $25,000 on your loan and your car is only worth $20,000, gap insurance will cover the $5,000 gap, minus your deductible.

Gap insurance is particularly useful if you have a valuable new vehicle that is either financed or leased. It is also a good idea if you have made a small down payment (less than 20%), are financing over a longer period (more than two years), or have bought a vehicle that depreciates quickly.

Gap insurance must be purchased within a short time frame, usually within 30 days of buying your new vehicle. It is also only available for vehicles that have never been titled before.

Loan/lease payoff coverage is similar to gap insurance but more flexible, as it can be purchased at any time. However, the payout is limited to a percentage of the car's ACV. For instance, if your vehicle has an ACV of $20,000, the maximum the loan/lease payoff coverage will pay is $5,000.

Vehicle Years: Insurance's Age Mystery

You may want to see also

Loan/lease payoff coverage is limited to a percentage of the car's ACV

Loan/lease payoff coverage is an optional auto insurance coverage that can be purchased at any time, unlike gap insurance which has to be purchased within a very short time frame. It is beneficial if your car is stolen or totaled and you owe more than its actual cash value (ACV). While gap insurance covers the entire difference between what you owe on a vehicle and the ACV, loan/lease payoff coverage is limited to a percentage of the car's ACV, typically 25% in most states. This means that if your vehicle has an ACV of $20,000, the maximum payout from loan/lease payoff coverage will be $5,000.

The limited payout from loan/lease payoff coverage could result in out-of-pocket expenses in the event of a total loss. For example, if you owe $14,000 on your loan and your vehicle is totaled, with an ACV of $12,000, collision coverage may pay out $12,000 (minus your deductible), while loan/lease payoff coverage will pay the remaining $2,000. This coverage is beneficial if you are currently making payments on or leasing your vehicle, as it can help offset the remaining amount due on the loan/lease.

It is important to note that loan/lease payoff coverage does not cover deductibles, overdue loan/lease payments, financial penalties, security deposits, the cost of extended warranties or services, or carry-over balances from other loans. Additionally, it may not cover additional charges related to your loan, such as excess mileage fees. Therefore, it is crucial to carefully review the terms and conditions of your loan/lease payoff coverage to understand its limitations and exclusions.

While both gap insurance and loan/lease payoff coverage can help pay off a car loan or lease, they have different requirements and payout limits. Gap insurance typically covers deductibles and pays the difference between the car's ACV and the loan balance, providing a sense of security as it has no limit on the coverage amount. On the other hand, loan/lease payoff coverage is more limited in its payout but offers flexibility in terms of the time frame for purchasing the coverage.

MCA Assessments: Vehicle Insurance Explained

You may want to see also

Gap insurance is optional and not legally required

Gap insurance is particularly useful for those who have financed a vehicle purchase or are leasing a vehicle. In these cases, the gap between the current value of the car and the outstanding loan or lease balance can be significant. Without gap insurance, the driver would be responsible for paying off the remaining loan or lease balance in the event of a total loss or theft of the vehicle.

While gap insurance is not mandatory, some lenders or leasing companies may require it to protect their financial interests. Additionally, gap insurance can provide peace of mind and financial protection for drivers concerned about covering the gap between the insured value of their vehicle and the outstanding loan or lease balance.

It is important to note that gap insurance has a narrow window for acquisition and is typically only available for purchase within a short time frame after buying a new vehicle. It is also important to compare the cost of gap insurance from different providers, as prices can vary significantly.

Calculating Two-Wheeler Insurance Premiums

You may want to see also

Loan/lease payoff coverage can be purchased at any time

Loan/lease payoff coverage is a form of gap insurance that can be purchased at any time. It differs from gap insurance in the amount it pays out. While gap insurance typically covers the full amount between what you owe and what your vehicle is worth, loan/lease payoff coverage usually pays up to 25% of your car's actual cash value (ACV). This means that in some cases, you may have to pay out of pocket to cover the remaining balance of your loan.

The flexibility of loan/lease payoff coverage is beneficial if you don't want to be restricted by a narrow window for acquiring coverage. With gap insurance, there is usually a very short time frame, often within 30 days of purchasing your vehicle, to acquire this type of insurance. Additionally, gap insurance is only available for new vehicles that have never been titled before. On the other hand, loan/lease payoff coverage can be added to your policy at any time, providing you with the convenience of choosing this option even months after your initial purchase.

When considering loan/lease payoff coverage, it's important to evaluate your financial situation and the value of your vehicle. If you owe more on your loan than your car is worth, loan/lease payoff coverage can be a valuable addition to your policy. It's worth noting that this type of coverage usually requires you to have existing full coverage or comprehensive and collision coverage on your vehicle.

Loan/lease payoff coverage provides peace of mind in the event that your vehicle is stolen or declared a total loss. It helps bridge the gap between your vehicle's current value and what you owe on your loan or lease, ensuring that you don't have to bear the entire financial burden alone.

In summary, loan/lease payoff coverage offers flexibility in terms of purchase timing and can be a valuable option for vehicle owners who want protection against financial shortfalls in the event of a total loss or theft of their vehicle.

Insurance: A Prerequisite for Vehicle Registration?

You may want to see also

Gap insurance is more common than loan/lease payoff coverage

Gap insurance covers the difference between the amount you owe on your car loan and the actual cash value (ACV) of your vehicle. It is an optional form of auto insurance that applies if your car is stolen or deemed a total loss. It is particularly useful if you have a valuable new vehicle that is either financed or leased.

Loan/lease payoff coverage is another form of gap coverage, but it usually only pays up to 25% of the ACV of your vehicle. This type of coverage is more flexible than gap insurance as it can be purchased at any time, whereas gap insurance must be purchased within 30 days of buying your vehicle.

Both types of coverage are fairly inexpensive since the risk for the insurance company is low. However, gap insurance provides more comprehensive coverage and is therefore the more common choice.

Michigan's Insured Vehicles: How Many?

You may want to see also

Frequently asked questions

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. It covers the difference between the amount an insurance company will pay you for your car and the amount you might owe to a lender or dealership.

Loan lease payoff coverage is another form of gap coverage. However, it usually pays up to 25% of your car's actual cash value, whereas gap insurance will often pay the full amount between what you owe and what your vehicle is worth.

No, they are not the same. While both can help pay off a car loan or lease, they may have different requirements and payout limits.

Gap insurance might be a good option if you have a financed or leased car, made a small down payment, are financing your vehicle long-term, or have bought a vehicle that depreciates quickly.

You can get gap insurance through your insurance company, the dealership, or your lender.