Michigan has one of the highest auto insurance costs in the US, with an average of $2,639 per year, which is 73% higher than the national average. The state's new auto insurance law has resulted in lower costs and more options for Michigan drivers, but it is still difficult to find cheap insurance in the state. The high costs are due to several factors, including the high number of uninsured drivers, insurance fraud claims, and the unlimited PIP coverage required for minimum coverage.

| Characteristics | Values |

|---|---|

| Average cost of car insurance | $2,639 per year in 2021 |

| % higher than the national average | 73% |

| % higher than the US average | 73% |

| Average auto policy cost | $3,096 |

| Average auto policy cost in Detroit | $6,280 |

| Minimum coverage | Bodily Injury $50,000 per person; Bodily Injury $100,000 per accident; Property Damage $10,000 per accident; Personal Injury Protection: $50,000 (lowest option available for Medicaid recipients) or opt-out (available for those with qualifying health care plans); Property Protection Insurance: $1,000,000 per accident |

| Optional coverage | Limited Property Damage; Rental Car Reimbursement; Uninsured/Underinsured Motorist Bodily Injury |

| Comprehensive policy with $1,000 deductible | $2,385 |

| Comprehensive policy with $500 deductible | $2,750 |

What You'll Learn

Michigan's auto insurance law changes

Michigan previously had the highest auto insurance benefits and costs in the country. Mandatory unlimited Personal Injury Protection (PIP) medical benefits proved too expensive for many Michigan families, with some drivers who could not afford the costly unlimited coverage choosing to drive uninsured. The new law gives drivers a choice to reduce their premiums for the medical portion of PIP by relying on their own health insurance for their medical bills.

The new law also established several consumer protections, including the elimination of some non-driving factors that insurance companies can use to set rates, the creation of a Fraud Investigation Unit, and increased transparency requirements for the Michigan Catastrophic Claims Association (MCCA).

In addition, the new law implemented several cost reduction measures, including allowing drivers to choose their PIP medical coverage limit and requiring insurance companies to reduce PIP statewide average medical premiums.

The auto insurance law changes in Michigan have resulted in lower costs and more choices for drivers, making it a great time for Michiganders to shop for auto insurance.

When is a Car Considered Totaled?

You may want to see also

Average cost of car insurance in Michigan

The average cost of car insurance in Michigan varies depending on the level of coverage and the driver's age, driving record, and vehicle type.

Average Cost of Minimum Coverage in Michigan

The average annual cost of minimum or liability-only car insurance coverage in Michigan ranges from $907 to $1,360, while the average monthly cost ranges from $76 to $113. These rates are significantly higher than the national average, exceeding it by up to 117%.

Average Cost of Full Coverage in Michigan

The average annual cost of full coverage in Michigan is reported to be $1,773 or $2,947, while the average monthly cost is $148 or $246. These rates are also higher than the national average, exceeding it by up to 81%.

Factors Affecting Car Insurance Costs in Michigan

In Michigan, car insurance rates are influenced by factors such as the driver's age, driving record, and the type of vehicle being insured. For example, young drivers pay higher rates, with 16-year-olds paying an average of $12,921 per year for full coverage. Additionally, drivers with a speeding ticket, accident, or DUI on their record can expect to pay significantly more for insurance. The type of vehicle also impacts rates, with a BMW 330i costing 43% more to insure than a Ford F-150.

It's worth noting that Michigan law prohibits insurance companies from using certain factors, such as location, gender, marital status, and credit score, to set car insurance premiums.

Insurance Write-Offs: What Happens When Your Car Is Totaled

You may want to see also

Required car insurance coverage in Michigan

Michigan has specific requirements for car insurance coverage, and it's important for drivers in the state to understand what is needed to comply with the law and ensure they are adequately protected. Here is an overview of the required car insurance coverage in Michigan:

No-Fault Insurance

Michigan operates as a no-fault state, which means that drivers are required to carry no-fault insurance to cover injuries and damages resulting from an accident, regardless of who is at fault. This type of insurance provides reimbursement for medical expenses, wage losses, and funeral costs if needed. While it covers these personal injury and property damage expenses, it does not cover any damage to your own car.

Personal Injury Protection (PIP)

PIP is a mandatory component of car insurance in Michigan and provides what are known as "No-Fault PIP Benefits." This coverage reimburses a portion of wage loss, medical expenses, and essential services incurred as a result of an accident. It also includes attendant care, such as in-home nursing services, and replacement services for help with household duties. The state of Michigan requires unlimited PIP coverage.

Property Protection Insurance (PPI)

PPI is another essential aspect of car insurance in Michigan. This coverage is specifically for damage caused to "tangible property" within the state. It includes damage to parked cars, buildings, fences, trees, and lawns. Every auto policy in Michigan must include a mandatory minimum of $1 million in PPI coverage.

Bodily Injury Liability (BI)

Bodily Injury Liability coverage is necessary to protect yourself in the event that you cause an accident resulting in injuries to another person. The minimum requirements for BI coverage in Michigan are $50,000 per person and $100,000 per accident. However, it is recommended to consider higher coverage limits, such as $250,000 per person and $500,000 per accident, for more comprehensive protection.

Property Damage (PD)

Property Damage coverage is crucial for protecting yourself financially if you cause damage to another person's vehicle outside of Michigan. While the minimum requirement is $10,000 of PD coverage, it is advisable to opt for higher coverage, such as $100,000, to ensure sufficient protection. This is especially important when travelling to tort states, where you would be responsible for the other driver's car damage in an accident.

Minimum Coverage Requirements

To summarise, the minimum amounts of car insurance coverage required in Michigan are as follows:

- $50,000 for bodily injury liability per person.

- $100,000 for bodily injury liability per accident.

- $10,000 for property damage liability per accident.

- Unlimited personal injury protection (PIP) per person.

It's important to note that Michigan's insurance premiums are influenced by the state's no-fault system, which prioritises coverage for injuries and property damage, regardless of fault, up to the coverage limit.

Insuring Rare Vehicles: Payout Process

You may want to see also

Michigan's most and least expensive cities for car insurance

Michigans Most and Least Expensive Cities for Car Insurance

Most Expensive Cities for Car Insurance in Michigan

Although Michigan has banned the use of information not directly related to your driving history as factors for calculating your car insurance premium, there are still geographic factors that may affect the cost of coverage, like the price of vehicle repairs and medical care in your state, as well as the statistical likelihood of accidents, theft and vandalism.

The following cities have the highest average annual rates for car insurance in Michigan:

- Detroit

- Dearborn

- Flint

- Warren

- Sterling Heights

Least Expensive Cities for Car Insurance in Michigan

The following cities have the lowest average annual rates for car insurance in Michigan:

- Traverse City

- Marquette

- Alpena

- Sault Ste. Marie

- Houghton

Maryland: No-Fault or At-Fault Insurance?

You may want to see also

Michigan's car insurance premiums by rating factor

Michigan's auto insurance law requires drivers to carry personal injury protection (PIP), property protection insurance (PPI), and residual bodily injury and property damage liability (BI/PD) coverage on every vehicle they use. The state is a no-fault state, which means that PIP coverage pays for financial losses regardless of who is at fault in an accident.

The average cost of car insurance in Michigan varies depending on the level of coverage, driver age, driving record, vehicle type, and other factors. Here is a breakdown of how these rating factors affect car insurance premiums in Michigan:

Age

Age is a significant rating factor, especially for young and teen drivers, who pay the highest rates among all age groups. The insurance premiums for 16-year-old drivers are approximately 41% more expensive than the national average. Age becomes less important at 20 and even less impactful at 25. Premiums reach their lowest point when drivers are in their mid-50s and then rise again for older drivers aged 70 and above.

Driving Record

A driver's history is a critical factor in determining insurance rates. A history of tickets, violations, accidents, or DUIs will increase insurance premiums. For example, drivers with one speeding ticket may pay up to 123% more than the national average, and those with an at-fault accident on their record may pay about 46% more than the state average for full coverage.

Vehicle Type

The type of vehicle insured also impacts insurance rates. For instance, drivers of a BMW 330i may pay 43% more for insurance per year than someone driving a Ford F-150.

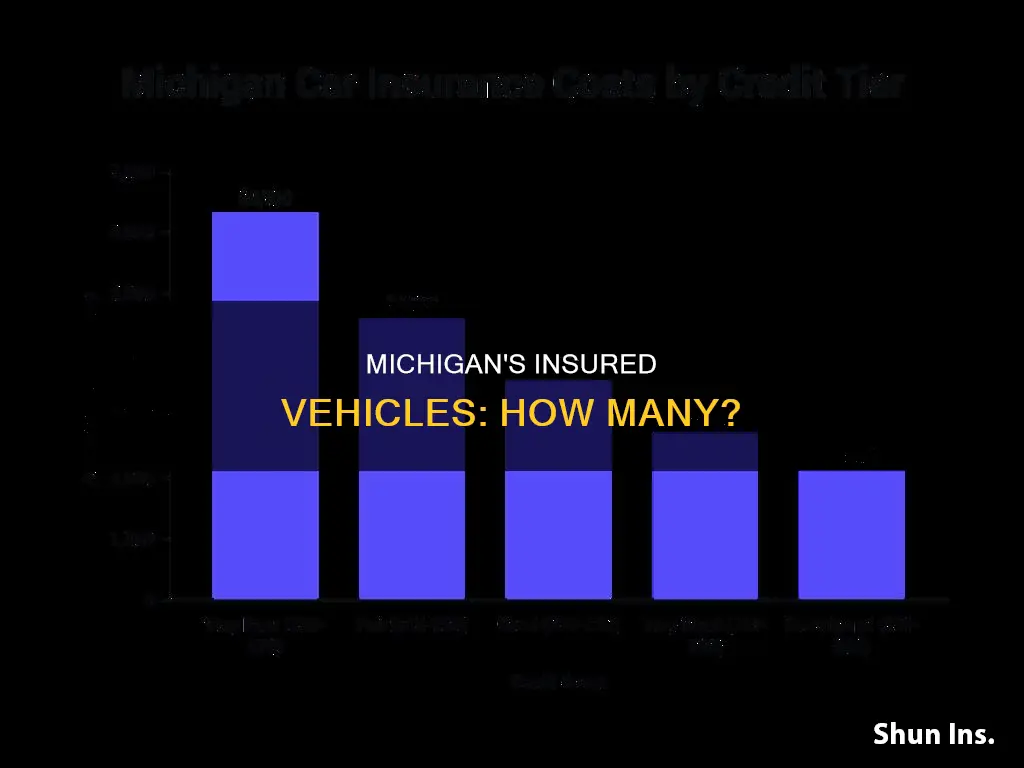

Credit History

Credit history is a significant but often overlooked rating factor. Drivers with poor credit tend to file more expensive claims than those with good credit. The difference in car insurance rates between drivers with the lowest and highest credit levels can be over $1,500 annually.

Years of Driving Experience

The more experience a driver has, the lower the insurance rates are likely to be. This is because experienced drivers are less likely to make mistakes that lead to violations and claims.

Location

Location affects insurance rates on both a state and ZIP code level. Michigan, as a no-fault state, already has higher insurance rates than neighbouring states like Ohio. Within Michigan, insurance rates may vary depending on whether someone lives in a large city with heavy traffic or an area with less traffic and fewer accidents.

Gender

Gender primarily impacts insurance rates for young drivers. Male teen drivers pay more than their female counterparts because insurance companies consider them more likely to take risks.

Insurance History

Insurance companies view a lack of continuous coverage as an indicator of higher risk. Drivers who were licensed but did not have insurance may have been driving uninsured, which increases their risk profile.

Annual Mileage

The number of miles driven per year can affect insurance premiums, especially in states like California. In general, those who drive fewer miles per year may qualify for lower rates.

Marital Status

Marital status has a minor effect on auto insurance rates. Married drivers often share driving duties, resulting in fewer individual claims.

Claims History

Insurance companies view a long claims history as a red flag, and rates will increase if the insurance company has paid out multiple claims.

Level of Coverage

The more coverage a driver carries, the higher the insurance premiums will be. Adding collision and comprehensive coverage to a policy will increase the cost.

Vehicle Ownership Status

Insurance rates can vary depending on whether a vehicle is owned, leased, or financed.

Discount Options

Various discounts may be available depending on the insurance company and location. Common discounts include those for anti-theft devices, bundling policies, good driving records, being a good student, owning a green vehicle, and low mileage.

Choice of Insurance Company

The choice of insurance company is a significant factor in determining auto insurance costs. Rates can vary substantially between companies, so it is essential to compare quotes from multiple providers.

Insurance Inspections: In-Person or Virtual?

You may want to see also

Frequently asked questions

There are 5.8 million insured vehicles in Michigan.

The average cost of car insurance in Michigan is $2,639 per year, 73% higher than the national average.

The cheapest car insurance in Michigan is GEICO, at $1,061 per year.

In Michigan, it is illegal to drive without insurance. Drivers are required to have bodily injury, property damage, uninsured motorist bodily injury, property protection, and personal injury protection.

Detroit has the most expensive car insurance in Michigan, with an average cost of $6,280 per year.