If your rare vehicle is damaged beyond repair, your insurance company will offer a payout based on its actual cash value (ACV) as outlined in your policy. This value is determined by factors such as the make, model, mileage, and condition of the vehicle. If you own your car outright, you can choose whether or not to use the payout from your insurance company on repairs. However, if your vehicle is deemed a total loss, your insurance company will likely require possession of the car as a condition of its payout.

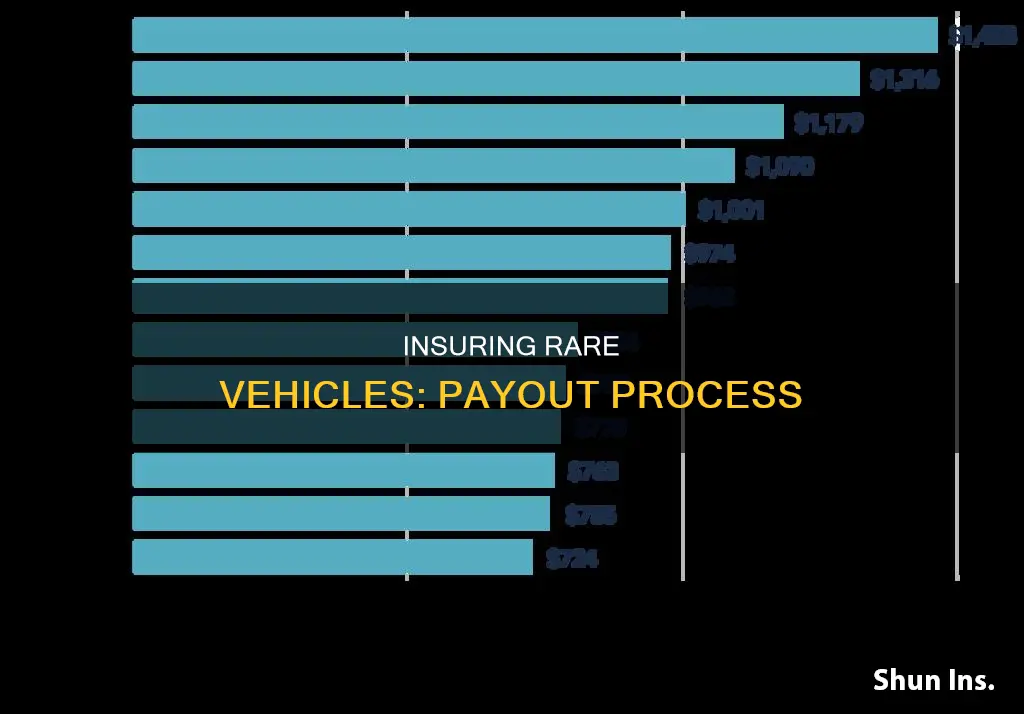

| Characteristics | Values |

|---|---|

| Payout calculation | Actual Cash Value (ACV) – Repair Costs + Salvage Value |

| Factors determining ACV | Vehicle type, customization, kilometers, condition, sale price |

| Total loss | Repairs that exceed the total vehicle value, structural damage that is not fixable, repair cost greater than current value |

| At-fault accident payout | Collision insurance covers the cost for replacement minus the deductible |

| Not-at-fault accident payout | Direct compensation for property damage (DCPD) based on the current market value |

| Claim process | File accident claim, repair estimate, calculate automobile value, write-off determination, settlement, replacement |

| Investigation | Contacting the police, reviewing policy coverage, potentially inspecting the scene |

| Stolen vehicle | Recovered or declared a total loss |

| Total loss payout | Based on ACV as outlined in the policy |

| Negotiation | Understand the claims process, don't immediately accept the first offer, do your own research, get advice, speak with claims representative |

| Agreed value coverage | Insurer agrees or guarantees the value of the car |

What You'll Learn

- Rare vehicles are reimbursed based on their current value, not replacement cost

- Specialty insurance companies deal with rare cars but the car won't be replaced

- The payout amount depends on whether the accident was your fault or not

- The payout amount is based on the vehicle's actual cash value, minus deductible

- You can negotiate with your insurance company if you disagree with the total loss settlement

Rare vehicles are reimbursed based on their current value, not replacement cost

When it comes to insurance payouts for rare vehicles, it's important to understand that reimbursement is typically based on the current value of the vehicle rather than the replacement cost. This means that insurance companies will aim to repay you the value of your rare vehicle at the time of the accident, taking into account factors such as make, model, mileage, condition, and current market prices for similar vehicles. This process can be complex and may involve negotiations between you and the insurance company to arrive at a final settlement amount.

In the event of a total loss, where the damage to your rare vehicle exceeds its value or it is deemed unsafe to repair, the insurance company will determine its actual cash value (ACV). This calculation considers factors such as the vehicle's make, model, year, customisations, mileage, condition, and comparable sale prices in your local market. The ACV represents the resale price of your vehicle before the accident and forms the basis for the insurance payout.

It's worth noting that rarity can influence the market value of a vehicle. The fewer cars of a particular model were produced, the more expensive each surviving one can become over time. This increased market value due to rarity is reflected in the insurance payout, ensuring you receive a fair amount for your rare vehicle.

To ensure a smooth process, it's recommended to have rare vehicles appraised and insured through specialty insurance companies that deal with classic or collector cars. These companies offer "Agreed Value" or "Guaranteed Value" policies, where the value of the vehicle is agreed upon before purchasing the policy. This provides clarity and peace of mind in the event of a total loss, as you are guaranteed to receive the full insured amount without depreciation.

While insurance companies are not obligated to replace your rare vehicle, they will reimburse you for its current value, taking into account any applicable deductibles and salvage value. This reimbursement allows you to use the settlement money to purchase a replacement vehicle, although finding an exact replacement for a rare model may be challenging.

Vehicle Insurance: Am I Covered?

You may want to see also

Specialty insurance companies deal with rare cars but the car won't be replaced

Specialty insurance companies that deal with rare cars exist, but it's important to note that they won't replace your vehicle if it's deemed a total loss. Instead, they offer tailored coverage designed for classic cars, including agreed value, spare parts coverage, inflation guard, and no annual mileage limits.

Agreed value coverage is a common feature of classic car insurance policies. This means that the insurance company agrees to or guarantees the value of your car before any potential total loss incident occurs. In the event of a total loss, you will receive the agreed-upon value, ensuring you get the full value of your rare vehicle.

Some specialty insurance companies also offer flexible mileage plans, including unlimited mileage options, perfect for collectors who drive their classic cars often. Additionally, these companies may provide coverage for restoration cars at any stage of the project, higher-than-average spare parts coverage, and no fixed mileage limits.

It's worth noting that classic car insurance is generally cheaper than standard car insurance due to lower risks. Classic cars are typically garaged, reducing the risk of theft or damage. They are also less likely to be involved in accidents since they are not used as daily drivers.

When choosing a specialty insurance company for your rare vehicle, consider factors such as coverage options, deductibles, mileage restrictions, and additional perks like spare parts coverage. It's also essential to shop around and compare quotes from multiple companies to find the best rates and coverage options that suit your specific needs.

Insuring a Salvage Vehicle: What You Need to Know

You may want to see also

The payout amount depends on whether the accident was your fault or not

The payout amount depends on several factors, including the type of insurance coverage you have, the severity of the accident, and whether or not you are at fault. If you are found to be at fault for the accident, your claim will typically fall under your collision insurance coverage. In this case, your insurance company will pay for the replacement or repair of your vehicle, depending on the extent of the damage. The payout will be based on the current market value of your vehicle, minus your deductible. It's important to note that being at fault will likely result in an increase in your insurance rates.

On the other hand, if you are not at fault for the accident, the claim will fall under direct compensation property damage (DCPD). In this case, you will receive a cash settlement based on the current market value of your vehicle. The at-fault driver's insurance company will be responsible for covering your expenses, including vehicle repairs or replacement, medical bills, lost wages, and other damages such as pain and suffering. It is important to gather evidence at the scene of the accident, such as witness statements, photos of the damage, and a police report, to support your claim.

Electric Cars: Cheaper Insurance?

You may want to see also

The payout amount is based on the vehicle's actual cash value, minus deductible

When a vehicle is damaged beyond repair, it is considered a total loss. In this case, the payout amount is based on the vehicle's actual cash value (ACV), minus the deductible. The ACV is the current market value of the vehicle, minus depreciation. Depreciation is the loss of value since the vehicle was purchased and is determined based on multiple factors, including mileage, wear and tear, accident history, and the vehicle's make, model, and year. Some insurers also consider the cost of comparable vehicles for sale in the owner's area.

If the owner of the vehicle disagrees with the insurer's valuation, they may be able to negotiate a higher payout or dispute the claim. It is recommended that the owner research the value of their vehicle using online pricing guides, such as Kelley Blue Book, Edmunds, or the National Auto Dealers Association. They can also compare similar vehicles for sale online and look at selling prices for similar models. If the owner wants to dispute the claim, they will need to provide evidence that their vehicle is worth more than the insurer's valuation. This could include maintenance records or an appraisal from a licensed appraiser.

It is important to note that the payout amount may not be enough to replace the vehicle with a comparable alternative, especially if the vehicle is rare or collectible. In this case, the owner may want to consider specialty insurance or collector car insurance, which offers agreed value coverage. With agreed value coverage, the owner and the insurance company agree on the vehicle's value before purchasing the policy. This ensures that the owner will receive the agreed-upon amount in the event of a total loss, rather than the vehicle's ACV.

Vehicle Tracking: Lower Insurance Rates?

You may want to see also

You can negotiate with your insurance company if you disagree with the total loss settlement

If you disagree with the total loss settlement offered by your insurance company, you can negotiate with them to reach a higher payout. Here are some steps you can take to effectively negotiate a settlement:

- Understand the total loss claims process: Familiarize yourself with how insurance companies determine settlement amounts. This will help you assess if their offer is fair and guide your negotiation strategy.

- Don't immediately accept the first offer: You have the right to dispute the initial settlement offer if you believe it is too low. Remember that insurance companies are profit-oriented and may undervalue your vehicle.

- Conduct independent research: Determine the actual cash value (ACV) of your vehicle by considering factors such as its year of manufacturing, the value of similar vehicles online, and using valuation tools like Kelley Blue Book (KBB) and Edmunds. This research will provide you with a baseline for negotiation.

- Get a written estimate: Obtain a written estimate from a qualified mechanic or body shop to support your claim that your vehicle is worth more than the insurance company's appraisal.

- Use online tools and comparable vehicles: Take advantage of online valuation tools and consider the value of similar vehicles in your area with the same year, make, and model. These steps will provide additional evidence to strengthen your case for a higher settlement.

- Request a Certified Collateral Corporation (CCC) report: Ask for a CCC report from the insurance adjuster, which details your vehicle's features and trim level. Review this report for accuracy and ensure all relevant information is included.

- Negotiate with the claims adjuster: Present your research, evidence, and counteroffer to the claims adjuster. Be firm on points where their valuation seems off, and provide supporting documentation.

- Consider hiring an attorney or public adjuster: If negotiations with the adjuster are unsuccessful, you may want to seek legal assistance. An attorney or a public adjuster (who works for you, not the insurance company) can help negotiate on your behalf and guide you through the process. Keep in mind that hiring an attorney or public adjuster may incur additional fees.

- Obtain a written settlement agreement: Once you and the insurance company reach a new settlement, confirm the terms in writing to ensure a clear understanding and agreement between both parties.

Remember that you have the right to dispute a total loss settlement and seek a higher payout. By conducting thorough research, presenting compelling evidence, and effectively negotiating, you can increase your chances of obtaining a fair settlement for your rare vehicle.

Leasing a Car: Insurance Requirements

You may want to see also

Frequently asked questions

If your rare vehicle is written off, you will be paid its current market value, minus your deductible. You will then have to go out and buy something different.

You have the right to seek legal advice and arbitration if you feel the insurance company's payout offer is unfair. You can also negotiate with the insurance company, file a complaint with the relevant regulatory body, or seek legal counsel.

If your rare vehicle is stolen, report the theft to the police immediately and contact your insurance company. They will guide you through the claim filing process. The insurance company will then launch an investigation to determine whether your car can be recovered or if it is a total loss. If it is a total loss, they will offer a payout based on its actual cash value as outlined in your policy.

The payout timeframe typically falls within 30-45 days after the initial claim filing. However, several factors can influence this timeline, such as the complexity of the investigation, the availability of the police report, and whether your car is recovered.

If your rare vehicle is deemed a total loss, your insurance company will take possession of the vehicle as a condition of its payout. You will receive a payout based on the vehicle's actual cash value, minus any deductible and the value the car could be sold for as salvage.