When it comes to auto insurance, the numbers 25/50/10, 25/50/25, 100/300/50, and so on, are often used to represent the different coverage limits included in a policy. The 50 in these sequences denotes the maximum amount of bodily injury liability coverage per accident, which is typically $50,000. This means that if you are at fault in an accident and multiple people are injured, your insurance company will pay up to $50,000 in total for all the injuries sustained.

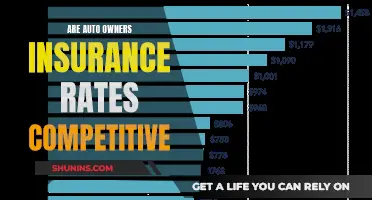

| Characteristics | Values |

|---|---|

| Bodily injury liability per person | $25,000 |

| Bodily injury liability per accident | $50,000 |

| Property damage liability | $10,000 |

What You'll Learn

- $50,000 is the maximum coverage for bodily injury liability for all persons injured in one accident

- This is the second number in a 25/50/10 or 25/50/25 policy

- The first number refers to bodily injury liability per person

- The third number refers to property damage liability

- The numbers represent the maximum amount your insurer pays per liability claim

$50,000 is the maximum coverage for bodily injury liability for all persons injured in one accident

Auto insurance policies often use a series of numbers to represent the monetary limits of your liability coverage. For example, a policy might be listed as 25/50/10, where the first number refers to the maximum coverage for bodily injury liability for one person, the second number refers to the maximum coverage for bodily injury liability for all persons injured in one accident, and the third number refers to the maximum coverage for property damage liability.

In the context of auto insurance, "$50,000 is the maximum coverage for bodily injury liability for all persons injured in one accident". This means that if you are at fault in an accident and multiple people are injured, your insurance company will pay up to a maximum of $50,000 total for all of their medical expenses combined. This per-accident limit is important because it sets a cap on how much your insurance company will pay out for all injuries resulting from a single accident, regardless of how many people are involved.

For example, let's say you have a policy with a 25/50/10 liability coverage limit. If you injure three people in an accident, your insurance company will pay up to $50,000 total for all of their medical expenses combined, with a maximum of $25,000 per person. So, if each person's medical expenses amount to $20,000, your insurance company will pay $25,000 to each of the first two people, and $10,000 to the third person, for a total of $60,000. In this case, you would be responsible for paying the remaining $10,000 out of pocket since the per-accident limit was exceeded.

It's important to note that these liability limits only apply if you are found to be at fault in an accident. Additionally, liability coverage does not cover your own medical expenses or damage to your own vehicle; it is meant to cover the expenses of other people involved in the accident.

Teenage Auto Insurance in Massachusetts: What's the Cost?

You may want to see also

This is the second number in a 25/50/10 or 25/50/25 policy

The second number in a 25/50/10 or 25/50/25 policy refers to the maximum amount of money your insurance company will pay out for bodily injury liability per accident. In other words, it is the total coverage for all people injured in a single accident.

In a 25/50/10 policy, the second number, 50, means that your insurance company will pay up to $50,000 for all people injured in a single accident. This means that if you hit someone else on the highway and injure three people, your insurance company will only pay up to $50,000 toward their total medical bills, with a limit of up to $25,000 per person.

In a 25/50/25 policy, the second number, 50, represents the most money your auto insurance policy will pay out in the event of an auto accident where you are at fault. For example, if you are at fault in an auto accident that causes injury to two people or ten people, $50,000 is the most your carrier will provide. A 25/50/25 policy would cover two people's injuries up to $25,000 each, without exceeding the $50,000 limit. The same policy would cover five people's injuries as long as the total was less than $50,000 and no individual required more than $25,000.

Massachusetts' Unique Auto Insurance Law: No Mandatory Coverage

You may want to see also

The first number refers to bodily injury liability per person

The first number in a series of three numbers (e.g., 25/50/10) on your auto insurance policy refers to the maximum amount of bodily injury liability coverage per person that your insurer will pay if you are at fault in an accident. For example, if the first number is 25, your insurer will pay a maximum of $25,000 for bodily injury liability for one person injured in one accident or incident.

Bodily injury liability coverage is a portion of your liability car insurance. It helps with the injury-related costs that other people incur as a result of an accident for which you are responsible. In other words, its purpose is to reimburse people in other vehicles involved in the crash who were harmed, not the driver who caused the accident.

Bodily injury liability insurance covers a range of costs associated with car accident injuries that you (or someone who was driving your car) cause to others. This includes many kinds of medical costs for other people involved in an accident you cause, such as emergency care, ongoing medical care, and hospital fees. If someone who is injured in the accident sues you, this liability insurance will cover your legal defence fees, court costs, judgments, and settlements, up to your policy limits. In cases where a person is injured in an accident you caused and they miss work because of it, bodily injury liability insurance can cover the income they lose as a direct result of the accident. If the accident results in the fatality of another driver or one of their passengers, liability insurance can pay for funeral costs.

While state-minimum coverage is available, with rising medical care and vehicle repair costs, minimum limits are typically too low for most drivers. It is recommended that drivers carry a minimum of 100/300/100 liability coverage to pay for any serious damage in an at-fault accident.

New York Auto Insurance: Understanding the Empire State's Regulations

You may want to see also

The third number refers to property damage liability

The third number in a set of auto insurance coverage figures refers to property damage liability. This is the maximum amount that an insurance company will pay for property damage liability in an accident caused by the insured party. For example, in a 25/50/10 policy, the third number, 10, stands for $10,000, which is the maximum coverage for property damage liability. This includes repairs to the other driver's vehicle, a rental vehicle while the other person's car is being repaired, damage to buildings, fences, or other structures, and damage to personal property, such as electronics or belongings inside a vehicle. It also covers legal fees if the insured party is sued for property damage.

Property damage liability insurance covers the costs of damages to someone else's vehicle and personal property resulting from an accident caused by the insured party. So, it helps pay for vehicle, building, or other property repairs or replacements. If the costs of repairs or replacements exceed the limit of the policy, the insured party must pay the difference.

It is important to note that liability coverage limits can be customized to fit an individual's needs and that the required limits vary by state. While each state requires a minimum coverage amount for property damage liability, drivers can choose to purchase additional coverage. It is recommended that individuals buy as much car insurance as they can afford to protect themselves financially in the event of an accident.

State Farm Auto Insurance: The Credit Score Conundrum

You may want to see also

The numbers represent the maximum amount your insurer pays per liability claim

The numbers on your car insurance policy, such as 25/50/10 or 100/300/50, refer to the maximum amount your insurer will pay per liability claim. These numbers represent the monetary limits of your liability coverage.

In a 25/50/10 policy, for example, the first number, 25, stands for $25,000, which is the maximum coverage for bodily injury liability for one person injured in one accident. The second number, 50, stands for $50,000, which is the maximum coverage for bodily injury liability for all persons injured in a single accident. The third number, 10, stands for $10,000, which is the maximum coverage for property damage liability in an accident.

Liability insurance covers damage you cause to another person or their property in an at-fault accident. It includes bodily injury liability and property damage liability. Bodily injury liability covers another person's medical costs if you cause an accident that injures them. Property damage liability insurance, on the other hand, covers the costs of damages to someone else's vehicle and personal property resulting from an accident you cause.

It is important to choose the right liability limits for your car insurance. While state-minimum coverage may seem sufficient, rising medical care and vehicle repair costs mean that minimum limits are typically too low. You should consider your budget, state-minimum coverage limits, and your financial risk when choosing your liability limits.

Additionally, it is recommended to purchase as much liability insurance as you can afford to protect your finances in case of a severe accident. If the cost of a bodily injury or property damage liability claim exceeds your policy limits, you may be left personally responsible for covering the remaining amount.

USSSA and Auto Insurance: Shore Veterans' Unique Needs

You may want to see also

Frequently asked questions

In a set of numbers like 25/50/10, 50 is the maximum amount ($50,000) that your insurer will pay for bodily injuries per accident.

Using the same example, the first number, 25, means your insurer will pay up to $25,000 for bodily injuries per person.

The third number, 10 in this case, means your insurer will pay up to $10,000 for property damage per accident.