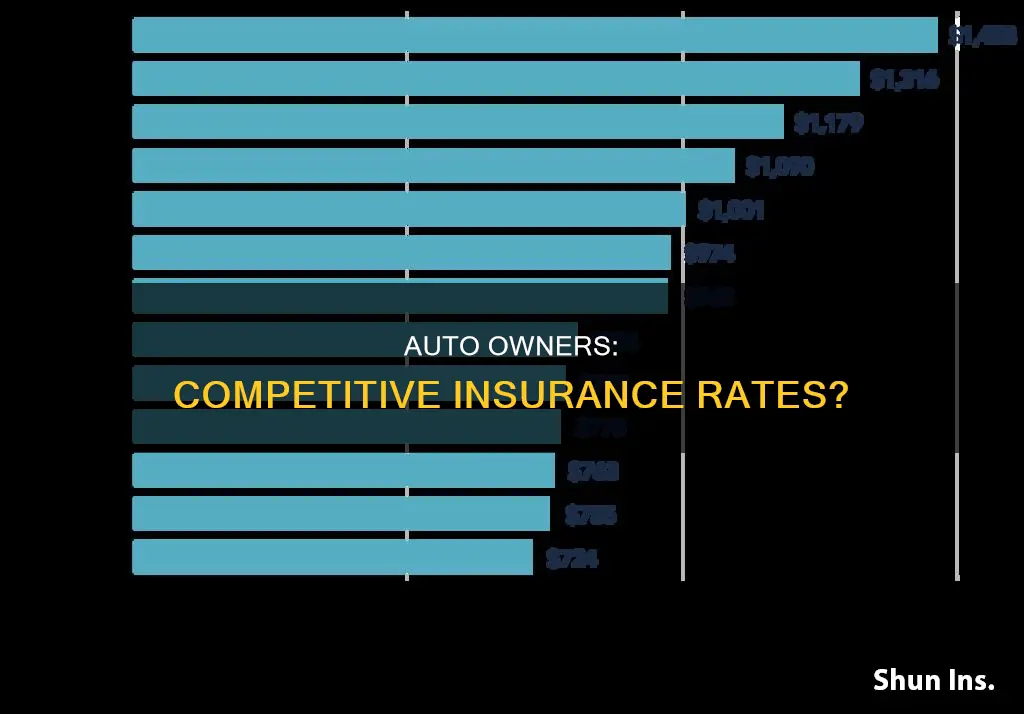

Auto-Owners Insurance offers competitive rates for car insurance, with average annual premiums for full coverage costing $1,619 and minimum coverage costing $358. As a regional provider, Auto-Owners offers standard car insurance policies and an array of add-on options for drivers. The company has high ratings from consumer studies and review sites like the Better Business Bureau and Google.

What You'll Learn

Auto-Owners' insurance rates compared to other providers

Auto-Owners Insurance is a regional provider, offering standard car insurance policies and an array of add-on options for drivers. Its rates are generally below the industry average, making it a competitive option for drivers.

According to Bankrate, the average cost of car insurance in the US is $2,278 per year for full coverage and $621 per year for minimum coverage. In comparison, Auto-Owners offers an average annual premium of $1,696 for full coverage and $440 for minimum coverage.

Auto-Owners also has lower-than-average customer complaints and offers various discounts and customization options. However, it lacks robust digital tools and has a lower-than-average J.D. Power customer satisfaction score.

MarketWatch also reports that Auto-Owners Insurance has competitive rates, with an average annual premium of $1,619 for full coverage and $358 for minimum coverage.

Compared to other top car insurance companies, Auto-Owners has lower rates for senior drivers but higher rates for drivers with poor credit or teens on their parent's policy.

| Insurance Provider | Average Annual Cost |

|---|---|

| Auto-Owners | $1,619 |

| Statewide Average | $1,687 |

| Nationwide | $1,361 |

| State Farm | $1,732 |

| Geico | $1,458 |

| Erie | $1,458 |

| Progressive | $1,624 |

| USAA | $1,200 |

In summary, Auto-Owners Insurance offers competitive rates, especially for senior drivers. However, it may not be the most affordable option for all driver profiles, and its digital tools and customer satisfaction scores are areas that could be improved.

Direct Auto Insurance: Full Coverage?

You may want to see also

Pros and cons of Auto-Owners' insurance

Auto-Owners Insurance is a good option for drivers looking for highly customizable coverage and plenty of discount options. The company has an excellent standing in customer service and award-winning claims services. However, it is only available in 26 states, and its digital tools are limited. Here is a more detailed look at the pros and cons of Auto-Owners Insurance:

Pros:

- Robust endorsement offerings: Auto-Owners offers standard auto insurance coverage types as well as several endorsement options, such as road trouble service, additional expense coverage, loan/lease gap, and diminished value coverage.

- Local agents available: Auto-Owners operates through a network of local licensed agents, providing personalized customer service.

- Financial stability: Auto-Owners has an excellent financial standing, demonstrating its ability to stay in operation during various economic fluctuations. It has an A++ (Superior) financial strength rating from AM Best.

- Affordable premiums: Auto-Owners offers affordable insurance premiums, with an average annual premium for full coverage that is 36% lower than the national average.

- Discounts: Auto-Owners offers various discounts, including paperless statements, paying bills online, good student discounts, and paid-in-full discounts.

- Customer satisfaction: Customers are generally satisfied with Auto-Owners' service and claims handling.

Cons:

- Limited availability: Auto-Owners Insurance is only available in 26 states, so it may not be an option for everyone.

- Limited digital tools: Auto-Owners lacks robust digital tools, so it may not be the best choice for those who prefer to manage their policies completely online.

- Lower-than-average J.D. Power scores: Auto-Owners has lower-than-average J.D. Power customer satisfaction and claims satisfaction scores in most regions.

Allstate's Salvage Vehicle Insurance

You may want to see also

Auto-Owners' insurance quotes by age

Auto-Owners Insurance offers highly customizable coverage and plenty of discount options. The company operates in 26 states and provides insurance through a network of independent agents.

Auto-Owners Insurance offers standard auto insurance coverage types as well as several endorsement options. To personalize your coverage, you can choose additional protections, such as road trouble service, additional expense coverage, loan/lease gap, and diminished value coverage.

Auto-Owners Insurance quotes vary depending on the age of the driver and whether they are on their parents' policy or their own. Here are some average costs for drivers with clean driving records across several ages:

Average cost of car insurance for drivers on their parents' policy

| Insurance Company | Average Full Coverage Premium | National Full Coverage Premium |

|---|---|---|

| Auto-Owners | $1,103 | $2,278 |

Average cost of car insurance for drivers on their own policy

| Insurance Company | Average Full Coverage Premium | National Full Coverage Premium |

|---|---|---|

| Auto-Owners | $1,361 | $2,278 |

It's important to note that Auto-Owners Insurance quotes may vary depending on various factors, including the driver's age, driving history, location, and coverage options. These rates are also subject to change over time.

Auto Insurance: Natural Disaster Coverage?

You may want to see also

Auto-Owners' insurance quotes by driver profile

Auto-Owners Insurance offers a range of insurance policies, including auto insurance, which can be highly personalised to the customer's needs. The company operates in 26 states and provides insurance through a network of local licensed agents. Auto-Owners Insurance has a good reputation, with high financial stability rankings, excellent customer reviews, and a low NAIC rating, indicating that it receives fewer complaints than other top auto insurance companies.

Auto-Owners Insurance offers a range of quotes for different driver profiles. The average cost of car insurance with Auto-Owners is $60 per month, or $1,696 per year for full coverage and $440 per year for minimum coverage. The company's rates vary depending on the driver's age, driving history, and location. For example, the average cost of car insurance for a driver with a clean driving history is $1,361 per year, while the average cost for a driver with a speeding ticket conviction is $1,478 per year. Auto-Owners Insurance also offers discounts for young drivers, including a good student discount, a student away at school discount, and a teen driver monitoring discount.

In addition to auto insurance, Auto-Owners Insurance also offers home insurance, life insurance, and business insurance. The company provides online access and a mobile app for customers to manage their policies and offers 24/7 claims filing.

Auto Insurance: Who Pays for Window Repairs?

You may want to see also

Auto-Owners' insurance company bundling discounts

Auto-Owners Insurance offers a bundling discount of up to 12% on its already competitive rates. This brings its average bundling rate to around $2,405 per year.

Auto-Owners also offers more than 20 home and auto insurance discounts to help you save even more. For example, you can save on your auto insurance rate by enrolling in paperless statements and paying your bills online. The company also offers a paid-in-full discount, so if you can afford to pay your auto premium in full, you could save on your premium and avoid billing fees.

Auto-Owners also has a life multi-policy discount, which is relatively unique. You can get a bundle discount on your auto insurance if you also have an Auto-Owners life insurance policy.

Auto-Owners has a decent Bankrate Score for home insurance but is pulled down by its lack of national availability and lack of credit ratings from Standard and Poor's and Moody's.

Auto-Owners Insurance has a high rating from AM Best, a global credit rating agency that scores the financial strength of insurance companies. It received an A++ (Superior) rating, the highest level available, which means that Auto-Owners has been financially strong enough to pay claims, even in situations where many claims are filed simultaneously.

Assurant: Vehicle Insurance Available?

You may want to see also

Frequently asked questions

Auto-Owners Insurance offers lower rates for young drivers than the national average. For a 16-year-old driver, the average annual cost of full coverage is $1,361, while the national average is $2,278.

Auto-Owners Insurance provides some of the most competitive rates on the market for a regional insurer. Its average monthly cost of $135 is lower than the industry average, and its annual cost of $1,619 is far below the national average of $2,008.

Auto-Owners Insurance's rates are generally lower than those of national providers. Its average annual cost of $1,619 is lower than the national average of $2,008, and its average monthly cost of $135 is also below the industry average.