Florida's vehicle insurance rates are high for several reasons, including the state's no-fault auto insurance laws, risk exposure due to extreme weather conditions, average driver profile, and the number of uninsured drivers. The average cost of car insurance in Florida is $2,208 per year, making it the fourth-highest compared to other states. Alabama and Georgia, which share a border with Florida, have lower rates — drivers in Georgia pay $1,638 on average, while policies in Alabama cost $1,221 annually.

| Characteristics | Values |

|---|---|

| Average cost of car insurance in Florida | $3,244 per year for full coverage |

| Average cost of car insurance in Florida for minimum liability coverage | $1,345 per year |

| Cheapest car insurance in Florida | State Farm |

| Cheapest car insurance in Florida for seniors | Geico |

| Cheapest car insurance in Florida for young drivers | Geico |

| Cheapest car insurance in Florida after a ticket | State Farm |

| Cheapest car insurance in Florida after an accident | State Farm |

| Cheapest car insurance in Florida after a DUI | Travelers |

| Cheapest car insurance in Florida for drivers with bad credit | UAIC |

What You'll Learn

Florida's no-fault auto insurance laws

Florida is a "no-fault" car insurance state, which means that the insurance claim process is meant to be more efficient after a car accident. Each driver's insurance covers their own medical bills and other financial losses, regardless of who caused the accident.

In Florida, all drivers are required by law to carry personal injury protection (PIP) insurance and property damage liability (PDL) insurance. PIP insurance covers 80% of medical expenses and 60% of lost income up to $10,000 per accident, no matter who caused the crash. PDL insurance covers damage to another person's property, also up to $10,000 per accident.

Florida's no-fault laws do not apply to vehicle damage claims, so a liability claim can be made against the at-fault driver for damage to a vehicle with no limitations.

Florida's no-fault laws also do not cover non-monetary damages such as "pain and suffering". To step outside of the no-fault system, injuries must meet the threshold set by state law, which includes significant and permanent loss of bodily function, permanent injury, or significant and permanent scarring or disfigurement.

Florida's no-fault laws have been criticised for being an "incubator for fraud" and for making Florida the fourth-costliest state for auto insurance.

Red Cars: Insurance Premiums Higher?

You may want to see also

High healthcare costs

Florida's vehicle insurance rates are high for several reasons, one of which is the state's high healthcare costs. The United States spends approximately $3 trillion on healthcare per year, and while costs are high across the country, Florida residents pay more than average. According to the Commonwealth Fund, Florida is one of five states in the US where the average resident spends 14% or more of their income on healthcare.

When an accident occurs, insurance providers use the premiums paid by consumers to help pay for the expenses incurred by the insured. The costs covered include medical expenses from injuries sustained by the drivers and their passengers or, in tort states, treatments needed by the other party. As healthcare costs in Florida are high, insurance companies charge higher premiums to cover these costs.

Healthcare spending in Florida increases by an average of 6.3% every year, and insurance companies are hit the hardest when paying out claims involving medical bills. This is a significant factor in why car insurance in Florida is so expensive.

Additionally, Florida is a no-fault state, meaning that Personal Injury Protection (PIP) insurance is required. This type of insurance covers a large portion of medical bills for both the driver of a vehicle and their passengers, regardless of who was at fault for the accident. This requirement increases costs for drivers by 20% and is one of the main reasons insurance prices are so high in the state.

Leasing a Vehicle: Is Insurance Included?

You may want to see also

High-risk drivers

- Living in a high-risk area

- Driving a high-risk vehicle type

- A history of driving violations

- Poor credit

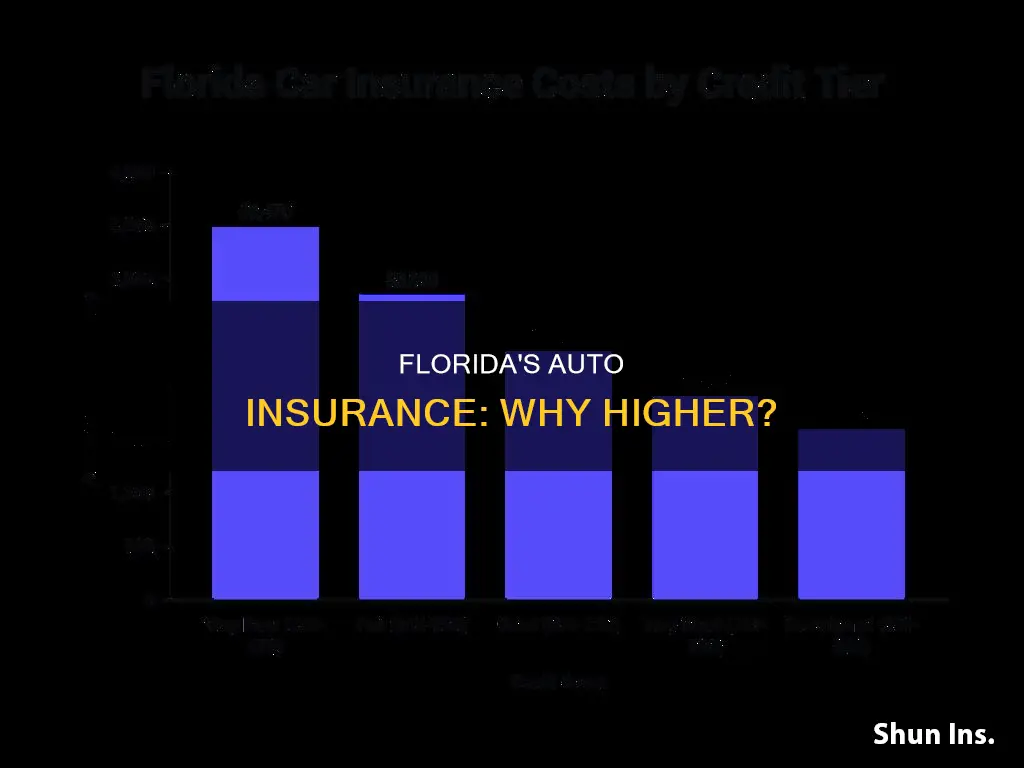

In Florida, high-risk drivers tend to pay more for auto coverage than those who are not deemed high-risk. The average cost of high-risk car insurance in Florida is $2,665, but this can vary depending on the driver's history. For example, the average rate for a driver with a DUI in Florida is $2,356, while a driver with a reckless driving conviction pays $2,356 on average. Poor credit can also put you in the high-risk category, with an average rate of $3,105 in Florida.

The cheapest car insurance company in Florida for high-risk drivers is State Farm, followed by Geico and Travelers. However, rates will vary depending on the driver's exact history.

Insurance and Vehicle Registration: What's the Link?

You may want to see also

Severe weather risks

Florida is known for its hurricanes and lightning, but there are other severe weather risks that residents and visitors should be aware of. The state experiences a wide range of weather phenomena throughout the year, and these can impact insurance costs.

Florida has the highest number of thunderstorms in the US, with between 75 and 105 days of thunderstorms each year. These storms can produce dangerous hazards, including lightning, tornadoes, hail, strong winds, and heavy rain that can lead to flooding. The state sees around 1.4 million cloud-to-ground lightning strikes annually and often has the highest number of lightning-related injuries and deaths in the country. The air around a lightning bolt can heat up to an incredible 50,000° F (27,760° C), hotter than the surface of the sun.

Thunderstorms can also produce severe winds, with gusts of up to 40-50 mph possible. These strong winds can cause damage to property and infrastructure, leading to costly insurance claims.

Florida is also susceptible to flooding, with localized flooding possible in urban and low-lying areas during heavy downpours or slow-moving storms. The state has seen an average of 5.7 natural disasters causing over $1 billion in damages over the past three years. Hurricanes, flooding, and other climate-related disasters have become increasingly problematic for insurance providers, with the frequency of severe weather events adding to the risk of insuring vehicles in the state.

The state is also prone to wildfires, with over 4,600 fires burning nearly 110,000 acres of land in a typical year. While prescribed burns can help reduce fuel buildups that cause dangerous wildfire conditions, the risk remains present.

The combination of these severe weather risks contributes to the higher cost of vehicle insurance in Florida. The state's unique climate and weather patterns result in a higher frequency of claims, leading to increased insurance rates for residents.

GST on Motor Vehicle Insurance: Calculation Method

You may want to see also

Florida's high rate of uninsured drivers

Florida has one of the highest rates of uninsured drivers in the United States. According to the Insurance Information Institute (III), about 13% of all drivers in the US, or 32 million people, operate vehicles without insurance coverage. The percentage of uninsured drivers varies from state to state, but Florida has one of the highest rates, with about 26.7% of all drivers being uninsured. This is substantially higher than the national average of 13%.

The high rate of uninsured drivers in Florida is likely due to the high cost of car insurance in the state. Florida has some of the most expensive car insurance rates in the country, with an average monthly cost of $115 for minimum liability coverage and $270 for full coverage. The national average for minimum coverage is much lower, at $52 per month or $627 per year, while Floridians pay an average of $3,244 per year. The high cost of car insurance in Florida has led to more drivers forgoing coverage, despite it being a violation of state law. As a result, insured drivers in Florida end up paying more for their car insurance due to the high volume of uninsured drivers.

The consequences of driving without insurance in Florida can be serious. Uninsured drivers who are caught can face fines, license suspension, or even jail time. Additionally, if an uninsured driver is involved in an accident, they may be responsible for paying for all the damages and expenses out of pocket. This can include lost wages, medical expenses, and car repairs, which can quickly become financially overwhelming.

To protect themselves from the high cost of accidents with uninsured drivers, many insured Florida drivers choose to purchase additional "uninsured and underinsured motorist insurance." This type of insurance coverage will protect drivers and their loved ones from the financial burden that can follow a severe car accident with an uninsured driver. While this added insurance can be expensive, it is worth considering in a state with such a high rate of uninsured drivers.

Company Cars: SR22 Insurance Impact

You may want to see also

Frequently asked questions

Vehicle insurance in Florida is expensive due to the state's no-fault auto insurance laws, high healthcare costs, high-risk drivers, uninsured drivers, and severe weather risks. Florida also has a large population of young students and seniors, who pay more for insurance coverage.

Florida is the fourth most expensive state for vehicle insurance, with an average cost of $2,208 per year. The most expensive state for vehicle insurance is Louisiana, with an average cost of $2,883 per year.

To save money on vehicle insurance in Florida, you can shop around for quotes, bundle your policies, take advantage of discounts, use an insurance comparison tool, increase your deductible, or consider pay-per-mile insurance.