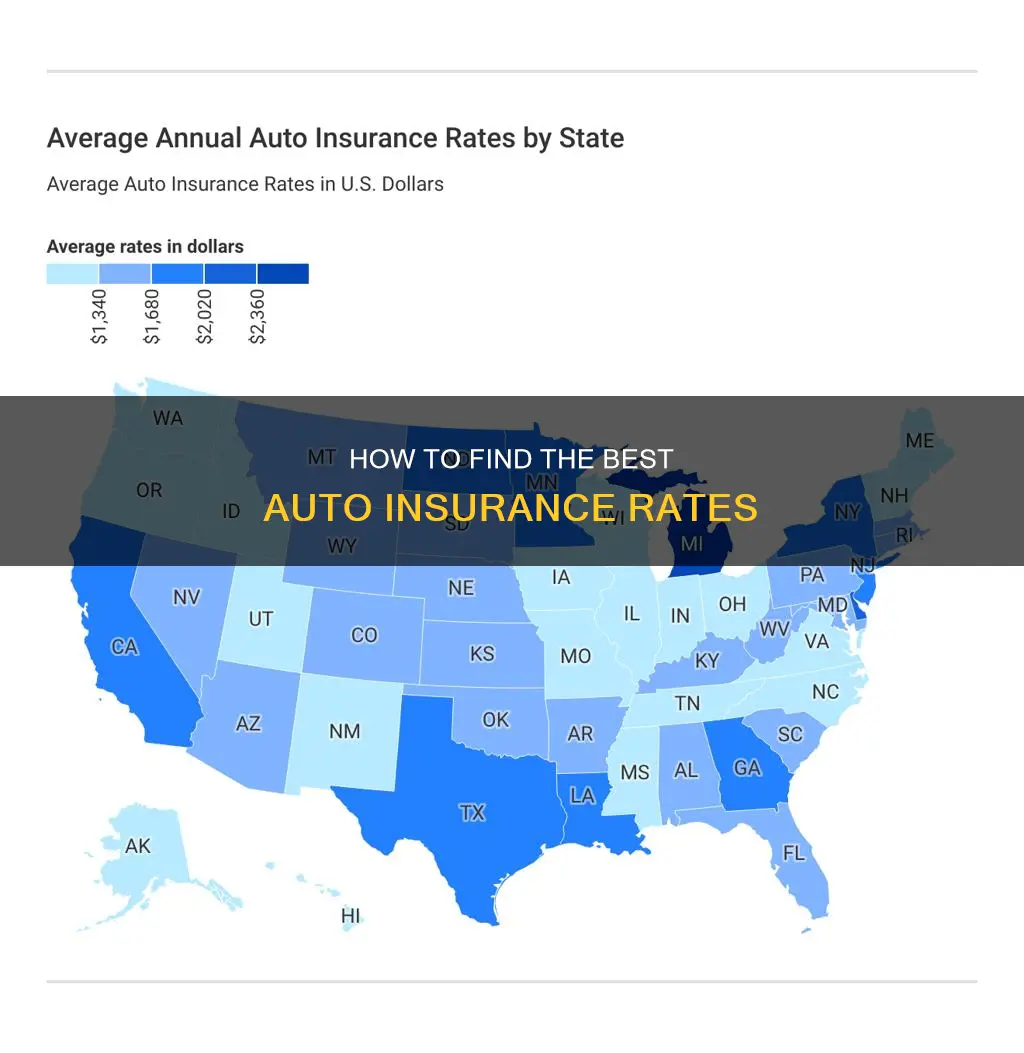

The best auto insurance rates can be found by comparing quotes from multiple companies. The best rates will depend on your driving record, age, and location, among other factors. Some of the cheapest car insurance companies in the U.S. include Geico, Progressive, State Farm, and USAA.

| Characteristics | Values |

|---|---|

| Company | Nationwide |

| USAA | |

| Travelers | |

| Erie | |

| Progressive | |

| Geico | |

| Westfield | |

| Auto-Owners |

What You'll Learn

How to get the best rates

To get the best rates on auto insurance, it is important to shop around and compare quotes from multiple providers. It is also beneficial to look for discounts, such as those for good drivers, students, or military members. Additionally, consider increasing your deductible, as this can lower your premium. Finally, maintaining a good credit score and a clean driving record can help you secure better rates.

Understanding Auto Insurance Statements: Responding to Your Questions

You may want to see also

How to get the best rates for young drivers

Young drivers often pay higher insurance premiums due to a lack of driving experience, higher chances of violations, and risky driving. Here are some tips for getting the best rates for young drivers:

- Stay on a parent's policy: Adding a teen to an existing policy is usually cheaper than buying a separate policy.

- Look for discounts: Many insurance providers offer discounts for good grades, taking a driving safety course, or being a safe driver.

- Choose a higher deductible: Raising your deductible can lower your premium, but ensure you can afford the higher amount in case of a claim.

- Shop around: Compare rates from multiple providers to find the best deal.

- Choose a cheaper car: More expensive cars are costlier to insure, and certain makes and models are also associated with higher insurance costs.

- Consider a pay-per-mile insurance program: If you don't drive much, these programs can save you money.

Who is a Listed Driver and Why it Matters

You may want to see also

How to get the best rates for seniors

How to Get the Best Auto Insurance Rates for Seniors

Senior drivers often face higher car insurance rates due to the increased accident risks associated with aging. However, there are ways to find affordable coverage that meets their needs. Here are some tips for seniors to get the best auto insurance rates:

- Compare rates from multiple insurers: It is important to shop around and compare quotes from different insurance companies. Rates can vary significantly between insurers, so getting multiple quotes can help seniors find the most competitive rates.

- Look for insurers with senior discounts: Some insurance companies offer discounts specifically for seniors. For example, Geico offers a discount for drivers aged 50 and above who complete a defensive driving course.

- Consider usage-based insurance: If seniors drive less, they can benefit from usage-based insurance programs, which calculate premiums based on driving habits and mileage. This can result in lower rates for seniors who drive infrequently or safely.

- Bundle insurance policies: Seniors can often get discounts by bundling their auto insurance with other types of insurance, such as homeowners or renters insurance. Combining multiple policies with the same insurer can lead to significant savings.

- Choose a car that is cheap to insure: The type of car driven can impact insurance rates. Seniors can opt for vehicles that are generally cheaper to insure, such as reliable cars with advanced safety features.

- Take advantage of other discounts: In addition to senior-specific discounts, seniors can also qualify for other discounts offered by insurance companies. These may include discounts for having safety features in their car, anti-theft devices, or a good driving record.

- Adjust coverage as needed: Review your policy to ensure you are not paying for coverage you no longer need. For example, if you have an older car, consider dropping collision or comprehensive insurance if the cost of the coverage and deductible exceeds the value of the car.

- Shop around regularly: Car insurance rates can change over time, so it is a good idea to shop around and compare rates from different insurers periodically. This helps seniors stay informed about the latest rates and find the best deals.

- Consider insurers with low complaint ratios: When choosing an insurer, consider not only the rates but also the level of customer satisfaction and the ease of filing claims. Opt for companies with low complaint ratios, as this indicates relatively fewer issues with their services.

- Look for insurers with strong claims processing: In the event of an accident, seniors will want an insurer that handles claims efficiently and effectively. Consider insurers with high scores in claims satisfaction surveys, as this indicates a positive claims experience for their customers.

Short-Term Auto Insurance: One-Month Policies

You may want to see also

How to get the best rates for military members

Military members can get some of the best car insurance rates around. Here are some tips for getting the best rates for military members:

- Compare car insurance rates – Compare car insurance rates from multiple companies to find the best deal. Many auto insurance companies offer discounts for active-duty military, veterans, and members of the National Guard.

- Get a military discount – If you are an active-duty service member, you may be eligible for a discount of up to 15% or more on your car insurance. Some companies also offer discounts for veterans.

- Store your vehicle while deployed – If you are deployed, some companies will charge you up to 60% less for auto insurance while your vehicle is being stored. Some companies also offer a discount if your car is kept on a military base.

- Bundle your insurance – You can often get a discount by bundling your car insurance with other types of insurance, such as home or renters insurance.

- Maintain a good driving record – In addition to military discounts, you can also save on auto insurance by having a good driving record.

- Choose a vehicle that is cheaper to insure – The type of vehicle you own can affect your insurance rates. Insuring a minivan, for example, is usually cheaper than insuring a sports car.

- Take advantage of other discounts – There are many other ways to save on car insurance, such as carpooling, being a non-smoker, using anti-theft devices, or having low annual mileage.

- Shop around – Don't be afraid to shop around for the best rates. Get quotes from multiple companies and compare the coverage and discounts they offer.

Alabama's New Vehicle Insurance Grace Period

You may want to see also

How to get the best rates for those with poor credit

Having a poor credit score can increase your car insurance rates by hundreds of dollars a year compared to having good credit. However, there are still ways to get the best rates. Here are some tips:

- Shop around for the best rate: Don't just settle for the first insurance company you find. Compare rates from multiple insurers to find the lowest rate possible.

- Ask about discounts: Many insurance companies offer a range of discounts, such as for bundling policies, insuring multiple cars, having a clean driving record, paying your premium in full, agreeing to receive documents online, or owning a car with certain safety features.

- Improve your credit score: Build your credit history by paying your credit card bills and loan payments on time, reducing your debt, and regularly checking your credit score.

- Increase your deductible: Opting for a higher deductible will lower your premium, but make sure you can afford to pay more out of pocket if you need to file a claim.

- Consider usage-based or pay-per-mile insurance: If you're a safe driver who doesn't drive a lot, you may qualify for a discount with these types of insurance programs.

State Farm's Signature Requirement: Understanding the Auto Insurance Sign-Up Process

You may want to see also

Frequently asked questions

Some of the best car insurance companies are:

- Nationwide

- USAA

- Travelers

- Erie

- Progressive

- Geico

- Westfield

- Auto-Owners