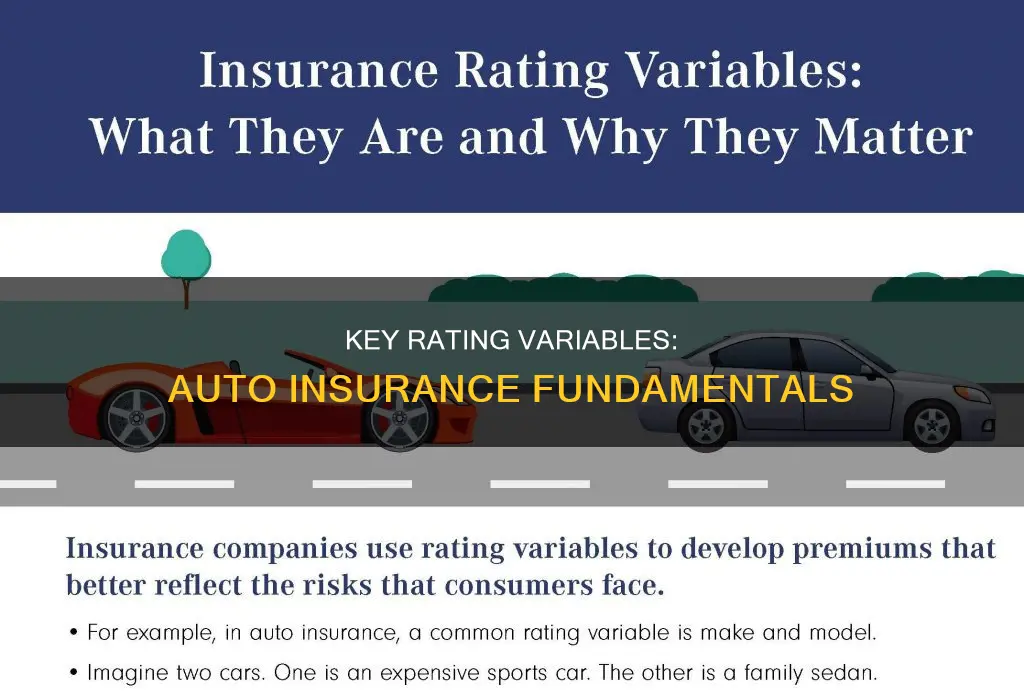

Auto insurance companies use rating variables to determine the cost of an individual's insurance policy. These variables are characteristics of the policyholder that can help approximate the cost of their risks. The less risky a policyholder's rating factors are, the cheaper their car insurance policy will be. Some key rating variables include the driver's age, accident history, vehicle type, gender, and location. These factors work together to create a risk profile that helps determine the policy rate. For example, teen drivers are considered very risky and tend to pay more in insurance premiums than older, more experienced drivers. By using these variables, insurance companies can price policies fairly and affordably while also broadening coverage.

| Characteristics | Values |

|---|---|

| Vehicle type | Cars with high safety ratings are cheaper to insure. Trucks are 3% cheaper to insure than sedans. |

| Motor vehicle record | A history of tickets, violations, accidents, or DUI convictions will increase insurance costs. |

| Previous claims history | Making a lot of insurance claims will increase costs, whether or not the accidents are your fault. |

| Driving experience | Inexperienced drivers will pay higher premiums. |

| Age | Teen drivers pay the most, with a cost gap of over $5,500 per year between teen and 50-year-old drivers. Premiums decrease until the driver's mid-50s, then increase again for older drivers. |

| Gender | Male drivers tend to pay more than female drivers, especially in the case of teenagers. |

| Marital status | Married drivers pay less than single, divorced, or widowed drivers. |

| Credit history | Drivers with poor credit pay more than those with good credit. |

| Location | Drivers in metropolitan areas pay more than those in suburbia or rural areas. |

| Annual mileage | Drivers who travel more pay higher premiums. |

What You'll Learn

Driver's age

The age of a driver is a significant factor in determining auto insurance rates. Teen drivers are considered the riskiest to insure due to their lack of experience and tendency to drive more recklessly, resulting in higher accident rates. This risk is reflected in insurance premiums, with teen drivers paying the most expensive rates, over $5,500 more per year than 50-year-olds.

Age becomes less of a factor in insurance rates as drivers reach their 20s, with a significant reduction in premiums around age 25. Insurance premiums reach their lowest point when drivers are in their mid-50s and begin to rise again for older drivers aged 70 and above.

The correlation between age and insurance rates is due to the increased risk associated with younger and older drivers. Teen drivers have a higher fatality rate and are involved in more collisions due to risk-taking behaviours, lack of experience, and immature decision-making. On the other hand, older drivers experience age-related declines in sensory, cognitive, and motor functions, which can impair their driving abilities and increase the risk of accidents.

Actuarial data supports the use of age as a classification variable in auto insurance, as it accurately captures the differences in risk among drivers of different ages. While some provinces and states have restricted the use of age as a rating factor, it remains a significant determinant of insurance rates in most places.

To summarize, a driver's age is a critical factor in auto insurance rates, with younger and older drivers typically facing higher premiums due to the increased risk associated with their age group.

Ho4 Home Insurance: Your Secret Weapon for Auto Accident Coverage

You may want to see also

Vehicle type

The make and model of a vehicle can influence the insurance premium. Certain makes and models are riskier for car insurance companies to cover due to vehicle-specific crash statistics. If a car requires expensive components or repairs, drivers often pay higher insurance premiums. Conversely, cars with safety measures tend to cost less to insure as they are often less susceptible to damage.

The age of a vehicle also affects insurance rates. Older vehicles are generally more expensive to insure than newer ones, with the exception of collectible cars. Newer cars tend to have more technology, and this can lead to higher replacement part costs, the need for specialized mechanics, and increased labor time. However, if a new car has additional safety features, cheaper parts, or is driven by a low-risk driver, it may be less expensive to insure than an older car.

The size and weight of a vehicle are also factors in determining insurance premiums. Larger and heavier vehicles often have higher insurance premiums because they have a higher potential for damage and pose a greater risk to other road users.

The safety features installed in a vehicle can also impact insurance rates. Insurance companies often charge lower premiums for vehicles with safety features such as anti-lock brakes, electronic stability control, and theft prevention systems, as these features can reduce the likelihood of accidents and the cost of potential damages.

The cost of repairs is another consideration. If a vehicle is expensive to repair or has costly components, insurance premiums are typically higher. Foreign cars, for example, often have more expensive parts than domestic vehicles. Luxury cars tend to be more expensive to repair and have pricier components, resulting in higher insurance costs.

In summary, the vehicle type is a significant factor in determining auto insurance rates. Insurers consider various aspects of the vehicle, including its make, model, age, size, weight, safety features, and repair costs, to assess the risk and set the appropriate premium.

Insurance Claims: Recovered Vehicle

You may want to see also

Driving history

Insurance companies view a driver's history as a predictor of future performance. A history of tickets, violations, accidents, and claims indicates a higher risk of future incidents and is therefore reflected in higher insurance premiums. Conversely, a clean driving record without accidents or violations typically results in cheaper insurance rates.

The impact of driving history on insurance rates varies depending on the severity of infractions. For example, an at-fault accident usually leads to higher increases in insurance rates than a speeding ticket conviction. Severe infractions, such as DUI convictions or multiple convictions and accidents within a short period, may result in insurers denying coverage. In such cases, high-risk drivers may need to seek coverage through non-standard insurance companies or state-backed high-risk pools.

Additionally, a lapse in insurance coverage or a "coverage gap" can also work against the driver, as insurers may view this as an additional risk and charge higher premiums.

Overall, a driver's history is a critical factor in determining auto insurance rates, and maintaining a clean driving record can help keep insurance costs down.

Racing Motors: The Impact on Auto Insurance Rates

You may want to see also

Insurance history

Insurance companies view continuous coverage as a positive indicator of responsible behaviour, suggesting that the driver is less likely to be uninsured. A history of uninterrupted insurance coverage can lead to lower insurance rates. On the other hand, a lack of continuous coverage, known as a "coverage gap," is considered a red flag by insurance providers. Coverage gaps may occur due to non-payment, switching between vehicles, or other reasons. Insurers perceive these gaps as an increased risk, often resulting in higher insurance premiums.

The impact of insurance history on rates can be significant. For instance, a driver with five years of uninterrupted coverage may pay approximately $182 less per year than someone without previous coverage.

In addition to insurance history, other key rating variables include age, driving record, vehicle type, location, credit score, and annual mileage. These variables help insurance companies assess the likelihood of a driver filing a claim and the potential costs involved. By analysing these factors, insurers can set rates that reflect the perceived risk of each individual policyholder.

Gap Insurance: Aviva's Offerings

You may want to see also

Location

Insurance companies examine data related to the number of accidents, vandalism incidents, and thefts in a particular area, which can vary significantly from one state to another and even within the same city. Urban areas, for example, tend to have higher rates of accidents, theft, and vandalism than rural areas due to higher traffic volumes and crime rates. As a result, individuals in large cities can expect higher premiums compared to those in less populated rural areas.

Within a city, insurance rates can vary between neighbourhoods. Insurance companies track the number of accidents and crime statistics, such as auto thefts and burglaries, down to the neighbourhood or ZIP code level. If people in a particular ZIP code file a lot of auto insurance claims, insurers may designate that neighbourhood as high risk and quote higher premiums for that area. Conversely, living in an area with low rates of property crime can result in lower insurance rates.

In addition to accident and crime rates, other location-specific factors that can impact insurance rates include driving conditions, driving laws, weather conditions, population density, and economic factors. Well-maintained roads and efficient traffic management can reduce accidents and lead to lower insurance costs. Areas with stringent seat belt laws and lower speed limits may have lower premiums due to a reduced risk of severe accidents. Harsh weather conditions, such as heavy rain, hail, or snow, can elevate the risk of accidents and property damage, leading to higher premiums in areas prone to such weather events.

In summary, the location of the insured individual plays a significant role in determining auto insurance rates. Insurance companies consider various factors related to location, including accident rates, crime statistics, driving conditions, weather patterns, and population density, to assess the risk associated with a particular area. This information is then used to set insurance premiums accordingly.

Insuring Your Child's Partner

You may want to see also

Frequently asked questions

Rating variables are used by actuaries to price insurance policies fairly and affordably. They are characteristics of individual policyholders that can help approximate the cost of their risks. Some key rating variables used in auto insurance include the driver's age, accident history, vehicle type, location, gender, and credit history.

Age is a significant rating variable in auto insurance, especially for young and inexperienced drivers. Teen drivers are considered high-risk due to their lack of driving experience and tendency to drive more recklessly. As a result, they often pay higher insurance premiums than older drivers. Insurance rates typically decrease after age 25 and reach their lowest point in a driver's mid-50s before rising again for older drivers aged 70 and above.

A driver's history, including traffic violations, accidents, and claims, is a crucial rating variable. Insurance companies view a driver's past as a predictor of future performance, so a history of tickets or violations will result in higher insurance premiums. Conversely, a clean driving record can lead to lower rates and safe-driver discounts.

Yes, the type of vehicle is another key rating variable. Insurance companies consider the safety ratings, repair costs, theft rates, and comprehensive claims history of similar models when determining insurance rates. Vehicles with high safety ratings may qualify for discounts, while those that are more expensive to replace or more likely to be stolen will typically have higher insurance premiums.

Location can influence auto insurance rates in several ways. Firstly, state regulations and minimum coverage requirements differ across states, leading to variations in insurance rates. Secondly, location-specific factors such as population density, accident frequency, theft rates, and weather conditions can impact rates. Urban areas often have higher insurance rates due to higher risks of theft, vandalism, and accidents.

Yes, there are other rating variables that can impact auto insurance rates. These include gender (especially for young drivers), credit history (in most states), marital status, and annual mileage. It's important to note that the weightage given to each variable may vary between insurance companies and states.