Michigan drivers pay an average of $1,980 per year for full coverage car insurance, which is about $165 per month. If you choose minimum coverage, you’ll pay around $904 annually, or about $75 per month. The average cost of full coverage and minimum coverage auto insurance in Michigan is $1,980 per year and $904 per year, respectively. Michigan drivers pay more than double what drivers pay in the 10 cheapest states for auto insurance.

What You'll Learn

Average monthly cost of car insurance in Michigan

The average monthly cost of car insurance in Michigan varies depending on factors such as age, driving record, and coverage level. Here's an overview of the average monthly costs for different coverage types and driver profiles:

Average Monthly Cost for Minimum Coverage

The average monthly cost for minimum coverage car insurance in Michigan is around $74 to $75. This option provides basic protection and is typically the most affordable.

Average Monthly Cost for Full Coverage

The average monthly cost for full coverage car insurance in Michigan ranges from $165 to $251. Full coverage includes comprehensive and collision insurance, offering more protection than minimum coverage.

Average Monthly Cost for Different Driver Ages

Age is a significant factor in determining car insurance rates. Here are the average monthly costs for different age groups in Michigan:

- 20-year-olds: Around $189 for full coverage.

- 30-year-olds: Around $165 to $167 for full coverage.

- 40-year-olds: Around $165 for full coverage.

- 50-year-olds: Around $165 for full coverage.

- 60-year-olds: Around $152 for full coverage.

- 70-year-olds: Around $165 for full coverage.

Average Monthly Cost for Teens

For teens in Michigan, the average monthly cost of car insurance is significantly higher, ranging from $521 to over $1,000, depending on age and gender.

Average Monthly Cost for High-Risk Drivers

Drivers with a less-than-perfect record, such as those with a speeding ticket, at-fault accident, or DUI, will pay more. Here are the average monthly costs for high-risk drivers in Michigan:

- With a speeding ticket: Around $227.

- With an at-fault accident: Around $246.

- With a DUI: Around $397.

Average Monthly Cost by City

The cost of car insurance in Michigan also varies by city. For example, the average annual cost of full coverage in Ann Arbor is $1,361, while in Detroit, it's $3,987.

Average Monthly Cost by Vehicle Type

The type of vehicle you drive also impacts your insurance rates. For instance, the average annual cost of insuring a 2012 model car in Michigan is $1,429, while a 2022 model costs $1,800.

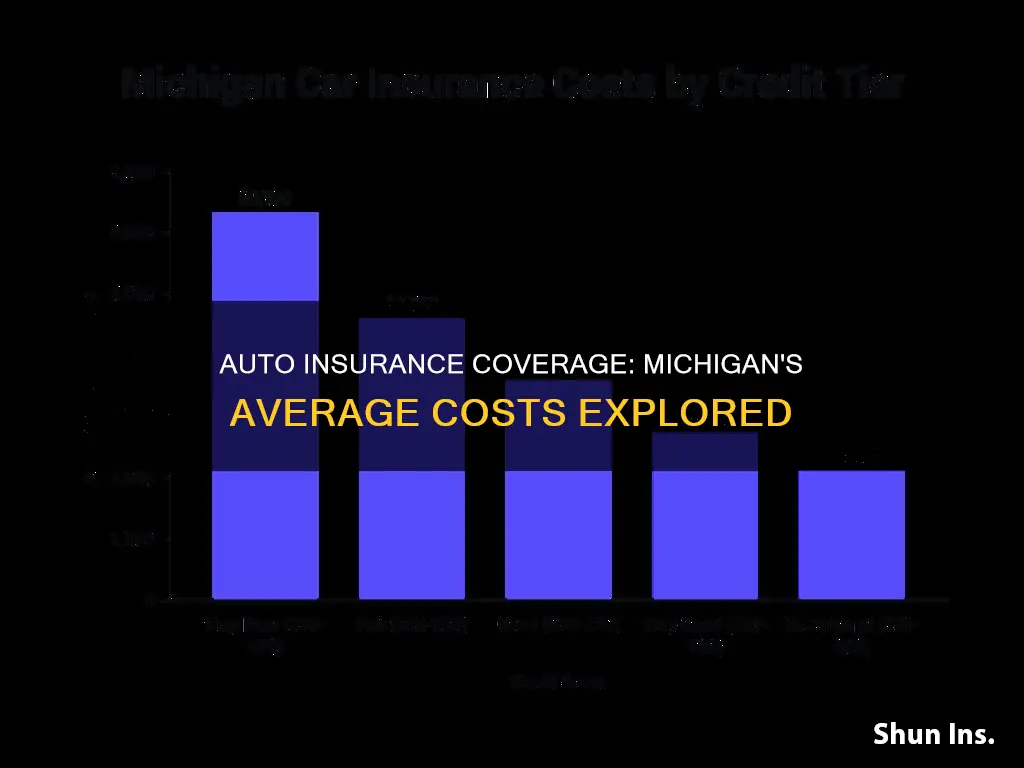

Average Monthly Cost by Credit Score

In Michigan, your credit score can affect your insurance rates. The average annual cost of car insurance for a driver with excellent credit is $1,309, while for a driver with poor credit, it's $4,061.

Safco Auto Insurance Rates: Rising Costs Explained

You may want to see also

Average annual cost of car insurance in Michigan

The average annual cost of car insurance in Michigan varies depending on the level of coverage, driver demographics, and driving record. Here is a detailed overview:

Average Annual Cost by Coverage Level

The cost of car insurance in Michigan depends on the chosen coverage level. State minimum liability-only coverage is the most affordable option, with an average annual cost of $904. In contrast, full coverage insurance with a $1,000 deductible is significantly more expensive, averaging $1,980 per year. Increasing the deductible to $1,500 can lower the annual cost to around $1,900.

Average Annual Cost by Company

The average annual cost of car insurance in Michigan also varies by company. GEICO offers the cheapest full coverage at $1,027 per year, while Hanover provides the most expensive average annual premium at $4,776. Westfield offers the cheapest minimum coverage at $409 annually, and GEICO is again competitive for full coverage, with an average annual rate of around $1,027.

Average Annual Cost by City

Location is another factor influencing car insurance rates in Michigan. Ann Arbor has the most affordable full coverage at $1,361 per year, while Detroit has the highest at $3,987.

Average Annual Cost by Age Group

Age is a significant factor, with younger drivers often facing higher rates. In Michigan, drivers aged 22 to 29 pay the most, with an average annual premium of $2,270. Seniors aged 60 and above benefit from the lowest average premiums, at $1,825 annually.

Average Annual Cost for Teens

In Michigan, the cost of car insurance for teens varies by age and gender. For example, adding a 16-year-old male driver to a family policy can cost around $5,205 per year, while the same coverage for a 16-year-old female is approximately $5,041. Obtaining an individual policy for a 16-year-old male can be even more expensive, reaching $9,053 annually.

Average Annual Cost by Driving Record

Your driving record also impacts your car insurance rates in Michigan. A clean driving record will result in lower premiums. On the other hand, violations such as a speeding ticket, an at-fault accident, or a DUI will increase your costs. For example, the average annual cost of car insurance with a speeding ticket is $2,722, while a DUI can raise the average cost to $4,765.

Average Annual Cost by Credit Score

Credit scores play a pivotal role in determining car insurance rates in Michigan. A good credit score can lead to lower premiums. In Michigan, the average annual cost ranges from $1,309 for excellent credit to $4,061 for poor credit.

Auto Insurance: Understanding Your Monthly Costs

You may want to see also

Cheapest car insurance companies in Michigan

The cost of car insurance in Michigan is higher than the national average. The average cost of full coverage car insurance in Michigan is $2,418 per year, or $202 per month, while the national average is $4,211 per year. The average cost of minimum coverage in Michigan is $593 per year, or $49 per month.

Michigan has a high number of uninsured drivers, with at least 20% driving without insurance, and in big cities like Detroit, as many as 60% of residents are uninsured. This means that insurance companies end up covering the costs associated with accidents caused by uninsured drivers, and they pass those costs on to customers in the form of higher premiums.

However, there are still some insurance companies that offer cheaper rates in Michigan. Here are the cheapest car insurance companies in Michigan:

- Secura: $53 per month on average for state-minimum coverage.

- Chubb: $65 per month on average.

- Travelers: $68 per month on average.

- Wolverine Mutual: $80 per month on average.

- Auto-Owners: $89 per month on average.

These rates are for drivers with a clean driving record. If you have a speeding ticket, an at-fault accident, or a DUI on your record, your rates may be higher.

In addition to these five companies, Geico, Progressive, and USAA also offer competitive rates in Michigan. It's important to shop around and compare quotes from multiple companies to find the best rate for your specific situation.

Essential Guide to Washington's Auto Insurance Minimums

You may want to see also

Average cost of car insurance by coverage level in Michigan

The average cost of car insurance in Michigan depends on the coverage level chosen. The average cost of car insurance in Michigan for 2024 is $887 for state-mandated minimum coverage and $3,010 for full coverage. The monthly average cost of car insurance in Michigan is $74 for minimum coverage and $251 for full coverage.

The cheapest car insurance in Michigan is from Geico at $2,131 per year for full coverage and from USAA at $560 per year for a minimum-liability policy. The average cost for a full-coverage policy in Michigan is $4,067 per year or $339 per month.

The cost of car insurance in Michigan varies depending on factors such as age, gender, driving record, and credit score. For example, young drivers tend to pay higher premiums due to their lack of experience, while senior drivers may see increased rates due to declining driving abilities. Additionally, drivers with a clean driving record typically receive lower rates than those with accidents or violations on their record.

When choosing a car insurance policy in Michigan, it is important to consider the coverage level that best suits your needs and budget. Minimum coverage may be sufficient for some drivers, while others may prefer the added protection of full coverage. Shopping around and comparing quotes from multiple companies can help find the most competitive rates.

Java Auto Insurance Program: A Comprehensive Guide

You may want to see also

Average cost of car insurance by age in Michigan

The average cost of car insurance in Michigan varies depending on age, gender, and other factors. According to Marketwatch, the average cost of a full-coverage policy in Michigan is $4,067 per year or $339 per month, which is about 52% more than the national average. However, the cheapest full-coverage car insurance in Michigan is offered by Geico at $2,131 per year.

Age is a significant factor in determining car insurance rates, with younger and older drivers often paying more than those in the middle-age range. In Michigan, teen drivers pay around $7,429 per year or $619 per month for car insurance, on average. As young drivers gain more experience, their rates gradually decrease, with 19-year-olds paying about 24% less than 18-year-olds, and 21-year-olds paying 17% less than 20-year-olds.

For 25-year-olds in Michigan, the average cost of car insurance is $2,235 per year or $186 per month. The rates continue to decrease for drivers in their 30s, 40s, and 50s, with 60-year-olds having the lowest rates at $158 per month, on average. After age 60, rates begin to rise again, with 75-year-olds paying 19% more than 60-year-olds.

Gender also plays a role in car insurance rates, with men paying more than women, on average. The difference is more pronounced for younger drivers, with young men paying 9% to 11% more than young women. Overall, men pay around 6% more for car insurance than women over their lifetime. However, it's important to note that some states, including Michigan, prohibit the use of gender as a factor in determining insurance rates.

Auto Insurance Occurrences: What You Need to Know

You may want to see also

Frequently asked questions

Michigan drivers pay an average of $173 per month for liability coverage and $309 per month for full coverage. With an overall average annual premium of $2,893, Michigan drivers face the highest insurance rates in the country.

Your driving history, age, location, and coverage amount all affect the cost of your Michigan car insurance premiums. Unlike in many states, however, Michigan providers can’t take into account your gender, credit score, marital status, or other non-driving factors when determining rates.

Yes, car insurance rates vary by location in Michigan. Someone who lives in an area with a high number of insurance claims will likely pay more for their premiums.

Some of the best insurance companies in Michigan include Auto-Owners, USAA, and Chubb, which also all offer the lowest rates in the state. But the best provider may vary for everyone, so it’s important to shop around.