A waiver of deductible on auto insurance is an optional feature that can be added to a car insurance policy to cover your deductible in the event of an accident where you are not at fault. This type of waiver is typically called a Collision Deductible Waiver (CDW) and is not available in all states or with all insurance providers. A CDW covers your collision deductible when you are involved in an accident with an uninsured or underinsured driver, providing financial relief when filing claims for repair expenses.

| Characteristics | Values |

|---|---|

| Definition | An optional endorsement that can be added to a car insurance policy to cover your deductible in the event of an accident where you are not at fault. |

| Availability | Not available in all states and may not cover all types of accidents, such as hit-and-runs or single-vehicle accidents. |

| Cost | The cost of a waiver will depend on the carrier, the amount of the deductible, and the overall policy and driving profile. |

| Benefits | Could save you a lot of money, especially if you have multiple policies with the same company. |

| Application | May only apply if certain conditions are met, such as if the other driver is entirely at fault, if there is physical contact between vehicles, or if the uninsured driver is identified. |

What You'll Learn

Collision deductible waiver in California

A collision deductible waiver (CDW) is an optional insurance feature that some auto insurers offer to waive your collision deductible if you have a qualifying claim. In other words, if you have this waiver and a driver hits you, your collision coverage will cover the damage to your vehicle, but you won't have to pay your deductible.

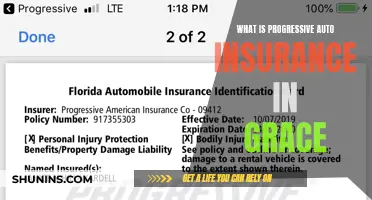

In some states, the driver must also be uninsured for a CDW to be applicable. Collision deductible waivers are not widely available. For example, Progressive only offers CDWs in California and Massachusetts.

In California, collision deductible waivers are called California deductible waivers. The California Insurance Code requires insurance companies to offer policyholders a CDW if they have both collision coverage and uninsured motorist bodily injury coverage (UMBI) on their policy. California requires insurance companies to offer uninsured motorist property damage (UMPD) coverage to all policyholders who do not have collision coverage but allows policyholders to reject this coverage in writing. However, UMPD coverage in California does not have a deductible, and collision and UMPD cannot be carried simultaneously on the same car. Therefore, this waiver allows policyholders to have the benefit of not paying a deductible if their vehicle is damaged by an uninsured driver.

If the policyholder is involved in a hit-and-run where the at-fault driver is not found, they will have to pay their collision deductible. For California drivers who opt for UMPD on top of liability-only coverage, the UMPD coverage limit is a fixed amount of $3,500.

A CDW may make sense if you choose a high deductible for your collision coverage. Auto insurance deductibles typically range from $100 to $2,500. If you have a deductible at or above $1,000, then a CDW could save you a significant amount if an uninsured motorist damages your vehicle. With a CDW, you pay a little more upfront to save yourself from paying a large deductible in the future.

According to the Insurance Information Institute, an estimated 16.6% of California drivers were uninsured as of 2019 — one of the highest uninsured rates in the country.

Lower Auto Insurance: Tips and Tricks

You may want to see also

Collision deductible waiver in Massachusetts

A collision deductible waiver (CDW) is an optional feature that can be added to a car insurance policy. It is an endorsement that covers your collision deductible when you are involved in an accident with an uninsured or underinsured driver. This type of endorsement is not available in every state or with every insurance company. In some states, the driver must be uninsured for a CDW to be applicable.

In the state of Massachusetts, CDW is an optional endorsement that allows the collision deductible to be waived if the policyholder is involved in an accident caused by an identifiable driver who is uninsured. If the driver is not identifiable, the policyholder will need to pay their collision deductible.

While CDW is not widely available, Progressive, for example, offers CDWs in Massachusetts.

The workings of a collision deductible waiver depend on the guidelines set by the insurance company. However, there are some common restrictions that most companies follow:

- Actual cash value (ACV): The ACV of your vehicle must be more than the amount of your deductible.

- Fault determination: Most insurers require you to be not at fault for the accident. Some auto companies may require you to be 100 percent fault-free to have the deductible waived, while others may waive a percent of your deductible based on your percentage of fault.

- Driver identification: The at-fault driver typically needs to be identified and found uninsured. If the driver is unidentified, the coverage will not apply, and if they are identified and have insurance, their property damage coverage will pay for your vehicle repairs.

Alternatives to collision deductible waivers

- Diminishing or vanishing deductible

- Uninsured motorist collision deductible waiver

- Uninsured motorist property damage

- Choose a low deductible

Auto Insurance: Statistics and Loss

You may want to see also

When can't I use a collision deductible waiver?

A collision deductible waiver (CDW) is an optional feature of an auto insurance policy that covers your collision deductible when you are involved in an accident with an uninsured or underinsured driver. However, there are certain situations in which a CDW cannot be used:

- If you are at fault or partially at fault for the accident. Most insurers require you to be not at fault at all for the accident for the CDW to be applicable.

- If no one is at fault for the accident. For example, if you hydroplane into another vehicle during heavy rain, neither of you would be deemed at fault, and the CDW would not apply.

- If your car collides with an object or is damaged due to environmental factors, such as a pothole or a windstorm knocking over a pole, and there is no other driver involved.

- If an insured driver hits your car. In most states, a CDW will not apply if the other driver has insurance.

- If you are a victim of a hit-and-run accident and cannot identify the driver or their vehicle. In most cases, you need to verify that the other driver is uninsured for the CDW to apply.

It is important to note that CDWs are not available in all states and the specific terms and conditions may vary depending on the insurance provider and the state regulations.

Georgia Drivers: Avoid Underinsurance

You may want to see also

Collision deductible waivers vs uninsured motorist property damage coverage

A collision deductible waiver (CDW) is an optional feature you can add to your car insurance policy. It is an endorsement that covers your collision deductible when you are involved in an accident with an uninsured or underinsured driver. This type of endorsement is not available in every state or with every insurance company. In California and Massachusetts, collision deductible waivers are state-regulated, but in other states, insurance companies define what a collision deductible waiver is and how it may be applied.

A CDW is an insurance feature that waives your collision deductible when a driver damages your vehicle. It only applies when collision is the primary coverage paying for the repairs to your vehicle.

Uninsured motorist property damage coverage (UMPD) is a separate coverage that directly pays to repair or replace your vehicle when an uninsured driver damages it. UMPD provides coverage for your vehicle and property when it is damaged by an uninsured driver. It acts as a replacement for the property damage liability coverage the at-fault driver should have had. UMPD availability, coverage, and deductible options vary between states and carriers.

In California, UMPD is only available if you don't have collision coverage. If your insurer offers CDWs, you typically must choose between carrying either a CDW or UMPD coverage.

The key difference between UMPD and collision coverage is that UMPD only covers damage to your vehicle caused by a driver with little or no insurance. In contrast, collision coverage applies to any damage to your vehicle caused by a collision with another vehicle or object, regardless of fault.

If you have collision coverage, you might not need UMPD coverage since you're already covered for accident-related damage to your vehicle. However, if you have comprehensive car insurance coverage but not collision coverage, then UMPD is worth considering so you're at least covered for vehicle damage caused by uninsured drivers.

Removing Gap Insurance from Your Auto Loan: A Step-by-Step Guide

You may want to see also

Pros and cons of a collision deductible waiver

A collision deductible waiver (CDW) is an optional feature that can be added to your car insurance policy. It covers your collision deductible when you are involved in an accident with an uninsured or underinsured driver. The cost of a CDW is relatively low, ranging from $1 to $12 per month, or $12 to $144 per year. It is important to note that CDWs are not available in all states and may not cover certain types of accidents, such as hit-and-runs or single-vehicle accidents.

Pros of a Collision Deductible Waiver

- It can save you money on your collision deductible if you are in an accident with an uninsured driver.

- The endorsement cost is generally low compared to the cost of a collision deductible.

- In certain states, such as Massachusetts and California, distinct versions of the waiver may apply even in specific hit-and-run cases.

Cons of a Collision Deductible Waiver

- Adding the waiver to your policy will increase your overall insurance costs.

- It does not provide new coverage; it only eliminates the deductible under specific circumstances.

- You will still need to pay deductibles in scenarios that fall outside the waiver's scope, such as accidents involving only your car or cases where another driver is not deemed responsible.

Auto Insurance: Factors Affecting Your Premiums and Coverage

You may want to see also

Frequently asked questions

A waiver of deductible on auto insurance, also known as a collision deductible waiver (CDW), is an optional feature that can be added to a car insurance policy to cover your deductible in the event of an accident where you are not at fault.

A CDW covers your collision deductible when you are involved in an accident with an uninsured or underinsured driver. This type of endorsement is not available in every state or with every insurance company.

A CDW could save you a significant amount of money if you are in an accident with an uninsured motorist and have a high deductible.

Yes, some alternatives include uninsured motorist property damage coverage, choosing a low deductible, or a diminishing or vanishing deductible.

A collision deductible waiver is an add-on to your personal auto insurance that covers your deductible if an uninsured driver causes an accident. A collision damage waiver is offered by rental car companies to cover repair costs if their vehicle is damaged in a crash.