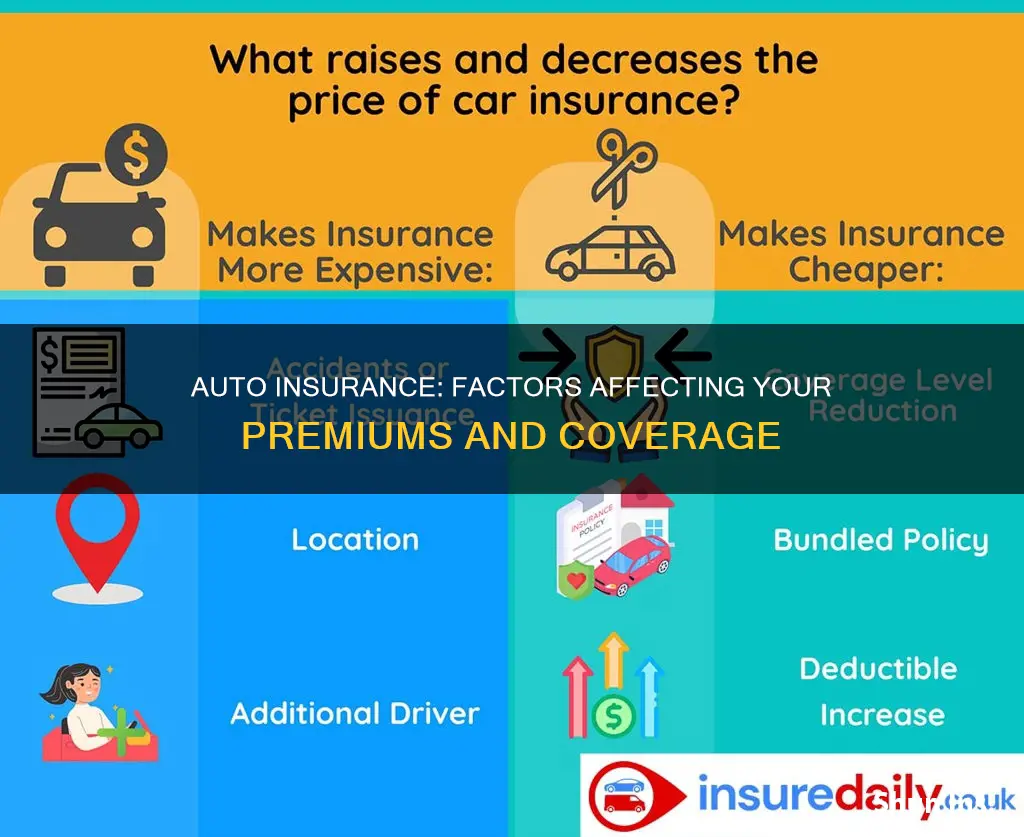

Auto insurance companies use multiple factors to determine your risk level, which in turn helps them set your insurance rate. The lower your perceived risk, the better your car insurance rates. Some of the factors that affect your auto insurance rate include your age, gender, driving history, credit score, location, and the type of car you drive.

| Characteristics | Values |

|---|---|

| Age | Younger and older drivers pay higher premiums. |

| Gender | Men tend to pay more than women. |

| Marital Status | Married drivers pay less. |

| Driving History | A history of tickets or violations will increase insurance costs. |

| Insurance History | Gaps in insurance coverage will increase costs. |

| Credit History | Poor credit history will increase costs. |

| Annual Mileage | Higher annual mileage will increase costs. |

| Vehicle Type | Luxury, sports, and newer vehicles cost more to insure. |

| Vehicle Age | Older vehicles are cheaper to insure. |

| Location | Urban areas are more expensive than rural areas. |

| Coverage Type | Higher coverage will increase costs. |

| Deductible | Higher deductible will decrease costs. |

Driving history

A driver's history is one of the most important factors that affect auto insurance rates. Insurance companies use driving records to assess the risk of insuring a driver, and this, in turn, determines how much the driver will pay in insurance premiums.

In the US, insurance companies typically look back at the previous three to five years of a driver's history, though some states may allow them to go back as far as ten years. During this period, any accidents, traffic violations, speeding tickets, DUI/DWI convictions, and claims made will be taken into account. The more incidents there are, the higher the insurance rates will be. For example, one accident can increase insurance rates by an average of $80 per month, while a speeding ticket can raise rates by $45 per month.

Serious moving violations, such as speeding tickets and DUI offenses, are particularly significant. They signal to insurance companies that a driver is more likely to be involved in an accident or make a claim, increasing the odds that their insurance premiums will rise. The more tickets accumulated, the higher the rates will be. Additionally, the faster a driver was going over the speed limit, the greater the chances of higher insurance rates.

A DWI or DUI conviction can cause insurance premiums to skyrocket, and insurers may even refuse to renew a policy. In such cases, drivers may be forced to settle for providers with much higher premiums.

It is worth noting that not all incidents will affect insurance rates equally. For example, non-moving violations usually have little impact on premiums. Additionally, many insurers won't increase premiums following a driver's first moving violation, even if it's for speeding. Some states even prohibit insurers from imposing a rate hike after a first-time speeding offense.

While a single accident or violation may not significantly impact insurance rates, multiple incidents over time will likely result in higher premiums. Therefore, maintaining a clean driving record is essential for obtaining more affordable auto insurance.

Ridesharing Risks: Progressive Auto Insurance Drop

You may want to see also

Vehicle type

The type of vehicle you drive has a significant impact on the price of your insurance. Insurers use vehicle symbols to help determine the appropriate premium to charge. The vehicle's make, model, age, size, weight, and unique Vehicle Identification Number (VIN) are all factors that influence the cost of insurance.

The make and model of a vehicle are important because certain cars and car companies brand their safety systems around the type of activity expected in any given situation. For example, a Ferrari's airbag system will include a different system when compared to a Jeep. Additionally, each make and model has different costs for components and repairs, with foreign and luxury cars tending to be more expensive in this regard.

The age of a vehicle also matters. Generally, insurance costs more for newer cars, though older or collectible automobiles are exceptions to this rule.

The size and weight of a vehicle influence insurance premiums because larger vehicles have a higher potential for damage and pose a greater risk to other road users. For example, it can cost more to insure a Jeep Wrangler than a smart car.

Vehicles with luxurious features tend to have higher insurance costs because these features increase the cost of the vehicle and insurance. Basic versions of cars without much customization tend to keep costs lower.

Safety features are another important consideration. Insurance companies often charge lower premiums for vehicles with safety features such as anti-lock brakes, electronic stability control, and theft prevention systems because these features reduce the likelihood of accidents and shield drivers from costly damages.

The value of a vehicle and the cost of repairs also play a role in determining insurance rates. If a vehicle needs expensive components or repairs, drivers often pay higher insurance premiums. Electric cars, for instance, can be more expensive to insure due to higher repair costs.

In summary, the type of vehicle you drive is a significant factor in determining your insurance rates. Insurers consider various aspects of the vehicle, including its make, model, age, size, weight, features, value, and repair costs, to calculate the appropriate premium.

Adding Parents to Your Auto Insurance Policy

You may want to see also

Age and experience

Insurance companies view teen drivers as very risky and potentially expensive clients to insure. According to the Insurance Institute for Highway Safety, drivers aged 16 to 19 are three to four times more likely to be in a fatal crash than drivers over the age of 20. As a result, teen drivers often pay three times more for car insurance than middle-aged drivers. The cost of auto insurance is generally the highest for drivers under 25 and starts to decrease as drivers gain more experience and enter their early 20s.

Age becomes less of a factor in determining insurance rates at age 25, with rates reaching their lowest point in a driver's mid-50s. However, insurance rates begin to increase again for drivers over 70 due to age-related factors such as vision or hearing loss and slowed response time.

While age is a significant factor, it is important to note that other factors, such as driving record, credit score, and location, also play a role in determining insurance rates. Additionally, insurance companies in some states, such as Hawaii and Massachusetts, are prohibited from using age as a rating factor.

Insurance Primary: Yours or Theirs?

You may want to see also

Location

Auto insurance providers look at multiple factors when calculating your car insurance quote, and your location is an important one. Your place of residence has a significant effect on your car insurance premium because insurance companies examine data that determines which areas' residents are most likely to file claims. These types of claims fall into two categories: claims arising from an auto accident and claims resulting from vandalism or theft of your vehicle.

Insurance companies calculate your likelihood of an auto accident based on the county or state in which you live, and your risk of vehicle theft or vandalism based on the city or neighbourhood in which you live. Car theft and vandalism typically occur while a vehicle is parked, so the location in which your car is parked plays a role in calculating your odds of theft or vandalism.

In general, you are more likely to get into an accident while driving in an urban area than in a rural one with less-populated roads. So, city drivers almost always pay more than rural drivers. However, drivers who live in rural areas might face higher premiums because most local residents have to drive long distances, which results in more time on the road and an increased risk of car accidents.

The state you live in can also affect your insurance rate. For example, Michigan guarantees unlimited personal injury protection and requires insurers to pay victims up to three years of lost wages, so the state's rates are among the highest in the US. On the other hand, Wisconsin is one of the cheapest states for car insurance because it has few cars on the road and fewer accidents.

Within a state, your ZIP code can also affect your insurance rate. If people in your ZIP code file a lot of auto insurance claims, insurers may designate your neighbourhood as high risk and quote higher premiums. This could be due to various location-related factors, such as harsh weather, high crime rates, or poorly designed or maintained roads.

Rideshare Gap Insurance: Filling the Coverage Gap

You may want to see also

Insurance history

A driver's insurance history is a key factor in determining their auto insurance rates. Insurance companies view a driver's past as an indicator of their future performance. A history of tickets, violations, or claims will increase the cost of current and future insurance premiums. Continuous coverage is important to insurance companies, who assume that drivers without it have been driving uninsured. Gaps in insurance coverage, therefore, make drivers seem riskier, and their rates tend to be higher.

The longer a driver goes without incidents, the better their insurance rates will be. After an accident or claim, insurance rates typically increase for three to five years, after which the incident is usually removed from the driver's record. Drivers with a history of at-fault accidents, traffic violations, or a DUI/DWI conviction may struggle to find insurance and may have to resort to non-standard car insurance or their state's assigned risk pool.

Insurance companies also consider a driver's credit history as part of their insurance history. Data shows that drivers with poor credit file more claims than those with better credit, and these claims are generally more expensive. As a result, drivers with lower credit scores are considered high-risk and tend to pay higher insurance premiums.

Auto Insurance in LA: Expensive or Affordable?

You may want to see also

Frequently asked questions

Yes, age is a significant factor in determining auto insurance rates. Younger and older drivers are considered higher-risk and tend to pay higher premiums.

Yes, your driving record is one of the most important factors in calculating your auto insurance rates. Accidents, tickets, and serious violations can cause your insurance costs to increase significantly.

Yes, your location can impact your auto insurance rates. Urban areas tend to have higher insurance rates due to a higher risk of theft, accidents, and vandalism. Insurance rates can also vary by state, depending on factors such as weather conditions and population density.