Auto insurance in Los Angeles is more expensive than the national average. The average cost of car insurance in Los Angeles is $2,276 annually, which is $365 higher than the California average and $681 more than the national average. The cheapest car insurance in Los Angeles starts as low as $47 per month for minimum coverage from Geico and $198 for full coverage from Mercury. The best car insurance companies with the cheapest rates in Los Angeles are Geico, Progressive, Travelers, Mercury, and Wawanesa.

What You'll Learn

How does location affect insurance costs?

The location of your residence has a significant effect on your car insurance premium. Insurance companies examine data that helps determine the likelihood of insurance claims in a particular area. These claims can be of two types: auto accidents and vehicle theft or vandalism. The likelihood of an auto accident is calculated based on the county or state in which you live, while the risk of vehicle theft or vandalism is assessed based on the city or neighbourhood.

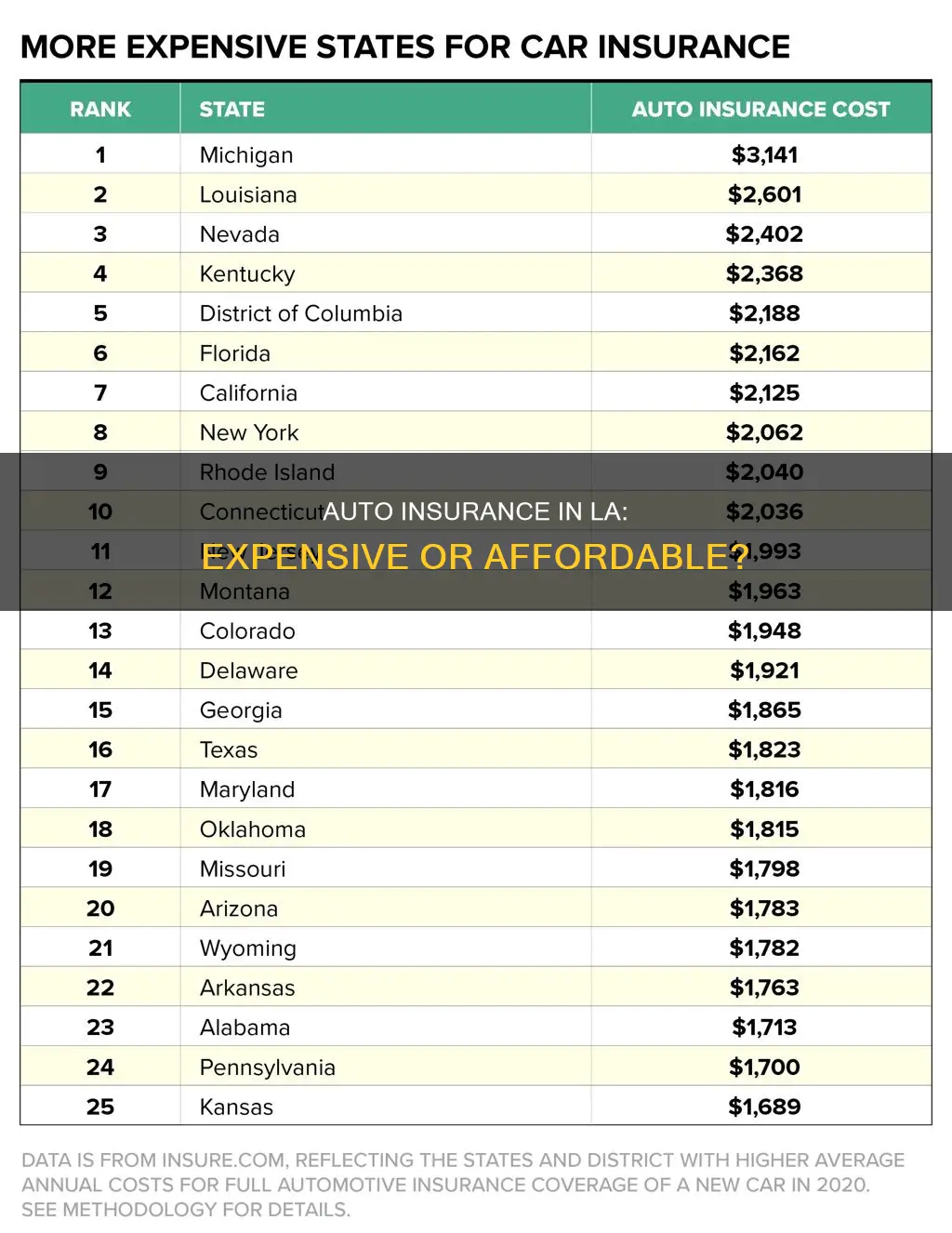

For instance, Los Angeles drivers tend to pay more for insurance coverage compared to statewide and national averages due to factors such as population density, traffic congestion, and auto theft rates. The average auto insurance rate in Los Angeles is $2,576 annually, higher than California's average of $1,782 and the national average of $1,543.

Location also influences home insurance rates. Factors such as fire protection, proximity to water sources, elevation, drainage systems, and crime rates can impact the premiums. For example, two identical homes on opposite sides of a street, with one serviced by a municipal fire department and the other by a volunteer fire department, will have different insurance costs due to the varying response times.

Allstate Auto Insurance: Understanding Your Coverage Options

You may want to see also

How does age affect insurance costs?

Age is one of the most important factors insurance companies consider when determining car insurance quotes. Young people have less driving experience, so they are more likely to cause an accident compared to other age groups.

Drivers under 25 years of age tend to pay the highest car insurance rates. Rates start to decrease as drivers gain more experience behind the wheel, reaching their lowest point when drivers are in their mid-30s to late 50s. After 60, rates begin to increase again as seniors start to experience slower reflexes that can impact their driving.

Here's a breakdown of average car insurance rates by age:

- A 16-year-old driver pays around $613 per month for full coverage insurance.

- A 25-year-old driver pays around $214 per month for full coverage insurance.

- A 60-year-old driver pays around $158 per month for full coverage insurance.

- A 75-year-old driver pays 19% more for car insurance than a 60-year-old, or around $187 per month.

- An 80-year-old driver pays around $209 per month for full coverage.

Young drivers can expect their car insurance rates to become much more affordable around the age of 25. Additionally, men tend to pay slightly more for car insurance than women, with the difference being more pronounced for drivers under the age of 21.

Auto Insurance: Allstate's Rates in TN vs. WY

You may want to see also

How does gender and marital status affect insurance costs?

Auto insurance in Los Angeles is more expensive than both the statewide and national averages. The average rate in the city is $2,576 per year, or $214.66 per month. This is due to factors such as population density, traffic congestion, and auto theft rates.

How Gender Affects Insurance Costs

In most states, gender plays a role in determining auto insurance rates, with males typically paying more during their teen and young adult years. This is because males are statistically more likely to get into accidents, receive tickets, and be arrested for DUI. However, as drivers age, the gender gap in rates narrows and eventually disappears.

How Marital Status Affects Insurance Costs

Marital status can also impact insurance costs. In Los Angeles, married 35-year-old drivers pay an average of $2,360 per year for car insurance, while their single counterparts pay around $3,097 annually. Being married is often seen as a sign of stability and lower risk, which can lead to lower insurance rates.

Auto Club Homeowners Insurance: College Student Coverage

You may want to see also

How does driving history affect insurance costs?

A driver's history is one of the most significant factors in determining car insurance costs. Insurance companies scrutinise an individual's driving record, including their history of moving traffic violations and at-fault accidents. This information is used to assess the driver's risk level and calculate their insurance premiums.

In the state of California, insurance providers are not permitted to use credit scores when determining insurance rates. However, they do consider the driver's age, gender, and marital status, with younger and less experienced drivers typically paying higher premiums due to their higher risk of accidents.

When it comes to driving records, insurance companies generally review the past three to five years of a driver's history. Minor violations, such as parking tickets or busted tail lights, usually result in fines but do not affect insurance rates. On the other hand, major violations like DUIs or leaving the scene of an accident can lead to a significant increase in insurance rates or even policy cancellation.

In states that utilise a point system for driving infractions, insurance companies may take these points into account when setting rates. Accumulating a certain number of points can result in a suspended or revoked licence, which will significantly impact insurance rates and may require high-risk insurance options.

To improve their driving record and lower insurance costs, drivers can take defensive driving courses, practice safe driving habits, and avoid violations like speeding tickets and accidents. Additionally, shopping around for insurance, taking advantage of discounts, and adjusting deductible amounts can also help reduce insurance costs.

Auto Insurance for Tesla: How Much Does It Cost?

You may want to see also

What are the minimum insurance requirements in Los Angeles?

In Los Angeles, California, auto insurance is mandatory. The state of California requires all drivers to carry minimum liability insurance, which is designed to provide a basic level of financial protection for drivers and victims of car accidents.

The minimum insurance requirements in Los Angeles are as follows:

- Bodily injury liability: $15,000 per person and $30,000 per accident. This coverage helps pay for medical expenses and lost wages if you cause an accident that injures someone else.

- Property damage liability: $5,000 per accident. This coverage helps pay for repairs to another person's property, such as their vehicle or a fence, if you are at fault in an accident.

While these are the minimum requirements, it is recommended that drivers get more coverage, especially if their car is new or worth more than $5,000 to $10,000. Full coverage includes comprehensive and collision insurance, which provide more protection and are therefore more expensive. Comprehensive coverage helps pay for damage caused by events out of your control, such as natural disasters, theft, and vandalism. Collision coverage helps pay for damage caused by accidents, whether you hit another vehicle or an object such as a tree or guardrail.

In addition to the minimum requirements, drivers in Los Angeles may also want to consider optional coverages such as uninsured/underinsured motorist coverage, medical payments coverage, and collision protection. These additional coverages can provide greater financial protection and peace of mind in the event of an accident or damage to your vehicle.

Switching State Farm Auto Insurance: A Smooth State Change

You may want to see also

Frequently asked questions

The average cost of car insurance in Los Angeles is around $2,200 per year for full coverage. The cost of car insurance varies depending on the driver's age, gender, marital status, driving record, and location.

Some of the cheapest car insurance companies in Los Angeles are Grange Insurance Association, USAA, Progressive, AAA, and Mercury.

The cost of car insurance in Los Angeles is higher than both the state and national averages. The average cost of car insurance in California is $1,622 per year, while the national average is around $1,500 per year.

The minimum insurance requirements in Los Angeles include bodily injury liability of $15,000 per person and $30,000 per accident, as well as property damage liability of $5,000 per accident.

To get cheap car insurance in Los Angeles, you can compare quotes from multiple insurers, ask for discounts, raise your deductible, and improve your credit score.