Allstate is the fourth-largest auto insurance company in the United States, known for its slogan, Are you in good hands?. The company offers a range of insurance products, including auto, home, renters, health, life, and pet insurance. While Allstate provides good coverage options and multiple car insurance discounts, its rates tend to be higher than the national average and other competitors in the market.

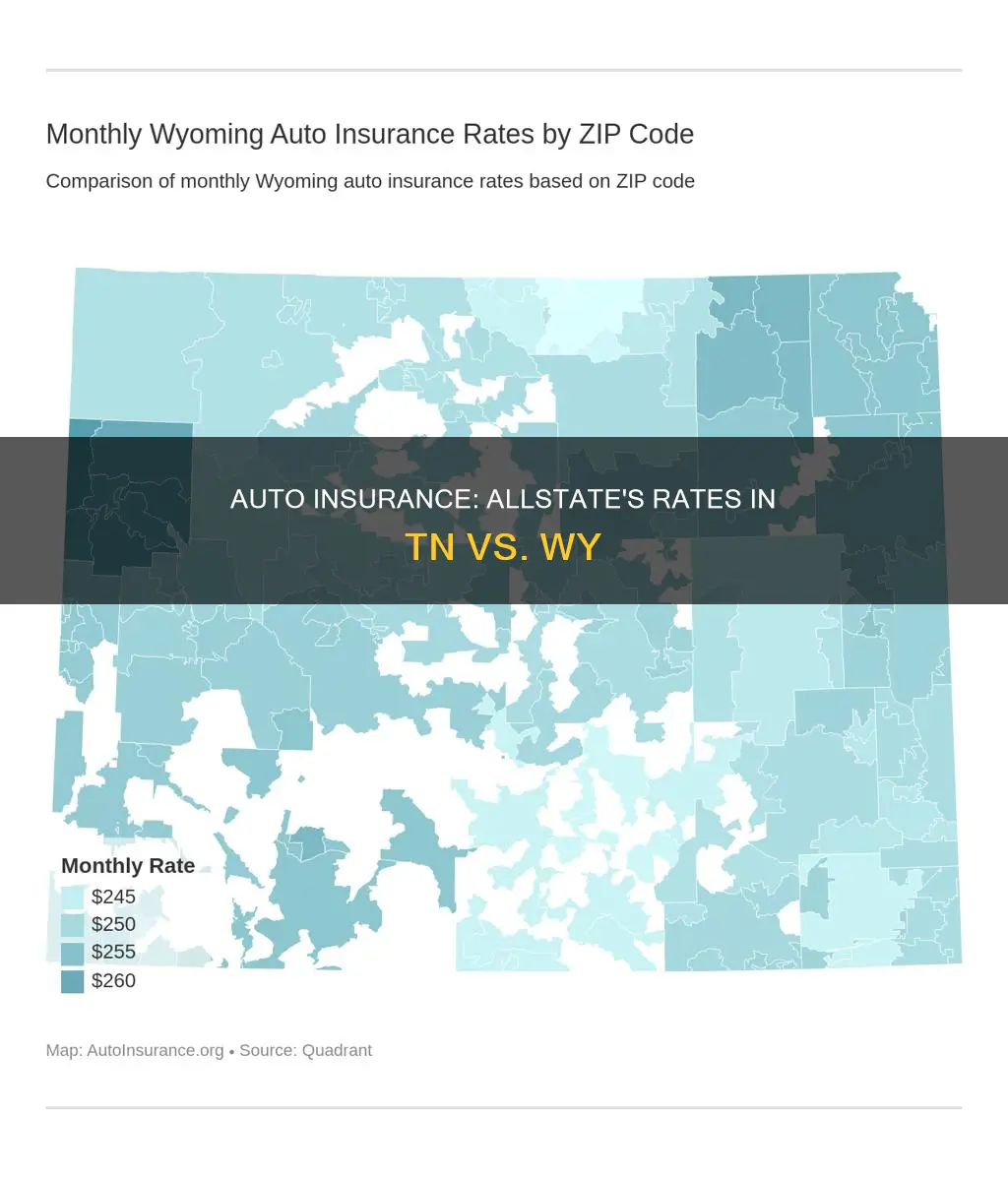

In this introduction, we will explore and compare the cost of Allstate auto insurance in Tennessee and Wyoming, evaluating whether there are notable differences between the two states. We will also analyse the factors that contribute to insurance rates and how they may impact the cost of Allstate auto insurance in these two states.

| Characteristics | Values |

|---|---|

| Average Annual Rate | $3,374 |

| Customer Service | Easy to contact |

| Opening a New Policy | Easy |

| Rates for Teen Drivers | Higher than the national average |

| Rates for Young Adult Drivers | Higher than the national average |

| Rates for Adult Drivers | Higher than the national average |

| Rates for Senior Drivers | Higher than the national average |

| Rates after a Speeding Ticket | Second-highest |

| Rates after an Accident | Second-highest |

| Rates after a DUI | Second-highest |

| Rates for Drivers with Poor Credit | Third-highest |

| Rates for Minimum Coverage | More than $1,200 higher than the national average |

| Rates for High Coverage | Nearly $1,400 more than the national average |

| Discounts | Anti-lock brake discount, Anti-theft device discount, EZ pay plan discount, Early signing discount, Pay in full discount, Responsible payer discount, Safe driving club discount, Smart student discount |

What You'll Learn

Allstate's rates for young drivers

Allstate's auto insurance rates for young drivers are higher than the national average. For instance, the average annual rate for a 17-year-old driver is $4,351 for males and $3,478 for females. For 25-year-old drivers, the average annual rate is $4,076 for males and $2,707 for females.

Allstate provides a range of discounts that may be applicable to young drivers, including:

- Good student discount

- Defensive driver/safe driving discount

- Multiple policy discount

- Anti-lock brake discount

- Anti-theft device discount

- Safe driving club discount

- Smart student discount

Additionally, Allstate offers two usage-based programs: Drivewise and Milewise. Drivewise tracks driving habits and rewards safe driving with discounts, while Milewise is a pay-per-mile program where rates are determined by mileage.

Understanding Commercial Auto Insurance: Class Code Basics

You may want to see also

Allstate's rates for senior drivers

Allstate auto insurance rates for senior drivers are 33% to 35% more expensive than the national averages. For a 60-year-old driver, the average annual rate is $2,987 for women and $3,053 for men. These rates are the highest in the industry, according to US News.

Allstate offers a "mature driver discount" of up to 10% for drivers aged 55 and older who are not working full-time or seeking full-time employment. This discount is dependent on the driver's continued safe driving record.

Senior drivers are considered a high-risk group by auto insurance providers due to the weakening of senses and reaction time that comes with age. However, they are also seen as being more cautious and spending less time on the road, which can lead to lower premiums.

In addition to Allstate, other insurance companies that offer discounts for senior drivers include GEICO, Farmers, and USAA.

Backdating Auto Insurance: Is It Possible?

You may want to see also

Allstate's customer service

In a survey conducted by MarketWatch, 59% of Allstate customers said they were completely satisfied with the ease of contacting customer service. However, in the same survey, only 33% of Allstate policyholders had filed a claim, while 67% had not. Of those who had filed a claim, 48% said it was resolved in under two weeks, and another 34% said it took between two and four weeks. Most found it easy to file a claim online.

Allstate's mobile app, which allows customers to access their policies, pay bills, file claims, and contact roadside assistance, has a rating of 4.8 out of 5 stars on the Apple App Store and 3.9 stars on Google Play.

Allstate has received an A+ rating from the Better Business Bureau (BBB), but a low score of 1.1 out of 5 stars from customer reviews on the BBB website. However, it's worth noting that only a small percentage of Allstate's overall customer base has left a review on the BBB website.

In the J.D. Power 2024 U.S. Auto Insurance Study, Allstate ranked above average in the regions of Florida, New England, North Central, and Texas, but scored below average in other regions. For claims satisfaction, Allstate scored slightly higher than the national average.

According to the National Association of Insurance Commissioners (NAIC), Allstate has a complaint ratio of 0.92, which is slightly lower than the national average of 1.0.

Gap Insurance Tax Status in Wisconsin

You may want to see also

Allstate's claims handling

Allstate offers a range of insurance coverage, including bodily injury/property damage liability, collision insurance, comprehensive insurance, medical payments, personal injury protection, and underinsured/uninsured motorist insurance. They also provide additional coverage options such as rideshare insurance, roadside coverage, rental reimbursement, and classic car insurance.

In terms of pricing, Allstate tends to be more expensive than its competitors, with average full-coverage rates of $3,340 per year or $278 per month. Minimum-liability plan prices average about $1,194 per year or $100 per month. The pricing varies depending on factors such as age, location, driving history, credit score, gender, and marital status.

Becoming an Auto Insurance Agent in Missouri: A Guide

You may want to see also

Allstate's customer loyalty

Allstate is tied with Geico for sixth in customer loyalty. A survey found that 50% of respondents said they were very likely to renew their Allstate policy, and just over 42% said they were very likely to recommend Allstate to someone looking for car insurance. In comparison, Progressive outperforms Allstate in customer loyalty, with Allstate customers being more likely to stay with the company than Allstate's customers. Progressive also ranks higher than Allstate in the areas of likelihood to renew and likelihood to recommend.

Allstate has excellent customer service and claims handling. In a survey, 59% of Allstate customers said they were completely satisfied with the ease of contacting customer service. For comparison, 56% of Progressive customers said the same. In the area of claims handling, 53% of those who’d filed a claim with Allstate were completely satisfied with the way their claim was resolved, while 57% gave the same rating to Progressive.

Allstate also has a range of coverage options and a large number of discount opportunities for drivers. The company offers 12 types of car insurance coverage, including rideshare insurance and classic car coverage, as well as two usage-based programs that offer discounts based on safe driving habits and mileage.

Does Your US Auto Insurance Cover Canada?

You may want to see also

Frequently asked questions

Allstate auto insurance is likely to be cheaper in Tennessee than in Wyoming. However, it is important to note that insurance rates can vary based on individual factors such as age, gender, driving record, credit score, vehicle type, and ZIP code. To get an accurate quote, it is recommended to contact Allstate directly or compare rates online.

The cost of Allstate auto insurance is influenced by various factors, including age, gender, driving record, credit score, vehicle type, and ZIP code.

Allstate is known for having higher rates compared to competitors like Geico, Progressive, and State Farm. It is ranked as the most expensive option among the companies evaluated in some reviews.

Yes, Allstate offers a wide range of discounts, including multiple policy discounts, good student discounts, safe driving discounts, and pay-in-full discounts. These discounts can help lower the overall cost of auto insurance for eligible customers.

Allstate receives mixed reviews for its customer service. Some customers praise the company for its easy-to-contact customer service and positive claims handling experience, while others have reported issues with policy cancellations and the claims process. Overall, Allstate ranks near the bottom when compared to other top insurers in terms of customer service and claims handling.