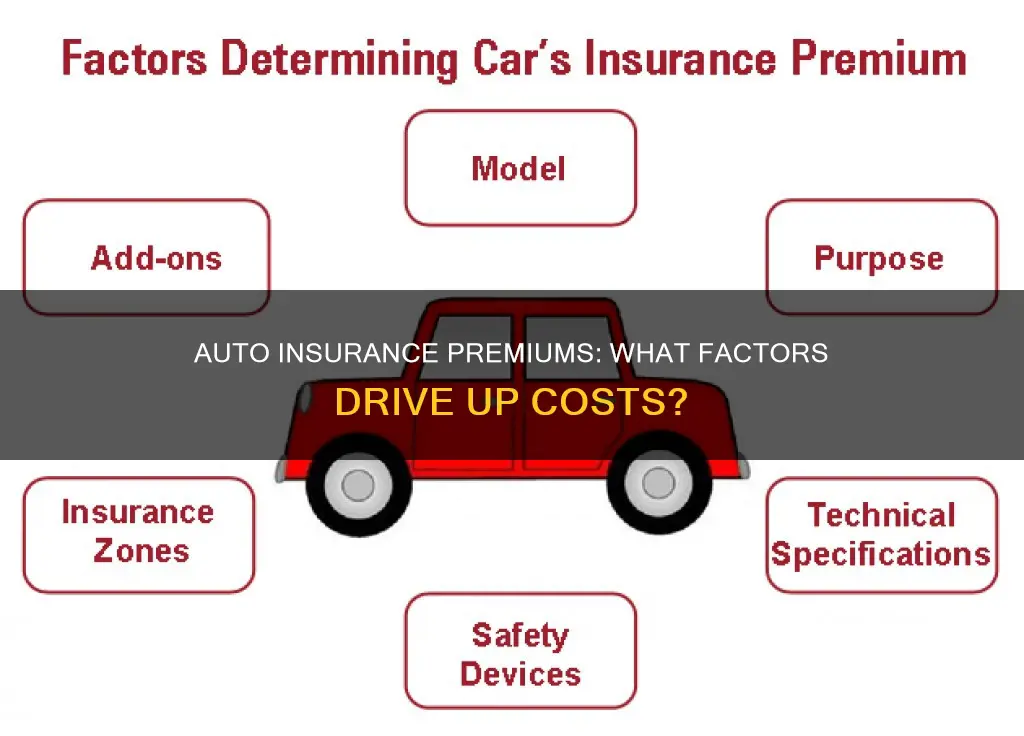

Auto insurance rates have been on a steep rise, with the cost of car insurance in the US rising by 20.6% in 2023. There are several factors that influence the cost of auto insurance, some of which are within the control of the insured and some that are not. Factors that influence the cost of auto insurance include age, gender, driving history, credit score, location, vehicle type, and repair costs. For example, insurance companies often charge higher rates for younger drivers due to their lack of driving experience and the increased risk of accidents. Additionally, the cost of repairing vehicles has been increasing due to factors such as supply chain issues and the inclusion of new technologies in cars, such as microprocessors and cameras. These rising repair costs are then passed on to consumers in the form of higher insurance rates.

What You'll Learn

Inflation and the rising cost of car parts

The rising cost of car parts can be attributed to various factors, including supply chain issues, increased shipping costs, and wage increases for mechanics. Additionally, the inclusion of new technologies in vehicles, such as microprocessors, cameras, and sensors, has also contributed to the higher cost of repairs. These technologies are often damaged in accidents, even minor ones, leading to expensive repair or replacement costs.

The impact of inflation on car parts and repairs has been significant. In 2022, the Consumer Price Index (CPI) for motor vehicle maintenance and repairs increased by nearly 12% year-over-year. This rise in repair costs has been reflected in the increase in insurance premiums, with car insurance prices as part of the CPI rising by 22.2% year-over-year in March 2024.

The increase in car parts and repair costs has also been influenced by the law of supply and demand. The shortage of new cars has fueled demand for used cars, causing prices for used vehicles to surge. This, in turn, has led to an increase in the cost of car parts and repairs for used cars.

The rising cost of car parts and repairs has had a significant impact on the affordability of car ownership. With sticker prices, refueling costs, and insurance premiums also on the rise, car owners are facing increased financial burdens. While there are ways to mitigate these costs, such as shopping around for insurance providers or increasing deductibles, the overall trend of increasing costs due to inflation is undeniable.

Auto Insurance: Is It Mandatory?

You may want to see also

An increase in claims in your area

The likelihood of filing a claim increases if you live in an area with high crime rates or an area that is prone to extreme weather events. For example, robberies may indicate that your neighbourhood is becoming less safe, and weather-related damage claims have been on the rise due to the increasing frequency and severity of extreme weather events.

Additionally, the cost of repairing vehicles has been increasing due to supply chain shortages, mechanic wage increases, and the presence of additional technologies in vehicles, such as microprocessors, cameras, and sensors. These factors contribute to higher insurance rates, as insurers need to pay out larger amounts for claims.

It's important to note that insurance premiums are not raised arbitrarily, and any increase in your car insurance rate is typically tied to insurance risk. While you may not be able to control all factors influencing your insurance rate, understanding the reasons behind the increase can help you make informed decisions and take appropriate actions to mitigate the impact.

Vehicle Insurance: Protection Essential

You may want to see also

Your age and gender

Age and gender are significant factors in determining auto insurance rates. In most states, young and old drivers are considered high-risk and are charged higher insurance premiums.

Teens

Teenagers are considered the riskiest drivers to insure. Statistically, drivers aged 16 to 19 get into almost three times as many fatal car accidents as any other age group. This is reflected in the cost of insurance, with 16-year-olds paying, on average, $7,581 per year for car insurance. The cost is also high for 18-year-olds, who pay the highest premiums out of all age groups.

Adults

For adults, the cost of auto insurance coverage generally begins to drop by the time a driver reaches their early 20s. By the age of 25, drivers might notice a significant reduction in their premiums. Throughout adulthood, provided that drivers have a history of safe driving and no insurance claims, premiums will usually continue to decrease as drivers gain more experience.

Seniors

As drivers reach their senior years, insurance premiums start to increase again. This is due to risk factors such as vision or hearing loss and slowed response time, which make seniors more likely to get into accidents. However, while seniors may see their insurance premiums increase, they will likely not pay the high rates of teen drivers, assuming they have a clean driving record.

Gender

In most states, gender is also used as a rating factor when determining car insurance premiums. In general, men are statistically more likely to engage in risky driving behaviour and are, therefore, riskier to insure. However, this does not automatically mean that men pay more than women for coverage. While the general trend of premiums shows that men pay more than women, this depends on numerous factors, including location, credit score, and driving record.

Business Insurance and Commercial Auto: What's the Difference?

You may want to see also

Your marital status

Marital status can impact car insurance rates, with married couples often paying less than single, divorced, or widowed drivers. On average, a married driver pays $96 less per year than a single driver. This is because married people are often viewed as safer and more financially stable drivers. They are also more likely to be homeowners, bundle their policies, cover multiple vehicles, and insure more than one driver on one policy.

Data shows that married couples file fewer claims than single, divorced, or widowed drivers, contributing to their classification as less risky clients. The average married couple pays $116 per month for car insurance, while the average single driver in the US pays $1,484 per year. Divorced and widowed drivers also tend to pay more for car insurance than married drivers, as they are statistically more likely to get into accidents and file claims.

However, it is important to note that insurance rates are based on various factors, including driving history, credit score, age, location, and vehicle make and model. While marital status can play a role in determining rates, other factors may also significantly influence the cost of car insurance.

Auto Insurance: Validity and Expiry Dates Explained

You may want to see also

Your credit score

Insurance companies argue that there is a correlation between credit and the chances of filing a car insurance claim. They claim that individuals with higher credit scores are less likely to file a claim, and therefore reward these customers with lower rates. Conversely, drivers with lower credit scores are seen as higher-risk and are often charged more for their insurance.

There are several factors that contribute to a credit-based insurance score:

- Outstanding debt: The amount of debt you currently have impacts your score.

- Credit history length: A longer credit history can improve your score.

- Credit mix: Having a mix of credit types, such as credit cards, auto loans, and mortgage loans, can positively affect your score.

- Payment history: A consistent record of on-time payments is essential for a good credit-based insurance score.

- Pursuit of new credit: Applying for new lines of credit can negatively impact your score.

It's important to note that insurance companies do not consider factors such as sex, marital status, age, ethnicity, address, or income when determining your credit-based insurance score. Additionally, getting a car insurance quote or changing insurance companies does not affect your credit score.

While improving your credit score can take time, it is worth the effort to ensure you are getting the lowest possible rate for your auto insurance. Some ways to improve your credit score include paying your bills on time, keeping hard credit inquiries to a minimum, monitoring your score regularly, and maintaining old lines of credit.

Full Coverage Auto Insurance: When to Drop

You may want to see also

Frequently asked questions

There are several factors that influence the cost of auto insurance. These include your age, gender, driving record, location, and the type of car you drive. Additionally, insurance companies take into account the frequency of claims in your area, the cost of repairs, and the level of risk they assume when covering you.

To lower your auto insurance premium, you can shop around for quotes from different insurers, change your coverage level, consider bundling policies, raise your deductible, and improve your credit score. It is also important to regularly review your bill and discuss potential discounts with your provider.

Insurance companies evaluate various personal statistics to determine your auto insurance premium. These include your age, gender, driving record, location, and the make and model of your vehicle. They use this information to assess the level of risk they are taking on by insuring you and set your premium accordingly.