There are a number of factors to consider when deciding whether to drop full-coverage auto insurance. Full coverage typically includes liability, collision, and comprehensive insurance. While it's a good idea to have full coverage on a new, rare, or expensive car, it may not be worth it for older, cheaper cars. If your car is paid off, not being driven, or covered by another policy, you may want to consider dropping collision coverage. Similarly, if your car is worth less than a few thousand dollars, you may want to drop comprehensive coverage. Ultimately, the decision depends on your financial situation, the type of car you drive, and the specific coverage you carry.

| Characteristics | Values |

|---|---|

| When to drop full coverage | When the cost of insurance equals or exceeds the potential payout |

| When the car is old or has high mileage | |

| When the car is not worth much | |

| When you have a big emergency fund | |

| When you have paid off your car loan | |

| When you can afford repairs or replacement out of pocket | |

| When you rarely drive | |

| When you have a high-risk tolerance |

What You'll Learn

When to drop full coverage on a new car

Understanding Full Coverage

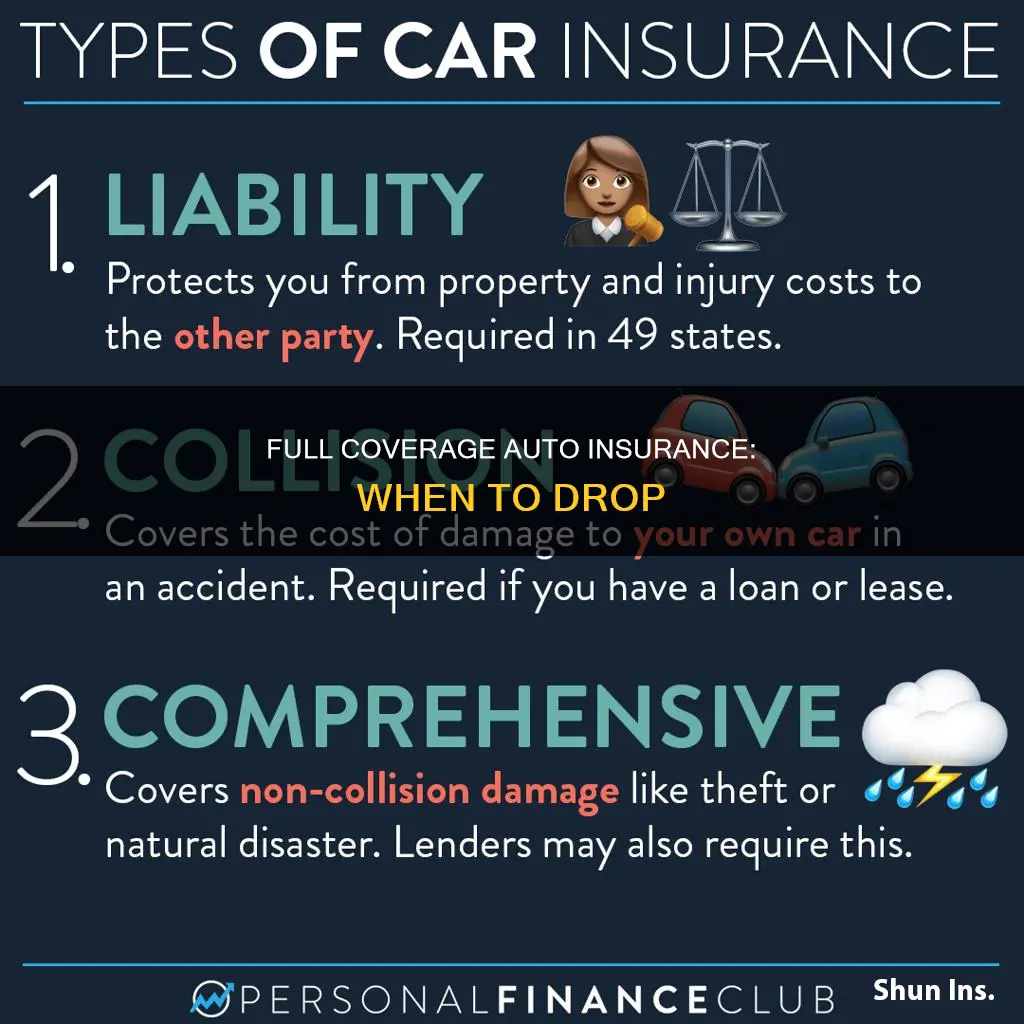

Firstly, it's important to understand what full coverage entails. Full coverage auto insurance typically includes liability, collision, and comprehensive insurance. Liability insurance covers damages and legal fees when you are at fault in an accident. Collision insurance covers repairs or replacement of your car in an accident, regardless of fault. Comprehensive insurance covers damage to your car from incidents other than collisions, such as theft, vandalism, or natural disasters.

Factors to Consider

When deciding whether to drop full coverage on a new car, consider the following:

- Car Value and Depreciation: A new car loses value over time, with Experian stating that a car loses 20% of its value in the first year of ownership. As your car depreciates, assess its value annually against sources like Kelley Blue Book to determine if the cost of full coverage is still worthwhile.

- Cost of Insurance vs. Potential Payout: If the cost of your insurance equals or exceeds the potential payout for repairs or replacement, it may be time to consider dropping full coverage. This usually happens when your car gets older and its value decreases.

- Affordability and Risk Tolerance: Evaluate your financial situation and risk tolerance. If you can afford to replace your car or pay for repairs out of pocket, you may not need full coverage. However, if you don't have savings and full coverage provides peace of mind, it may be worth retaining.

- Driving Habits and Mileage: Infrequent drivers or those with low mileage are less likely to be involved in accidents. If you rarely drive your new car, you may be comfortable dropping full coverage.

- State Requirements and Lender Mandates: Different states have varying insurance requirements, so check the regulations in your area. Additionally, if you leased or financed your new car, your lender likely requires full coverage until the loan is paid off.

Making the Decision

When deciding whether to drop full coverage on a new car, weigh the potential savings against the financial risk. If your car is several years old and has depreciated significantly, the cost of full coverage may outweigh the benefits. However, if you have an expensive or rare new car, full coverage can provide valuable protection. Ultimately, the decision depends on your personal circumstances, the value of your car, and your comfort level with risk.

E-350: Commercial Vehicle Insurance Classification

You may want to see also

When to drop full coverage on an old car

Full coverage car insurance is a catch-all term for insurance that covers you, other drivers, and your vehicles. It generally includes liability, collision, and comprehensive insurance. While it's a good idea to have full coverage on a new, rare, or expensive car, it may not be worth it for older, cheaper cars.

When to Drop Full Coverage

You should consider dropping full coverage on an old car when the cost of insurance equals or exceeds the potential payout should your car be damaged or stolen. This is usually the case when your car is around 10 years old, but this will depend on the value of your car and its replacement parts.

You may also want to drop full coverage if you are willing to pay for repairs out of pocket, or if you would prefer to save up for a new car instead of paying for extra insurance. For example, if your car is only worth $850, it doesn't make sense to pay for full coverage.

Another rule of thumb is to drop full coverage when your annual premium meets or exceeds 10% of your car's value.

When to Keep Full Coverage

If you have a loan on your vehicle, your lender will likely require you to maintain full coverage for the duration of your financing period.

If you have a new car, full coverage can save you from a financial hole if it's damaged or totaled.

If you have an expensive car, full coverage can help you avoid spending money needlessly on repairs.

If your car is expensive to repair, keeping full coverage can save you a considerable amount of money.

If you don't have much in savings, full coverage insurance will protect you from potentially crippling repair bills.

Dropping Comprehensive or Collision Coverage

You can also drop certain aspects of a full-coverage policy without reducing your protection to minimum coverage. For example, you might want to drop comprehensive coverage if:

- Your car is garaged or otherwise protected.

- You plan to replace your car next time it needs big repairs.

- Your car is worth less than the deductible on your comprehensive coverage.

Gap Insurance Refund: Calculating Your Return

You may want to see also

When to drop full coverage on a financed car

If you have a financed car, your lender will likely require you to carry a full-coverage auto insurance policy until your loan is paid off. This is because your vehicle is the collateral for your loan. If your car is stolen or totaled and you don't have full coverage, you'll still need to pay off the loan for a vehicle you no longer have.

Full-coverage car insurance usually refers to a policy that includes the state-minimum coverage and adds at least collision and comprehensive insurance. Collision insurance covers the repair or replacement of your car if you are in an accident with another vehicle or a stationary object. Comprehensive insurance covers damage to your car that occurs due to perils other than collision, such as vehicle theft, falling objects, vandalism, fire, floods, hail, and natural disasters.

Once you've paid off your loan, you can decide whether to keep full coverage on your car. Here are some reasons you may want to keep or drop full coverage:

Reasons to keep full coverage:

- You have a newer car: Newer cars have higher replacement costs than older cars. Full coverage can save you from a financial hole if your new car is damaged or totaled.

- You have an expensive car: Even if your car isn't new, certain makes and models retain their value. Full coverage can help you avoid spending a lot of money on repairs.

- Your car is expensive to repair: Keeping full coverage can save you a considerable amount of money if you need to replace a damaged or stolen part.

- You have a classic or rare vehicle: Some older cars still have a fair amount of value. If you have a classic or rare vehicle that has held its value, you may want to keep full coverage to protect your investment.

- Peace of mind: You may feel uneasy about dropping full coverage. In this case, the peace of mind that comes from insurance may be more valuable than the premium you pay.

Reasons to drop full coverage:

- Your car is old and has high mileage: The value of your car drops as it gets older and accumulates more miles. Older cars with high mileage may not need the protection of full coverage.

- You can't afford full coverage: If the cost of auto insurance is a financial burden, consider stepping down from full coverage to save money. You can talk to your insurance agent about finding a policy that is more affordable without significantly increasing your risk.

- Your car is worth less than the cost of your policy: If your car isn't worth much, you may be better off putting the money you would spend on full coverage into a savings account.

- You have a large emergency fund: If you have significant savings, you may decide that you don't need full coverage and can pay for repairs or a new car if needed.

- You rarely drive: If you don't drive much, you are less likely to damage your vehicle in an accident than someone who drives frequently.

In summary, whether to keep or drop full coverage on a financed car depends on various factors, including the type of car you drive, your financial situation, and your risk tolerance. It's important to assess your needs and risk level and consider how car insurance fits into your budget.

Vehicle Insurance Certificate: What You Need to Know

You may want to see also

When to drop full coverage on a car you own

Full coverage car insurance is a combination of liability, collision, and comprehensive insurance. Liability insurance covers the costs that arise from accidents that you are responsible for, such as medical expenses and legal fees. Collision insurance covers the repair or replacement of your car if you are in an accident with another vehicle or object. Comprehensive insurance covers damage to your car from events other than a collision, such as theft, vandalism, or extreme weather.

The decision to drop full coverage on a car you own depends on several factors, including the value of your car, your financial situation, and the type of coverage you carry. Here are some scenarios when dropping full coverage on a car you own may be a good idea:

- Your car isn't worth much: If your car is old or has high mileage, its value has likely depreciated significantly. In this case, the cost of full coverage insurance may outweigh the potential payout if your car needs to be repaired or replaced. A good rule of thumb is to drop full coverage when your annual premium meets or exceeds the estimated payout for replacement.

- You have a large emergency fund: If you have substantial savings, you may not need full coverage insurance to protect you from unexpected repair bills.

- You rarely drive: If you don't drive your car often, you are less likely to be involved in an accident and may not need the level of coverage provided by full coverage insurance.

- You have a high-risk tolerance: If you are comfortable with the financial risk of paying for accident repairs yourself, you may choose to save money by dropping full coverage.

- You can afford repairs or a new car: If you have the financial means to cover the cost of repairs or to purchase a new car if needed, you may not need the added protection of full coverage insurance.

On the other hand, there are also situations where maintaining full coverage on a car you own may be beneficial:

- You have a new or expensive car: Newer cars and certain makes and models tend to have higher replacement costs. Full coverage can provide financial protection in the event of an accident or damage.

- Your car is expensive to repair: If your car has costly repair or replacement parts, full coverage can help offset these expenses.

- You have a loan on the car: If you are still making payments on your car loan, you may be required by the lender to maintain full coverage until the loan is paid off.

- You feel uneasy about dropping full coverage: The peace of mind that comes with full coverage insurance may outweigh the cost of the premium for some individuals.

Insuring Antique Vehicles: Registration Requirements

You may want to see also

When to drop full coverage on a car with a loan

If you are purchasing a car with a loan, your lender will require you to maintain full coverage on the car for the duration of your financing period. This is to protect their investment. Full coverage includes liability insurance, collision insurance, and comprehensive insurance.

Liability insurance covers costs that arise from accidents for which you are responsible, such as medical expenses and legal fees. Collision insurance covers the repair or replacement of your car if you are in an accident with another vehicle or a stationary object. Comprehensive insurance covers damage to your car due to causes other than collision, such as theft, vandalism, and extreme weather.

Once you have paid off your loan, you are no longer required to maintain full coverage. At this point, you may choose to reduce your coverage to liability insurance only, which will significantly reduce your insurance premiums. However, this also means that the insurance company will not pay to repair or replace your car if it is totaled, and you will be solely responsible for these costs.

When deciding whether to drop full coverage, it is important to consider the value of your car. If your car is new or expensive, full coverage can save you from a financial hole if it is damaged or totaled. On the other hand, if your car is old or has high mileage, it may not be worth the cost of repairs, and you may prefer to save for a new car instead.

Another factor to consider is your financial situation. If you have a large emergency fund, you may not need full coverage as much as someone who does not have savings. Additionally, if the cost of your insurance is equal to or higher than the potential payout, it may be more cost-effective to drop full coverage.

In summary, while you are required to maintain full coverage on a car with a loan, once the loan is paid off, the decision to keep or drop full coverage depends on your car's value, your financial situation, and your risk tolerance.

Umbrella vs. Gap Insurance: What's the Difference?

You may want to see also

Frequently asked questions

Full-coverage car insurance is a combination of liability, collision, and comprehensive insurance. Liability insurance covers costs that arise from accidents for which you are responsible, such as medical expenses and legal fees. Collision insurance covers the repair or replacement of your car if you are in an accident with another vehicle or a stationary object. Comprehensive insurance covers damage to your car from causes other than collision, such as theft, vandalism, and extreme weather.

You should consider dropping full-coverage auto insurance when the cost of insurance equals or exceeds the potential payout if your car needs to be repaired or replaced. This usually happens when your car is five or six years old.

Some reasons to drop full-coverage auto insurance include:

- Your car is old and has high mileage.

- You have a large emergency fund and can afford to pay for repairs or replacement out of pocket.

- You rarely drive your car, reducing the risk of an accident.

- Your car is worth less than the cost of your full-coverage policy.

Yes, there are situations where it makes sense to maintain full-coverage auto insurance. For example:

- You have a new or expensive car with high replacement costs.

- Your car is rare or classic and has retained its value.

- You have an expensive car to repair.

- You want peace of mind and are willing to pay a premium for comprehensive protection.

In addition to liability, collision, and comprehensive insurance, full-coverage auto insurance can also include uninsured or underinsured motorist coverage, personal injury protection, and gap insurance. These components provide additional protection in the event of an accident or damage to your vehicle.