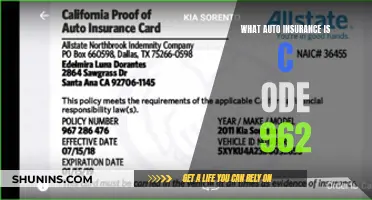

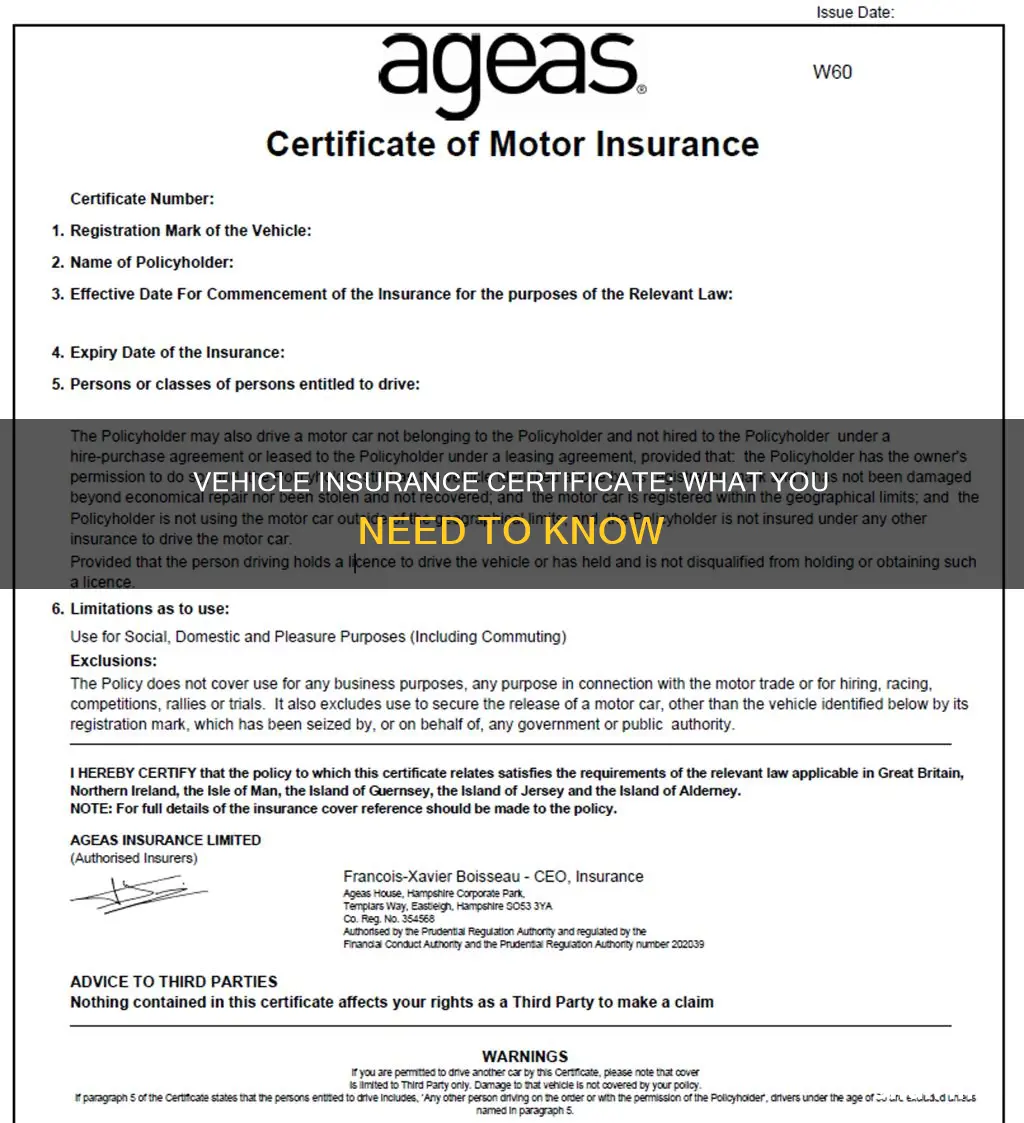

A vehicle insurance certificate, also known as a certificate of insurance or certificate of liability insurance, is a document that proves you have the minimum third-party insurance required by law to drive your vehicle. It is issued by your insurance company or broker and contains key information about your insurance policy, such as your name, your vehicle's registration number, the dates your insurance cover is valid, and the type of insurance you have. This certificate is important as it serves as proof of insurance when needed and helps keep you legal and protected financially.

| Characteristics | Values |

|---|---|

| Purpose | Proof of insurance |

| Format | One- or two-page document |

| Issuing Entity | Insurance company or broker |

| Storage | In vehicle, on phone, or at home/office |

| Coverage Details | Vehicle information, policyholder name, insurance type, additional drivers, policy dates, etc. |

| Use Cases | Police stops, accidents, renting a car, repairs, registration, buying/selling a car, etc. |

What You'll Learn

What is a vehicle insurance certificate?

A vehicle insurance certificate, also known as a certificate of motor insurance, is a document that proves you have insurance for your vehicle, as required by law. It is issued by the insurance company or broker and typically includes key details about your insurance policy, such as:

- Your name as the policyholder

- Your vehicle's registration number

- The dates your insurance cover is valid from (start and end date)

- The type of car insurance you have (e.g. third-party, third-party fire and theft, comprehensive)

- Any additional drivers covered by the policy (depending on your coverage)

This certificate is important because it helps you stay within the law, serves as proof of insurance when needed, and provides peace of mind that you have financial protection in case of an accident. It is also used for communication with other organisations, such as when registering a new car or transferring ownership.

In most cases, you will receive your certificate of motor insurance right after purchasing car insurance and paying the premium. It is recommended to keep this certificate in your vehicle at all times, as you may be asked to present it during police inspections or when renting or repairing your vehicle.

Dropping Vehicle Insurance: Sunday Options

You may want to see also

When do you need to show your certificate?

A certificate of motor insurance is a crucial document that you should keep in your vehicle at all times. While you don't need to present it every time you drive, there are several instances when you must produce a valid insurance certificate:

During Traffic Stops or Police Interactions:

Police officers may request to see your certificate during routine checks or if they pull you over. It allows them to verify that your car is insured and helps them enforce the law. In most US states, you can show an electronic copy of your insurance, but some states, like New Mexico, require a physical copy.

After a Road Accident:

If you're involved in a collision, your insurance certificate is essential for exchanging information with the other driver and starting the claims process. It contains key details like your insurer's name, policyholder's name, and policy dates. It also acts as proof of valid insurance, which is crucial for the claims process and any legal actions that might follow.

When Registering, Buying, or Selling a Vehicle:

Government offices typically require proof of insurance before registering your vehicle. The certificate confirms that your car meets the legal insurance requirements. When buying or selling a used car, you may also want to see the other party's certificate to verify their insurance status.

For Renting a Car or Using Certain Facilities:

Rental car companies and some car parks may ask for your insurance certificate to ensure the vehicle is properly insured before you drive it off their lot or enter their premises.

During an MOT Inspection:

In some places, you may be required to present your insurance certificate when your vehicle undergoes an MOT (Ministry of Transport) inspection.

Remember, while you don't always need to carry your insurance certificate, it's a good idea to keep it in your vehicle to comply with the law and be prepared for situations where proof of insurance is necessary.

Insuring Yourself to Drive Hospital Vehicles

You may want to see also

What is the importance of a certificate of insurance?

A certificate of insurance is a crucial document for businesses and individuals alike. It is a document issued by an insurance company or broker that verifies the existence of an insurance policy and summarises its key aspects, such as the type of coverage, policy limits, effective dates, and contact information for the insurance company. This certificate is often used to prove that a business or contractor has liability insurance and workers' compensation to complete contract work.

The importance of a certificate of insurance is multifaceted. Firstly, it serves as concrete evidence that a business or individual has valid insurance coverage. This is particularly important when engaging in partnerships, signing leases, or bidding on projects, as stakeholders will often require proof of financial protection. A certificate of insurance demonstrates a business's commitment to risk management and its ability to fulfil obligations in unforeseen circumstances.

Secondly, a certificate of insurance is essential for regulatory compliance. Many industries and jurisdictions mandate specific insurance coverage requirements for businesses to operate legally. By obtaining a certificate of insurance, businesses can ensure they adhere to these regulatory frameworks and maintain their legal and ethical standards. Failure to meet these standards can result in penalties, fines, or legal consequences.

Moreover, a certificate of insurance plays a pivotal role in mitigating risks. In today's litigious environment, businesses and individuals face potential liabilities ranging from property damage to bodily injury. A certificate of insurance provides financial protection and peace of mind, allowing them to navigate challenges with resilience. By transferring certain risks to insurance carriers, businesses can focus on their core operations without the burden of unforeseen losses.

Additionally, a certificate of insurance is necessary when applying for certain licences or permits. For example, in the case of driving a vehicle, most states require drivers to carry a minimum level of liability insurance and provide proof of insurance if requested by law enforcement. A certificate of insurance serves as this proof and can help drivers avoid tickets, fines, or even jail time for driving without insurance.

In summary, a certificate of insurance is of utmost importance as it provides proof of insurance coverage, ensures regulatory compliance, mitigates risks, and is often required by law. It is a vital document that protects businesses and individuals from financial and legal consequences, allowing them to operate with confidence and peace of mind.

Burning Vehicle for Insurance: The 'How-To' Guide

You may want to see also

What information is stated on the certificate?

A certificate of motor insurance is a document that proves you hold the minimum third-party insurance for your vehicle, as required by law. It is usually a one- or two-page document that includes key details about your insurance policy. While the information on the certificate may vary slightly depending on your insurer and specific coverage, here is a list of what is typically stated on the certificate:

- Vehicle registration and description: The registration/number plate of your vehicle, and possibly the make, model, and year of production.

- Name of policyholder: The name of the person who holds the policy (usually yourself).

- Date of policy commencement: The date the period of insurance begins.

- Expiry date of policy: The last day of the period of insurance (typically 365 days after the start of the cover date).

- Permitted drivers: A list of drivers (including the policyholder and any named drivers) permitted to drive the vehicle, provided they hold a valid licence.

- Limitations and class of use: This section describes which vehicles are covered by the policy and the type of driving (i.e. social, commuting, business, etc.) you're covered for. It will also outline exclusions from cover, such as racing your vehicle or using it for business purposes if you haven't declared it.

- Unique ID: Each certificate has a special certificate number that acts as a reference code for your policy.

- Insurer's details: The name and address of your insurance company, which is useful if you need to contact them about your policy.

- Car's details: The exact vehicle your insurance covers, usually specified by the registration number.

- Type of cover: The type of insurance coverage you have, such as third-party, third-party fire and theft, or comprehensive.

- Policy excess: The voluntary excess you have chosen to pay in the event of making a claim.

Insuring Your New Financed Vehicle

You may want to see also

Where and how should you get the certificate?

Obtaining a vehicle insurance certificate is a straightforward process. Here are the steps you need to follow:

Contact Your Insurer

You can reach out to your insurance company by phone or through their website. It is always a good idea to have your policy number and other relevant details handy when contacting them. Inform them that you need a copy of your vehicle insurance certificate and specify why you need it.

Understand the Delivery Options

Different insurance companies may have varying delivery options. Some may email the certificate, while others may offer to mail it to your address or provide access through their online portal. If you require the certificate urgently, be sure to inform your insurer so they can expedite the process if possible.

Verify the Details

Before finalising the request, double-check that all the information on the certificate is accurate and up to date. This includes confirming that the policy number, effective dates, vehicle details, and policyholder name are correct.

Alternative Methods

If you are unable to obtain the certificate directly from your insurer, there are a few alternative methods to consider:

- Insurance Broker: If you used an insurance broker to purchase your policy, they may be able to provide you with a copy of the certificate.

- Digital Services: Many insurance companies offer digital services that allow policyholders to access and download their insurance documents, including the insurance certificate. You can log in to your account on their website or mobile app and download a digital copy.

- Print a Copy: If you have received the certificate previously, either digitally or physically, you can print a copy to keep in your vehicle.

It is important to note that you should always keep a copy of your vehicle insurance certificate in your car, as it may be required during police inspections, accidents, or when renting a vehicle. Additionally, some states require physical proof of insurance, so it is best to keep it in your wallet or glove compartment as well.

Vehicle Registration and Insurance: Keep or Toss?

You may want to see also

Frequently asked questions

A vehicle insurance certificate is a document that proves you have insurance for your vehicle, as required by law. It is issued by the insurance company and contains key details about the insurance policy, such as the name of the policyholder, the vehicle's registration number, and the dates the insurance cover is valid.

You need a vehicle insurance certificate whenever you are driving your vehicle. It is required by law to be carried with you in case of an accident or a police stop. You may also need it when renting a car, registering your vehicle, or getting repairs.

You will automatically receive a vehicle insurance certificate when you purchase or renew your car insurance policy. You can typically get it from your insurance company or broker, either electronically or physically. There is usually no additional cost for the certificate.