Commercial auto insurance is a crucial aspect of running a business, and understanding class codes is essential for ensuring adequate coverage and accurate premium payments. These codes are numerical identifiers assigned to different types of jobs, helping insurance companies assess the level of risk associated with various occupations. In the context of commercial auto insurance, class codes are determined by commercial vehicle usage and play a role in classifying commercial vehicles. This classification impacts the rating process and, ultimately, the cost of insurance.

| Characteristics | Values |

|---|---|

| Purpose | To determine the risk level of a business |

| Usage | Part of the rating process in classifying commercial vehicles |

| Classifications | Service, Retail, Commercial |

| Codes | Numerical identifiers assigned to different types of jobs |

| Code Providers | Insurance providers, National Council on Compensation Insurance (NCCI), state workers' compensation boards |

What You'll Learn

Understanding workers' comp class codes

For example, a construction worker is likely to be assigned a higher-risk code than a graphic designer, resulting in a higher cost of workers' compensation insurance for the construction company compared to a design agency. Similarly, different types of contractors will have varying codes and risk levels. Electricians and carpenters, for instance, will have distinct codes reflecting their unique risk profiles.

These codes are not uniform across all states in the US. While most states use the class code system provided by the National Council on Compensation Insurance (NCCI), some states operate with independent or monopolistic codes. This means that insurance class codes can vary depending on the state's rules and regulations. To illustrate, certain states may require businesses to obtain workers' compensation insurance through a state fund, influencing the applicable class codes.

Businesses can find their relevant workers' comp class codes through their insurance providers, who assign these codes based on the nature of their employees' work. Additionally, resources like the NCCI or the state's workers' compensation board can provide valuable information on class codes. By consulting these sources and reviewing job descriptions, businesses can ensure they are using the correct codes, avoiding overpayment or underpayment issues.

In summary, workers' comp class codes are crucial in determining insurance premiums by assessing the risk associated with different occupations. These codes vary by state and can be found through insurance providers, the NCCI, or state-specific resources. Understanding and correctly applying these codes are essential for businesses to manage their workers' compensation insurance effectively.

Capital One Auto Finance: Gap Insurance Offered?

You may want to see also

Business use classifications

Service

This classification does not include the transportation of any property except for tools, equipment, and supplies to and from jobs.

Retail

This classification includes the transportation of property to and from individual households.

Commercial

This classification applies to any other type of transportation except service and retail.

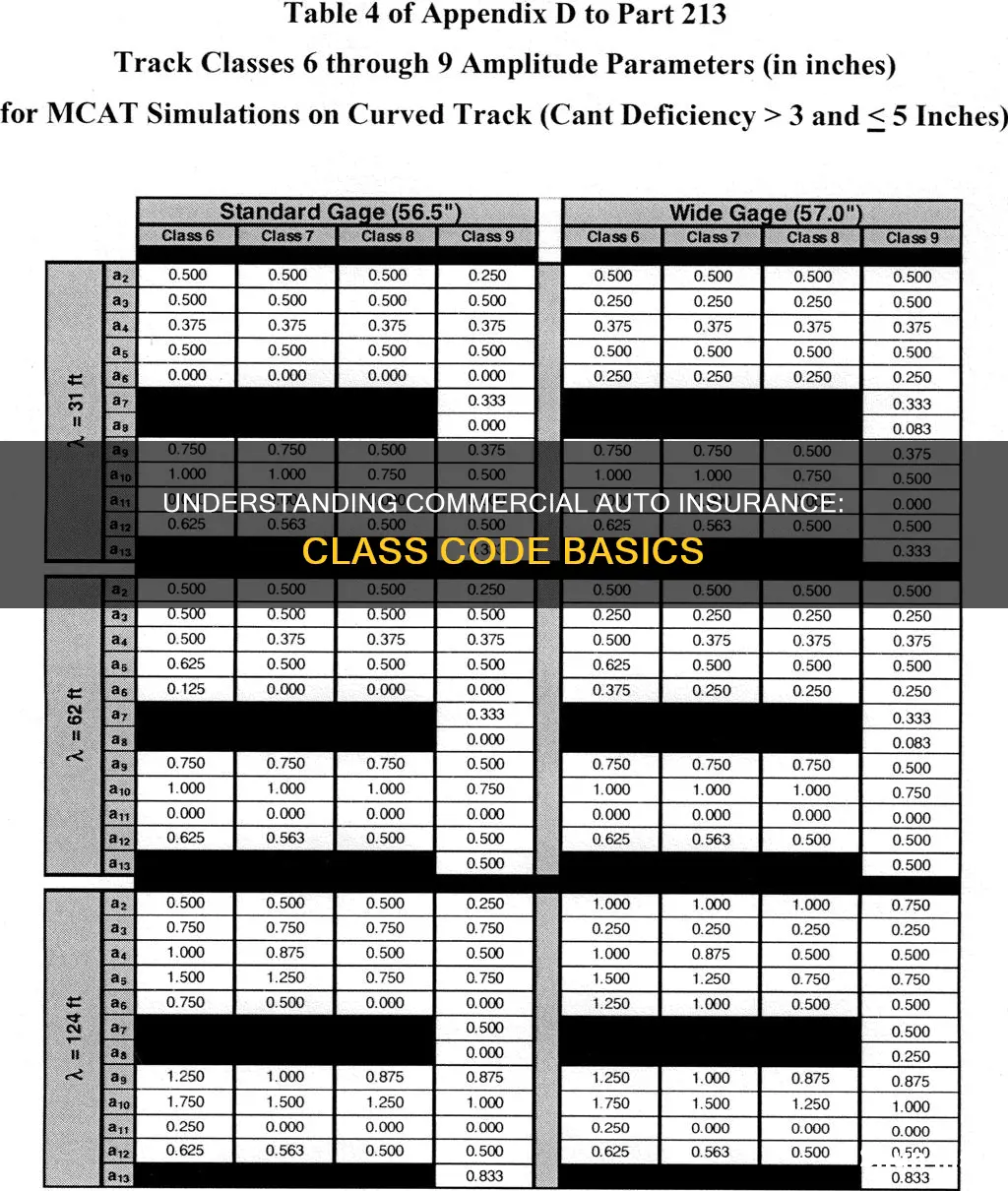

The Insurance Services Office, Inc. (ISO) uses a 5-digit code that describes the industry of the insured. The code is included on all ISO classifications to give the insured an idea of how the insurer views them in a general manner. Each general classification has a different premium basis. For example, the premium for manufacturing or processing is developed by applying the rate to gross sales, while the rate for contracting or servicing is applied to payroll.

It is important to note that the classification code or class description does not usually affect the coverage afforded by the ISO CGL policy. This is because the classification system is primarily used to match the premium with the exposure. However, there are important exceptions to this. For instance, certain surplus lines (non-admitted) insurers use a non-ISO endorsement called the "classification limitation endorsement," which adds an exclusion to the CGL policy. This endorsement restricts coverage to bodily injury, property damage, personal injury, or advertising injury that arises out of any classification(s) that are not scheduled in the Commercial General Liability Coverage Part Declarations and for which the insured has not paid a premium.

Autonomous Cars: Disrupting Industries

You may want to see also

General liability class codes

Various organizations manage their own general liability classification systems, including the Insurance Services Office (ISO), National Council on Compensation Insurance (NCCI), North American Industry Classification System (NAICS), and Standard Industrial Classification (SIC). These systems categorise industries into broad groups and then subdivide them into more specific types of work. For example, NAICS uses a 6-digit number for its class codes, with the first two digits indicating the industry, such as "52" for Finance and Insurance, and "72" for Accommodation and Food Services.

It is crucial for businesses to keep their general liability class codes current by promptly informing their insurance providers about any changes in their operations or business models. This ensures that the business has the necessary coverage and is paying the correct premium based on their risk level.

- Barbershops – 10113

- Consultants – 41677

- Photographers – 16471

- Technology businesses doing computer service or repair – 91555

- Full-Service Restaurants – 722511

- Limited-Service Restaurants – 722513

- Cafeterias, Grill Buffets, and Buffets – 722514

- Snack and Nonalcoholic Beverage Bars – 722515

Financers Dictate Auto Insurance Coverage

You may want to see also

Insurance cost and coverage

Commercial auto insurance is a necessity for any business that uses vehicles for work purposes. The cost of commercial auto insurance can vary widely depending on several factors, and it's important to understand these factors to ensure you're getting the right coverage for your business needs.

The cost of commercial auto insurance is influenced by a range of variables specific to your business. The type of work you do and the amount of driving it involves will impact your premium. For example, a mortgage broker who drives less for work will pay less than a roofing contractor who drives more frequently. The number of vehicles your business owns and their value will also affect your premium, with more vehicles and higher-value vehicles resulting in a higher premium.

The state where your business is located also matters. Businesses in areas with a higher population, such as Miami, tend to pay more for insurance due to factors like higher property prices and crime rates. Additionally, states with a higher risk of natural disasters, such as hurricanes, can increase insurance costs.

Your business's driving history and records of losses and claims will also impact your premium. A business with a clean driving record and fewer claims will generally pay less. The make, model, and year of your vehicles are other factors that influence the cost, with newer and more reliable vehicles often resulting in lower premiums.

The level of coverage you choose will also affect the cost. Basic liability coverage will be more affordable, while comprehensive coverage, which includes protection against theft, weather damage, vandalism, and fire, will increase your premium. Higher coverage limits will also increase your premium, but they can provide greater peace of mind and financial protection in the event of an accident.

When determining the right coverage for your business, it's essential to consider your specific needs and the level of risk you're comfortable with. Consult with a licensed insurance agent to discuss your options and ensure you're getting the most suitable coverage for your commercial auto insurance needs.

Careless Driving: Friend or Foe to Your Auto Insurance Rates?

You may want to see also

Consulting a professional

- Expertise and Experience: Insurance professionals, such as agents or brokers, have extensive knowledge and experience in the field. They can guide you through the complex world of commercial auto insurance and help you navigate the various class codes and their implications.

- Risk Assessment: Professionals can conduct a comprehensive risk assessment of your business. They will consider factors such as the nature of your business, the types of vehicles used, and the level of risk associated with your commercial activities. This risk assessment is crucial for determining the appropriate class code and ensuring adequate coverage.

- Accurate Classification: By consulting a professional, you can ensure that your business is accurately classified according to industry standards. They will help you identify the specific class code that reflects the unique characteristics of your commercial operations, including the usage and types of vehicles involved.

- Cost and Coverage Optimization: Insurance professionals can assist in optimizing your insurance costs and coverage. They can explain how different class codes impact your insurance rates and help you find the right balance between adequate coverage and affordable premiums. Their expertise will ensure you are not overpaying for insurance or left underinsured.

- Claims and Exclusions: Understanding how class codes affect claims and exclusions is essential. Professionals can explain how performing work outside your industry's scope can impact insurance coverage. They will clarify which types of liabilities are typically excluded from your policy and provide advice on additional coverage you may require.

- Industry-Specific Knowledge: Commercial auto insurance professionals stay updated on industry trends and changes. They can provide insights into the class codes commonly used in your specific industry and advise on any unique considerations or risks associated with your line of work.

- Customized Solutions: Every business is unique, and a one-size-fits-all approach may not always work. Insurance professionals can tailor insurance solutions to your specific needs, ensuring that your commercial auto insurance provides the necessary protection for your business and employees.

- Ongoing Support: When you consult a professional, you establish a relationship that can provide ongoing support. They can assist with policy reviews, claims processing, and adjustments as your business evolves and your insurance needs change over time.

- Regulatory and Compliance Advice: Staying compliant with insurance regulations is essential. Professionals can guide you through the legal requirements related to commercial auto insurance, ensuring your business meets the necessary standards and avoids potential penalties.

- Peace of Mind: Ultimately, consulting a professional can give you peace of mind. Knowing that your commercial auto insurance is in the hands of experts allows you to focus on running your business with the confidence that you have the right coverage in place.

Remember, insurance professionals are there to help you make informed decisions about managing risk and protecting your business assets. Their expertise can be invaluable in navigating the complex world of commercial auto insurance and ensuring that your business is adequately covered.

United Auto Workers Health Insurance: A Comprehensive Review

You may want to see also

Frequently asked questions

Commercial auto insurance class codes are numerical identifiers assigned to different types of vehicles and drivers. They help insurance companies determine the risk level associated with insuring them.

Class codes are important because they impact the cost of insurance. Accurate class codes ensure that the correct premium is paid for the level of risk. Incorrect codes can lead to overpayment or underpayment, both of which can be problematic.

You can find your commercial auto insurance class code by consulting your insurance provider, reviewing job descriptions, and using state resources.

Examples of commercial auto insurance class codes include:

- Service: Does not include the transportation of any property except for tools, equipment, and supplies to and from jobs.

- Retail: Includes transportation of property to and from individual households.

- Commercial: Applies to any other type of transportation except service and retail.

Insurers use commercial auto insurance class codes to predict a vehicle's risk level based on its usage and the type of work performed. The class code also helps determine specific exclusions in the insurance policy.