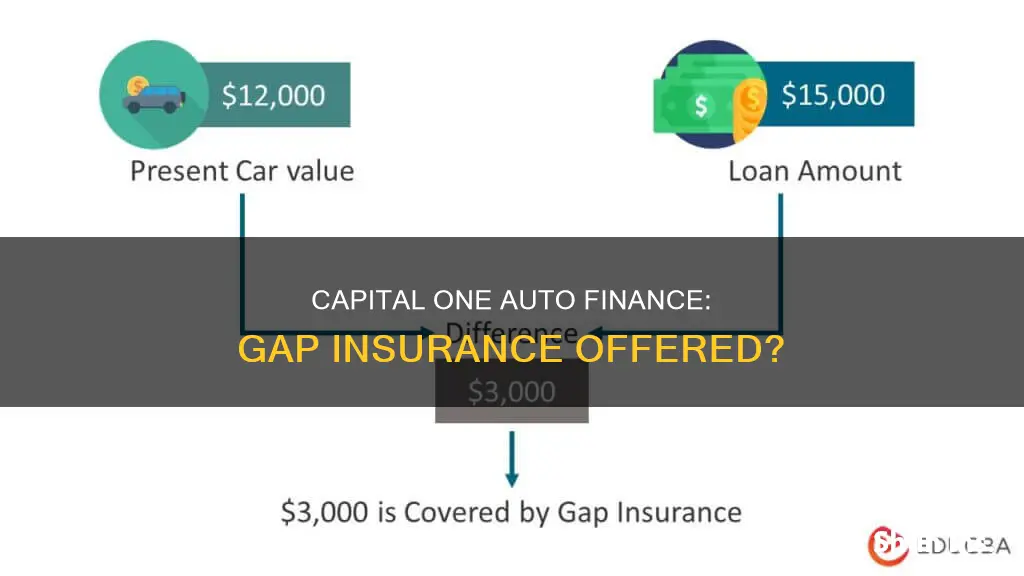

Capital One offers Guaranteed Asset Protection (GAP) insurance to its customers. This type of insurance covers the difference between the amount paid by your insurer and your remaining car loan balance in the event that your car is stolen or totaled. GAP insurance is optional and can be purchased through your regular car insurance provider, your dealership, or added onto your loan agreement when financing with a bank or credit union.

| Characteristics | Values |

|---|---|

| Company Name | Capital One |

| Service | Guaranteed Asset Protection (GAP) Insurance |

| Service For | Individuals financing their vehicles with a car loan through Capital One Bank |

| Cost | A few dollars a month |

| Cost Estimation Factors | Age, driving record, state, credit history, and the model and model year of the vehicle |

| Purchase Options | Through regular car insurance provider, dealership, or added onto loan agreement when financing with a bank or credit union |

| Cancellation | Allowed; may receive a refund for a portion of unused premiums |

| Coverage | Remaining amount on auto loan if the vehicle is stolen or deemed a total loss |

What You'll Learn

- Capital One offers Guaranteed Asset Protection (GAP) insurance to protect customers in the event of their car being stolen or written off

- GAP insurance covers the difference between the amount paid by a customer's insurer and their remaining car loan balance

- GAP insurance is an optional type of coverage that can be paid for through a customer's regular car insurance provider

- Capital One offers GAP insurance to individuals financing their vehicles with a car loan through Capital One Bank

- GAP insurance is worth it if a customer has a long-term auto loan or has leased a vehicle

Capital One offers Guaranteed Asset Protection (GAP) insurance to protect customers in the event of their car being stolen or written off

GAP insurance is intended for situations where the remaining balance on a customer's account is larger than the insurance proceeds received for the car. A customer's regular car insurance usually covers the fair market value of the car, not the amount they still owe on their loan. It is common for customers to owe more than their car is worth at the beginning of a loan. If this is the case at the time of total loss, GAP insurance can help cover the difference between the amount paid by their insurer and their remaining loan balance.

Capital One offers GAP insurance to individuals financing their vehicles with a car loan through Capital One Bank. Customers can choose to add the price of GAP insurance to their total loan amount. GAP insurance is not available to customers who are not using Capital One as their auto loan provider.

GAP insurance is generally available for newer vehicles. It is important to differentiate GAP insurance from new car replacement coverage. While both types of insurance are usually for newer cars, new car replacement coverage is designed to cover the cost of a new model of a totaled car. GAP insurance, on the other hand, helps customers clear any negative loan balance in the event their vehicle is totaled.

GAP insurance is a smart choice for those financing a new or nearly new vehicle, especially if they have a low down payment, a long-term loan, or a car that depreciates quickly. It is an affordable way to protect against the risk of a big expense if a car is totaled or stolen.

Auto Insurance: Who Pays for Window Repairs?

You may want to see also

GAP insurance covers the difference between the amount paid by a customer's insurer and their remaining car loan balance

Capital One offers Guaranteed Asset Protection (GAP) insurance to individuals financing their vehicles with a car loan through Capital One Bank. This type of insurance is intended to cover the difference between the amount paid by a customer's insurer and their remaining car loan balance.

GAP insurance is an optional type of coverage that you can purchase through your regular car insurance provider, your dealership, or as an add-on to your loan agreement when financing with a bank or credit union. It is designed to protect you financially in the event that your car is stolen or written off, and the remaining balance on your loan is larger than the insurance payout you receive for the car.

Your standard car insurance typically covers the fair market value of your car, rather than the amount you still owe on your loan. As most cars depreciate quickly, it is common to owe more than the car is worth, especially at the beginning of a loan. In this case, GAP insurance can help cover the difference between the insurance payout and your remaining loan balance.

It is worth noting that GAP insurance does not cover missed payments or interest accrued on late payments. It is also important to carefully review the terms of your GAP insurance policy to understand exactly what is and isn't covered.

When considering GAP insurance, it is recommended to compare prices and coverage from different providers, as the cost can vary significantly. Additionally, if you choose to finance a GAP policy into your loan, it will increase the total amount you pay in interest over time.

Saskatchewan Vehicle Insurance GST Status

You may want to see also

GAP insurance is an optional type of coverage that can be paid for through a customer's regular car insurance provider

Guaranteed Asset Protection (GAP) insurance is an optional type of coverage that can be paid for through a customer's regular car insurance provider. It is a low-cost coverage that supplements standard auto insurance to protect against financial loss in the event of a vehicle being stolen or declared a total insured loss.

While auto insurance covers the replacement value of the vehicle, GAP insurance covers the difference between the insurance settlement and the remaining loan balance. This can amount to thousands of dollars, as vehicles can quickly depreciate, meaning you may owe more than the car is worth, especially at the beginning of a loan. GAP insurance is designed to ensure that your car loan does not become a financial burden in the event that your vehicle is stolen or written off.

For example, if you buy a new car for $35,000, the moment you drive it off the dealer's lot, the value will drop. If your car is then written off in an accident, your auto insurance will only pay out the depreciated value of the car, which may be significantly less than the remaining loan amount. GAP insurance would cover this difference.

It is important to note that GAP insurance can also be purchased through your dealership or added to your loan agreement when financing with a bank or credit union. It is usually only a few dollars a month to add GAP insurance to a full-coverage insurance policy.

Vehicle Insurance: Third-Party Coverage Mandatory

You may want to see also

Capital One offers GAP insurance to individuals financing their vehicles with a car loan through Capital One Bank

Capital One offers Guaranteed Asset Protection (GAP) insurance to individuals financing their vehicles with a car loan through Capital One Bank. This optional coverage is designed to protect you financially in the event of total loss, theft, or damage to your vehicle, by covering the difference between the insurance payout and the remaining loan balance. This is particularly useful if you owe more than the car's current market value, which is common at the beginning of a loan.

GAP insurance is typically purchased through your car insurance provider, dealership, or loan agreement. If you choose Capital One Auto Finance as your lender, you have the option to purchase GAP insurance and include it in your total loan amount. It is important to note that Capital One requires full coverage insurance and may mandate GAP insurance for your vehicle loan.

While GAP insurance is not legally required, it can provide valuable financial protection. It is worth considering if you have a low down payment, long-term loan, or a vehicle that depreciates quickly. GAP insurance ensures that you are not left with outstanding loan payments for a car you can no longer drive due to theft or total loss.

The cost of GAP insurance varies depending on your age, driving record, location, credit history, and vehicle model. When purchased through a dealership or lender like Capital One, the cost is usually added to your monthly payments, along with the applicable interest rate. On the other hand, insurance companies often charge a lower amount, typically between $20 to $40 per year, as an add-on to your annual premium.

Before deciding to purchase GAP insurance, it is essential to understand what it covers and what it excludes. While it can provide financial peace of mind, it is important to weigh the benefits against the additional cost.

Vehicle Insurance: Who Needs to Be Covered?

You may want to see also

GAP insurance is worth it if a customer has a long-term auto loan or has leased a vehicle

Guaranteed Asset Protection (GAP) insurance is worth considering if a customer has a long-term auto loan or has leased a vehicle. GAP insurance is designed to protect drivers in the event that their car is stolen or written off, and the remaining balance on their account is larger than the insurance payout they receive for the car.

When a car is written off, standard car insurance policies will usually only pay out the fair market value of the car, which may be less than the amount the driver still owes on their loan. This is especially common at the beginning of a loan, as cars can depreciate rapidly. GAP insurance covers this difference, ensuring the driver isn't left out of pocket.

GAP insurance is typically worth considering for those with long-term auto loans or leased vehicles, as the longer the loan period, the higher the chance of owing more on the vehicle than it is worth. Additionally, those who have made a small down payment on a new car may want to consider GAP insurance, as they could end up with negative equity on the vehicle as soon as they drive it away from the dealership.

It's important to note that GAP insurance is optional and not required by any insurer or state. However, some lenders and leasing companies may require it. Before purchasing GAP insurance, it's advisable to compare the cost of this insurance from different providers, as prices can vary significantly.

Gap Insurance: Missed Payment, Now What?

You may want to see also

Frequently asked questions

Yes, Capital One offers Guaranteed Asset Protection (GAP) insurance to individuals financing their vehicles with a car loan through Capital One Bank.

GAP insurance covers the difference between the amount paid by your insurer and your remaining car loan balance. Your regular car insurance policy will only cover the depreciated value of your vehicle, which could be less than what you owe on your loan.

Generally, it costs a few dollars a month to add GAP insurance to a full-coverage insurance policy. According to the Insurance Industry Institute, you can secure this type of coverage for just $20 a year, or 5% to 6% of your full-coverage premium.

When applying for an auto loan through Capital One, you will be offered GAP insurance as an option. You cannot purchase GAP insurance from Capital One if you are not using the company as your auto loan provider.