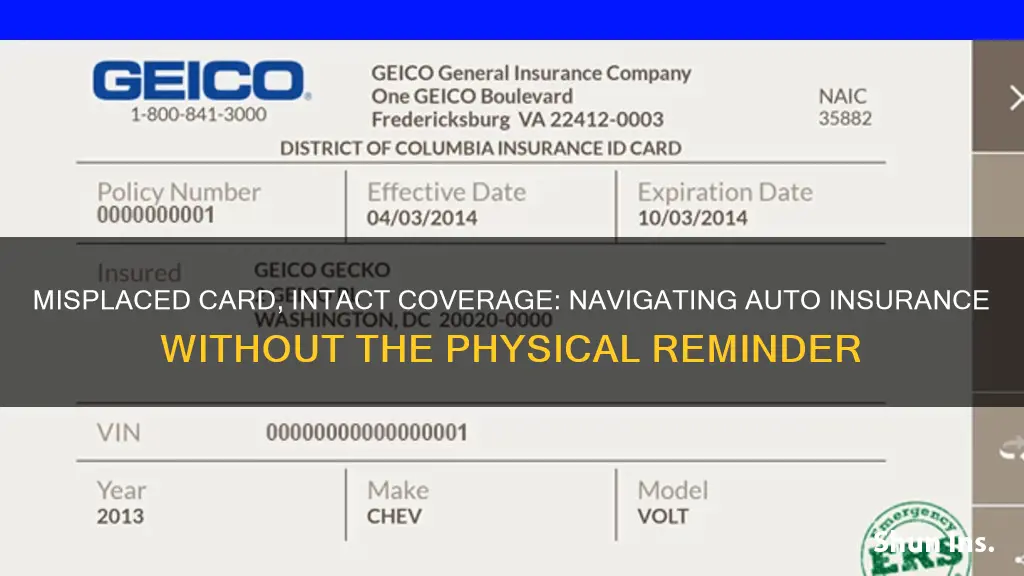

If you have auto insurance but have lost your card, don't panic. It's a common issue that can be easily resolved by contacting your insurance company. You can do this by calling their customer service line, using their website or mobile app, or visiting an agent in person. They will be able to provide you with a replacement card, usually free of charge. In some cases, they may charge a small fee for the replacement, but this is not standard practice. It's important to keep your insurance card with you when driving, as it serves as proof of insurance in case of an accident or traffic stop. Most states require physical proof of insurance, so it's crucial to have your card readily available.

| Characteristics | Values |

|---|---|

| What to do if you lose your car insurance card | Contact your insurer immediately for a replacement. |

| How to get a replacement card | Call your insurer, use their mobile app, visit an agent in person, or print a copy yourself. |

| How long does it take to receive a replacement card | A few business days. |

| What happens if you don't have a card when asked by police | You will likely be ticketed for driving without insurance. |

| Can you use a digital copy of your card | Yes, but only in 49 states. New Mexico does not allow digital copies. |

What You'll Learn

Contact your insurer by phone or email

If you have auto insurance but have lost your card, you should contact your insurer by phone or email to request a replacement. This is a standard procedure and should be a quick and easy process. Here are some detailed steps to guide you through the process:

Step 1: Contact Your Insurer

Get in touch with your insurance company as soon as possible. You can find their contact information, including their phone number and email address, on their website or your insurance policy documents. It is always a good idea to have this information readily available, so you know where to turn in case of an emergency. When you reach out, they will likely ask for some information to verify your identity and policy details.

Step 2: Make the Request

Once you are connected with a customer service representative, simply explain that you have lost your insurance card and would like a replacement. You don't need to speak to a licensed agent for this request. Be sure to mention that you need a copy of your auto insurance certificate, which serves as proof of your insurance coverage. It typically contains essential information such as your name, policy number, effective dates, and coverage details.

Step 3: Choose Your Delivery Method

Inquire about the available delivery options for your replacement card. Some insurance companies may offer multiple options, such as email, physical mail, or a digital copy through their online portal. If you need the card urgently, let them know so they can expedite the process if possible. You may also be able to download a digital copy from their website or mobile app, providing instant access to your proof of insurance.

Step 4: Confirm the Details

Before receiving your replacement insurance card, take the time to confirm that all the information on it is accurate and up to date. This includes checking that your name, policy number, coverage dates, and other details are correct. This simple step can save you potential hassles down the line and ensure you have the necessary proof of insurance when needed.

Remember, it is important to always carry your insurance card with you when driving or keep it in your vehicle. In most states, you are required to have physical proof of insurance, and failing to provide it during a traffic stop or accident can result in fines or other penalties. Maintaining valid proof of insurance is crucial for complying with state laws and avoiding unnecessary complications.

Auto Insurance and Employment Perks: Unlocking Discounts and Benefits

You may want to see also

Use your insurer's website or app

If you have auto insurance but have lost your card, you can use your insurer's website or app to get a copy. Many insurance companies now offer digital services that allow you to access proof of insurance and manage your policy online or via a mobile app.

To use your insurer's website or app, you will first need to log in to your account. You can usually find the login page by clicking on a "Login" or "Sign In" button on the homepage of the website or app. If you have forgotten your login details, you should be able to reset your password or find your username by following the instructions on the login page.

Once you are logged in, you should be able to navigate to the relevant section to download a digital copy of your insurance card. This may be located under a section called "ID Cards" or "Proof of Insurance". In some cases, you may be able to add your insurance card to your digital wallet. For example, on some insurer apps, you can tap on a button that says "Add to Apple Wallet" to save your insurance card to your phone.

If you are unable to locate your insurance card on your insurer's website or app, you can try contacting their customer service team for assistance. They may be able to guide you through the process or send you a copy of your insurance card via email.

It is important to always carry proof of insurance with you when driving, as it is required by law in most states. In addition to keeping a digital copy on your phone, you may also want to consider printing out a physical copy to keep in your wallet or glove compartment.

Auto Insurance Premiums: What You Need to Know

You may want to see also

Visit an agent in person

If you've lost your auto insurance card, don't panic! You can visit an agent in person to get a replacement. Here's what you need to know:

Locate a Nearby Agent

Most major auto insurance companies, such as State Farm, Farmers, Allstate, and Liberty Mutual, have agents across the country who are ready to assist policyholders. You can use the insurer's website to locate the nearest agent by entering your ZIP code. If you have a local agent, they will be your best resource for quick assistance.

Contact the Agent

While many offices welcome walk-ins, it is often a good idea to contact the agent ahead of time to confirm their availability and let them know about your situation. This way, they can ensure they have the necessary information and resources to help you efficiently.

Bring Relevant Information

When you visit the agent, be sure to bring any relevant information that may be needed to verify your identity and policy details. This could include your name, policy number, vehicle information, and other personal details. The agent will use this information to look up your policy and provide you with a replacement insurance card.

Understand the Cost

In some cases, insurance companies may charge a small fee for replacement insurance cards. This is usually a nominal amount, but it's good to be aware of any potential charges. If you feel that this is an unnecessary expense, it may be a sign that it's time to consider switching insurance providers.

Take Preventative Measures

To avoid future inconveniences, it is a good idea to keep your insurance card in a safe and easily accessible place, such as your wallet or vehicle glove compartment. You can also take advantage of digital insurance cards, which are accepted as valid proof of insurance in most states. Downloading a digital copy to your phone ensures that you always have access to your insurance information, even if you misplace the physical card.

Remember, it is essential to maintain valid proof of insurance to comply with state laws and avoid penalties such as fines, license suspension, or even jail time in some cases. By visiting an agent in person, you can quickly and easily obtain a replacement auto insurance card and ensure you're prepared for any situations where proof of insurance is required.

Leased Cars: Higher Insurance?

You may want to see also

Print a copy yourself

If you have lost your auto insurance card, don't panic. You can print a copy yourself by following these steps:

First, check if your insurance company offers digital copies of insurance cards. Most companies nowadays provide digital copies, which can be downloaded to your phone or device as a backup. You can also check their website or mobile app to see if they offer this service. Having a digital copy ensures that you always have proof of insurance with you, even if you lose the physical card.

Second, log in to your online account on the insurance company's website or mobile app. You will need your policy information to log in, so keep this handy. Once you are logged in, navigate to the relevant section to find your digital insurance card. This may be in a section called "ID cards" or "insurance cards."

Third, download and print your digital insurance card. Make sure your printer is connected and has enough ink, and select the "Print" option on your device. It is a good idea to print multiple copies of your insurance card and keep them in different places, such as your wallet, glove compartment, or at home, so you always have one readily available.

Remember, it is important to always carry proof of insurance with you when driving, as you may face penalties, fines, or even license suspension if you cannot produce it when requested by law enforcement or in the event of an accident. While digital proof of insurance is accepted in most states, some states, like New Mexico, require a physical copy, so it is always best to be prepared.

Auto Insurance: Claiming Business Expenses

You may want to see also

Get a digital copy

If you've lost your physical insurance card, don't panic! You can obtain a digital copy in several ways. Here are some steps you can take to get a digital copy of your auto insurance card:

- Contact your insurance provider: Reach out to your insurance company by phone, email, or through their website. They can help you replace your lost card and provide a digital copy. Be prepared to provide necessary information such as your policy number, name, address, and any other details requested to verify your identity.

- Use your insurer's mobile app: Many insurance companies, including Progressive, offer mobile apps that provide access to electronic insurance cards. Download your insurer's app, log in, and locate the section for insurance ID cards. You may also be able to add your digital insurance card to your mobile wallet.

- Visit your insurer's website: If your insurance company doesn't have a mobile app, you can usually log in to their website to access and download your insurance card. Look for a customer portal or account section on their website.

- Request a copy by email: Some insurance companies, like State Farm, allow you to request a copy of your insurance card by providing your phone number and date of birth via email. They will then send you a digital copy of your insurance card.

- Print a copy: If you have access to a printer, you can log in to your online account or mobile app and print a copy of your digital insurance card. Keep this printed copy in your vehicle, as some states may require physical proof of insurance.

Remember that it is essential to keep a valid proof of insurance with you while driving. Most states accept digital insurance cards as valid proof, but there are exceptions, like New Mexico. Always check your state's requirements and keep your insurance information up to date.

RV Gap Insurance: Necessary Protection?

You may want to see also

Frequently asked questions

Contact your insurance company to request a new card. You can do this by phone, email, or through their website. You can also print a copy yourself, or visit an agent in person.

Some companies may charge a small fee for a replacement card, but this is not common.

You will likely be ticketed for driving without insurance. Most states will allow you to provide proof after the fact and have the ticket dismissed, but you may still need to pay fees or fines.

Driving without insurance can result in hefty fines, a suspended license, and even jail time.