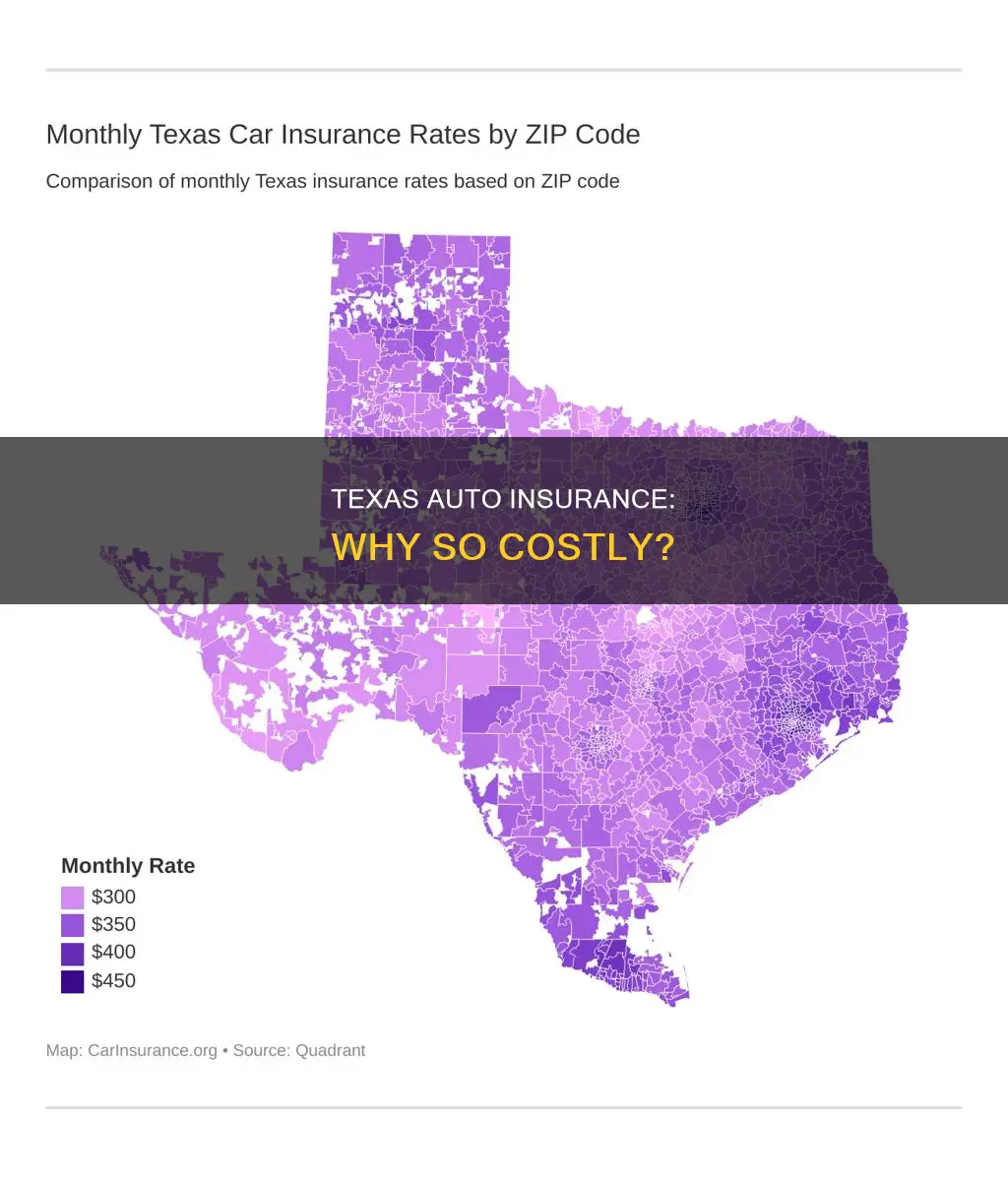

Texas is known for its high auto insurance rates, which are influenced by a combination of individual and state-specific factors. The cost of auto insurance in Texas is determined by factors such as age, driving record, location, and credit score. Additionally, Texas has a high urban population density, long roads, and high speed limits, leading to a higher probability of accidents and claims. The state also experiences frequent natural disasters, which increase the risk of vehicular damage and subsequent insurance claims. Moreover, Texas has a high number of uninsured drivers, which further contributes to rising insurance costs for law-abiding drivers.

| Characteristics | Values |

|---|---|

| High urban population density | Urban neighborhoods have higher rates of accidents, car thefts and vandalism. |

| Higher-than-average vehicle theft rate | Texas has a higher-than-average rate of vehicle thefts compared to the rest of the U.S. |

| High speed limits | Texas has the highest speed limits in the country, up to 85 mph. |

| Frequent natural disasters | Texas is prone to disasters such as wildfires, hurricanes, winter storms and tornados. |

| High crash rate per driver | Texas has a high crash rate per driver. |

| High number of uninsured drivers | Texas has a high number of uninsured drivers. |

| High number of claims per year | Texas has a high number of claims per year. |

What You'll Learn

High urban population density

Texas is the second most populous state in the US, with 84% of its population living in urban areas. The state is home to three of the top ten largest cities in the country, with the majority of the population living in the triangle made up of the Dallas-Fort Worth area, Houston, and the San Antonio-Austin area.

Urban areas tend to have higher insurance premiums than rural areas due to the increased risks associated with city living, such as higher traffic density, and higher rates of theft and vandalism. Urban neighbourhoods typically have higher accident rates, and insurance companies receive more claims from these areas. As a result, they charge higher premiums to cover the increased risk.

The high urban population density in Texas, therefore, contributes to the overall expense of auto insurance in the state.

Report Single-Vehicle Accidents to Insurance?

You may want to see also

Higher-than-average vehicle theft rate

Texas has a higher-than-average rate of vehicle theft compared to the rest of the U.S. In 2022, the state experienced a vehicular theft rate of 13 automobiles for every 1000 registered. This amounted to a total of 105,015 stolen automobiles out of 7,784,067.

The high rate of vehicle theft in Texas is a significant factor contributing to the state's expensive auto insurance premiums. Insurance companies use the rate of car thefts to calculate premiums because it impacts the number of claims they are likely to receive. When car thefts are frequent, insurance companies charge more for car insurance to compensate for the increased risk.

According to the National Insurance Crime Bureau (NICB), Texas had the tenth-highest rate of car thefts in 2021, with 320 thefts per 100,000 residents. This marked an increase from the previous year, with the rate rising from 319 in 2020 to 320 in 2021.

The most commonly stolen vehicles in Texas include full-size pickup trucks, such as the Chevrolet Silverado 1500, Ford F-150, and GMC Sierra 1500. Compact to midsize sedans, including the Honda Civic, Honda Accord, Toyota Camry, and Nissan Altima, are also popular targets for thieves.

The high rate of vehicle theft in Texas, coupled with other factors such as high-speed limits, highway density, and frequent natural disasters, contributes to the state's high auto insurance costs. These factors collectively increase the risk of accidents, claims, and payouts, leading to higher insurance premiums for Texas drivers.

Gap Insurance Pricing in New Jersey

You may want to see also

High crash rate per driver

Texas has a high crash rate per driver, which is a significant factor in the high cost of auto insurance in the state. The high crash rate leads to more accidents, claims, and payouts, which insurers pass on to consumers through higher premiums.

The high crash rate in Texas can be attributed to several factors. Firstly, the state has a higher-than-average traffic and highway density, with long roads, leading to a higher probability of crashes and accidents. Texas also has a high urban population density, particularly in cities like Houston, which have higher rates of accidents, car thefts, and vandalism.

Additionally, Texas has one of the highest speed limits in the country, up to 85 mph, which increases the risk of high-speed crashes and the severity of their impact. The state also experiences frequent natural disasters, such as wildfires, hurricanes, winter storms, and tornados, which can cause vehicular damage and lead to more claims.

The combination of these factors contributes to Texas's high crash rate per driver and, consequently, the high cost of auto insurance in the state.

Vehicle Insurance Binder: What's the Deal?

You may want to see also

High number of uninsured drivers

Texas has a high number of uninsured drivers, which is one of the reasons why auto insurance is so expensive in the state. In 2019, 8% of drivers in Texas lacked even the minimum liability insurance, and this number is likely to have increased as the cost of car insurance continues to rise. This is a significant issue because the cost of uninsured drivers is passed on to consumers through higher premiums.

The high number of uninsured drivers in Texas can be attributed to the increasing cost of car insurance, which has led more drivers to take the risk of driving without insurance. This creates a cycle where the cost of insurance continues to rise, pricing out more drivers, and leading to even higher premiums for those who remain insured.

In addition to the financial burden placed on insured drivers, the presence of uninsured motorists also increases the risk of accidents and the difficulty of obtaining compensation for damages or injuries caused by uninsured drivers. This further contributes to the high cost of auto insurance in Texas.

To address the issue of uninsured drivers, Texas law requires insurance companies to offer uninsured motorist coverage when purchasing auto insurance. This coverage provides financial protection in the event of an accident involving an uninsured or underinsured driver, paying for car repairs, medical bills, rental cars, and personal property damage. While this coverage is optional, it can provide valuable protection for drivers in Texas.

The high number of uninsured drivers in Texas is a significant factor contributing to the high cost of auto insurance in the state, and it is important for drivers to be aware of this issue and the potential risks and costs associated with it.

Uber Vehicle Insurance: What You Need

You may want to see also

Frequent natural disasters

Texas is prone to natural disasters such as wildfires, hurricanes, winter storms, and tornadoes. These disasters increase the risk of vehicular damage, and drivers are more likely to file claims in states like Texas, where natural disasters occur frequently. This is one reason why auto insurance is so expensive in Texas.

Texas has experienced 179 confirmed weather/climate disaster events with losses exceeding $1 billion each from 1980 to 2024. These events include 19 drought events, nine flooding events, 118 severe storm events, 14 tropical cyclone events, seven wildfire events, and 11 winter storm events. The annual average for the last five years (2019-2023) is 11.0 events, a significant increase from the 1980-2023 average of 3.9 events.

The state's diverse landscape and ample nature make it susceptible to these natural disasters. Texas has ten climate zones, ranging from high plains and forests to humid marine prairies. The nearby Rocky Mountains, expansive flat prairies, and the Gulf of Mexico heavily influence the state's weather patterns.

The Gulf of Mexico, in particular, provides most of Texas's moisture and contributes to its pattern of receiving intense, short bursts of rain from thunderstorms, tropical storms, and hurricanes. This makes the state exceptionally prone to flooding, earning it the nickname "Flash Flood Alley."

Hurricanes and tropical cyclones can cause catastrophic damage to Texas, including extensive flooding, wind damage, storm surges, and utility disruptions. From 1957 to 2024, Texas experienced nine major hurricanes (Category 3 or higher), including Hurricane Rita in 2005 and Hurricane Harvey in 2017. Hurricane Harvey was the second most expensive natural disaster in US history, causing widespread flooding and historic rainfall in Houston and the Middle Texas Coast.

Winter storms in Texas can also be dangerous as cities are not equipped to handle them. The state's electric grid is not winterized against freezing temperatures, and the privately owned, self-contained power grid is prone to maintenance issues and blackouts. During the winter storms of February 2021 and February 2023, the Texas power grid failed, leaving millions without power.

Wildfires are another frequent natural disaster in Texas, occurring anytime during the year but most commonly from February to April and August to October. Higher temperatures and longer droughts due to climate change have extended the fire season, especially in the central part of the state. In 2023, Texas experienced hundreds of small wildfires, with 85% of the state under burn bans.

The frequency and severity of these natural disasters in Texas contribute to the high cost of auto insurance in the state. The risk of vehicular damage and the likelihood of insurance claims increase, leading to higher premiums for drivers.

Motorcycle Insurance: Motor Vehicle Classification

You may want to see also

Frequently asked questions

There are several reasons why auto insurance is expensive in Texas. Firstly, Texas has a high urban population density, with several large cities, which leads to higher rates of accidents, car thefts, and vandalism. Secondly, the state has a high number of uninsured drivers, which increases the cost of insurance for those who are insured. Additionally, Texas has a high crash rate per driver, and frequent natural disasters such as wildfires, hurricanes, and tornados, which result in more claims being filed. Other factors include the high speed limits in the state, and the increasing cost of auto repairs due to added technology in vehicles.

To get cheaper auto insurance in Texas, it is recommended to shop around and compare quotes from multiple insurance companies. You can also consider adjusting your coverage, such as opting for a higher deductible or removing comprehensive and collision coverage if you have an older car. Maintaining a clean driving record, improving your credit score, and bundling your auto insurance with other types of insurance can also help lower your premiums.

While auto insurance in Texas is more expensive than the national average, it is not the most expensive state for auto insurance. Texas ranks in the top five most expensive states, along with Louisiana, Florida, California, and Colorado. Factors that contribute to higher insurance rates in these states include high population density, high numbers of uninsured drivers, frequent natural disasters, and high repair and labor costs.