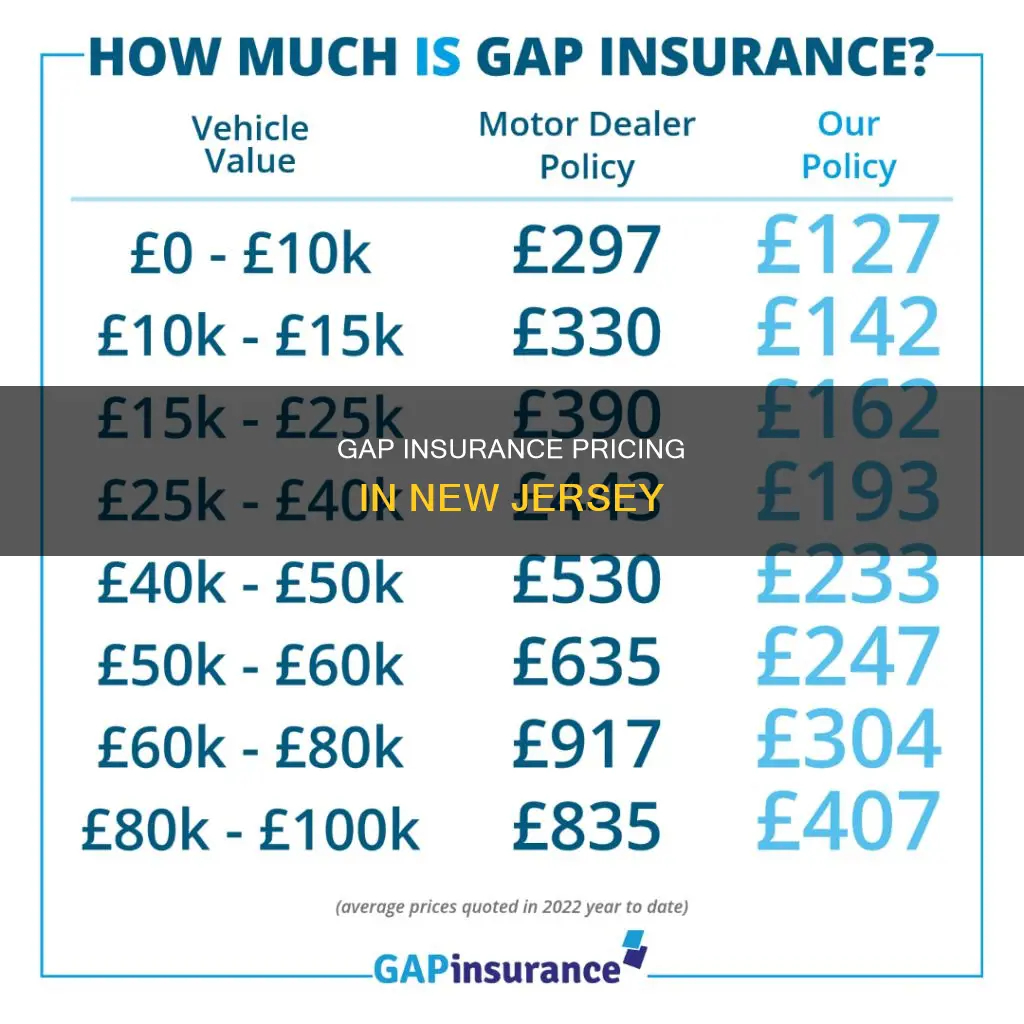

Gap insurance, also called loan/lease coverage, is an optional form of insurance that covers the difference between the amount owed on a car loan or lease and the vehicle's actual cash value in the event of a total loss. In New Jersey, several factors determine the pricing of gap insurance, including whether it is purchased from an insurance company, dealer, or lender. While it is not mandatory, some lenders may require it for car loans or leases. The cost of gap insurance in New Jersey can range from $200 to $700, and it is often cheaper to purchase it from an insurance company than a dealership. The pricing is influenced by various factors, such as the vehicle's actual cash value, the driver's location, age, and auto insurance claim history.

What You'll Learn

The cost of gap insurance from an insurance company, dealer or lender

The cost of gap insurance varies depending on where you buy it. Dealerships and banks typically charge a one-time fee of between $400 and $700 for gap insurance, making them the most expensive option. This sum is usually added to your auto loan, which means you will also have to pay interest on it.

The most affordable gap insurance is generally available from car insurance companies, which charge as little as between $3 and $40 per month for coverage. Instead of charging a lump sum, insurers include the cost in your regular premium payments. If your insurance provider offers gap insurance, they will factor in your car's actual cash value, your location, age, and auto insurance claim history to determine the price.

For example, if you already have a policy with Progressive, you can add gap coverage for as little as $5 a month. If you are a State Farm customer, you can add the Payoff Protector plan to your coverage. This is very similar to gap insurance and is available to anyone who finances their vehicle through a State Farm-affiliated bank.

Westlake Financial: Gap Insurance Coverage

You may want to see also

Whether gap insurance is worth the money

Whether or not gap insurance is worth the money depends on several factors, including the cost, coverage options, available providers, and the driver's qualifications. Gap insurance is generally inexpensive, but it is a specific type of coverage only used when a financed new vehicle is stolen or declared a total loss.

Gap insurance is worth considering if:

- You made a small down payment (less than 20%) or no down payment at all.

- You took out a long-term loan (more than five years).

- You leased the vehicle (as gap insurance is generally required for a lease).

- You purchased a vehicle that depreciates faster than average.

- You rolled over negative equity from an old car loan into the new loan.

On the other hand, gap insurance may not be necessary if:

- You made a substantial down payment (at least 20%) on the car.

- You expect to pay off your car loan in less than five years.

- You financed or leased a vehicle that holds its value longer than most.

The cost of gap insurance depends on various factors, including the actual cash value of the vehicle when the policy is purchased and the individual's claims history. If obtained through a lender, gap insurance typically costs a flat fee of $500 to $700 on average. Credit unions may offer lower rates, but interest will be charged on the insurance. Auto insurers usually charge $20 to $40 per month for add-on policies.

In summary, gap insurance is worth the money if you owe more on your car loan than the car is worth, as it can help bridge the financial gap. However, if you have enough money to cover the difference, gap insurance may not be necessary.

BECU: Gap Insurance Options

You may want to see also

How gap insurance works

Gap insurance, also called loan/lease coverage, is an optional form of coverage that you can buy from your car insurance company. It covers the "gap" between the amount you still owe to your auto lender and the actual cash value of your vehicle if it's totaled in an accident or stolen.

For example, if your car is assessed at $15,000 but you still owe $20,000, gap insurance will cover the $5,000 difference, minus your deductible. It is important to note that gap insurance only works if your car is totaled in a covered car claim and your vehicle's value is less than your loan amount.

When you file a claim for comprehensive or collision coverage on your car insurance policy, the insurer determines whether the vehicle is a total loss. They will pay you the actual cash value (ACV), less your coverage deductible. If your loan or lease balance is higher than the payout, the gap insurance will pay the difference.

Gap insurance protects you from depreciation. Once you buy your car, its value starts to decrease. If you finance or lease a vehicle, this depreciation leaves a gap between what you owe and the car's value.

It is worth noting that gap insurance doesn't cover other property or injuries resulting from an accident, nor does it cover engine failure or other mechanical repairs. It also doesn't cover your comprehensive or collision deductible, your car's extended warranty, a down payment for a replacement car, any extra benefits or fees you owe on the balance (such as late fees or credit insurance coverage), or your security deposit.

The cost of gap insurance varies depending on where you get it from. You may be able to get it for free if you lease your car, but it can cost between $200 to $700 or more if you finance through a credit union, bank, or dealer. It may be cheaper to get gap insurance through your car insurance, costing about 5% to 6% of your comprehensive and collision insurance premium.

Texassure: Legit Vehicle Insurance Verification

You may want to see also

When to buy gap insurance

Gap insurance is an optional form of coverage that pays the difference between what a car is worth and what the driver owes on their auto loan or lease if the car is stolen or declared a total loss. This type of insurance is especially useful if you've made a small down payment on your vehicle, have a long-term loan, or have a car that depreciates in value quickly.

- You have a car with a high depreciation rate: If you own a car that depreciates in value quickly, such as a sports car or an electric vehicle, gap insurance can protect you from owing more than the car's value.

- You made a low down payment: If you made a small down payment, such as less than 20%, on a large loan, you will likely benefit from gap insurance. A small down payment results in a bigger gap between what you owe and the car's depreciated value.

- You have a long-term loan: Long-term loans almost guarantee that the car buyer will have negative equity for some time. If the loan term is 60 months or longer, gap insurance can help cover the difference between the car's value and the loan amount.

- You carried over negative equity: If you carried over negative equity from a past car loan into your current loan, gap insurance can help cover the remaining payments.

- You lease your car: Auto leases often include gap coverage automatically. If you are leasing a car, gap insurance can provide valuable protection in case of a total loss.

It's important to note that gap insurance is not required by state law, but it may be required by lenders or lessors. Additionally, you can usually only purchase gap insurance if you are the original owner of the vehicle, and the car is not more than two to three years old.

Full Insurance vs Gap Insurance: What's the Difference?

You may want to see also

What gap insurance doesn't cover

Gap insurance, also known as loan/lease coverage, is an optional form of insurance that covers the difference between the amount you owe on a car loan or lease and the amount paid out in a total loss settlement from an auto insurer. However, there are certain things that gap insurance does not cover.

Firstly, gap insurance does not cover your car insurance deductible. This means that if you have a collision or comprehensive insurance deductible, you will need to pay this amount yourself before your gap insurance coverage kicks in. Additionally, gap insurance does not cover overdue payments or late fees on your car loan or lease. It also does not cover extended warranties, carry-over balances from previous loans or leases, or lease penalties for high mileage or excessive use.

Furthermore, gap insurance does not cover charges for credit insurance connected to the loan, nor does it cover a down payment for a new car. It is important to note that gap insurance only covers total losses resulting from accidents or theft, and does not cover mechanical issues, engine failure, or transmission failure.

When deciding whether to purchase gap insurance, it is important to consider the limitations of its coverage. While it can provide valuable financial protection in the event of a total loss, it is not a comprehensive solution and may not cover all expenses related to your vehicle.

Allstate: Gap Insurance Coverage

You may want to see also

Frequently asked questions

Gap insurance, also called loan/lease coverage, is an optional form of insurance that covers the gap between the amount you still owe to your auto lender and the actual cash value of your vehicle if it's totaled in an accident or stolen.

The price of gap insurance depends on whether you get it from an insurance company, dealer, or lender. You can expect to pay between $200 to $700 or even more if you finance through a credit union, bank, or dealer. According to WalletHub, it costs about 5% to 6% of your comprehensive and collision insurance premium.

You can purchase gap insurance from your lending company or the dealership when you purchase your vehicle. You can also add it to your full-coverage insurance policy. In New Jersey, lenders and dealers must offer a gap insurance waiver as part of the buyer's contract, and you have 30 days to decide if you want to keep it.