Driving in North Carolina requires auto insurance, and it is illegal to drive without it. The state has specific requirements for the minimum coverage drivers must have, including liability coverage for bodily injury to others and uninsured/underinsured motorist coverage. The minimum coverage amounts are set at $30,000 per person and $60,000 per accident for bodily injury liability and uninsured/underinsured motorist coverage, and $25,000 per accident for property damage liability. These requirements are essential for drivers in North Carolina to be aware of and abide by, ensuring they have the necessary financial protection in case of an accident.

| Characteristics | Values |

|---|---|

| Required Insurance Coverage | Bodily Injury Liability Coverage, Property Damage Liability Coverage, Uninsured Motorist Bodily Injury Coverage, Uninsured/Underinsured Motorist Property Damage Coverage |

| Minimum Bodily Injury Liability Coverage | $30,000 per person and $60,000 per accident |

| Minimum Property Damage Liability Coverage | $25,000 per accident |

| Minimum Uninsured Motorist Bodily Injury Coverage | $30,000 per person and $60,000 per accident |

| Minimum Uninsured/Underinsured Motorist Property Damage Coverage | $25,000 per accident |

What You'll Learn

Minimum insurance requirements in North Carolina

In North Carolina, drivers are required by law to carry a minimum amount of auto insurance. This includes liability coverage, which is a standard feature of most car insurance policies, as well as uninsured motorist coverage.

The minimum coverage requirements in North Carolina are as follows:

- Bodily injury liability coverage: $30,000 per person and $60,000 per accident.

- Uninsured motorist bodily injury: $30,000 per person and $60,000 per accident.

- Uninsured/underinsured motorist property damage: $25,000.

- Property damage liability coverage: $25,000.

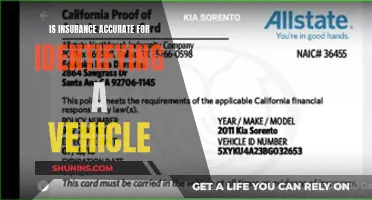

Drivers in North Carolina must also carry proof of insurance with them at all times when driving and present it to a law enforcement officer if asked. This can include a DL-123 certification from an insurance agent, a copy of the policy declaration page, or an insurance binder copy.

While car insurance is the most common form of proof of financial responsibility, North Carolina law allows for some alternatives. These include:

- Surety bond: a guarantee from a licensed company that the driver can make payments to the injured party after causing an accident.

- Self-insurance: an option for those who own or lease 26 or more cars, requiring proof of financial ability to satisfy payments.

- Security deposit/cash: a deposit of $85,000 to the State Treasurer in exchange for a certificate from the Commissioner of Motor Vehicles.

- Real estate bond: a guarantee of payment of up to $85,000 backed by a piece of property, signed by two other individuals who own real estate in North Carolina with a combined equity of at least $170,000.

Assurant: Vehicle Insurance Available?

You may want to see also

Uninsured motorist coverage

In North Carolina, uninsured motorist coverage (UM) is mandatory. It covers the cost of medical bills for you, your family members, or anyone occupying your car if an uninsured driver causes an accident and injures you or anyone in your car. UM will also pay for repairs to your car caused by an uninsured driver.

The minimum limits for UM coverage in North Carolina are:

- UM bodily injury: $30,000 per person, $60,000 per accident

- UM property damage: $25,000

It's important to note that UM coverage must be written on all vehicles at the same limit. However, you can purchase higher UM limits than your bodily injury liability limits.

If you are in an accident caused by an uninsured driver, your UM insurance may not cover all your expenses. For example, if your injuries result in $40,000 in medical bills and your UM coverage only includes $30,000, you will have to pay the remaining $10,000 out of pocket. Therefore, it is recommended to review your policy periodically and discuss with your insurance agent whether you have adequate UM coverage.

Insurance Status: License Plate Lookup

You may want to see also

Full coverage insurance

In North Carolina, full-coverage car insurance is not mandatory, but it is a good idea to have it. Full-coverage insurance is a combination of collision and comprehensive insurance, which covers damage to your car in an accident, as well as theft, vandalism, or damage from natural disasters.

While liability insurance is mandatory in North Carolina, it only covers the cost of the other driver's car repair and medical bills if you are found legally responsible for an accident. With full-coverage insurance, you can also repair or replace your own car if it is damaged or stolen. This can give you peace of mind and protect your finances in the event of an accident.

The cost of full-coverage insurance in North Carolina varies depending on factors such as age, driving history, and location. On average, it costs around $1,627 per year or $136 per month. The cheapest full-coverage insurance in the state is offered by Erie, at an average of $87 per month or $1,043 per year. Other affordable options include State Farm, North Carolina Farm Bureau, Nationwide, and Penn National.

When shopping for full-coverage insurance in North Carolina, be sure to compare quotes from multiple providers and ask about available discounts to get the best rate.

GM Financial: Leased Cars and Insurance

You may want to see also

Average insurance costs

The average cost of car insurance in North Carolina is $1,828 per year for full coverage and $536 per year for state-required minimum coverage. This is well below the national average cost of car insurance, which is $2,311 per year for full coverage and $640 per year for minimum coverage.

On a monthly basis, full coverage costs $152 per month, while minimum coverage costs $45 per month.

The cost of car insurance in North Carolina varies depending on several factors, including age, gender, marital status, credit rating, and driving history. For example, younger, less experienced drivers tend to pay higher rates, with 16-year-old drivers paying an average annual rate of $2649.93, while drivers in their 50s pay around $842 per year. Additionally, drivers with a good to excellent credit rating tend to benefit from lower insurance rates, as they are less likely to file a claim.

The city in which you live can also impact the cost of car insurance. For instance, Newell, North Carolina, is the state's most expensive city, with rates up to 29% higher than the average. In contrast, Alexander is the cheapest city, with rates approximately 13% lower than the state average.

It is worth noting that North Carolina is an at-fault state, meaning the party responsible for an accident must cover the injuries of the other driver and their passengers.

Red Cars: Insurance Premiums Higher?

You may want to see also

Best insurance companies in North Carolina

When it comes to vehicle insurance in North Carolina, drivers are required to have auto liability coverage (including BI liability and PD liability) and either uninsured motorist (UM) coverage or uninsured/underinsured motorist (UM/UIM) coverage.

Now, let's take a look at some of the best insurance companies in North Carolina, focusing on their vehicle insurance offerings:

Geico

Geico is often a good choice for drivers on a budget, as it offers some of the lowest average full-coverage premiums in the state. They provide standard car insurance and three add-on options: emergency roadside assistance, rental car reimbursement, and mechanical breakdown insurance. Geico also has a long list of potential discounts, including for military members and safe driving. Additionally, they offer a usage-based program called DriveEasy, which rewards good drivers with premium discounts. However, Geico's J.D. Power ratings are below average, and they have limited coverage options compared to competitors.

State Farm

State Farm is the largest auto insurance company in the nation, and they have a strong presence in North Carolina, with offices in 158 cities. They offer a wide range of coverage options, including full coverage, minimum coverage, comprehensive coverage, medical payments coverage, underinsured/uninsured motorist coverage, rideshare driver coverage, and emergency roadside assistance coverage. State Farm also has a highly-rated mobile app that makes it easy for customers to manage their policies. On the downside, State Farm does not offer accident forgiveness as an endorsement, and they have received a higher-than-average number of complaints.

Nationwide

Nationwide is a good choice for those looking for a one-stop shop for insurance and financial services. They offer a wide range of insurance products, including standard coverage and add-ons like accident forgiveness, vanishing deductible, and total loss deductible waiver. Nationwide also has several discount programs, such as multi-policy, defensive driving, and anti-theft. However, their digital tools and customer satisfaction ratings are below average.

Allstate

Allstate offers extensive coverage options, including sound system coverage, roadside assistance, and rental car reimbursement. They have local agents available to help with policy selection and claims filing. However, Allstate's rates in North Carolina can be higher compared to competitors, and they have a below-average customer satisfaction score.

North Carolina Farm Bureau

North Carolina Farm Bureau is ideal for those looking for local coverage and affordable rates. They offer standard auto insurance coverage and roadside assistance. Membership is required, and members may have access to discounts on hotels, rental vehicles, and farm equipment. However, their coverage options are basic, with limited personalization options.

Erie Insurance

Erie Insurance is a regional provider with a strong presence in North Carolina. They offer a wide range of coverage options, including standard coverage and add-ons like first accident forgiveness and diminishing deductible. Erie also has a variety of discount programs, such as policy bundling, safe driving, and student driver discounts. They have received high ratings in consumer studies, particularly for customer satisfaction. However, Erie Insurance is not available in every state, and they do not offer a usage-based insurance option.

Leasing a Vehicle in Florida: Insurance Laws

You may want to see also

Frequently asked questions

The minimum legal requirement for auto insurance in North Carolina is $30,000 per person and $60,000 per accident for bodily injury liability coverage, and $25,000 per accident for property damage liability coverage. In addition, drivers must have uninsured motorist bodily injury coverage of at least $30,000 per person and $60,000 per accident, and uninsured/underinsured motorist property damage coverage of at least $25,000.

While the state minimum coverage is all that is legally required in North Carolina, "full coverage" is often considered to include comprehensive and collision coverage in addition to the state minimums. Comprehensive coverage helps pay for damages caused by events like hail, fire, or theft, while collision coverage helps cover the cost of repairing damage to your car from an accident with another car.

Yes, it is illegal to drive without insurance in North Carolina.

The average cost of auto insurance in North Carolina was $1,067 per year in 2021, according to thezebra.com. However, your auto insurance cost will depend on factors such as your age, location, and driving history.