Insurance is an important aspect of vehicle ownership, as it provides financial protection in case of accidents or damages. When it comes to identifying a vehicle through insurance, there are several methods and factors to consider. Firstly, it is essential to have the correct insurance information, including the Vehicle Identification Number (VIN), vehicle license plate number, or owner's driver's license number. This information can be obtained from the insurance company or through government websites and portals, such as the Department of Motor Vehicles (DMV) in the United States or the Parivahan Sewa and Vahan portals in India. Additionally, insurance tracking devices or smartphone apps can be used to monitor driving behaviour and provide data to insurance companies for adjusting premiums or offering discounts. It is worth noting that insurance requirements and platforms vary by country and state, so it is important to refer to the specific regulations in your region.

| Characteristics | Values |

|---|---|

| How to identify a vehicle | Vehicle Identification Number (VIN), vehicle license plate number, owner's driver's license number |

| How to find out if a vehicle has insurance | Check by license plate number, contact your state's DMV, check the vehicle for proof of insurance, review financial documents, check with local police |

| How to check insurance status | Online: insurer’s website, Parivahan Sewa/Vahan portal, mParivahan app, IIB portal, RTO website; Offline: call insurance company, visit insurer's office, visit RTO office |

What You'll Learn

Vehicle Identification Number (VIN)

A Vehicle Identification Number (VIN) is a unique code used to identify individual vehicles. This includes motor vehicles, towed vehicles, motorcycles, scooters and mopeds. The VIN is usually stamped into the chassis of the vehicle and can also be found in multiple locations, such as in the lower corner of the windshield on the driver's side, under the bonnet next to the latch, and inside the door pillar on the driver's side.

The VIN is made up of 17 characters (numbers and letters) that act as a unique identifier for the vehicle. The first three characters are the World Manufacturer Identifier (WMI) or WMI code, which identifies the manufacturer of the vehicle. The fourth to ninth positions are the Vehicle Descriptor Section (VDS), which is used to identify the vehicle type and may include information on the model, body type, transmission type, and engine code. The 10th to 17th positions are the Vehicle Identifier Section (VIS), which is used by the manufacturer to identify the individual vehicle in question and may include information on options installed, engine and transmission choices, or a simple sequential number.

In the United States, the National Highway Traffic Safety Administration standardised the VIN format in 1981, requiring all on-road vehicles sold to contain a 17-character VIN. This standard was quickly adopted by manufacturers producing vehicles for the American market, and it was also used in Europe. There are also other VIN standards used in different parts of the world, such as the FMVSS 115, Part 565 standard used in the United States and Canada, and the ISO 3779 standard used in Europe and many other regions.

VIN verification is important when purchasing a vehicle, as it can help potential car owners identify defective vehicles or those that have been written off. Additionally, when registering a vehicle, it is essential to have a valid VIN, as this is required for insurance and tax purposes.

Vehicle Insurance Status: Quick Verification in India

You may want to see also

License plate number

A license plate number is a crucial piece of information when it comes to identifying a vehicle and its insurance details. In the event of a collision, exchanging license plate information with the other driver is essential for making insurance claims. This information, along with the other driver's name and contact details, helps insurance companies process claims efficiently.

Additionally, license plate searches are similar to Vehicle Identification Number (VIN) checks and can reveal a wealth of information about a vehicle. By performing a license plate search, individuals can access data such as the vehicle's accident history, theft reports, current ownership, registration status, and inspection history. This information is particularly useful when considering purchasing a used car, as it provides a comprehensive overview of the vehicle's history.

It's worth noting that while insurance companies are a source of information for license plate searches, there are also other sources, including motor vehicle departments, service stations, and federal motor vehicle databases. The Freedom of Information Act and other laws grant individuals the right to access this government-collected data.

In summary, license plate numbers play a vital role in identifying vehicles and their insurance details. They are often linked to vehicle registration information, which can be obtained from the DMV. License plate searches provide valuable insights into a vehicle's history and current status, making them a useful tool for vehicle owners, buyers, and insurance companies alike.

Insurance Total Loss: What's Next?

You may want to see also

Insurance policy number

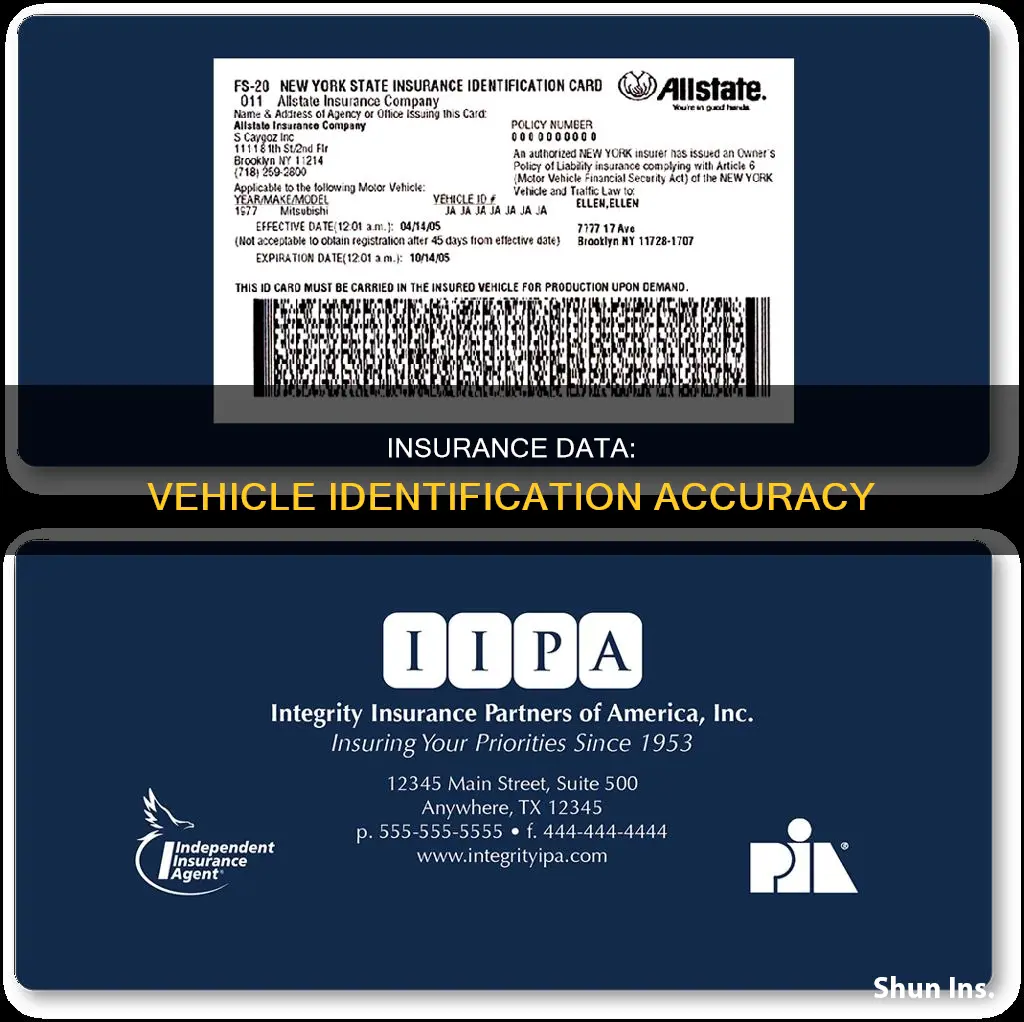

An insurance policy number is a unique identifier assigned to a policyholder by an insurance company. It is used to identify your account and connect you to your specific coverage details. This number is usually 8 to 13 digits long and can be found on your insurance card, often labelled as "Policy #" or "Policy ID". It should also be present on your billing statements, policy declarations page, and possibly in your online insurance portal or mobile app.

Your insurance policy number is essential in situations such as reporting an accident, getting pulled over by the police, or when discussing your policy with your insurance company. It is also required when filing a claim, as it helps your insurance company quickly access your policy details.

If you lose your insurance card, most insurance companies will mail you a paper copy and allow you to print new cards from your online account. It is recommended to keep at least two copies: a digital copy on your phone and a paper copy in your glove box. Although most states allow digital proof of insurance, it is good to have a paper copy as a backup.

In addition to your insurance policy number, there are several other pieces of information you will need to provide or obtain following an accident. This includes the other driver's name, contact information, insurance company, and policy number. You will also need the vehicle's license plate number and vehicle identification number (VIN). It is a good idea to take photos of the other driver's insurance card, as well as the damage to both vehicles involved in the accident. Filing a police report is also crucial, as it serves as an objective record of the incident and helps determine fault.

Paid-Off Cars: Cheaper Insurance?

You may want to see also

Insurance coverage types

There are several types of car insurance, but most people don’t need all of them. Here are some of the most common types of insurance coverage:

Liability Insurance

Liability insurance covers you in the event of a car accident where you are at fault. It will cover the cost of repairing any damaged property and the medical bills from any resulting injuries. Liability insurance is required in nearly every state and you will need proof of insurance to drive a new vehicle. There are two types:

- Bodily injury liability covers medical expenses from an accident.

- Property damage liability covers the repair costs to other vehicles, fences, mailboxes, or buildings.

Collision Coverage

Collision coverage pays for repairs to your car after an accident, regardless of who was at fault. It will also pay for damage to your car from hitting a pothole or an object like a pole or tree. Collision coverage is not required by state law but is mandatory if you have a lienholder.

Comprehensive Coverage

Comprehensive insurance covers damage to your car from something other than a collision. This includes damage from theft, vandalism, floods, fire, or other covered losses. Like collision coverage, comprehensive coverage is not required by state law but is mandatory if you have a lienholder.

Uninsured Motorist Coverage

Uninsured motorist coverage pays for expenses that result from an uninsured driver hitting you. According to a 2021 study by the Insurance Research Council, about 1 in 8 drivers did not have car insurance in 2019. Uninsured motorist coverage is often paired with underinsured motorist coverage.

Underinsured Motorist Coverage

Underinsured motorist coverage pays out when the at-fault driver’s insurance limits are too low to cover all of the injuries or damage they caused. Many drivers choose to carry the minimum in liability coverage, but this might not be enough. Underinsured motorist coverage can protect you in this situation.

Medical Payments Coverage

Medical payments coverage, or MedPay, covers certain medical expenses, funeral costs, and health insurance deductibles for motorists who end up in car accidents. MedPay coverage is mandatory in three states: Maine, New Hampshire, and Pennsylvania.

Personal Injury Protection (PIP)

Personal injury protection, or PIP, covers certain medical bills, funeral costs, and childcare services after car accidents. PIP is required in 12 states and is similar to MedPay, but it comes with more extensive coverage offerings.

Other Types of Car Insurance

There are several other types of car insurance that you can add to your policy, including:

- Rental reimbursement

- Roadside assistance

- New-car replacement insurance

- Full glass coverage

- Rideshare insurance

- Mechanical breakdown coverage

- Custom parts and equipment value coverage

- Classic car insurance

- Business or commercial auto insurance

Unregistered Vehicles: Insurance Removal?

You may want to see also

Insurance tracking devices

There are two main types of insurance tracking devices: physical telematics devices and smartphone apps. Physical telematics devices, also known as dongles, are plugged into the vehicle's onboard diagnostic port, usually found beneath the steering wheel. Smartphone apps, on the other hand, are downloaded onto a driver's phone and synced with the car. Both types of devices monitor a range of driving habits, including speed, acceleration, braking, cornering, and phone usage while driving.

However, it is important to consider the risks associated with using insurance tracking devices. Privacy concerns are a primary issue, as these devices can track a driver's location and daily routines. There is also the possibility of data being sold to third-party marketers or other entities, or being used for purposes other than determining insurance premiums. Additionally, there is a risk of hacking, with sophisticated cyber-attacks potentially accessing and misusing personal data.

Before opting for an insurance tracking device, it is essential to research the insurance company's policies, understand what data they collect, and how it will be used and protected. While these devices offer potential benefits, users should carefully weigh the risks and ensure their privacy and security are maintained.

Audi Connect: Insurance Tracking System?

You may want to see also

Frequently asked questions

You can identify a vehicle through insurance by checking the Vehicle Identification Number (VIN), license plate number, or owner's driver's license number. You can also contact the insurance company directly and provide them with the necessary information.

To identify a vehicle through insurance, you will typically need the vehicle's registration number, policy number, and owner's contact information.

Yes, you can identify a vehicle's insurance status online through various platforms, including the insurer's website, government websites, and mobile applications.

Checking a vehicle's insurance status online offers several benefits, such as convenience, quick access to information, and the ability to avoid penalties and fines for not having valid insurance.

If you cannot find the insurance details of a vehicle online, you can try contacting the insurance company directly, visiting their local office, or reaching out to the vehicle's registered owner or policyholder.