In most US states, you need to present proof of insurance to register your vehicle and get your tags. However, seven states—Arizona, Mississippi, New Hampshire, North Dakota, Tennessee, Washington, and Wisconsin—do not require proof of insurance for registration. Even in these states, however, you'll need a minimum insurance coverage policy to drive legally. In the UK, the Motor Insurance Database (MID) is the central database of all insured vehicles. When you buy a car insurance policy, the details are uploaded to the MID, but there can be a delay before the information is updated.

| Characteristics | Values |

|---|---|

| Number of US states requiring proof of insurance or financial responsibility to register a vehicle | 43 states and Washington, D.C. |

| Number of US states not requiring proof of insurance or financial responsibility to register a vehicle | 7 (Arizona, Mississippi, New Hampshire, North Dakota, Tennessee, Washington and Wisconsin) |

| Number of US states requiring basic liability coverage to operate a vehicle | 49 (all except New Hampshire) |

| Number of US states using an electronic insurance verification system to identify uninsured drivers | At least 43 |

What You'll Learn

- Police can check the Motor Insurance Database (MID) to see if a vehicle is insured

- Most states require proof of insurance to register a vehicle

- Driving without insurance is a misdemeanor and can lead to fines and jail time

- In most states, you must surrender your license plates before cancelling your insurance

- Insurance companies provide proof of insurance after your first premium payment

Police can check the Motor Insurance Database (MID) to see if a vehicle is insured

In most states, you must turn in your license plates to the DMV or its equivalent before canceling your car insurance policy. This rule is in place to keep uninsured vehicles off the road, in line with most states' insurance laws. If a vehicle isn't insured, it can't be driven and registered legally.

If you get pulled over by the police while driving, they might ask you to show that you're insured. You can show them your policy documents, which you'll get a copy of by email as soon as you pay. They should also be available in the app. If you can't access your documents, customer support can send you a new copy as long as you have an active policy. Once the police have seen your policy documents, there's rarely an issue.

It's important to remember that by law, vehicles have to be insured at all times. These are known as Continuous Insurance Enforcement (CIE) laws. So while you can use a non-insured car for a Cuvva policy, it would be illegal to leave that vehicle uninsured between policies.

White Cars: Cheaper Insurance?

You may want to see also

Most states require proof of insurance to register a vehicle

Most states require proof of insurance or financial responsibility to register a vehicle and obtain license plates. This is to ensure that vehicles on the road have the minimum insurance coverage required by the state. In most states, you must turn in your license plates to the DMV or its equivalent before canceling your car insurance policy. This is because insurance policies are tied to the vehicle, and keeping the plates could suggest the vehicle is still insured.

However, the specific rules and requirements can vary from state to state. For example, in Arizona, you can keep your license plates if you temporarily cancel your insurance, but you cannot drive the vehicle without insurance. In California, you can register your vehicle without immediately providing proof of insurance, but you must provide it within 30 days of registration.

It is important to note that driving without insurance can lead to fines and even jail sentences in repeat cases. Additionally, your registration will be suspended if your insurance policy lapses. Therefore, it is essential to understand the requirements of your state and maintain the necessary insurance coverage.

To find specific information about your state, you can visit the official website of your state's Department of Motor Vehicles or its equivalent agency.

OHV Insurance: Arizona's Law

You may want to see also

Driving without insurance is a misdemeanor and can lead to fines and jail time

Driving without insurance is illegal in all 50 states and Washington D.C. While the specific penalties vary depending on the state, driving without insurance is generally considered a misdemeanor and can lead to fines, jail time, and other consequences.

In most states, the police will verify that a driver has an active insurance policy during a traffic stop by requesting a copy of the driver's insurance information or by running the vehicle's license plate through their state's insurance database. Failing to provide proof of insurance can result in tickets, fees, and license reinstatement fees.

For example, in Iowa, driving without insurance is classified as a simple misdemeanor, punishable by a fine. However, a conviction can result in a driver's license suspension and the requirement to carry more expensive SR-22 insurance. In some states, such as Michigan, driving without insurance can result in up to a full year of jail time, particularly for repeat offenses.

Additionally, drivers who are involved in an accident while uninsured may face even more severe penalties, including substantial financial liability for the other driver's medical and vehicle expenses. Reinstating a suspended license can also be costly, with fees ranging from a few hundred dollars to several thousand dollars.

To avoid legal repercussions and ensure the safety of yourself and others on the road, it is crucial to maintain active car insurance that meets the minimum liability coverage requirements in your state.

Vehicle Insurance: Am I Covered?

You may want to see also

In most states, you must surrender your license plates before cancelling your insurance

In most states, you must surrender your license plates to the DMV or its equivalent before cancelling your car insurance policy. This rule is in place to keep uninsured vehicles off the road, in line with most states' insurance laws.

License plates serve as proof that a vehicle meets the state's minimum insurance requirements. When a vehicle owner cancels their insurance without surrendering the license plates, it creates a discrepancy in state records, suggesting that an uninsured vehicle could be operating legally. To mitigate this risk, some states require the surrender of license plates before or at the same time as the cancellation of the insurance policy.

The process for surrendering license plates can vary depending on the state. In some states, you may be able to mail your license plates to the DMV or surrender them at a designated drop-off location or kiosk. It is recommended that you contact your local DMV to understand the specific requirements and procedures for surrendering license plates.

It is important to note that driving without insurance can result in significant fines and even jail time in some states. Additionally, your vehicle's registration may be suspended if it remains uninsured, making it illegal to drive on public roads. Therefore, it is crucial to follow the proper procedures when cancelling your car insurance policy and surrendering your license plates.

- Cancelling your auto insurance policy and not planning to replace it immediately.

- Selling or transferring ownership of your vehicle.

- Relocating to a new state and registering your vehicle there.

- Storing your vehicle or keeping it off the road for an extended period.

- Your vehicle is deemed totalled, scrapped, or otherwise taken out of service permanently.

Vehicle Insurance: Am I Covered?

You may want to see also

Insurance companies provide proof of insurance after your first premium payment

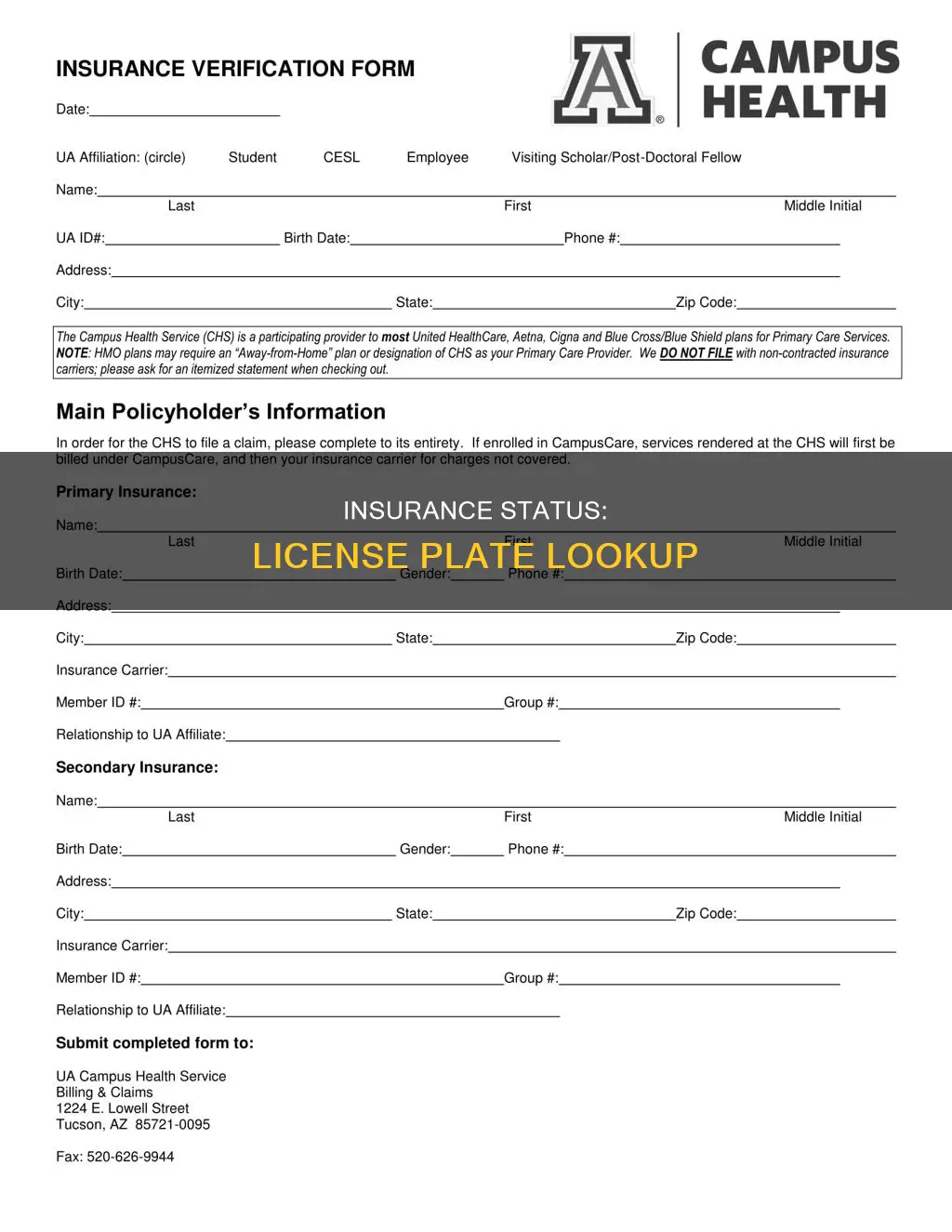

In most states, you will need to provide proof of insurance or financial responsibility to register your vehicle and get your tags. This proof of insurance is a document that shows you have a current and valid auto insurance policy. It includes basic information such as the insurance company's name and address, the effective date and expiration of the policy, the policyholder's name, and the insured vehicle's details.

Insurance companies typically provide proof of insurance after you purchase a policy and make your first premium payment. Depending on the insurance company, you may receive immediate proof via fax or email. You may also receive this document electronically, as 49 states and the District of Columbia allow digital copies of insurance cards. However, New Mexico is the only state that does not accept electronic proof during a traffic stop.

It is important to always have your proof of insurance with you when driving, as you may be required to show it during a traffic stop or when registering for a new vehicle. Additionally, maintaining consecutive insurance coverage can help you avoid higher car insurance premiums, as insurance companies may view lapses in coverage as a higher risk.

Unregistered Vehicles: Insurance Removal?

You may want to see also

Frequently asked questions

Yes, the police can check if a vehicle is insured or not by running the number through the Motor Insurance Database (MID).

Yes, in most states, you need to present proof of insurance or financial responsibility to register your vehicle and get your tags. However, there are seven states that do not require insurance for registration: Arizona, Mississippi, New Hampshire, North Dakota, Tennessee, Washington, and Wisconsin.

If you are in a state that requires insurance, you won't be able to register your vehicle without it. In states with an electronic filing system, your insurance provider will notify the DMV if your policy lapses, and you will need to renew your insurance to maintain registration.

Driving without insurance is a misdemeanor offense and can result in fines, license suspension, and even jail time for repeat offenses.

Insurance companies usually provide proof of insurance immediately after your first premium payment. They may send it via mail, fax, or electronically. You can also access your insurance ID through your insurance provider's mobile app or by logging into your account on their website.