Auto insurance companies are required by state law to provide notice before cancelling your policy. This grace period is typically between 10 and 20 days, and you will be notified by mail, phone call or email. If you miss paying during the grace period, your policy could be cancelled and you wouldn't be allowed to drive your car. You can then ask for the policy to be reinstated or find a new policy from another company. If you cancel your policy, you should get a refund for the remaining time in your policy.

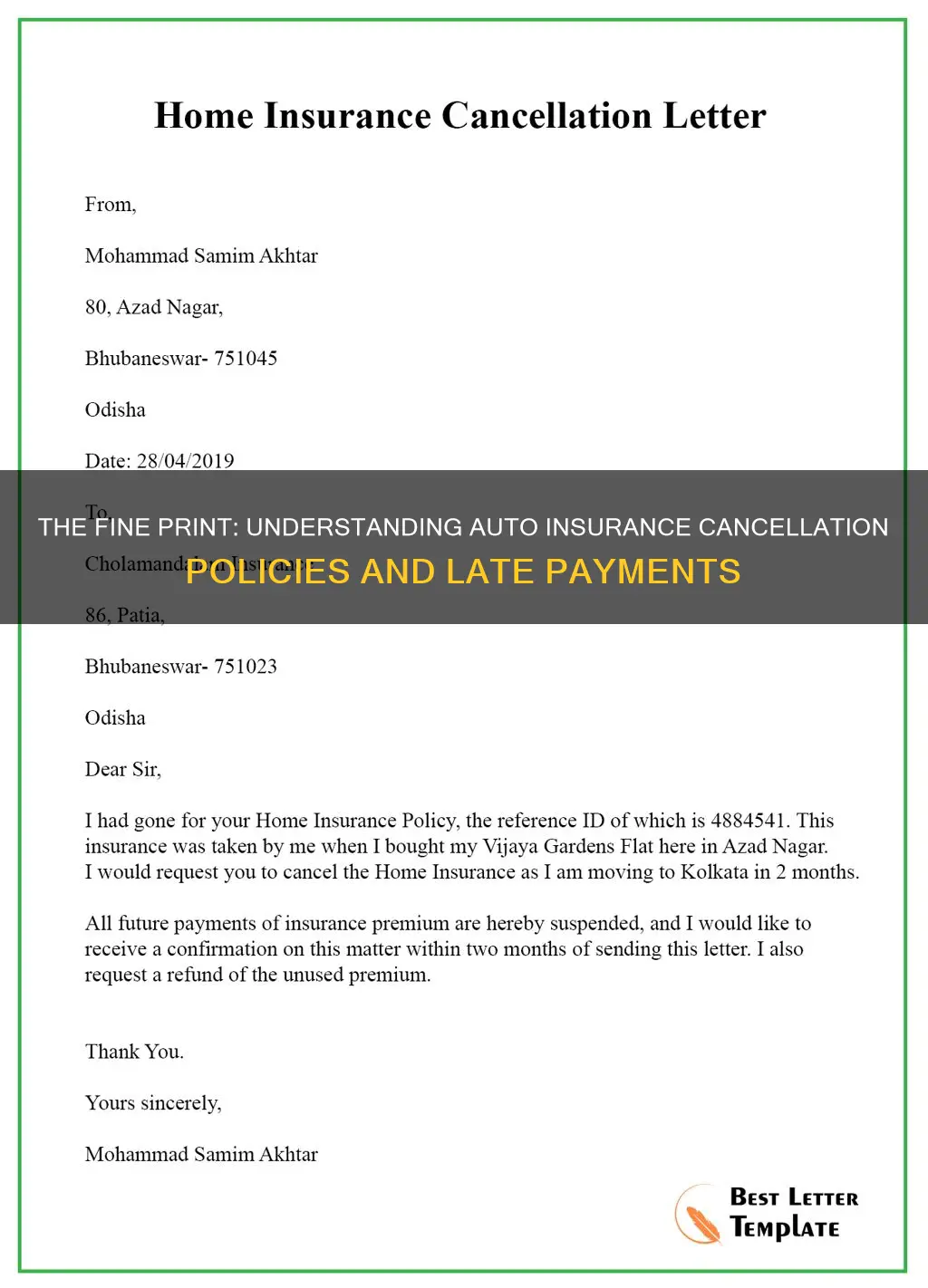

| Characteristics | Values |

|---|---|

| Time before cancellation | Between 10 and 20 days |

| Notice | Required by state law |

| Method of notice | Mail, phone call, or email |

| Driving without insurance | Illegal in almost every state |

| Driving without insurance consequences | License suspension, fines, higher insurance rates, repossession of vehicle |

| Cancelling insurance consequences | Higher insurance rates, fines |

| Cancelling insurance | Notify insurance company, ask for policy reinstatement, or find a new policy |

| Cancelling insurance fees | Cancellation fees, late fees, short-rate fees |

| Cancelling insurance refunds | Possible refund for remaining time in policy |

What You'll Learn

You will be notified before cancellation

If you miss a payment, your auto insurance won't be cancelled right away. Auto insurance companies are required by law to notify you before cancelling your policy. The exact amount of time you have before your policy is cancelled depends on the state, but it's usually between 10 and 20 days. You will be notified by mail, phone call, or email.

The grace period for late payments also depends on your insurer and your state, but it's typically between one and 30 days. If you pay within this time frame, the consequences should be minimal, and you will likely only incur a late payment fee. However, if you pay after the grace period, your insurance can lapse.

If your policy is cancelled, you may be able to have it reinstated. Contact your insurance company to ask about reinstating your policy. If your insurer requires you to get a new policy, shop around to find the best rate.

Unveiling Your Auto Insurance History: A Comprehensive Guide

You may want to see also

You can reinstate your policy

If your auto insurance policy has been cancelled, you may be able to get it reinstated by contacting your insurance provider, depending on their rules and your state's laws. Reinstatement is the restoration of a cancelled policy to full force and effect.

Get in touch with your insurance representative and explain your case as soon as possible. The insurance company may work out a deal with you to settle this problem much easier. But be ready to pay off the full amount due to avoid any more headaches.

Note that reinstatement of your current policy is only allowable with the same carrier and under the same policy you previously had – not with a new insurer. Many carriers will usually reinstate a policy cancelled due to non-payment if the lapse in coverage has been less than 30 days and there have been no claims/losses.

Some carriers have built-in grace periods, so read through your policy to see what is said about reinstating it if it is cancelled. Be aware that the reinstatement may be effective after the policy cancellation date, creating a lapse of coverage.

Also, car insurance providers allowing reinstatement within 30 days may require you to sign a “statement of no loss”. This is a form stating you have not experienced a loss in the time your policy lapsed and that you cannot and will not make a claim during that time period. Some companies may charge you a reinstatement fee, as well, to reinstate your policy.

Once your policy is reinstated, you may need to contact your state’s motor vehicle department to update your insurance information and confirm that your driver’s license and car registration are valid and remain active.

Marital Status and Auto Insurance Savings

You may want to see also

You may be considered a high-risk driver

Auto insurance is essential financial protection for you and your vehicle. Late or missing payments can result in a lapse in coverage, which means you won't be protected. If you miss a payment, your auto insurance provider may charge you a late fee of up to $15 per day until they process it. If you stop paying for coverage altogether, your coverage will lapse and your insurance provider will cancel your policy.

If you receive a cancellation notice from your insurance company, it's important to act promptly. Contact your provider, try to reinstate your policy with your current insurer, or shop around for a new policy. It's crucial to avoid driving your car until you are no longer uninsured, as driving without insurance is illegal in almost every state. Even one day without coverage can result in a higher car insurance rate.

Letting your policy lapse is one sign to insurers that you're a high-risk driver. If your previous company won't offer you insurance, you'll need to go with another company, such as a non-standard insurer or a company that specializes in high-risk drivers. You will likely face higher rates and a more challenging process when finding insurance after a policy lapse.

Additionally, late or skipped payments can have far-reaching effects on your credit. While auto insurance companies don't report late payments to credit reporting agencies, if the debt is passed to a collection agency, it will likely impact your credit score. This can affect your ability to get a credit card or loan, and the negative mark will stay on your credit report for up to seven years.

Umbrella Insurance: Auto-Optional

You may want to see also

You may face legal consequences

Driving without insurance is illegal in most states. If you are caught driving without insurance, you will likely face legal consequences. The severity of these penalties depends on a number of factors, including the state you are in when it happens and whether this is your first or a repeat offense.

Fines and Fees

If you are pulled over without insurance, you will likely be fined. The amount of the fine varies by state, ranging from $25 in Tennessee to $5,000 in Massachusetts. In California, for example, you could pay $100 to $200 plus penalty fees for a first offense. In addition, some states, such as Florida, will suspend your driver's license and registration and require fees to have them reinstated.

License Suspension

In many states, driving without insurance will result in the suspension of your driver's license and registration. This punishment is usually coupled with a hefty fine. In some cases, you may be required to file an SR-22 or FR-44 certificate with your state's Department of Motor Vehicles (DMV), stating that you are now carrying the required minimum coverage.

Jail Time

In some states, driving without insurance can result in jail time, especially for repeat offenders. In North Carolina, for example, driving without insurance is a Class 3 misdemeanor offense and can result in a permanent criminal record.

Vehicle Impoundment

If you are pulled over without insurance, a law enforcement officer may have the right to impound your vehicle. You would then be responsible for towing fees and other costs and might not be able to get your vehicle back until you can provide proof of insurance.

Increased Insurance Rates

If you are caught driving without insurance, you may find that the cost of car insurance increases. Insurance companies may view you as a higher-risk driver, resulting in more expensive premiums.

Difficulty Obtaining Insurance

If your previous insurance company will not offer you a new policy after a lapse, you may need to turn to a non-standard insurer that specializes in high-risk drivers. These companies tend to charge higher rates and provide worse service.

Repossession

If your vehicle is financed through a loan or lease, your lending or leasing company may require you to have full insurance coverage. If you let your insurance lapse, they may repossess the vehicle.

Credit Score Impact

If you owe money to your insurance company and they pass the debt to a collection agency, it can negatively affect your credit score. This can impact your ability to obtain a credit card or loan, and the negative mark will stay on your credit report for up to seven years.

Cars with the Cheapest Insurance Rates

You may want to see also

You can avoid a lapse in coverage

Lapses in car insurance coverage are common, but they can be avoided. If you're struggling to pay your insurance premiums, there are a few things you can do to keep your coverage. Firstly, shop around for quotes—you may be surprised at the premium differences between insurers. Secondly, consider lowering your policy limits to the state minimum. Finally, look for discounts, such as those offered by many insurers for paying premiums online or setting up recurring payments.

If you're going to be out of the country for a while, or your car is going to be in storage, you may be able to switch to a simple policy with just comprehensive coverage. This can help maintain your coverage and offer a reduced premium. If you're in the military, companies like USAA, Geico, and Esurance allow you to suspend your car insurance while you're deployed overseas.

If you're switching between two policies, make sure there's no gap between the ending of your old policy and the beginning of the new one. Set up a system to remind yourself when your premium is due, and if you're going to miss a payment, contact your insurance company straight away. They may be able to arrange a partial payment or extend the due date to keep you insured.

If you're moving to a new state, contact your insurance provider to see if your policy can be transferred. If not, arrange a new policy a few weeks before ending your current one to avoid a lapse in coverage.

Secura: Auto Insurance Options

You may want to see also

Frequently asked questions

Auto insurance companies typically offer a grace period for late payments, which is usually between 10 and 20 days. However, this can vary depending on the insurer and state laws, so it's important to check with your provider.

If you don't pay your bill within the grace period, your policy may be cancelled and you will no longer be able to drive your car legally. You may also face financial consequences, such as late fees and higher rates when you reinstate your policy or purchase a new one.

If your policy is cancelled, you should contact your insurance company immediately to see if it can be reinstated. If not, you will need to purchase a new policy, possibly from a company that insures high-risk drivers.