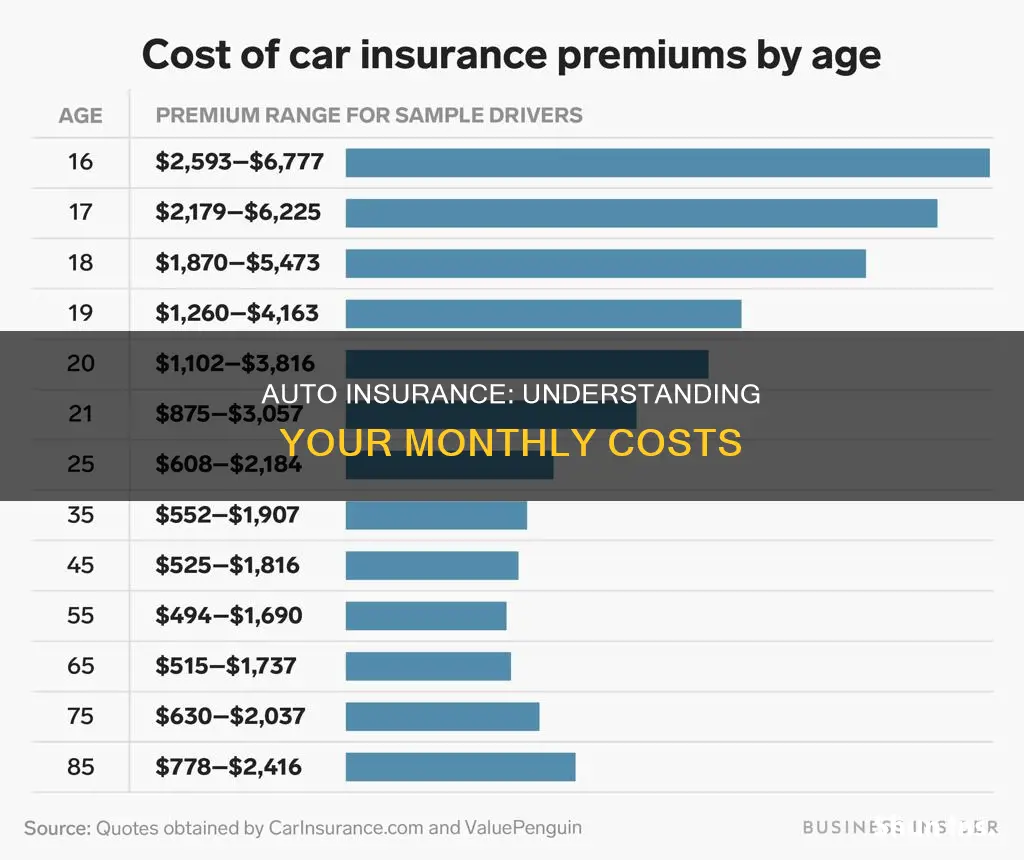

The average cost of car insurance in the US is $194 for full coverage and $53 for minimum coverage per month. However, the cost of car insurance varies depending on several factors, such as age, driving record, credit-based insurance score, location, vehicle type, and more. For example, the average cost of car insurance for a 16-year-old driver is $5,486 per year, while it is $1,220 per year for a 40-year-old driver. Additionally, the cost of car insurance also differs across states, with New York, Louisiana, and Florida being the most expensive states for full-coverage car insurance.

What You'll Learn

Car insurance costs for young drivers

Car insurance for young drivers can be expensive. The cost of insuring a young driver varies depending on several factors, including age, gender, driving history, location, and the type of car they drive. Here are some key insights on car insurance costs for young drivers:

Average Costs:

According to various sources, the average annual cost of car insurance for young drivers can range from around $3,500 to $7,000 or more. The cost tends to be higher for younger drivers, with 16-year-olds paying the most. As young drivers gain more experience and age, the insurance costs tend to decrease.

Gender Impact:

In most states, male drivers tend to pay more for car insurance than female drivers in the same age group. This is because male drivers are generally considered to engage in riskier driving behaviors and have a higher rate of accident severity. However, the difference in costs between genders tends to decrease as drivers get older.

Driving History:

Young drivers with a clean driving record will typically pay lower insurance rates than those with accidents, speeding tickets, or DUI convictions on their record. A single speeding ticket can increase rates by around 20-30%, while an at-fault accident can result in a 40-50% increase. A DUI conviction will lead to even higher increases, sometimes doubling the insurance cost.

Location and State Regulations:

The cost of car insurance for young drivers also varies by state. Factors such as population density, accident rates, insurance requirements, and local labor and vehicle repair costs contribute to these variations. States like Idaho, Vermont, and Ohio tend to have lower insurance costs for young drivers, while states like New York, Louisiana, and Florida have higher average rates.

Type of Car:

The type of car a young driver chooses can significantly impact insurance costs. Sports cars, luxury vehicles, and SUVs tend to have higher insurance rates due to higher repair costs, safety concerns, and theft rates. Opting for a standard sedan or a vehicle with good safety ratings and security features can help keep insurance costs lower.

Credit Score:

In most states, insurance companies consider an individual's credit score when determining insurance rates. Young drivers with poor credit may pay significantly more for car insurance than those with good credit. Improving credit scores over time may help reduce insurance costs.

Discounts and Savings:

Young drivers can explore various discounts offered by insurance companies to help lower their insurance costs. These may include good student discounts, driver's education discounts, defensive driving course discounts, and discounts for bundling policies or paying premiums in full.

Insuring Electric Cars in Massachusetts

You may want to see also

Car insurance costs for drivers with a history of accidents

The cost of car insurance for drivers with a history of accidents varies depending on the state, the driver's age, and the insurance company. According to US News, the national average rate for drivers with a single accident on their record is $2,940 per year, which is about $872 higher than the national average for a driver with a clean driving record.

The cost of car insurance also depends on the severity of the incident. Minor accidents and violations, like speeding or running a stop sign, usually cause a relatively minor increase in premiums of around 23%. However, if you are convicted of a serious traffic violation, like a DUI, you could see a difference in rates of 83%.

According to Forbes Advisor, the national average rate increase is 45% after an accident with property damage, and 47% for causing an accident that results in injuries. State Farm had the lowest average rate hike (21%) for at-fault accidents with only property damage, while Geico had the highest (73%), on average.

The cost of car insurance after an accident also depends on the insurance company. According to US News, USAA, which is only available to the military community, has the lowest sample rate in their study for drivers with a single accident: $1,908 per year. Erie Insurance is the next cheapest at $1,964. On the other hand, Farmers Insurance has the highest sample rate in their study for drivers with a single accident: $4,926 per year.

In addition to the cost of insurance, drivers with a history of accidents may also have to pay higher deductibles and surcharges. These additional costs can further increase the financial burden on drivers with a history of accidents.

Retroactive Auto Insurance: Is It Possible?

You may want to see also

Car insurance costs for drivers with a history of speeding tickets

The cost of car insurance typically goes up about 23% to 25% after a speeding ticket. On average, a driver convicted of speeding will pay $38 more per month or $2,486 a year for full coverage insurance. However, the exact amount will vary based on your driving history, where you live and your insurance company's rules.

For example, State Farm has the smallest average rate hike after a speeding ticket, increasing rates by around 11% or $11 per month. On the other hand, Farmers had the biggest increase among large insurers.

Your car insurance premium will likely increase after you get a speeding ticket, but typically not until it's time to renew your policy. If you just got your first speeding ticket, there's a chance it won't affect your car insurance costs at all. Some insurers don't raise rates after a single speeding violation.

If your current insurer does raise your premium after one ticket, shop around for a new policy. You might find a company that won't penalize you.

Credit Card Auto Insurance: Hertz Rental Coverage Explained

You may want to see also

Car insurance costs for drivers with a history of DUIs

The cost of car insurance for drivers with a history of DUIs will vary depending on the state and insurance provider. However, it is important to note that a DUI is typically considered one of the most severe driving incidents, and insurance companies assess potential customers' risk of filing a claim when setting their rates. As a result, drivers with a DUI on their record can expect to see a significant increase in their car insurance premiums.

On average, a driver with a clean driving record pays around $2,542 per year for a full coverage auto insurance policy, while a driver with a DUI conviction pays approximately $4,790 per year, which is 88% higher for the same coverage. The cost of car insurance after a DUI can also vary by state due to differences in insurance laws and location-specific factors.

Some insurance companies may refuse to provide coverage to drivers with a DUI conviction, and existing insurers may choose not to renew policies. However, there are carriers that specialise in high-risk drivers and are willing to offer coverage.

- Maintain a clean driving record by avoiding future tickets and accidents.

- Bundle auto and home insurance or auto and renters insurance to take advantage of bundling discounts.

- Increase your deductible on collision and comprehensive coverage, but choose an amount that you can comfortably pay out of pocket.

- Compare rates from different insurance providers, as each company has its own underwriting guidelines and rating factors.

- Speak with a licensed insurance agent to identify the best ways to save based on your circumstances.

Insuring Your Child's Partner

You may want to see also

Car insurance costs for drivers with poor credit

Car insurance rates are determined by a variety of factors, including age, location, driving record, vehicle type, and credit score. While the weight of these factors varies by insurance company, drivers with poor credit tend to pay more for car insurance than those with good credit. This is because drivers with poor credit are considered higher-risk and are more likely to file insurance claims. In fact, drivers with poor credit pay nearly 87% more for full-coverage car insurance than those with good credit.

How Credit Score Affects Car Insurance Rates

In most states, insurance companies use a credit-based insurance score to evaluate how likely a driver is to file insurance claims. This score is based on an individual's credit history, including their outstanding debt, credit history length, credit mix, payment history, and pursuit of new credit. While the specific formula for calculating this score varies by insurance company, a lower credit score generally results in a higher insurance rate.

For drivers with poor credit, the cost of car insurance can vary significantly depending on location and insurance company. According to MoneyGeek, the cheapest car insurance companies for drivers with poor credit are Nationwide and GEICO, with average annual rates of $1,374 and $1,775, respectively. However, the cheapest company may also depend on the state, with regional insurers sometimes offering more competitive rates.

Strategies for Reducing Car Insurance Costs for Drivers with Poor Credit

Drivers with poor credit can employ several strategies to reduce their car insurance costs:

- Take advantage of discounts: Many insurance companies offer discounts for bundling policies, having a good driving record, or being a loyal customer.

- Pay the full annual premium at once: Some insurance companies offer discounted rates for policyholders who pay their premium in full rather than in monthly or quarterly installments.

- Improve your credit score: This can be done by paying bills on time, keeping credit utilization low, and disputing any errors on your credit report.

- Reduce your coverage: Evaluate your circumstances and determine if you need all of your current coverage.

- Raise your deductibles: Increasing your deductible can lower your monthly payments, but keep in mind that you will have to pay more out-of-pocket if you need to make a claim.

- Shop around: Compare quotes from different insurance companies to find the best rate for your needs.

While drivers with poor credit may face higher car insurance rates, there are strategies to reduce these costs. By improving their credit score, taking advantage of discounts, and shopping around for the best rate, drivers with poor credit can find more affordable car insurance coverage.

Gap Insurance: Partial Payment Explained

You may want to see also

Frequently asked questions

The average cost of car insurance is $50 per month for minimum coverage and $108 per month for full coverage.

The average cost of car insurance is $135 per month for full coverage for a driver with a speeding ticket.

The average cost of car insurance is $158 per month for full coverage for a driver with an accident.

The average cost of car insurance is $190 per month for full coverage for a driver with a DUI.