Car insurance rates are known to decrease as people age, and this is especially true after the age of 25. This is because younger drivers are considered to be less experienced and more prone to accidents, making them a higher risk to insure. Once a driver turns 25, they are considered more mature and less likely to be involved in accidents, which leads to a decrease in insurance rates. However, the decrease in rates may not be as significant as expected, and other factors such as driving history, credit score, and location can also impact insurance premiums.

What You'll Learn

- USAA auto insurance for 25-year-olds with a clean driving record

- USAA auto insurance for 25-year-olds with a poor driving record

- USAA auto insurance for 25-year-olds with a military background

- USAA auto insurance for 25-year-olds with low mileage

- USAA auto insurance for 25-year-olds with good credit history

USAA auto insurance for 25-year-olds with a clean driving record

USAA is an insurance company that offers some of the lowest insurance rates on the market. It was founded in the 1920s by military members and is available to current and former members of the military and their families.

USAA's car insurance rates are determined by several factors, including location, credit score, marital status, gender, driving record, age, and how often the policyholder drives. Generally, car insurance rates tend to decrease as policyholders age and gain more driving experience. This is because younger drivers are considered higher risk due to their lack of driving experience and are therefore more likely to be involved in accidents.

For USAA policyholders, car insurance rates typically decrease around the age of 25. This is because drivers are considered more mature and less likely to engage in risky driving behaviour. USAA also offers a variety of discounts that can help lower insurance rates for 25-year-olds, including:

- Military Installation: A 15% discount if you park your vehicle on a military base.

- Premier Driver: A discount for maintaining a good driving record for five years, which also qualifies you for accident forgiveness.

- Defensive Driving Course: Enrolling in a defensive driving course can result in significant savings on USAA insurance premiums.

- Good Student: Full-time students with a GPA of 3.0 or higher, or those on their school's academic achievement list, can receive a discount.

While age is a significant factor in determining insurance rates, it is important to note that other factors, such as driving experience, driving history, and credit history, also play a role. Additionally, insurance rates can vary depending on the company, so it is always a good idea to shop around and compare rates from different providers.

Massachusetts Auto Insurance Law: Understanding the Requirements

You may want to see also

USAA auto insurance for 25-year-olds with a poor driving record

USAA is an auto insurance company that offers some of the lowest rates on the market. It was founded in the 1920s by military members and is only available to current and former members of the military and their families.

Your monthly rates with USAA will depend on several factors, including location, credit score, marital status, gender, driving record, age, and how often you drive. USAA also offers several discounts that you may be able to take advantage of to lower your premium.

For a 25-year-old driver with a poor driving record, USAA's rates will vary depending on the specific details of their driving history. For example, a single 25-year-old male with a speeding ticket on his record can expect to pay an average of *$1,094.44* per year, while a single 25-year-old female with an at-fault accident on her record can expect to pay an average of *$1,037.67* per year.

To get an accurate quote for your specific situation, you can visit the USAA website or speak with a company representative over the phone. It is important to note that rates can vary significantly from company to company, so it is always a good idea to compare quotes from multiple companies to ensure you are getting the best rate.

Bundling Home and Auto Insurance: Smart Savings or Costly Mistake?

You may want to see also

USAA auto insurance for 25-year-olds with a military background

USAA was founded in the 1920s by military members to provide insurance for those who couldn't get it elsewhere. Today, it offers some of the lowest insurance rates on the market, with annual rates for a single 25-year-old male at $1,094.44 and a single 25-year-old female at $1,037.67.

USAA offers insurance for active, retired, and separated veterans, as well as their immediate family members, including spouses, children, step-children, and widows. To be eligible, you'll need to provide proof of military service or a copy of your government-issued identification.

USAA offers a range of discounts to its members, including:

- Good driving discount: For maintaining a good driving record for more than five years.

- Defensive driving discount: For taking an approved course.

- Driver training course: For drivers younger than 21 who take an approved introductory driving training course.

- Good student discount: For high school and college students who maintain good grades.

- Multi-vehicle discounts: For insuring more than one car through USAA.

- New vehicle discounts: For vehicles less than three years old.

- Anti-theft device discount: For having an alarm system, wheel lock, or GPS-based vehicle recovery system.

- Storing your car discount: For keeping your car in storage, reducing the risk of driving.

- Driving less discount: For putting fewer miles on your car each year.

- Loyal member discount: For long-standing members or those whose families have been members for generations.

- Accident forgiveness: An optional feature that is free after five years of paying for it.

In addition to these, USAA also offers discounts from retail partners, such as FTD Flowers, FedEx, fitness centres, prescription drugs through GoodRx, and TurboTax tax prep software.

USAA also has stellar mobile banking and telematics apps that track your driving habits, which can provide a discount on your auto insurance.

Canceling Gap Insurance: What You Need to Know

You may want to see also

USAA auto insurance for 25-year-olds with low mileage

USAA is a good option for 25-year-olds looking for low-cost auto insurance. USAA is only available to current and former members of the military and their families, but it offers some of the cheapest car insurance for 25-year-olds across the nation.

The cost of your auto insurance will depend on several factors, including your location, credit score, marital status, gender, driving record, age, and how often and how far you drive. USAA offers an annual mileage discount for drivers who are 29 years of age or older, which can help to keep rates low.

According to US News, the national USAA annual rate for a single 25-year-old female driver is $1,037.67, while a single male driver of the same age would pay $1,094.44. These rates are significantly lower than the national average for drivers in this age group, which is $1,909 per year.

USAA also offers a range of other discounts that can help to reduce your premium. These include:

- Safe driver discount

- Driver training discount

- Good student discount

- New vehicle discount

- Multi-vehicle discount

- Family discount

- Automatic payments discount

In addition, USAA has been rated No. 1 for customer service, claims handling, and discounts, so you can be confident that you're getting a good deal and a high level of service.

Windshield Repair: Understanding the Impact on Auto Insurance Rates

You may want to see also

USAA auto insurance for 25-year-olds with good credit history

USAA offers some of the cheapest car insurance rates for 25-year-olds with good credit history. However, it is important to note that USAA insurance is only available to current and former military members and their families.

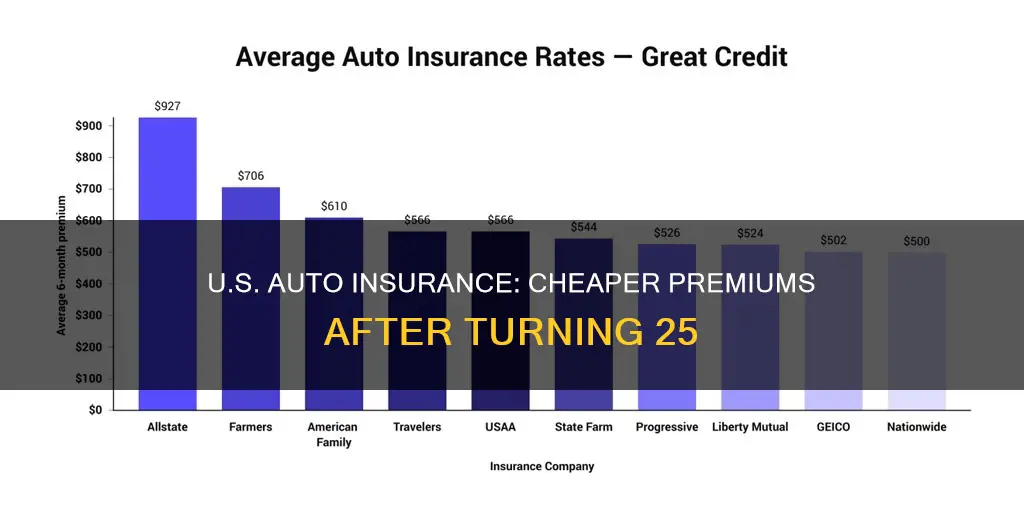

The average cost of car insurance for 25-year-olds is $159 per month or $1,909 per year. This is 17% more expensive than the national average for drivers aged 30 to 45. USAA's rates are significantly lower, with an average of $106 per month or $1,266 per year.

USAA also has a usage-based insurance app called SafePilot, which offers a discount of up to 30% for good driving behaviour. Additionally, USAA offers a variety of other discounts, such as multi-policy, military on-base, good student, safe driver, and loyalty discounts.

While USAA is a great option for those who are eligible, it is important to compare quotes from multiple insurance providers to find the best rate for your specific needs and circumstances.

Chase AARP Rewards Card: Understanding Auto Rental Insurance Benefits

You may want to see also

Frequently asked questions

Yes, USAA auto insurance premiums tend to decrease once a driver reaches the age of 25, as they are considered less risky.

The decrease in USAA auto insurance rates after turning 25 can vary depending on various factors, including driving experience, gender, and driving record. On average, car insurance rates decrease by about 11% when a driver turns 25.

USAA takes into account several factors when setting auto insurance rates, including age, marital status, gender, driving record, credit score, location, and how often the vehicle is driven.

Yes, USAA offers various discounts that may be applicable to 25-year-old policyholders, such as the safe driver discount, good student discount, and multi-policy discount.

USAA typically offers competitive rates for 25-year-old drivers compared to other major insurance companies. However, the rates may vary based on individual circumstances, so it is recommended to compare quotes from multiple providers.