Auto insurance rates are on the rise across the US, with drivers paying 26% more on average in 2024 than the year before. While income is not a direct factor in determining insurance rates, it does have an indirect impact on how much one pays. Socioeconomic factors such as one's ZIP code, job title, and employment status are considered by insurance companies, and these factors can be influenced by income level. For example, those with lower incomes may be more likely to live in high-crime areas where insurance rates are higher. Income also affects the affordability of insurance premiums, as the same premium amount will impact individuals with lower incomes more significantly. Thus, while income may not be a direct determinant of auto insurance rates, it plays a role in the overall cost and accessibility of auto insurance.

| Characteristics | Values |

|---|---|

| Direct impact of income on auto insurance rates | No direct impact |

| Indirect impact of income on auto insurance rates | Yes, income can have an indirect impact on auto insurance rates through factors such as ZIP code, job title, and employment status |

| Factors considered by insurance companies | Age, job title, ZIP code, credit score, driving data, make and model of the car, demographics, driving record, accident and claims history, mileage, discounts, etc. |

| Impact of inflation on auto insurance rates | Inflation can impact auto insurance rates by increasing repair and replacement costs, healthcare expenses, and business expenses for insurance companies |

| Impact of location on auto insurance rates | Location can affect auto insurance rates due to factors such as population density, weather conditions, traffic, auto theft rates, and state insurance legislation |

| Impact of driving record on auto insurance rates | Traffic violations, accidents, and claims can increase auto insurance rates |

| Impact of vehicle changes on auto insurance rates | Adding or changing vehicles can increase auto insurance rates, especially if the new vehicle is more expensive, less safe, or has higher repair costs |

| Impact of coverage changes on auto insurance rates | Increasing coverage limits, adding optional coverages, or lowering deductibles can increase auto insurance rates |

| Impact of personal factors on auto insurance rates | Age, gender, marital status, and number of drivers and vehicles on the policy can influence auto insurance rates |

What You'll Learn

Auto insurance rates and income correlation

There are a multitude of factors that influence auto insurance rates, and while income is not a direct factor, there is a correlation between the two. Income can have an indirect impact on auto insurance rates, and it is important to understand the relationship between them. Firstly, let's explore the factors that insurance companies consider when determining rates.

Insurance companies take into account various personal factors such as age, gender, driving record, type of vehicle, and insurance coverage. They also look at broader variables like state insurance legislation changes, the propensity for claims in specific regions, and rising auto repair prices. For example, if you add a teenage driver to your policy, your rates will likely increase due to the higher risk associated with less experienced drivers. Similarly, the cost of repairing or replacing a vehicle is a significant factor, as newer cars with advanced technology can be more expensive to fix.

While income is not a direct factor, it can influence certain aspects that insurance companies consider. For instance, insurance companies often take into account your ZIP code or address when calculating rates. If you live in an area with a high rate of theft, accidents, or weather-related claims, your rates are likely to be higher. Income can play an indirect role here, as lower-income areas may have higher crime rates or be more susceptible to natural disasters, leading to increased insurance claims.

Additionally, income can impact the affordability of auto insurance. The same insurance premium may represent a higher proportion of monthly expenses for someone with a lower income compared to someone with a higher income. This means that the relative impact of an insurance rate increase will be greater for individuals with lower incomes.

It is also worth noting that insurance companies may consider your job title and employment status when determining rates. Certain occupations may be perceived as riskier by insurance companies, which could lead to higher rates. Income can be correlated with certain job titles, which could indirectly influence insurance rates.

Furthermore, income can affect your ability to take advantage of certain discounts offered by insurance companies. For example, insurance providers may offer discounts for having multiple policies, owning a car with advanced safety features, or maintaining a good driving record. Higher-income individuals may have an easier time qualifying for these discounts, as they may have the financial means to purchase additional policies or newer, safer vehicles.

In summary, while income is not a direct factor in determining auto insurance rates, it can have an indirect impact. Income can influence the affordability of insurance, the risk associated with certain areas, and the ability to qualify for discounts. Understanding this correlation can help individuals make informed decisions about their auto insurance choices.

Insuring Vehicles for Transport: The Basics

You may want to see also

Inflation and insurance costs

Firstly, inflation increases the cost of goods and services across the economy, including the cost of repairing and replacing vehicles. This rise in repair and replacement costs is then reflected in higher car insurance premiums. The cost of vehicle repairs has been impacted by supply chain shortages, mechanic wage increases, and the presence of additional technologies in vehicles, such as microprocessors, cameras, and sensors. These factors have contributed to higher insurance costs for consumers.

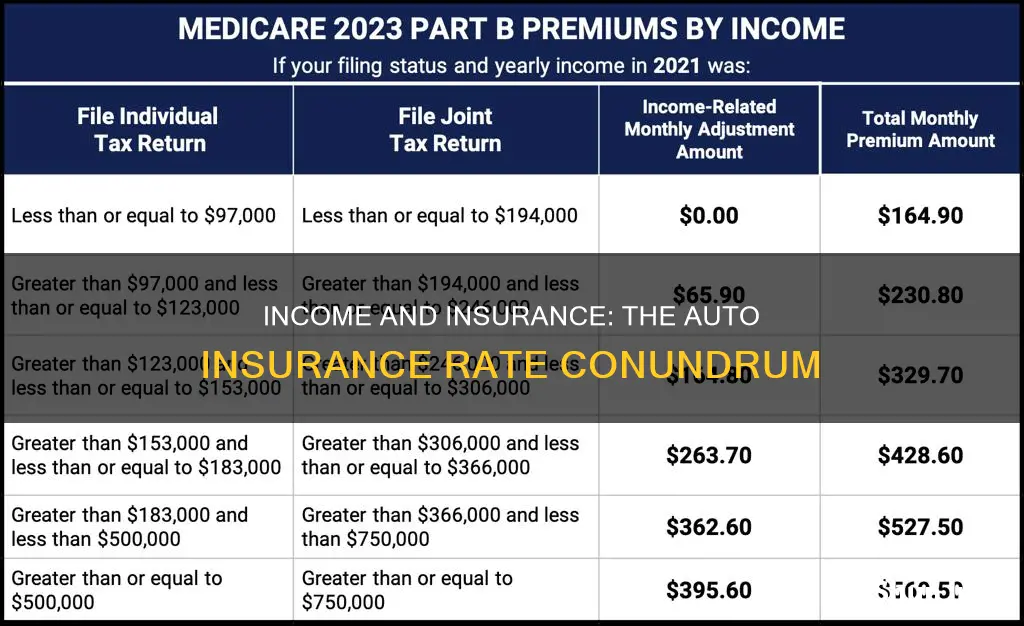

Secondly, inflation has resulted in higher healthcare costs, which have, in turn, led to an increase in health insurance premiums. Medical expenses, such as hospital stays and prescription drugs, continue to rise, causing health insurance providers to charge higher premiums.

Thirdly, inflation has impacted the cost of construction materials and labor, leading to higher property repair and replacement costs. This has particularly affected property and casualty insurance, with insurers raising premiums to cover these increased costs.

Furthermore, inflation has diminished the buying power of money. As a result, insurers are raising rates to keep up with the increasing costs. The microchip shortage, for example, has increased the cost of new cars, leading to higher insurance premiums.

The impact of inflation on insurance rates is a growing concern for both insurance companies and consumers. Inflation has contributed to a surge in insurance premiums across various types of insurance, including car, health, and property insurance. This has added to the overall inflationary pressures in the economy.

To counteract the impact of inflation on insurance costs, consumers can consider strategies such as taking advantage of discounts offered by insurance companies, increasing deductibles, or opting for payment plans. However, with inflation affecting a wide range of industries, it is challenging for policymakers to address all the drivers behind this trend.

Postponing Auto Insurance: Can I Delay Payment?

You may want to see also

Repair and replacement costs

The cost of repairing vehicles has been increasing due to factors such as inflation and supply chain concerns. This has contributed to the rise in insurance rates.

In addition, the increasing price of new and used cars has also impacted insurance rates. As the value of vehicles rises, so does the cost of insurance. This is because insurance companies need to pay out more for repairs or replacements if a vehicle is damaged or written off.

The age and mileage of a vehicle also play a role in repair and replacement costs. Older vehicles with more miles are generally more expensive to repair or replace. This is because they may have sustained more damage or wear and tear, and finding replacement parts can be more difficult and costly.

Furthermore, the type of vehicle also affects repair and replacement costs. Certain makes and models may be more expensive to repair due to the cost of parts or the complexity of repairs. Luxury or sports cars, for example, may have specialized parts that are more expensive to replace.

When it comes to insurance rates, the level of coverage also matters. Higher coverage limits and additional coverages, such as collision or comprehensive insurance, will result in higher premiums. This is because the insurance company is taking on more risk and may have to pay out more in the event of a claim.

Overall, the increasing cost of repairing and replacing vehicles is a significant factor in the rise of auto insurance rates. This, coupled with other factors such as inflation and the value of vehicles, has contributed to the rising cost of insurance for drivers across the country.

Selling Auto Insurance: Mastering Phone Skills

You may want to see also

Natural disasters and insurance

Natural disasters can have a significant impact on insurance rates. In the United States, car insurance rates have been increasing, and natural disasters are a contributing factor. States that experience frequent natural disasters such as tornadoes, hurricanes, and severe weather events tend to have higher insurance premiums. For example, Louisiana and Florida, which have faced an increasing number of severe weather events, have the highest share of paychecks going towards car insurance in the country.

Homeowners insurance typically covers a wide range of potential disasters, including wind and rainstorms, snow accumulation, fire, tornadoes, wildfires, volcanic eruptions, and blizzards. However, it's important to note that common natural disasters like floods and earthquakes are often excluded from standard coverage. Homeowners in coastal areas or regions prone to flooding or earthquakes may need to purchase separate policies for these hazards.

The impact of natural disasters on insurance rates is not limited to car and homeowners insurance. The frequency and severity of natural disasters can influence insurance rates across various sectors, including health, life, and business insurance. The cost of repairing or replacing damaged property, as well as the impact on public infrastructure and the economy, can contribute to insurance rate adjustments.

Additionally, insurance companies may consider the risk associated with natural disasters when setting rates. Areas with a higher risk of natural disasters may have higher insurance premiums to account for the potential costs of claims arising from these events.

It's worth noting that insurance rates can also be influenced by other factors, such as inflation, supply chain issues, and changes in state legislation. However, natural disasters play a significant role in insurance rate fluctuations, especially in regions prone to such events.

Auto Insurance: The Annual Creep of Rising Premiums

You may want to see also

Socioeconomic status and insurance

While auto insurance companies in the US do not directly consider income when setting rates, an individual's socioeconomic status can play a role in how much they pay. This is because insurance companies do take into account factors such as ZIP code, job title, and employment status, all of which can be influenced by socioeconomic status.

ZIP Code

Insurance companies often consider the ZIP code of the policyholder when calculating rates. People living in urban areas with higher rates of theft, vandalism, and traffic accidents may pay higher premiums. These areas tend to have a higher population density and be more susceptible to the impacts of extreme weather events, both of which can increase the likelihood of accidents and insurance claims. As a result, insurance companies view these areas as riskier and charge higher premiums to offset potential costs.

Job Title and Employment Status

The job title and employment status of an individual can also influence their insurance rates. Certain occupations may be deemed riskier by insurance companies, leading to higher premiums. Additionally, unemployment can impact insurance rates as more people on the road can increase the likelihood of accidents.

Income's Indirect Impact on Affordability

Income can also have an indirect impact on auto insurance by affecting affordability. For example, a $100 premium will be more affordable for someone earning $8,500 a month than for someone earning $3,500, even if income was not a factor in determining the rate.

Other Factors Affecting Auto Insurance Rates

Several other factors can influence auto insurance rates, and these are often interconnected with socioeconomic status. Age, gender, marital status, driving record, accident and claims history, mileage, and vehicle make and model can all impact insurance rates. Additionally, broader variables such as state insurance legislation changes, the propensity for claims in specific regions, and rising auto repair prices can also play a role.

Strategies to Reduce Auto Insurance Costs

Individuals can take several proactive steps to reduce their auto insurance costs. These include shopping around for more affordable policies, taking advantage of discounts offered by insurance companies, improving one's driving record and credit score, and regularly reviewing and adjusting one's policy to match changing circumstances.

Podium Vehicles: Insured or Not?

You may want to see also

Frequently asked questions

Auto insurance companies do not directly consider income when setting rates. However, income can have an indirect impact on insurance rates. For example, insurance companies may consider your ZIP code, job title, and employment status when calculating your rate.

Auto insurance companies consider a wide range of factors when setting rates, including your age, gender, driving record, type of vehicle, and insurance coverage. They also take into account broader variables such as state insurance legislation changes, the propensity for claims in specific regions, and rising auto repair prices.

To prevent your auto insurance rates from increasing significantly, you can maintain a clean driving record, avoid accidents and traffic violations, and consider raising your policy's coverage limits or deductibles. Shopping around for insurance providers and comparing quotes can also help you find more affordable rates.