Renters insurance is a type of insurance policy that offers protection to tenants of a rented property. It covers the policyholder's personal property, which includes all of a renter's belongings, such as clothing, furniture, and electronics. It does not cover the rental unit's fixtures, such as built-in appliances, or damage to the exterior of the building. This is covered by the landlord's insurance. Renters insurance also covers the policyholder's legal and liability expenses related to lawsuits resulting from accidents occurring on the rental property. It also compensates for additional living expenses if the policyholder and other covered occupants are forced to relocate temporarily due to a covered disaster.

Auto insurance, on the other hand, covers vehicles and protects against financial losses due to injury incurred by visitors. It does not cover the renter's belongings in the car, but renters insurance does.

What You'll Learn

Protecting your personal belongings

Renters insurance is a type of policy that safeguards a tenant's personal belongings from theft, damage, or destruction. It is important to note that a landlord's insurance policy typically only covers the building and not a tenant's personal items. Therefore, renters insurance is crucial for protecting your possessions.

Personal property coverage, also known as personal belongings coverage, is the most well-known component of renters insurance. This coverage includes items such as furniture, clothing, shoes, electronics, appliances, kitchen equipment, bedding, towels, sports equipment, and hobby equipment.

However, certain high-value items may be excluded from standard policies. These can include jewelry, artwork, collectibles, and specialised computer equipment. If you own such items, you may need to purchase additional coverage or add a rider to your policy. A rider is an endorsement that can be added to your policy to cover valuable items for their full value.

Additionally, renters insurance can provide coverage for items stored in off-site storage units or while you are in transit and moving to a new place. This coverage typically includes repair or replacement of your belongings due to perils such as fire, water damage, or vandalism, up to the limits of your policy.

To ensure your items are adequately protected, it is recommended to create an inventory of your possessions, including photos, acquisition dates, and receipts. This documentation will be crucial if you ever need to file a claim.

In summary, renters insurance is essential for protecting your personal belongings. By understanding what is covered and taking the necessary steps to document your items, you can have peace of mind knowing that your possessions are safeguarded.

Dropping Auto Insurance: A Step-by-Step Guide to Canceling Your Policy

You may want to see also

The difference between actual cash value and replacement cost

Renters' insurance is important as it protects your personal belongings, which are not covered by your landlord's insurance, in the event of theft or damage. It also provides personal liability coverage if someone is injured in your home and covers legal costs if you are sued for the same. Additionally, it covers medical expenses for guests injured on the property and provides additional living expenses if you need to move out temporarily due to covered losses.

Now, when it comes to renters' insurance, you have the option to choose between two types of coverage for your personal property: actual cash value (ACV) and replacement cost value (RCV). Here's the difference between the two:

Actual Cash Value (ACV)

ACV takes into account the depreciation of your belongings. In the event of a claim, your insurance company will compensate you based on the current value of the item in its used condition, factoring in age and wear and tear. While this type of coverage usually results in lower premiums, the payout may not be sufficient to purchase brand-new replacements. For example, if you have a six-year-old washing machine that is damaged in a fire, your insurance company will determine its current value, considering depreciation, and provide you with that amount as a payout.

Replacement Cost Value (RCV)

RCV, on the other hand, does not factor in depreciation. With this type of coverage, your insurance company will compensate you for the full cost of replacing your old possessions with new ones of similar kind and quality. While this option usually comes with higher premiums, it ensures that you can adequately replace your lost or damaged items without having to pay out of pocket. For instance, if your four-year-old TV is stolen, RCV coverage will allow you to buy a new TV with similar features, even if the cost of a similar model is now cheaper.

When deciding between ACV and RCV, consider your budget and risk tolerance. ACV is generally more affordable, but you may have to pay out of pocket to replace your items with new ones. On the other hand, RCV provides more comprehensive protection but usually comes at a higher cost.

Understanding Factors Behind a Drop in Auto Insurance Scores

You may want to see also

Personal liability protection

For example, if someone falls down your stairs and breaks their arm, or your child accidentally throws a ball through a neighbour's window, breaking an expensive vase, you may be held legally responsible for the damages caused. Personal liability coverage will help to pay for the medical bills and legal fees that result from such incidents, up to your coverage limits.

Many renters' insurance policies provide a minimum of $1,000 per person in medical payments coverage and a minimum of $100,000 in personal liability coverage. If you feel you need more protection, higher limits are available, and you can also purchase an umbrella policy, which enables you to extend your liability coverage beyond the limits of your primary policy.

It's important to note that personal liability coverage does not cover all situations. For example, it typically does not cover liability resulting from an automobile accident, bodily injury or property damage caused intentionally by you or a family member, or injuries or damages sustained by you or your family members in your home. Be sure to carefully review your renters' insurance policy to understand what is and isn't covered by personal liability protection.

Understanding Auto Insurance: 500 Comprehensive Deductible Explained

You may want to see also

Additional living expenses

Renters insurance is not a legal requirement but it is often mandated by landlords and rental companies. It is designed to protect your personal belongings in the event of theft or damage. This includes items stolen from your car or while you are travelling. It also covers you financially if someone is injured in your home or if you are legally responsible for damage to someone else's property.

One of the key benefits of renters insurance is additional living expenses (ALE) coverage. This is designed to cover the costs incurred if you are forced to live elsewhere temporarily due to damage to your home. For example, if your home is damaged by a fire and you need to live in a hotel for two months while it is repaired, ALE will cover the costs of your hotel, food and other expenses. It is important to note that ALE only covers additional expenses on top of your normal living costs. For example, if you are staying in a hotel, it will cover the cost of the hotel but not your usual mortgage payments.

ALE is typically set at 20% of your dwelling coverage but this can often be increased if required. Most insurance policies include an automatic amount of ALE coverage but you may wish to increase it if you feel it is not enough to maintain your standard of living. It is important to review the details of your policy as coverage limits and specifics can vary by carrier.

To make a claim for ALE, you will need to provide detailed records and receipts for any expenses you incur while living away from your home. It is also important to note that ALE does not cover all situations. For example, it typically does not cover floods or earthquakes, which require separate insurance policies.

Auto Insurance Agents: Open Saturdays?

You may want to see also

Discounts for bundling renters and auto insurance

Renting a home means you need renters insurance to protect your belongings from theft or damage. While it's not required by law, landlords may require tenants to have a renters policy before moving in. This is because a landlord's insurance policy covers the building but not your personal items.

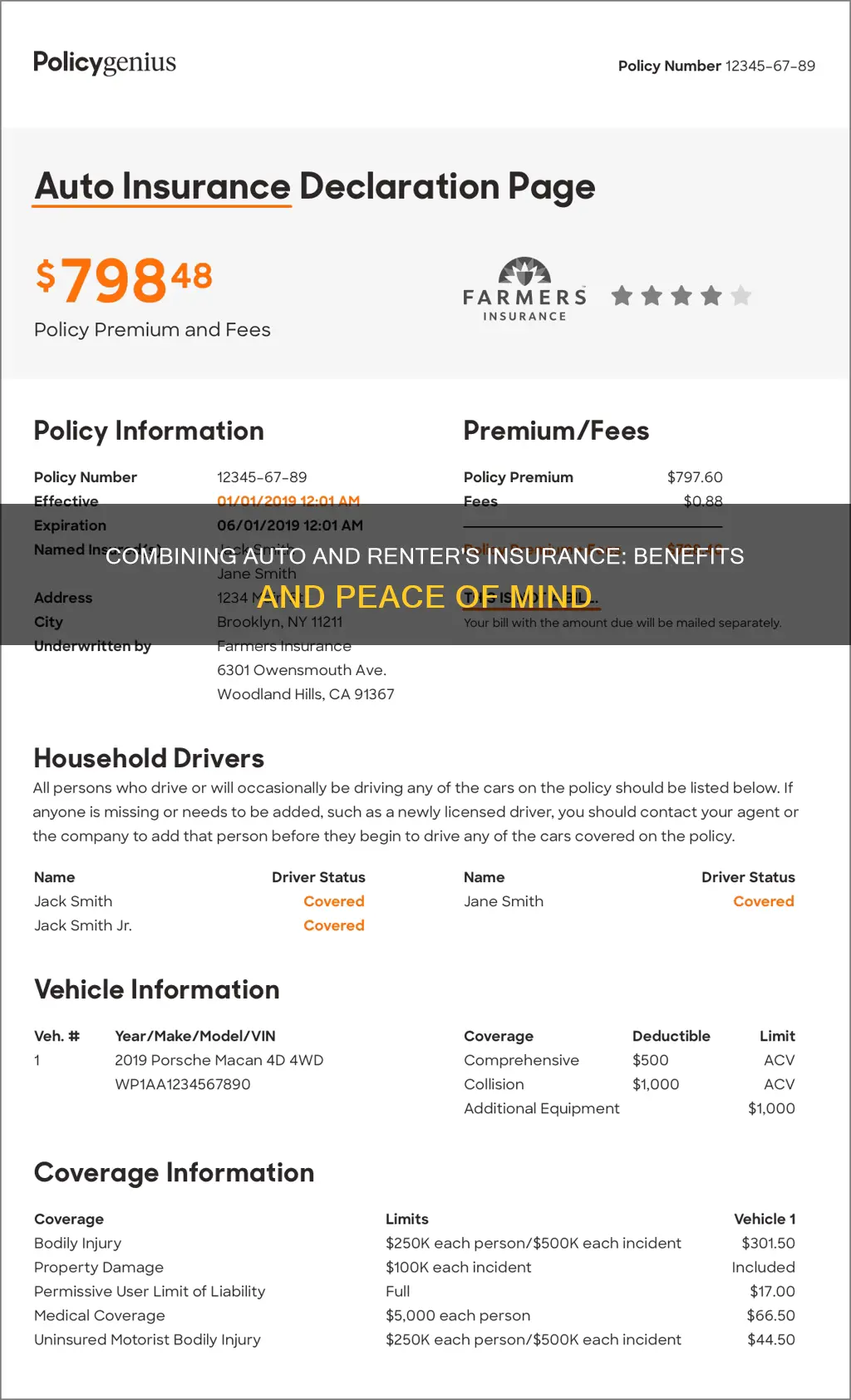

Bundling renters and auto insurance can lead to modest savings. Many insurance companies, including State Farm, Geico, Progressive, Allstate, and Farmers, offer a discount for bundling these policies. The amount you can save depends on the company and location. For example, State Farm offers a 4.7% bundling discount, which could save you $108 per year. In contrast, GEICO offers the cheapest rate for bundling at $91 per month.

Progressive also offers a bundling discount, though the amount saved is not specified. Additionally, Progressive allows customers to combine renters insurance with other policies, such as motorcycle or boat insurance, which may result in extra discounts.

Bundling your auto and renters insurance can be a convenient way to streamline bill payments and insurance claims. It's worth noting that you might pay more for a combined policy with one company than you would with separate policies from different providers. Therefore, it's essential to compare rates and discounts offered by different insurance companies before deciding.

Get a Fair Auto Insurance Settlement: Your Guide

You may want to see also

Frequently asked questions

Auto insurance covers your vehicle, not your personal belongings. A renter's policy will protect your possessions in the event of theft, damage, or destruction.

A renter's policy typically covers personal property, personal liability, additional living expenses, and guest medical expenses.

A renter's policy usually does not cover earthquakes, floods, bedbugs, mould, or damage to the exterior of the building.

The cost of renter's insurance depends on your location, the type of rental, and coverage limits. In California, the average monthly price of renter's insurance in 2023 was $16.18, while in Texas, it was about $20.