The average cost of car insurance varies depending on several factors, including age, gender, driving history, location, and the insurance company. The national average cost of car insurance is $2,150 per year for full coverage and $467 per year for state minimum coverage, according to Forbes Advisor's analysis. However, the cost can be significantly higher or lower depending on individual circumstances. For example, young and inexperienced drivers tend to pay much more for coverage, with the average cost of car insurance for a 16-year-old being $378 more per month than for a 25-year-old. Additionally, the cost of car insurance varies by state, with Idaho having the cheapest full coverage rates and New York having the most expensive.

| Characteristics | Values |

|---|---|

| Average cost of car insurance per year | $2,068 |

| Average cost of car insurance per month | $172 |

| Average cost of car insurance for full coverage per year | $1,718 |

| Average cost of car insurance for full coverage per month | $143 |

| Average cost of car insurance for minimum coverage per year | $488 |

| Average cost of car insurance for minimum coverage per month | $41 |

What You'll Learn

Average cost of car insurance by state

The cost of car insurance varies significantly depending on the state you live in. The national average annual cost for a full-coverage policy is $1,895, but this can be as low as $1,307 in New Hampshire and as high as $3,067 in Florida.

Factors Affecting the Cost of Car Insurance by State

Several factors contribute to the variation in car insurance rates across different states. Here are some key factors:

- Population Density and Traffic Congestion: States with higher population density and congested urban areas tend to have higher insurance rates due to the increased risk of accidents and theft.

- Weather Conditions: States prone to severe weather events, such as hurricanes, hailstorms, or snow, may experience higher insurance rates as these events can cause significant damage to vehicles.

- Road Conditions and Infrastructure: States with poorly rated highway systems and poor road conditions often have higher insurance rates as they can increase the likelihood of accidents and vehicle damage.

- Number of Uninsured Motorists: States with a high percentage of uninsured drivers, such as Florida and Texas, tend to have higher insurance rates.

- State Insurance Requirements and Laws: Each state has its own insurance requirements and laws, which can impact the cost of coverage. For example, some states require personal injury protection or medical payment coverage, driving up the overall cost of insurance.

- Crime Rate and Vehicle Theft: States with higher crime rates and vehicle theft tend to have higher insurance rates as it increases the risk of insurance claims.

- Cost of Living: The cost of living in a state can impact insurance rates. However, this relationship is not always linear, as some states with a high cost of living have relatively lower insurance rates.

Cheapest States for Car Insurance

The cheapest states for car insurance coverage, on average, include:

- Ohio

- Maine

- Idaho

- New Hampshire

- Vermont

Most Expensive States for Car Insurance

On the other hand, the states with the most expensive average car insurance rates are:

- Florida

- Louisiana

- Delaware

- Texas

- Rhode Island

Virginia Auto Insurance: Understanding the Requirements

You may want to see also

Average cost of car insurance by company

The average cost of car insurance varies depending on the company, with some offering cheaper rates than others. Here is a list of some of the cheapest annual rates for full coverage from widely accessible insurers in the US:

- Travelers: $1,124

- Nationwide: $1,141

- Kemper: $1,121

- Progressive: $1,149

- Hanover: $3,826

Among regional insurance companies, North Carolina Farm Bureau has the lowest average rate for full coverage at $531, and Farmers Mutual of Nebraska has the cheapest state minimum liability-only car insurance at $208 per year.

Carvana: Gap Insurance Included?

You may want to see also

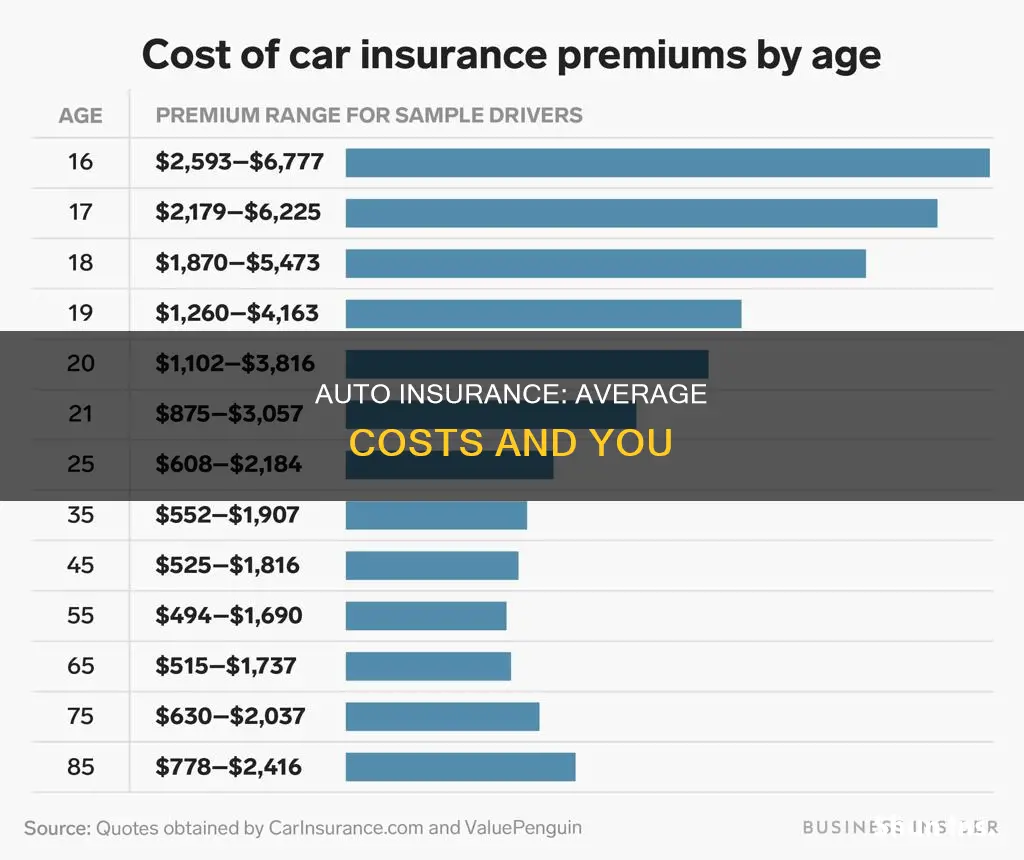

Average cost of car insurance by age

The cost of car insurance is dependent on a variety of factors, with age being one of the most significant. In general, younger and older drivers pay more for car insurance than those in middle age, as they are considered to be high-risk due to an increased likelihood of accidents and expensive claims.

The average cost of car insurance for a 16-year-old driver is around $3,192 per year for minimum coverage and $3,343 per year for full coverage. For a 19-year-old, these figures drop to $2,360 and $2,856, respectively. At age 25, car insurance rates become more affordable, with the average cost of full coverage being around $1,500 per year.

For drivers in their mid-30s to mid-50s, car insurance rates are typically lower as they are considered more experienced and responsible. However, rates may rise again for senior drivers due to insurers associating advanced age with slower reaction times and a higher probability of accidents. For example, the average cost of full coverage for a 60-year-old driver is around $1,900 per year, while for a 75-year-old, it increases to $2,500 per year.

It is important to note that car insurance rates can vary based on other factors such as gender, driving record, location, and the type of vehicle. Additionally, the cost of car insurance can also differ between states.

Divorced Couples: Share Auto Insurance?

You may want to see also

Average cost of car insurance by gender

The cost of car insurance varies depending on several factors, including age, location, and gender. While some states have banned the use of gender as a factor in determining insurance rates, it is still used in others. In states that do consider gender, men tend to pay more for car insurance than women, especially at younger ages. This is because data shows that men are more likely to engage in riskier driving behaviours and are involved in more accidents.

Car Insurance Rates by Gender

According to a 2024 analysis by Forbes Advisor, men pay slightly more for car insurance than women, especially at younger ages. The analysis found that:

- Male drivers ages 20 and 25 pay about 11% and 5% more, respectively, than their female counterparts.

- By age 40, the national average cost of full coverage car insurance for men is only 4% more than for women.

- As men and women age, the difference in insurance rates becomes negligible, with rates for males and females being about the same in their middle years.

- However, as men enter their senior years, rates start to increase again, as older males exhibit riskier driving patterns than females.

States That Have Banned the Use of Gender in Insurance Rates

It is important to note that not all states allow gender to be a factor in insurance rates. In California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania, insurance rates are gender-neutral. Additionally, Oregon has issued a regulatory bulletin requiring insurers to accommodate drivers who do not designate a gender on their driver's licenses.

Average Car Insurance Rates by Gender and State

The average cost of car insurance can vary significantly by state, and this is true for both male and female drivers. Here are the average annual rates for full coverage car insurance for male and female drivers in a few states, according to Forbes Advisor:

- Idaho: Male - $1,021, Female - $967

- Vermont: Male - $1,037, Female - $982

- Maine: Male - $1,216, Female - $1,161

- New York: Male - $4,769, Female - $4,511

- Florida: Male - $4,326, Female - $4,072

- Louisiana: Male - $3,629, Female - $3,452

Ways to Save on Car Insurance

Regardless of gender, there are several ways to save on car insurance:

- Shop around: Compare quotes from multiple insurance companies to find the best rates.

- Ask about discounts: Take advantage of discounts such as good driver discounts, multi-policy discounts, and paperless billing discounts.

- Increase your deductible: Opting for a higher deductible can lower your monthly premium.

- Consider telematics/UBI insurance: These policies are priced based on your actual driving habits rather than factors like gender or age.

- Be smart with your coverage: Remove unnecessary coverage on older vehicles and consider raising your deductibles to lower your premium.

Auto Insurance Trackers: Worth the Cost?

You may want to see also

Average cost of car insurance by marital status

The average cost of car insurance varies depending on the individual's marital status. While there are many factors that influence the cost of car insurance, marital status is one of the most significant factors. On average, married drivers pay less for car insurance than their single, divorced, or widowed counterparts. This is because married individuals are perceived as more financially stable and safer drivers, resulting in lower insurance rates.

Average Cost of Car Insurance for Married Couples

According to The Zebra, the average cost of car insurance for a married couple in the United States is $116 per month, or $694 for a standard six-month policy. This rate is relatively reasonable because married drivers are considered "safe" insurance clients. They often own homes, bundle their policies, cover multiple vehicles, and insure more than one driver on a single policy. Data also shows that married couples file fewer claims than single, divorced, or widowed drivers, contributing to their classification as less risky clients.

Average Cost of Car Insurance for Single Drivers

In contrast, the average single driver in the US pays $1,484 per year for car insurance, or about $742 for a standard six-month policy. This cost can vary depending on age, credit score, driving history, and vehicle type.

Average Cost of Car Insurance for Divorced Drivers

Divorced drivers pay slightly more for car insurance than married drivers. The average divorced driver in the US pays $1,486 per year, which is $99 more than a married driver. This difference is attributed to historical data and statistical correlations, as divorced drivers tend to file more claims than married drivers.

Average Cost of Car Insurance for Widowed Drivers

Widowed drivers pay the least premium difference compared to married drivers. On average, they pay $1,437 per year for car insurance, which is $50 more than a married driver. This is because widowed drivers are statistically more likely to get into accidents and file claims than married drivers, resulting in a higher premium.

Factors Affecting Car Insurance Rates

It is important to note that car insurance rates are highly individualized and can vary based on factors such as age, gender, driving record, credit score, vehicle type, and location, among others. Additionally, insurance companies use different algorithms to calculate rates, so it is always a good idea to compare quotes from multiple providers to find the most competitive price.

Strategies to Lower Car Insurance Costs

There are several strategies that individuals can use to lower their car insurance costs, regardless of their marital status:

- Compare multiple quotes from different insurance companies.

- Bundle policies, such as home and auto insurance, with the same provider.

- Reduce annual mileage by driving less or carpooling.

- Raise the deductible on comprehensive and collision coverage.

- Look for discounts, such as good student discounts, paperless billing discounts, or multi-policy discounts.

- Improve credit score, as it is a significant factor in determining insurance rates in most states.

While marital status is a significant factor in determining car insurance rates, it is important to consider the various other factors that can influence the cost of car insurance. By comparing quotes, bundling policies, reducing mileage, raising deductibles, and taking advantage of discounts, individuals can find ways to lower their car insurance costs.

Missouri Auto Insurance: The Gap Increase Mystery

You may want to see also

Frequently asked questions

The average cost of auto insurance per year is $2,068. However, this varies depending on factors such as age, gender, location, and driving history.

The average cost of auto insurance per month is $172. This also varies depending on factors such as age, gender, location, and driving history.

The cost of auto insurance varies by state, with Idaho, Vermont, and Ohio being the cheapest, and Florida, Louisiana, and Texas being the most expensive.

The cost of auto insurance increases for drivers with a poor driving record. For example, the average cost of auto insurance after an accident is $2,940, and the average cost after a DUI is $3,538.