In Missouri, gap insurance works in the same way as in the rest of the US. It covers the difference between what you owe on a car loan or lease and the car's worth if it is written off in a covered loss, such as an accident or theft. Missouri does not require drivers to have gap insurance, but certain lenders may require it. If you are involved in an accident in Missouri and cannot show proof of insurance, a law enforcement officer may issue you a ticket.

| Characteristics | Values |

|---|---|

| Is gap insurance required in Missouri? | No, but certain lenders may require it. |

| What does gap insurance cover? | The balance remaining on your car loan or lease after a liability, comprehensive, or collision policy pays out the actual cash value of your totaled vehicle. |

| Where can you buy gap insurance in Missouri? | From dealerships or insurance companies. |

| Is gap insurance worth it? | Yes, if you owe more on your car loan or lease than the car is worth. |

| Do you need gap insurance if you have full coverage? | Yes, if you still owe money on a car loan or lease. |

What You'll Learn

Gap insurance is not required by Missouri state law

While Missouri state law requires all motor vehicle drivers and owners to maintain some type of motor vehicle liability insurance, gap insurance is not included in this mandate. Gap insurance, or guaranteed asset protection insurance, is not required by Missouri state law. This means that residents of Missouri are not legally obligated to carry gap insurance.

However, it is important to note that certain lenders in Missouri may require gap insurance if you take out a car loan or lease. Gap insurance protects you in the event that you owe more money on your car loan or lease than the car is worth. For example, if you total your brand new car in an accident a few months after purchasing it, gap insurance would cover the difference between what your insurance company pays out and what you still owe to the bank.

While not a legal requirement, gap insurance can provide valuable financial protection in the event of a total loss of your vehicle. It is worth considering if you want to ensure you are not left with a large bill after an accident or other covered loss.

Missouri residents should also be aware of the mandatory insurance requirements in the state. Missouri law requires drivers and vehicle owners to maintain a minimum level of liability insurance coverage. This includes $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 per accident for property damage. Uninsured motorist coverage of $25,000 for bodily injury per person and $50,000 per accident is also required.

Auto Insurance: Fixed or Variable?

You may want to see also

Missouri drivers must have liability insurance

Missouri is an "at-fault" state, meaning that the driver who is at fault for a car accident is responsible for paying for the other party's damages, including medical bills, car repairs, lost wages, and pain and suffering. As such, drivers in Missouri must carry insurance to cover possible liabilities. The state operates under a fault-based insurance system, where the at-fault driver in an accident is responsible for covering the damages. This system can influence the costs and coverage options for drivers, as those found at-fault may face higher insurance premiums.

Drivers in Missouri have three ways to meet the insurance requirements:

- A motor vehicle liability insurance policy that meets the minimum liability insurance limits of "25/50/25".

- Proof of financial responsibility filed with the Department of Revenue.

- A certificate of self-insurance (for companies or religious organizations) issued by the Missouri Department of Revenue.

It is illegal to drive without insurance in Missouri, and there are penalties for those who do so. If a law enforcement officer asks for proof of insurance and the driver cannot show it, the officer may issue a ticket. The court will then send the conviction to the Driver License Bureau, and four points will be added to the driver's record. It only takes eight points within an 18-month period for a driver to lose their driving privileges in Missouri. For repeat offenders, there are higher fines, longer suspension periods, and the possibility of jail time.

Lucrative Career: Auto Insurance Sales

You may want to see also

Missouri drivers can be penalised for letting insurance lapse

Missouri drivers are required by law to have automobile liability insurance. If a driver lets their coverage lapse, they will be penalised. The penalties for driving without insurance in Missouri include fines, higher insurance premiums, and the loss of driving privileges.

If a driver is caught without insurance, they will be charged with a class D misdemeanour. For a first offence, the driver's license, registration, and license plates will be suspended until they can prove they have obtained insurance. The driver will also receive four points on their driving record and have to pay a fine not exceeding $500. To regain driving privileges, a $20 reinstatement fee must be paid.

For a second offence, the driver will be suspended from driving for 90 days and receive four points on their driving record. A second conviction is also punishable by jail time of 15 days and/or a fine of $200 to $500. To get their driving privileges back, the driver must provide proof of insurance and pay a $200 reinstatement fee.

If a third offence occurs within two years of a previous violation, the driver's license, registration, and license plates will be suspended for one year, and the reinstatement fee will be $400. The driver may also face another 15 days in jail and/or a fine between $200 and $500, as well as four points added to their driving record.

If a driver accumulates 12 points in 12 months, their license can be revoked for one year. If a driver accumulates eight points within 18 months, their driver's license can be suspended for 30 days, assuming it is their first suspension. The suspension increases to 60 days for a second suspension and 90 days for every subsequent suspension.

Glass Claims: Impact on Auto Insurance Premiums

You may want to see also

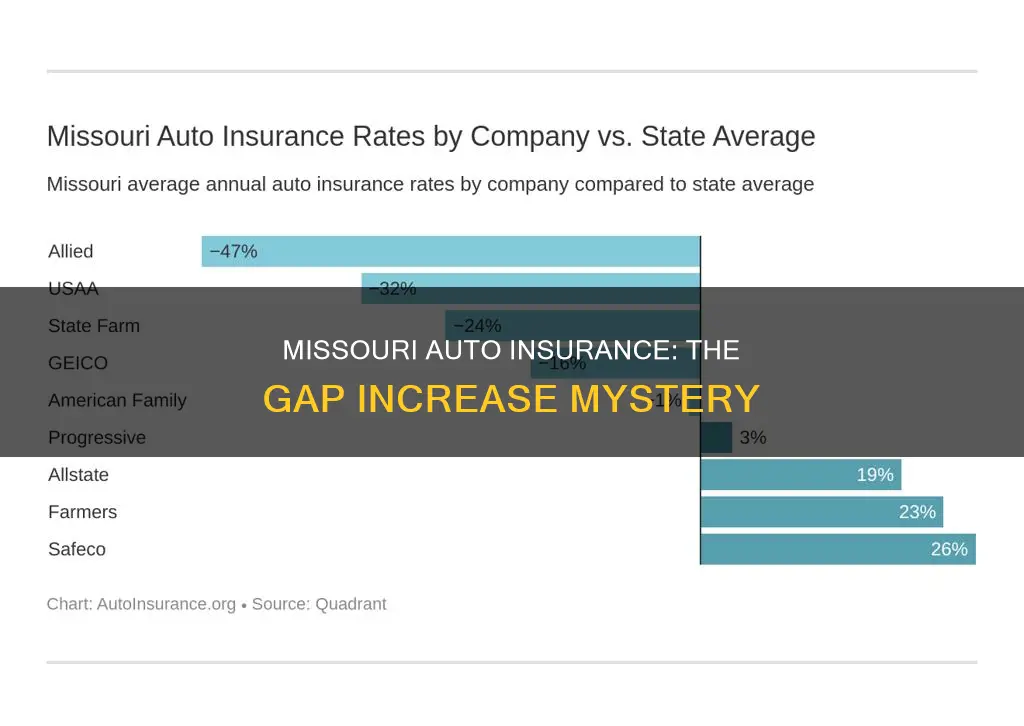

Missouri drivers can reduce premiums by increasing deductible amounts

Missouri drivers are required by law to have some form of motor vehicle liability insurance coverage. The minimum coverage required by state law is $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 per accident for property damage. Drivers must also have uninsured motorist coverage of $25,000 for bodily injury per person and $50,000 for bodily injury per accident.

While gap insurance is not required in Missouri, some lenders may require it if you take out a car loan or lease. Gap insurance covers the balance remaining on your car loan or lease after a liability, comprehensive, or collision policy pays out the actual cash value of your totaled vehicle.

If you're looking to reduce your insurance premium, one way to do so is by increasing your deductible. A deductible is the amount you pay toward a claim before your insurance company covers the rest. For example, if you have a $100 deductible and $1,000 worth of damage, you pay the first $100 and your insurance company covers the remaining $900. By increasing your deductible amount, you can lower your monthly premium. However, keep in mind that you'll need to pay the full deductible amount before your insurance company covers any damages.

When deciding on a deductible amount, it's important to choose a level that you can comfortably afford. For instance, if a $1,000 deductible is too high, you could opt for a $500 deductible instead. It's also a good idea to build an emergency savings fund to cover the cost of the higher deductible in case of an accident.

Florida's Fine Print: Understanding Auto Accident Health Coverage

You may want to see also

Missouri drivers can reduce premiums by improving their driving record

Missouri drivers can save money on their car insurance by improving their driving record. The state uses a point system, and it only takes eight points within an 18-month period for a driver to lose their license. Every time a driver is responsible for an accident or receives a moving traffic violation, they risk having their premium raised or their policy cancelled. A clean driving record can lead to lower insurance costs.

The Missouri Department of Revenue tracks drivers to ensure they keep their liability insurance policies in force. If coverage lapses, drivers are subject to suspension of their vehicle's registration and possibly their driver's license.

Drivers with a history of violations such as DWIs, accidents, or tickets on their record will see higher insurance costs. For example, drivers with a DWI on their record pay on average $2,024 per year for car insurance. This is because violations remain on a driver's record for a period of time and continue to affect insurance rates until they drop off. In Missouri, a DWI can impact insurance rates for up to five years.

To reduce premiums, Missouri drivers should aim to improve their driving record by avoiding accidents and violations. This will help keep their premiums low and reduce the risk of losing their driving privileges.

Switching Auto Insurance: Penalties or Savings?

You may want to see also

Frequently asked questions

No, Missouri does not require any driver to carry gap insurance. However, certain lenders in Missouri may require it if you get a car loan or lease.

Gap insurance covers the difference between what you owe on your vehicle and what it is worth if it is totaled in a covered loss, such as an accident or theft.

You can purchase gap insurance in Missouri from dealerships or your insurance agent. It is usually cheaper to buy it from an insurance company than a dealership.

Gap insurance in Missouri works the same way as in the rest of the U.S. It pays the balance remaining on your car loan or lease after a liability, comprehensive, or collision policy pays out the actual cash value of your totaled vehicle.