Texas insurance policies can be cancelled at any time, but there are best times to do so. For instance, during the free look period, which is considered a cooling-off period for newly signed-up policyholders to gauge their plan and decide whether to continue or cancel. Cancelling during this period often guarantees a full refund. Another ideal time is at the end of an active policy year, as most insurance policies require policyholders to reapply to renew the policy annually.

There are also scenarios where cancelling insurance is ill-advised. For example, when there is no backup coverage, when coverage is legally mandated, when contract terms are violated, or when there are pending premium payments.

| Characteristics | Values |

|---|---|

| Can you cancel your Texas insurance policy at any time? | Yes, but there are "best times" to cancel, such as during the "free look" period or at the end of an active policy year. |

| When is it a good idea to cancel insurance in Texas? | When you have nothing to lose and more to gain, for example, when you are relocating, or when you need a lower premium rate. |

| When is it a bad idea to cancel insurance in Texas? | When there is no backup coverage, when coverage is legally mandated, when contract terms are violated, or when there are pending premium payments. |

| What happens if you cancel your insurance in Texas? | You lose coverage for the insured object, and the insurable risk becomes vulnerable to financial loss or legal implications. |

| Does it cost money to cancel insurance in Texas? | Yes, insurance cancellation may incur costs such as cancellation fees. |

| Do you get a refund if you cancel insurance in Texas? | It depends on factors such as the insurance type and the duration of the policy. |

| What happens if you don't pay your insurance cancellation fee in Texas? | The insurer may deduct the fee from your refund, the non-payment can stall the cancellation process, or it may negatively affect your credit rating. |

| How do you stop automatic insurance renewal in Texas? | Notify the insurer before the expiration date and provide a reason for cancelling. |

| Can you dispute auto-renewal of an insurance policy in Texas? | Yes, in some instances, for example, if there are material changes to the policy. |

What You'll Learn

Cancelling during the free look period

Cancelling during the "free look" period is one of the "best times" to cancel an insurance policy in Texas. This period is regarded as a "cooling-off" period for newly signed-up policyholders, who can gauge their policy plan and decide whether to continue with it. It usually applies to brand new policies and new customers only. The length of the "free look" period may differ between insurance types, so make sure you know the length of your specific period. A cancellation under the "free look" period often guarantees a full refund.

In Texas, insurance policies run for a set period: a day, a week, a month, or usually a year. During this time frame, you get the benefits of coverage in the event of an insured loss. However, when choosing to change or cancel coverage, it is important to know the process of how to cancel your insurance.

Generally, there are three methods of cancelling an insurance contract in Texas:

- Stop auto-renewal: You may wait for the active policy to expire (lapse) and then decline to renew the policy.

- Cancel in the middle of the policy: All insurance companies in Texas are required to refund the consumer the unused portion of premiums.

- Refuse to renew: Either by application or by stopping premium payments altogether, which is a way to trigger the cancellation process.

Yes, all Texas insurance policies (of all types) can be cancelled at any time. However, there are "best times" to cancel an active insurance policy in Texas, and these include during the "free look" period or at the end of an active policy year.

If you have insurance coverage that you get through an employer, it is automatically cancelled when you leave the job (withdrawal of service). However, some employers may provide insurance coverage even after retirement, usually with life and health insurance. In this case, the employer is responsible for processing the cancellation of the policy on behalf of the individual. Check with your employee benefit representative in Human Resources.

Does Aviva Home Insurance Auto-Renew?

You may want to see also

Cancelling at the end of an active policy year

However, it is important to note that insurance companies in Texas differ in their responses to an auto-renewal response. Thus, it is advisable to find out from your insurance agent or the insurance company about any responsibilities on your part regarding the cancellation of your policy.

Additionally, some insurance plans in Texas can only be purchased during specific times of the year. Therefore, it is crucial to ensure that you do not cancel existing coverage during a time when an equivalent replacement cannot be obtained.

To initiate the cancellation process, you need to notify your insurance company before the expiration date and provide a reason for cancelling. While there is no legal timeframe for this, it is advisable to notify your insurance agent ahead of time to allow them to commence the necessary administrative processes and find alternative coverage options for you.

It is always best to seek advice from a licensed insurance professional before opting out of active coverage to ensure you understand the repercussions of your decision.

Your Auto Insurance Adjuster: What They Do and Don't

You may want to see also

Cancelling after relocation

Cancelling your auto insurance in Texas after relocating to another state is a good idea, especially if you cannot transfer your insurance policy to your new state of residence. However, it is important to confirm this with your insurance provider, as some have partnerships or offices in other states.

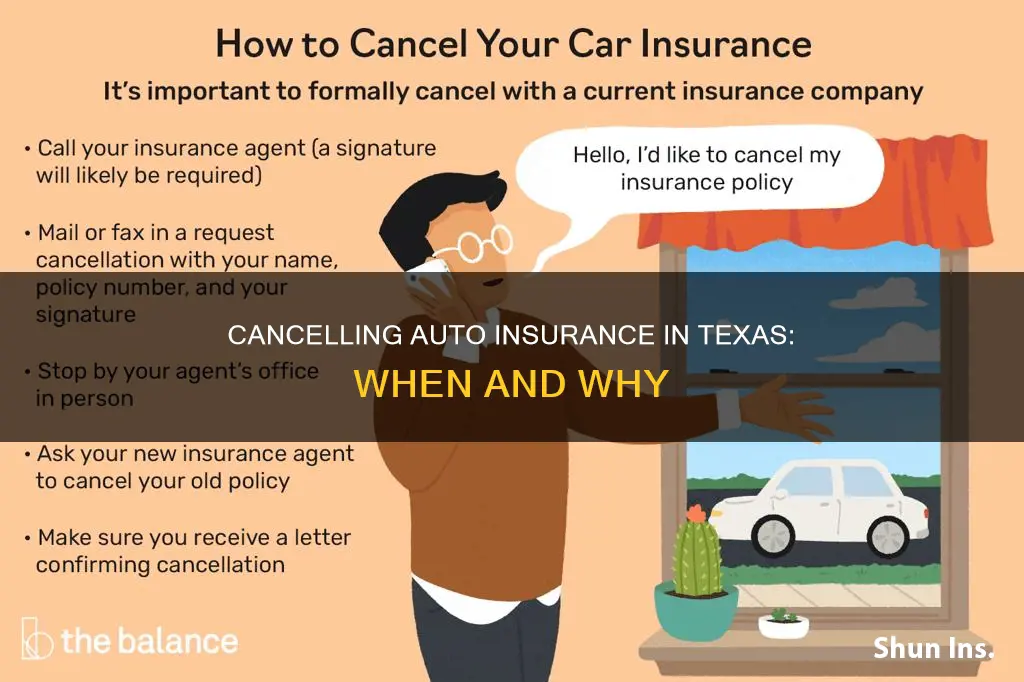

To cancel your auto insurance in Texas, you need to notify your insurance company before the expiration date and provide a reason for cancelling. It is also important to be aware of the different types of insurance policies and their specific requirements for cancellation. For example, commercial property and liability policies have different cancellation requirements than residential policies.

When cancelling your auto insurance in Texas, you may need to pay a cancellation fee, and you may be eligible for a refund of your unused premiums. It is important to review your insurance policy and understand the financial implications of cancelling before proceeding.

Additionally, if you have insurance coverage through an employer, it is important to note that this coverage will automatically be cancelled when you leave your job. However, your employer may provide insurance coverage even after retirement, especially with life and health insurance. In this case, your employer is responsible for processing the cancellation of the policy on your behalf.

Alabama Auto Insurance: Understanding the Mandatory Coverage

You may want to see also

Cancelling after a life-changing event

Cancelling your insurance after a life-changing event in Texas is possible, but there are some important considerations to keep in mind. Firstly, understand that you can cancel your insurance policy at any time; however, there are "best times" to do so to avoid unnecessary costs and complications.

One ideal time to cancel your insurance policy is during the "free look" period, which is typically offered with life insurance policies. This "cooling-off" period allows new policyholders to assess their plan and decide whether to continue or cancel it. Cancelling during this period often guarantees a full refund, but be sure to check the length of the "free look" period for your specific policy.

Another strategic time to cancel is at the end of an active policy year. Most insurance policies in Texas require annual renewal, so letting your policy expire without renewal is an indirect way of cancelling it. Keep in mind that insurers may have different responses to auto-renewal, so be sure to find out from your agent or insurance company about any specific requirements.

If you need to cancel your insurance policy mid-year due to a life-changing event, it is recommended to speak with your agent to get professional advice on the best course of action. They can guide you through the process and help you find alternative coverage options. Early notification of your intentions to cancel is beneficial, as it allows the insurance company to commence administrative processes and gives your agent time to find you alternative coverage.

When cancelling your insurance policy after a life-changing event, be aware that you may need to pay a cancellation fee to facilitate the administrative process. The amount of refund you receive will depend on factors such as the insurance type, duration of the policy, and the number of claims made. Additionally, failing to pay the cancellation fee can result in deductions from your refund or complications in the cancellation process, and it may negatively affect your credit rating.

In summary, while you can cancel your insurance policy at any time in Texas, there are strategic times to do so to optimize your refund and avoid unnecessary costs. Cancelling after a life-changing event can be a good idea, but be sure to consult with a licensed insurance professional to understand the financial and administrative implications fully.

GM Gap Insurance: Peace of Mind

You may want to see also

Cancelling to find a better fitting insurance package

Cancelling your insurance policy to find a better fitting insurance package is a good idea, especially when you have nothing to lose and more to gain. The insurance industry in Texas is highly competitive, with a wide range of products to choose from. As a consumer, you have the right to choose a package that best suits your needs and preferences.

However, it is important to note that there are "best times" to cancel an active insurance policy in Texas. One of these times is during the "free look" period, which is considered a "cooling-off" period for newly signed-up policyholders. This period allows you to assess the policy and decide whether to continue or cancel it. Cancelling during this time often guarantees a full refund, although the length of the "free look" period may vary depending on the insurance type.

Another ideal time to cancel your insurance policy is at the end of an active policy year. Most insurance policies in Texas require policyholders to reapply for renewal annually, so letting your active policy expire without renewal indicates your intention to cancel.

When considering a mid-year cancellation, it is advisable to speak with your insurance agent to seek professional advice. They can guide you through the process and help you find alternative coverage options. Additionally, switching insurance policies or modifying endorsements may result in a lower premium, so it is worth discussing these options with your agent before opting for cancellation.

To cancel your insurance policy in Texas, you need to notify your insurer before the expiration date and provide a reason for cancelling. It is important to be open with your insurer about your reasons for cancelling, as they may be able to offer modifications or alternative options.

Keep in mind that insurance cancellation may incur costs, such as cancellation fees, and the amount of refund depends on factors like the insurance type and the duration of the policy. Cancelling your insurance policy means losing coverage for the insured object or person, leaving you vulnerable to potential financial loss or legal implications. Therefore, it is crucial to have backup coverage in place before cancelling.

Double-Naming Auto Insurance: Is It Allowed?

You may want to see also

Frequently asked questions

You can cancel your auto insurance at any time in Texas, but there are "best times" to do so. The ideal times are during the "free look" period, or at the end of an active policy year.

The "free look" period is a "cooling off" period for newly signed-up policyholders to gauge their insurance policy and decide if they want to stick with it. The length of this period differs between insurance types.

When you cancel your auto insurance in Texas, you lose coverage for your vehicle, which is legally mandated in the state. You will need to obtain a replacement coverage to avoid legal action.